Boot Barn Holdings, Inc. (NYSE: BOOT) today announced its

financial results for the third fiscal quarter ended December 30,

2023. A Supplemental Financial Presentation is available at

investor.bootbarn.com.

For the quarter ended December 30, 2023:

- Net sales increased 1.1% over the prior-year period to $520.4

million.

- Same store sales decreased 9.7% compared to the prior-year

period, cycling 51% same store sales growth on a 2-year stack

basis. The 9.7% decrease in consolidated same store sales is

comprised of a decrease in retail store same store sales of 9.4%

and a decrease in e-commerce same store sales of 11.5%.

- Net income was $55.6 million, or $1.81 per diluted share,

compared to $52.8 million, or $1.74 per diluted share in the

prior-year period.

- The Company opened 11 new stores, bringing its total store

count to 382.

Jim Conroy, President and Chief Executive Officer, commented “I

am pleased with our third quarter performance. We added 11 new

stores and were able to maintain our consistent track record of

delivering growth. Excluding three quarters in calendar 2020 that

were impacted by the pandemic, the third quarter marks our 38th

consecutive quarter of year-over-year sales growth since our IPO in

2014, nearly ten years ago. Our top line was driven by the sales

from the 49 new stores opened over the past 12 months, which more

than offset a 9.7% decline in same store sales. We also grew

earnings compared to last year through a combination of sales

growth, disciplined expense control and an increase in merchandise

margin, which benefited from improved freight. These results

underscore the strength of the Boot Barn business model and are a

testament to solid execution across the organization.”

Operating Results for the Third Quarter Ended December 30,

2023 Compared to the Third Quarter Ended December 24, 2022

- Net sales increased 1.1% to $520.4 million from $514.6 million

in the prior-year period. Consolidated same store sales decreased

9.7% with retail store same store sales decreasing 9.4% and

e-commerce same store sales decreasing 11.5%. The increase in net

sales was the result of the incremental sales from new stores

opened over the past twelve months, partially offset by the

decrease in consolidated same store sales.

- Gross profit was $199.1 million, or 38.3% of net sales,

compared to $187.8 million, or 36.5% of net sales, in the

prior-year period. Gross profit increased primarily due to

merchandise margin expansion and sales growth. The increase in

gross profit rate of 180 basis points was driven primarily by a 300

basis-point increase in merchandise margin rate partially offset by

120 basis points of deleverage in buying, occupancy and

distribution center costs. The increase in merchandise margin rate

was driven by a 250 basis-point improvement in freight expense as a

percentage of net sales and 50 basis points of product margin

expansion resulting primarily from lower promotional activity and

growth in exclusive brand penetration. The deleverage in buying,

occupancy and distribution center costs was driven primarily by the

occupancy costs of 49 new stores and operating costs related to the

new Kansas City distribution center.

- Selling, general and administrative expenses were $124.0

million, or 23.8% of net sales, compared to $115.3 million, or

22.4% of net sales, in the prior-year period. The increase in

selling, general and administrative expenses as compared to the

prior-year period was primarily a result of higher general and

administrative expenses, store payroll associated with operating 49

new stores and other operating expenses in the current year.

Selling, general and administrative expenses as a percentage of net

sales increased by 140 basis points primarily as a result of higher

overhead, payroll and other operating expenses.

- Income from operations increased $2.6 million to $75.1 million,

or 14.4% of net sales, compared to $72.5 million, or 14.1% of net

sales, in the prior-year period, primarily due to the factors noted

above.

- Net income was $55.6 million, or $1.81 per diluted share,

compared to net income of $52.8 million, or $1.74 per diluted share

in the prior-year period. The increase in net income is primarily

attributable to the factors noted above.

Operating Results for the Nine Months Ended December 30, 2023

Compared to the Nine Months Ended December 24, 2022

- Net sales increased 3.8% to $1.279 billion from $1.232 billion

in the prior-year period. Consolidated same store sales decreased

6.3% with retail store same store sales decreasing 5.6% and

e-commerce same store sales decreasing 11.4%. The increase in net

sales was the result of the incremental sales from new stores

opened over the past twelve months, partially offset by the

decrease in consolidated same store sales.

- Gross profit was $475.0 million, or 37.2% of net sales,

compared to $454.7 million, or 36.9% of net sales, in the

prior-year period. Gross profit increased primarily due to sales

growth and merchandise margin expansion. The increase in gross

profit rate of 30 basis points was driven primarily by a 170

basis-point increase in merchandise margin rate, partially offset

by 140 basis points of deleverage in buying, occupancy and

distribution center costs. The increase in merchandise margin rate

was driven by a 120 basis-point improvement in freight expense as a

percentage of net sales and 50 basis points of product margin

expansion resulting primarily from growth in exclusive brand

penetration. The deleverage in buying, occupancy and distribution

center costs was driven primarily by the occupancy costs of 49 new

stores and operating costs related to the new Kansas City

distribution center.

- Selling, general and administrative expenses were $315.0

million, or 24.6% of net sales, compared to $285.7 million, or

23.2% of net sales, in the prior-year period. The increase in

selling, general and administrative expenses as compared to the

prior-year period was primarily a result of higher store payroll

and store-related expenses associated with operating 49 new stores

and general and administrative expenses in the current year.

Selling, general and administrative expenses as a percentage of net

sales increased by 140 basis points primarily as a result of higher

payroll and overhead costs.

- Income from operations decreased $9.1 million to $160.0

million, or 12.5% of net sales, compared to $169.1 million, or

13.7% of net sales, in the prior-year period, primarily due to the

factors noted above.

- Net income was $117.6 million, or $3.84 per diluted share,

compared to net income of $124.1 million, or $4.09 per diluted

share in the prior-year period. Net income per diluted share in the

current-year period includes an approximately $0.01 per share tax

benefit, primarily due to income tax accounting for share-based

compensation, partially offset by changes to state tax rates. Net

income per diluted share in the prior-year period includes an

approximately $0.03 per share tax benefit, primarily due to income

tax accounting for share-based compensation. Excluding these net

tax effects, net income per diluted share was $3.83 in the

current-year period, compared to $4.06 in the prior-year

period.

Sales by Channel

The following table includes total net sales growth, same store

sales (“SSS”) growth/(decline) and e-commerce as a percentage of

net sales for the periods indicated below.

Thirteen Weeks

Preliminary

Ended

Four Weeks

Four Weeks

Five Weeks

Four Weeks

December 30, 2023

Fiscal October

Fiscal November

Fiscal December

Fiscal January

Total Net Sales Growth

1.1

%

3.0

%

4.2

%

(1.2)

%

(14.8)

%*

Retail Stores SSS

(9.4)

%

(8.8)

%

(11.5)

%

(8.5)

%

(7.4)

%

E-commerce SSS

(11.5)

%

(16.8)

%

(15.1)

%

(8.4)

%

(12.9)

%

Consolidated SSS

(9.7)

%

(9.7)

%

(11.9)

%

(8.5)

%

(8.1)

%

E-commerce as a % of Net Sales

13.0

%

9.7

%

10.4

%

16.1

%

11.9

%

*Last year’s fiscal January included the week after Christmas,

which is a high-sales volume week. In the current year, the week

after Christmas was included in the third fiscal quarter.

Balance Sheet Highlights as of December 30, 2023

- Cash of $107 million.

- Zero drawn under our $250 million revolving credit

facility.

- Average inventory per store decreased approximately 1% on a

same store basis compared to December 24, 2022.

Fiscal Year 2024 Outlook

The Company is providing updated guidance for the fiscal year

ending March 30, 2024, superseding in its entirety the previous

guidance issued in its second quarter earnings report on November

2, 2023. As a result, for the fiscal year ending March 30, 2024,

the Company now expects:

- To open 52 new stores.

- Total sales of $1.654 billion to $1.664 billion, representing a

change of (0.2)% to 0.4% over the prior year, which was a 53-week

year.

- Same store sales decline of approximately (7.0)% to (6.3)%,

with retail store same store sales declines of (6.3)% to (5.5)% and

an e-commerce same store sales decline of (11.7)%.

- Gross profit between $605.7 million and $610.6 million, or

approximately 36.6% to 36.7% of sales. Gross profit reflects an

estimated 170 basis-point increase in merchandise margin, including

a 130 basis-point improvement from freight expense. We anticipate

180 basis points of deleverage in buying, occupancy and

distribution center costs.

- Selling, general and administrative expenses between $411.8

million and $412.7 million. This represents approximately 24.9% to

24.8% of sales.

- Income from operations between $194.0 million and $198.0

million. This represents approximately 11.7% to 11.9% of

sales.

- Net income of $142.8 million to $145.8 million.

- Net income per diluted share of $4.65 to $4.75 based on 30.7

million weighted average diluted shares outstanding.

- Capital expenditures between $95 million and $105 million.

For the fiscal fourth quarter ending March 30, 2024, the Company

expects:

- Total sales of $376 million to $386 million, representing a

decline of (11.7)% to (9.3)% over the prior year, which was a

14-week quarter.

- Same store sales decline of approximately (9.0)% to (6.3)%,

with retail store same store sales declines of (8.5)% to (5.5)% and

an e-commerce same store sales decline of (13.0)%.

- Gross profit between $130.7 million and $135.6 million, or

approximately 34.8% to 35.2% of sales. Gross profit reflects an

estimated 160 basis-point increase in merchandise margin, including

a 140 basis-point improvement from freight expense. We anticipate

310 basis points of deleverage in buying, occupancy and

distribution center costs.

- Selling, general and administrative expenses between $96.7 and

$97.6 million. This represents approximately 25.7% to 25.3% of

sales.

- Income from operations between $34.0 million and $38.0 million.

This represents approximately 9.0% to 9.8% of sales.

- Net income per diluted share of $0.82 to $0.92 based on 30.7

million weighted average diluted shares outstanding.

Conference Call Information

A conference call to discuss the financial results for the

second quarter of fiscal year 2024 is scheduled for today, January

31, 2024, at 4:30 p.m. ET (1:30 p.m. PT). Investors and analysts

interested in participating in the call are invited to dial (877)

451-6152. The conference call will also be available to interested

parties through a live webcast at investor.bootbarn.com. Please

visit the website and select the “Events and Presentations” link at

least 15 minutes prior to the start of the call to register and

download any necessary software. A Supplemental Financial

Presentation is also available on the investor relations section of

the Company’s website. A telephone replay of the call will be

available until March 2, 2024, by dialing (844) 512-2921 (domestic)

or (412) 317-6671 (international) and entering the conference

identification number: 13744029. Please note participants must

enter the conference identification number in order to access the

replay.

About Boot Barn

Boot Barn is the nation’s leading lifestyle retailer of western

and work-related footwear, apparel and accessories for men, women

and children. The Company offers its loyal customer base a wide

selection of work and lifestyle brands. As of the date of this

release, Boot Barn operates 382 stores in 44 states, in addition to

an e-commerce channel www.bootbarn.com. The Company also operates

www.sheplers.com, the nation’s leading pure play online western and

work retailer and www.countryoutfitter.com, an e-commerce site

selling to customers who live a country lifestyle. For more

information, call 888-Boot-Barn or visit www.bootbarn.com.

Forward Looking Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. All statements other than

statements of historical fact included in this press release are

forward-looking statements. Forward-looking statements refer to our

current expectations and projections relating to, by way of example

and without limitation, our financial condition, liquidity,

profitability, results of operations, margins, plans, objectives,

strategies, future performance, business and industry. You can

identify forward-looking statements by the fact that they do not

relate strictly to historical or current facts. These statements

may include words such as “anticipate”, “estimate”, “expect”,

“project”, “plan“, “intend”, “believe”, “may”, “might”, “will”,

“could”, “should”, “can have”, “likely”, “outlook” and other words

and terms of similar meaning in connection with any discussion of

the timing or nature of future operating or financial performance

or other events, but not all forward-looking statements contain

these identifying words. These forward-looking statements are based

on assumptions that the Company’s management has made in light of

their industry experience and on their perceptions of historical

trends, current conditions, expected future developments and other

factors they believe are appropriate under the circumstances. As

you consider this press release, you should understand that these

statements are not guarantees of performance or results. They

involve risks, uncertainties (some of which are beyond the

Company’s control) and assumptions. These risks, uncertainties and

assumptions include, but are not limited to, the following:

decreases in consumer spending due to declines in consumer

confidence, local economic conditions or changes in consumer

preferences; the Company’s ability to effectively execute on its

growth strategy; and the Company’s failure to maintain and enhance

its strong brand image, to compete effectively, to maintain good

relationships with its key suppliers, and to improve and expand its

exclusive product offerings. The Company discusses the foregoing

risks and other risks in greater detail under the heading “Risk

factors” in the periodic reports filed by the Company with the

Securities and Exchange Commission. Although the Company believes

that these forward-looking statements are based on reasonable

assumptions, you should be aware that many factors could affect the

Company’s actual financial results and cause them to differ

materially from those anticipated in the forward-looking

statements. Because of these factors, the Company cautions that you

should not place undue reliance on any of these forward-looking

statements. New risks and uncertainties arise from time to time,

and it is impossible for the Company to predict those events or how

they may affect the Company. Further, any forward-looking statement

speaks only as of the date on which it is made. Except as required

by law, the Company does not intend to update or revise the

forward-looking statements in this press release after the date of

this press release.

Boot Barn Holdings,

Inc.

Consolidated Balance

Sheets

(In thousands, except per share

data)

(Unaudited)

December 30,

April 1,

2023

2023

Assets

Current assets:

Cash and cash equivalents

$

107,166

$

18,193

Accounts receivable, net

10,380

13,145

Inventories

563,378

589,494

Prepaid expenses and other current

assets

54,205

48,341

Total current assets

735,129

669,173

Property and equipment, net

308,085

257,143

Right-of-use assets, net

366,745

326,623

Goodwill

197,502

197,502

Intangible assets, net

60,710

60,751

Other assets

5,334

6,189

Total assets

$

1,673,505

$

1,517,381

Liabilities and stockholders’

equity

Current liabilities:

Line of credit

$

—

$

66,043

Accounts payable

131,655

134,246

Accrued expenses and other current

liabilities

152,704

122,958

Short-term lease liabilities

59,243

51,595

Total current liabilities

343,602

374,842

Deferred taxes

39,949

33,260

Long-term lease liabilities

375,345

330,081

Other liabilities

3,664

2,748

Total liabilities

762,560

740,931

Stockholders’ equity:

Common stock, $0.0001 par value; December

30, 2023 - 100,000 shares authorized, 30,528 shares issued; April

1, 2023 - 100,000 shares authorized, 30,072 shares issued

3

3

Preferred stock, $0.0001 par value; 10,000

shares authorized, no shares issued or outstanding

—

—

Additional paid-in capital

229,322

209,964

Retained earnings

693,587

576,030

Less: Common stock held in treasury, at

cost, 227 and 192 shares at December 30, 2023 and April 1, 2023,

respectively

(11,967

)

(9,547

)

Total stockholders’ equity

910,945

776,450

Total liabilities and stockholders’

equity

$

1,673,505

$

1,517,381

Boot Barn Holdings,

Inc.

Consolidated Statements of

Operations

(In thousands, except per share

data)

(Unaudited)

Thirteen Weeks Ended

Thirty-Nine Weeks

Ended

December 30,

December 24,

December 30,

December 24,

2023

2022

2023

2022

Net sales

$

520,399

$

514,553

$

1,278,550

$

1,231,954

Cost of goods sold

321,292

326,739

803,564

777,214

Gross profit

199,107

187,814

474,986

454,740

Selling, general and administrative

expenses

123,960

115,318

315,016

285,669

Income from operations

75,147

72,496

159,970

169,071

Interest expense

522

2,258

2,008

4,345

Other income/(loss), net

351

63

525

(210

)

Income before income taxes

74,976

70,301

158,487

164,516

Income tax expense

19,352

17,529

40,930

40,372

Net income

$

55,624

$

52,772

$

117,557

$

124,144

Earnings per share:

Basic

$

1.84

$

1.77

$

3.90

$

4.17

Diluted

$

1.81

$

1.74

$

3.84

$

4.09

Weighted average shares outstanding:

Basic

30,293

29,813

30,117

29,790

Diluted

30,649

30,294

30,575

30,340

Boot Barn Holdings,

Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Thirty-Nine Weeks

Ended

December 30,

December 24,

2023

2022

Cash flows from operating

activities

Net income

$

117,557

$

124,144

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

35,801

25,968

Stock-based compensation

10,429

9,562

Amortization of intangible assets

41

47

Noncash lease expense

40,361

35,203

Amortization and write-off of debt

issuance fees and debt discount

81

101

Loss on disposal of assets

660

250

Deferred taxes

6,689

506

Changes in operating assets and

liabilities:

Accounts receivable, net

2,905

(4,571

)

Inventories

26,116

(117,851

)

Prepaid expenses and other current

assets

(5,945

)

(14,430

)

Other assets

855

(3,194

)

Accounts payable

2,588

19,571

Accrued expenses and other current

liabilities

28,476

32,785

Other liabilities

916

423

Operating leases

(27,071

)

(21,464

)

Net cash provided by operating

activities

$

240,459

$

87,050

Cash flows from investing

activities

Purchases of property and equipment

$

(91,297

)

$

(83,056

)

Net cash used in investing activities

$

(91,297

)

$

(83,056

)

Cash flows from financing

activities

(Payments)/Borrowings on line of credit,

net

$

(66,043

)

$

30,522

Repayments on debt and finance lease

obligations

(655

)

(626

)

Tax withholding payments for net share

settlement

(2,420

)

(4,501

)

Proceeds from the exercise of stock

options

8,929

329

Net cash (used in)/provided by financing

activities

$

(60,189

)

$

25,724

Net increase in cash and cash

equivalents

88,973

29,718

Cash and cash equivalents, beginning of

period

18,193

20,674

Cash and cash equivalents, end of

period

$

107,166

$

50,392

Supplemental disclosures of cash flow

information:

Cash paid for income taxes

$

45,637

$

58,324

Cash paid for interest

$

1,931

$

4,002

Supplemental disclosure of non-cash

activities:

Unpaid purchases of property and

equipment

$

15,427

$

27,474

Boot Barn Holdings,

Inc.

Store Count

Quarter

Ended

Quarter

Ended

Quarter

Ended

Quarter

Ended

Quarter

Ended

Quarter

Ended

Quarter

Ended

Quarter

Ended

December 30,

September 30,

July 1,

April 1,

December 24,

September 24,

June 25,

March 26,

2023

2023

2023

2023

2022

2022

2022

2022

Store Count (BOP)

371

361

345

333

321

311

300

289

Opened/Acquired

11

10

16

12

12

10

11

11

Closed

—

—

—

—

—

—

—

—

Store Count (EOP)

382

371

361

345

333

321

311

300

Boot Barn Holdings,

Inc.

Selected Store Data

Thirteen Weeks Ended

Fourteen

Weeks

Ended

Thirteen Weeks Ended

December 30,

September 30,

July 1,

April 1,

December 24,

September 24,

June 25,

March 26,

2023

2023

2023

2023

2022

2022

2022

2022

Selected Store Data:

Same Store Sales (decline)/growth

(9.7

)%

(4.8

)%

(2.9

)%

(5.5

)%

(3.6

)%

2.3

%

10.0

%

33.3

%

Stores operating at end of period

382

371

361

345

333

321

311

300

Total retail store square footage, end of

period (in thousands)

4,153

4,027

3,914

3,735

3,598

3,451

3,333

3,194

Average store square footage, end of

period

10,872

10,855

10,841

10,825

10,806

10,751

10,717

10,648

Average net sales per store (in

thousands)

$

1,185

$

909

$

958

$

1,088

$

1,320

$

966

$

1,031

$

1,094

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240131235420/en/

Investor Contact: ICR, Inc. Brendon Frey, 203-682-8216

BootBarnIR@icrinc.com or Company Contact: Boot Barn

Holdings, Inc. Mark Dedovesh, 949-453-4489 Senior Vice President,

Investor Relations & Financial Planning

BootBarnIRMedia@bootbarn.com

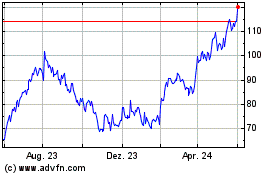

Boot Barn (NYSE:BOOT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Boot Barn (NYSE:BOOT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024