0001861449false00018614492023-09-182023-09-180001861449us-gaap:CommonClassAMember2023-09-182023-09-180001861449us-gaap:WarrantMember2023-09-182023-09-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2023

Bird Global, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41019 | | 86-3723155 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

392 NE 191st Street #20388

Miami, Florida 33179

(Address of principal executive offices and Zip code)

(866) 205-2442

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | BRDS | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable to purchase one share of Class A common stock at an exercise price of $11.50 per share | | BRDS WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement

Spin Acquisition and Purchase Agreement

On September [19], 2023, Bird Global, Inc. (the “Company”) announced the acquisition by its wholly-owned subsidiary Bird Rides, Inc., a Delaware corporation (“Bird Rides”) of 100% of the stock of Skinny Labs, Inc. d/b/a Spin, a Delaware corporation (“Spin”), from Tier Mobility SE, a company incorporated in Germany with registered number HRB 236551 B (“Seller”), pursuant to the terms of a stock purchase agreement (the “Purchase Agreement”), entered into by and among the Company, Bird Rides, Seller and Spin (the “Acquisition”) on September [19], 2023, (the “Closing Date”).

The aggregate consideration paid, or that will be paid, by the Company and Bird Rides for the transactions contemplated by the Purchase Agreement, is $19 million (the “Purchase Price”), which is comprised of (a) $10 million in cash, (b) $6 million in the form of a secured vendor take-back promissory note (the “VTB Consideration”), and (c) $3 million in hold-back consideration comprised of $1 million in cash (the “Cash Hold-Back) and $2 million of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”) (the “Stock Hold-Back,” and together with the Cash Hold-Back, the “Hold-Back Consideration”). The number of shares of Common Stock in the Stock Hold-Back will be determined based upon the volume-weighted average price of Common Stock over the thirty (30) consecutive trading days ending on the Closing Date. The VTB Consideration and Hold-Back Consideration are subject to adjustment for any post-closing working capital adjustments to the Purchase Price; breaches of representations, warranties, and covenants; and for certain indemnification obligations of the Seller.

The Purchase Agreement contains representations, warranties and covenants that the respective parties made to each other as of the respective date of the Purchase Agreement, or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement. In particular, the assertions embodied in the representations and warranties in the Purchase Agreement were made as of a specified date, are modified or qualified by information in one or more confidential disclosure letters or disclosure schedules prepared in connection with the execution and delivery of Purchase Agreement may be subject to a contractual standard of materiality different from what might be viewed as material to investors, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Purchase Agreement are not necessarily characterizations of the actual state of facts about the Company, Bird Rides, Seller or Spin, or the other parties at the time they were made or otherwise and should only be read in conjunction with the other information that the Company makes publicly available in reports, statements and other documents filed with the Securities and Exchange

Commission (the “SEC”). The Purchase Agreement also contains customary indemnification provisions by the Company and Seller with respect to breaches of representations and warranties and the performance of post-closing covenants. Indemnification claims will survive the closing for (i) with respect to breaches of general representations and warranties, 18 months, (ii) with respect to breaches of fundamental representations and warranties, until the expiration of the applicable statute of limitations, and (iii) with respect to post-closing covenants, in accordance with their terms or until fully performed.

The foregoing description of the Purchase Agreement is not complete and is subject to, and qualified in its entirety by, reference to the Purchase Agreement, a copy of which is filed with this Current Report on Form 8-K (this “Current Report”) as Exhibit 2.1 and incorporated by reference herein.

Senior Secured Promissory Note - VTB Note

On the Closing Date, pursuant to the Purchase Agreement and in satisfaction of the VTB Consideration, Bird Rides issued to Seller a secured promissory note in the principal amount of $6 million (the “Note”). Under the Purchase Agreement and the Note, Spin, as guarantor and as a wholly-owned subsidiary of the Company, delivered to the Seller a guarantee and security agreement (the “Security Agreement”) secured by [certain assets of Spin, certain existing and new licenses and permits; and all amounts received or receivable under any or all of, the foregoing licenses and permits and all rents, profits and products of the foregoing]. The Company guaranteed the Note on an unsecured basis. The principal amount of the Note is to be repaid in three installments, which due on October 19, 2023, December 31, 2023 and April 24, 2024, together with interest thereon. The Note bears interest at the rate of 8.0% per annum from the Closing Date until the unpaid balance is paid in full. The Note provides for certain representations and warranties, covenants and events of default. Upon the occurrence and during the continuation of an Event of Default (as defined in the Note), the interest rate shall be increased by an additional 5.0% per annum.

The foregoing descriptions of the Note and the Security Agreement are not complete and are subject to, and qualified in their entirety by, reference to the Note and the Security Agreement, a copy of each is filed with this Current Report as Exhibits 4.1 and 10.1 and incorporated by reference herein.

Amended and Restated Loan Agreement

On the Closing Date, the Company, as parent, Bird Rides, as borrower, and certain other subsidiaries of the Company, as guarantors, entered into that certain Amended and Restated Loan Agreement (the “Loan Agreement”) with MidCap Financial Trust, as administrative agent, and the lenders party thereto, to amend and restate, in its entirety, that certain Loan and Security Agreement, dated as of April 27, 2021 by and among Bird US Opco, LLC, as borrower, Bird US Holdco, LLC, as holdco guarantor, and MidCap Financial Trust, as administrative agent, and the lenders party thereto (as amended prior to the Closing Date)). The Amended and Restated Loan Agreement provides for, among other things, (a) an additional advance of $6 million, to be used for, among other things, the completion of the transactions contemplated under the Purchase Agreement, (b) an extension of the maturity date of the loan to July 12, 2025, (c) amendments to the monthly amortization payment amounts and (d) the extension of the senior security in favor of the Administrative Agent to include substantially all of the assets of the Company, Bird Rides and certain of the Company’s other material US subsidiaries.

In connection with the Loan Agreement, the Company, Bird Rides and certain other material US subsidiaries of the Company, as guarantors, entered into that certain Amended and Restated Guarantee (the “Senior Guarantee”) granting a guarantee of the obligations under the Loan Agreement and other Transaction Documents (as defined in the Loan Agreement) in favor of the Administrative Agent and the Lenders.

As security for obligations of the grantors under the Amended and Restated Loan Agreement and other Transaction Documents (as defined in the Loan Agreement), the Senior Guarantee and other Transaction Documents, the Company, Bird Rides and certain other material US subsidiaries of the Company, as grantors, entered into that certain Amended and Restated Pledge and Collateral Agreement (the “Senior Security Agreement”), to grant a senior security interest on substantially all of their present and after acquired property and assets in favor of the Administrative Agent, as collateral agent.

The foregoing descriptions of the Amended and Restated Loan Agreement, the MidCap Amended and Restated Guarantee and the MidCap Amended and Restated Collateral Agreement are not complete and are qualified in their entirety by reference to the full text of such agreements, copies of which are filed as Exhibits 4.2, 10.2 and 10.3, respectively, to this Current Report and are incorporated by reference herein.

Second Amendment to Note Purchase Agreement and Intercreditor Agreement

As a condition of the Loan Agreement, on the Closing Date, the Company, as issuer, U.S. Bank, National Association, as collateral agent (the “Collateral Agent”), and the several purchasers from time to time party there (“Purchasers”), entered into that certain Second Amendment to Note Purchase Agreement (the “Second Amendment”) to further amend that certain Note Purchase Agreement, dated as of December 30, 2022, as amended by that certain First Amendment to Note Purchase Agreement, dated as of March 17, 2023, by and among the Company, the Collateral Agent and the Purchasers (collectively, the “Note Purchase Agreement”).

In connection with the Second Amendment, the Company, Bird Rides and certain other material US subsidiaries of the Company, as guarantors, entered into that certain Amended and Restated Guarantee (the “Note Guarantee”) granting a guarantee of the obligations under the Note Purchase Agreement and other Note Documents (as defined in the Note Purchase Agreement) in favor of the Collateral Agent and the Purchasers.

As security for obligations of the grantors under the Note Purchase Agreement, the Note Guarantee and other Note Documents, the Company, Bird Rides and certain other material US subsidiaries of the Company, as grantors, entered into that certain Amended and Restated Pledge and Collateral Agreement (the “Note Security Agreement”) to grant a security interest on substantially all of their present and after acquired property and assets in favor of the Collateral Agent.

In addition, in connection with the Loan Agreement and the Second Amendment, the Purchasers, the Collateral Agent and the Administrative Agent, amended and restated, in its entirety, that certain Subordination and Intercreditor Agreement dated as of December 30, 2022, as amended and supplemented by Supplement and Amendment No. 1 to the Intercreditor Agreement dated as of March 17, 2023 pursuant to that certain Amended and Restated Subordination and Intercreditor Agreement by and among the Purchasers, as subordinate lender, the Collateral Agent, as subordinated collateral agent and the Administrative Agent and acknowledged by the Company, Bird Rides and certain other subsidiaries of the Company (the “Intercreditor Agreement”).

The foregoing descriptions of the Second Amendment, the Note Guarantee, the Note Security Agreement and the Intercreditor Agreement are not complete and are qualified in their entirety by reference to the full text of such agreements, copies of which are filed as Exhibits 4.3, 10.4, 10.5 and 10.6, respectively, to this Current Report and are incorporated by reference herein.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information included, or incorporated by reference, in Item 1.01 of this Current Report is incorporated by reference into this Item 2.01 of this Current Report.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included, or incorporated by reference, in Item 1.01 of this Current Report is incorporated by reference into this Item 2.03 of this Current Report.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth under the caption “Spin Acquisition Agreement” in Item 1.01 is incorporated herein by reference. None of the shares of Common Stock to be issued in connection with the Acquisition will be registered under the Securities Act of 1933, as amended (the “Securities Act”), at the time of sale, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D

promulgated thereunder. This filing does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Item 7.01 Regulation FD Disclosure.

On the Closing Date, the Company issued a press release announcing the closing of the Acquisition. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and incorporated herein by reference.

The information contained in Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| |

| 2.1* | | Stock Purchase Agreement, dated September 19, 2023, by and among Bird Global, Inc., a Delaware corporation (“Parent”), Bird Rides, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Acquiror”), Skinny Labs, Inc. (d/b/a “SPIN”), a Delaware corporation (the “Company”), and Tier Mobility SE, a company incorporated in Germany with registered number HRB 236551 ("Seller”). |

| 4.1* | | Senior Secured Promissory Note, dated September 19, 2023, issued by Bird Rides, Inc. to Tier Mobility SE. |

| 4.2* | | Amended and Restated Loan Agreement, dated September 19, 2023, by and among Bird Rides, Inc. (the “Borrower”), Bird Global, Inc. (the “Parent”), the Persons from time to time party hereto as Lenders; and MidCap Financial Trust (“MidCap”), as Administrative Agent. |

| 4.3* | | Second Amendment to Note Purchase Agreement, dated September 19, 2023, by and among Bird Global, Inc., a Delaware corporation (the “Issuer”), each of the Purchasers signatory hereto and U.S. Bank Trust Company, National Association, as collateral agent (the “Collateral Agent”). |

| 10.1* | | Limited Recourse Guarantee and Security Agreement, dated September 19, 2023, by and among Skinny Labs, Inc., a Delaware corporation (d/b/a “SPIN”) (“Skinny Labs”) and Bird Global Inc., a Delaware corporation (“Parent”, and together with Skinny Labs, each, a “Guarantor” and collectively, the “Guarantors”), in favor of Tier Mobility SE, a company incorporated in Germany with registered number HRB 236551 B (the “Seller”). |

| 10.2* | | Amended and Restated Pledge and Collateral Agreement, dated September 19, 2023 by and among Bird Rides, Inc., a Delaware corporation (“Borrower”), Bird Global, Inc. (“Parent”), certain Affiliates of the Borrower party hereto (collectively, together with the Borrower and Parent, the “Grantors”), and MidCap Financial Trust, as Administrative Agent and as collateral agent on behalf of the Secured Parties (in such capacity, the “Collateral Agent”). |

| 10.3* | | Amended and Restated Guarantee, dated September 19, 2023, made by Bird Global, Inc. (“Parent”), Bird Rides, Inc. (“Bird Rides”), Bird US Holdco, LLC (“Holdco Guarantor”), Bird US Opco, LLC (“Bird Opco”), Bird Treasury Holdco, LLC (“Treasury”), Scoot Rides, Inc. (“Scoot”), Bird Rides Holdings (US), LLC (“Holdings”, and together with Parent, Bird Rides, Holdco Guarantor, Bird Opco, Treasury, and Scoot, each a “Guarantor”, and collectively the “Guarantors”), is made in favor of MidCap Financial Trust, as Administrative Agent) (the “Administrative Agent”), the Lenders (the “Lenders”) and the other Secured Parties (together with the Lenders and the Administrative Agent, collectively the “Beneficiaries”). |

| 10.4* | | Amended and Restated Guarantee, dated as of September 19, 2023, by and among Bird Global, Inc. (“Issuer”), Bird Rides, Inc. (“Bird Rides”), Bird US Holdco, LLC (“Holdco Guarantor”), Bird US Opco, LLC (“Bird Opco”), Bird Treasury Holdco, LLC (“Treasury”), Scoot Rides, Inc. (“Scoot”), and Bird Rides Holding (US), LLC (“Holdings”) (collectively the “Guarantors”), made in favor of U.S. Bank Trust Company, National Association (the “Collateral Agent”), and the Purchasers (the “Purchasers” and the other Secured Parties (together with the Purchasers and the Collateral Agent, collectively the “Beneficiaries”). |

| 10.5* | | Amended and Restated Pledge and Collateral Agreement, dated September 19, by and among Bird Global, Inc. (“Issuer”), Bird Rides, Inc., a Delaware corporation (“Bird Rides”), certain Affiliates of the Issuer party hereto (collectively, together with the Issuer and Bird Rides, the “Grantors”), and U.S. Bank Trust Company, National Association as collateral agent on behalf of the Secured Parties (in such capacity, the “Collateral Agent”). |

| 10.6* | | Amended and Restated Subordination and Intercreditor Agreement, dated September 19, 2023, by and among the several purchasers from time to time party to the Note Purchase Agreement party hereto (collectively, the “Subordinated Lender”), U.S. Bank Trust Company, National Association (the “Subordinated Collateral Agent”), and MidCap Financial Trust, a Delaware statutory trust (“Agent” and “Lenders,” and collectively with the Agent, the “Senior Lenders”). |

| 99.1 | | |

| 104 | | Cover page Interactive Data File (embedded within Inline XBRL document) |

*To be filed by amendment to this Current Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Bird Global, Inc. | | |

| | | | |

| Date: September 19, 2023 | | | | By: | | /s/ Michael Washinushi | | |

| | | | Name: | | Michael Washinushi | | |

| | | | Title: | | Interim Chief Executive Officer | | |

1 Bird Acquires Spin, Now North America’s Largest Micromobility Operator By Market Share Synergies upwards of $20 million and key profitable markets including Washington D.C., Baltimore, MD and Salt Lake City UT. Combined, Bird will serve approximately 350 markets globally with over 200,000 vehicles MIAMI – September 19, 2023 – Bird Global, Inc. (NYSE:BRDS), (“Bird” or the “Company”) a leader in environmentally friendly electric transportation, today announced it has acquired shared electric bike and scooter operator Skinny Labs, Inc, (doing business as Spin) from Berlin-based TIER Mobility. The transaction makes Bird the largest micromobility operator in North America by market share1 and is expected to be immediately accretive to earnings. Spin is now a wholly-owned subsidiary of Bird Rides, Inc. The purchase price was $19 million, including $10 million in upfront cash, $6 million in a vendor take back and $3 million as a hold back. This transaction was supported by MidCap Financial Investment and MidCap Financial Trust, managed or advised by Apollo Capital Management, LP. For the 12 months ended June 30, 2023, Spin delivered approximately $45 million in net revenue, bringing the combined net revenue for Bird and Spin to approximately $265 million for that period. The transaction is expected to have upwards of $20 million in synergies and be immediately accretive to earnings for Bird, due in part to recent operational restructuring. Spin, which is headquartered in San Francisco, has a strong presence in North America including operations in over 50 cities and university campuses with minimal overlap with Bird’s existing footprint. The acquisition increases Bird’s geographical footprint, solidifying its position as the leading micromobility operator in North America by market share and by number of markets serviced. The company plans to leverage this leadership position to further expand its operations in multiple profitable key cities such as Baltimore, Salt Lake City, and Washington D.C, one of the top micromobility markets for cash flow in North America, as well as major university campuses such as Penn State University and the University of Michigan. Combined with Spin, Bird now operates in 87% of the 50 most populous cities in the United States and Canada2 that have a shared micromobility program. "Spin is a great financial and strategic acquisition for Bird and we expect this acquisition will enable us to achieve long term sustainable profitability. In addition to our overall market leadership in North America, the company now holds a leading market share position in key markets, more new vehicles, cutting-edge technology and a significantly stronger financial position,” said Michael Washinushi, Bird Interim CEO. “Bird and Spin have many strategic synergies, which we believe will have an immediate impact in the third quarter. We are thrilled to

2 welcome the Spin team to the Bird family and excited to continue to execute on our shared vision of a more liveable, sustainable future. Due to the success we are having in improving Bird’s financial performance we are able to make acquisitions like Spin today” Spin brings Bird a fleet of over 60,000 vehicles, a significant portion of which are new, state-of- the-art vehicles. Along with Bird, Spin has been an industry pioneer at deploying sidewalk detection technology at scale, and Spin’s fleet of swappable-battery vehicles are complementary to Bird’s. Spin has earned its position as a trusted resource for riders and cities alike and will continue to operate the brand independently in many cities. “We are excited to join forces with Bird, an innovative brand and a pioneer in micromobility. Together Bird and Spin create a powerful player in the North America market -- one that is focused on responsible partnership, bringing reliable alternative transportation options to the communities we serve, and creating a more sustainable future,” said Philip Reinckens, CEO of Spin. For more information on Bird, visit www.bird.co and for more information on Spin, visit www.spin.app. About Bird Bird is an electric vehicle company dedicated to bringing affordable, environmentally friendly transportation solutions such as e-scooters and e-bikes to communities across the world. Bird’s cleaner, affordable, and on-demand mobility solutions are available in 350 cities, primarily across Canada, the United States, Europe, the Middle East, and Australia. We take a collaborative, community-first approach to micromobility. Bird partners closely with the cities in which it operates to provide a reliable and affordable transportation option for people who live and work there. 1 Based on data compiled by Earnest Analytics as of June 30, 2023. 2 Based in U.S. Census Bureau data as of 2022 and Statistics Canada data as of 2022. Forward-looking Statements Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Bird’s future financial or operating performance. For example, projections of future revenue, and other metrics, business strategy and plans, and anticipated impacts from the acquisition of Skinny Labs, Inc. (d/b/a Spin) (the “Spin Acquisition”), are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Bird and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to the expansion plans and opportunities relating to the Spin Acquisition and the costs related to the

3 Spin Acquisition. Other factors may also cause Bird’s actual results to differ materially from those expressed or implied in the forward-looking statements and such factors are discussed in Bird’s filings with the U.S. Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and subsequent reports filed by Bird with the SEC. Copies of Bird’s filings with the SEC may be obtained at the “SEC Filings” section of Bird’s website at www.bird.co or on the SEC’s website at www.sec.gov. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. The forward-looking statements included in this press release are made as of the date hereof. Bird is not under any obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate, whether as a result of new information, future events or otherwise, except as otherwise may be required by the federal securities laws. Contacts Media Contact Press@bird.co Investor Contact Investor@bird.co Source: Bird Global, Inc.

v3.23.3

Cover

|

Sep. 18, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 19, 2023

|

| Entity Registrant Name |

Bird Global, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41019

|

| Entity Tax Identification Number |

86-3723155

|

| Entity Address, Address Line One |

392 NE 191st Street #20388

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33179

|

| City Area Code |

(866)

|

| Local Phone Number |

205-2442

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001861449

|

| Amendment Flag |

false

|

| Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

BRDS

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable to purchase one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BRDS WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

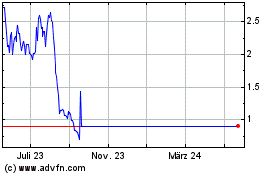

Bird Global (NYSE:BRDS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bird Global (NYSE:BRDS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024