UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

|

| Filed by the Registrant ☒ |

|

|

|

| Filed by a Party other than the Registrant ☐ |

|

|

| Check the appropriate box: |

|

|

|

|

| ☐ Preliminary Proxy Statement

☐ Definitive Proxy Statement |

|

☐ Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2)) |

|

| ☒ Definitive Additional Materials |

|

| ☐ Soliciting Material Pursuant to §

240.14a-12 |

BLACKROCK HEALTH SCIENCES TERM TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

On May 26, 2024, representatives of the funds listed below (collectively, the “Funds”) submitted

slides to certain representatives of Institutional Shareholder Services Inc. regarding the Funds. A copy of these slides is filed herewith.

BlackRock

California Municipal Income Trust

BlackRock New York Municipal Income Trust

BlackRock MuniHoldings New York Quality Fund, Inc.

BlackRock

MuniYield Pennsylvania Quality Fund

BlackRock MuniYield New York Quality Fund, Inc.

BlackRock Innovation and Growth Term Trust

BlackRock Health

Sciences Term Trust

BlackRock Science and Technology Term Trust

BlackRock Capital Allocation Term Trust

BlackRock ESG Capital

Allocation Term Trust

ISS Supplement Contested funds: BlackRock California Municipal Income Trust (NYSE: BFZ) BlackRock New York Municipal Income Trust (NYSE:

BNY) BlackRock MuniHoldings New York Quality Fund, Inc. (NYSE: MHN) BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA) BlackRock MuniYield New York Quality Fund, Inc. (NYSE: MYN) BlackRock Innovation and Growth Term Trust (NYSE: BIGZ)

BlackRock Health Sciences Term Trust (NYSE: BMEZ) BlackRock Science and Technology Term Trust (NYSE: BSTZ) BlackRock Capital Allocation Term Trust (NYSE: BCAT) BlackRock ESG Capital Allocation Term Trust (NYSE: ECAT)

Saba rejected constructive settlement proposals that would provide all shareholders with substantial liquidity The Boards offered strong

concessions to prevent a costly and unnecessary proxy contest in exchange for a standstill, dismissal of pending litigation and other customary terms Introductory Meeting with Board Saba Submits Formal Demands to Board January 15, 2024

March 15, 2024 Saba shares its desired outcomes of its Saba demands that (i) seven of the engagement with the Funds, including Funds (including Saba’s six largest open-ending, merging and liquidating stakes) merge into open-end funds or certain Funds (as well as tenders offers), ETFs and (ii) the remainder of the Funds without any concrete economic or conduct tender offers governance proposals Funds Start Evaluating Potential

Funds Submit Settlement Proposals Responsive Counter-Proposal January 17, 2024 April 15, 2024 The Boards instruct management to The Funds offer to provide evaluate potential settlement liquidity to all shareholders proposals and deliberate

on how to in an amount of continue to improve total returns while approximately $2.1 billion protecting the interests of all across five Funds (incl. shareholders ECAT)

Saba rejected constructive settlement proposals that would provide all shareholders with substantial liquidity (cont’d) Despite its

ongoing campaign attacks on the Funds’ corporate governance, Saba did not ask for a single change to any of the Funds’ corporate governance practices during settlement negotiations Saba Declines to Negotiate Saba Drastically Changes Scope

of Its Demands April 16, 2024 April 24, 2024 Saba rejects Funds’ Saba demands that (i) all Fund trustees resign at ECAT so that proposal, declines to make all Saba nominees can be elected unopposed (and the Fund a

counter-proposal would not conduct a tender) and (ii) the other nine Funds merge to an open-end fund, initiate a self-tender or implement a trigger tender1 Funds Sweeten Proposal in Funds Take Steps to

Funds Reject Saba Boards Continue Taking Order to Reach a Resolution Enhance Liquidity Demands As Too Extreme Shareholder-Friendly Actions April 22, 2024 May 3, 2024 May 7, 2024 May 20, 2024 The Funds offer to The Funds announce

In light of the drastic Following the Boards’ extensive deliberations and trigger tenders1 at changes in Saba’s productive engagements with shareholders, the provide liquidity to all Boards continue taking additional

shareholder-shareholders in an 98% of NAV and proposal, the Funds friendly actions, including distribution rate amount of approximately enter into agreement confirm they will not increases providing liquidity at NAV ($0.7 billion annually) and

fee waivers ($2 million plus $3.1 billion across five with Karpus ($2.2 submit yet another ongoing monthly waivers)—these actions, Funds (incl. ECAT) billion) counter-proposal together with the Karpus agreement, provide

$2.9 billion in liquidity at NAV across all Funds 3

BIGZ and ECAT convened their annual meetings three times to reach quorum and Saba failed to submit the proxies of shareholders it had

solicited each time The Funds convened their 2023 annual meetings on July 10, adjourned them to July 25, BIGZ and ECAT each convened their and then adjourned them again to August 7 in an effort to achieve quorum 2023 annual

meetings three times in When quorum was again absent on August 7, the Funds declared that no action would an effort to reach quorum be taken at the meetings Establishing quorum requires Maryland trust law is generally silent on

quorum and meeting conduct verifying that a majority of The Funds’ trust agreements set the threshold for quorum, and the Funds’ bylaws outstanding shares are present or empower the chair of a meeting to do all acts appropriate in

his or her judgment for represented by proxy at the meeting the proper conduct of the meeting Saba’s representatives attended Representatives of First Coast Results, the independent inspector of elections, have each of the meetings but

failed to confirmed in writing that Saba’s representatives informed them at the convened and submit their proxies to be counted reconvened meetings that Saba would not be turning in their proxies (see next page) The chair of the

meeting As the meeting minutes evidence, at both August 7 meetings the chair of the meeting asked if any proxies had not been asked whether there were any proxies that had not been presented to the independent submitted to the inspector

of elections inspector of elections—and both times Saba’s representatives remained silent Broadridge provides both sides of a proxy contest with a preliminary tabulation of proxies submitted through its systems Saba says it believed

no quorum existed due to unofficial, preliminary Broadridge tabulations are not complete records of all votes: they do not include registered holders and beneficial holders through other intermediaries (e.g., Mediant) Broadridge tabulations

that did not account for all shares Saba could not know whether there was quorum based solely on the Broadridge tabulation because it did not know how many how many proxies the Funds held from shareholders outside of Broadridge Because Saba

never submitted its As of August 7, pre-meeting tabulations from Broadridge showed: (1) 37.1% of proxies, it is impossible to determine outstanding shares at BIGZ and (2) 44.6% of outstanding shares

at ECAT as voted whether quorum could have been The Funds could not (and still cannot) determine how many proxies Saba held from obtained shareholders outside of Broadridge that were not included in the tabulations 4

The independent inspector of elections has confirmed what occurred at BIGZ and ECAT in 2023 First Coast Results, Inc. was the inspector

of elections for the shareholder meetings of BIGZ and ECAT in 2023. First Coast is an independent third-party service provider, who has served as independent inspector of elections in the vast majority of all proxy contests in the U.S. They are

recognized as experienced, neutral and reliable by companies and activists alike. Below is a description from First Coast about what occurred at the shareholder meetings of BIGZ and ECAT in 2023 “First Coast recalls the following from last

year’s BlackRock funds’ meetings for BIGZ and ECAT on July 10, July 25 and August 7 of 2023: Saba and its proxy solicitor, Mr. John Grau, attended the ECAT and BIGZ meetings on July 10th but did not turn in their votes.

The adjourned meetings on July 25 and August 7 were attended by Douglas Jaffe representing InvestorCom, he did not turn in any votes for either meeting. We have all the hard copy votes from each of those two meetings, and there are no

votes from Saba. We could not count their votes because Saba did not give them to us. Mr. Grau showed us Saba’s votes for the July 10th meetings briefly before the meetings, but he advised First Coast that Saba had decided not to turn them

in. The same procedure was followed on July 25th and August 7th but those meetings were attended by Mr. Jaffe. Mr. Grau is mistaken in his affidavit regarding First Coast’s determination of quorum. In a contested election, an

inspector of elections never makes this determination at the meeting because the inspector does not have a chance to audit the votes for validity and revocations prior to the meeting. The quorum determination at the meeting is made by a

company’s proxy solicitor on a preliminary basis. The inspector verifies quorum after the fact.” Statement from First Coast, May 24, 2024 It is unclear why Saba’s representatives did not submit their proxies, as they were

legally required to do, and it is disingenuous to try to blame the Funds for their own failure 5

Our corporate governance protects all shareholders, who face different risks than in operating companies â–ª The Boards

believe that it is inappropriate to compare the Funds’ corporate governance practices to those of operating companies because there are important differences to CEFs CEFs are (1) inherently more vulnerable to opportunistic investors than

operating companies because of the arbitrage opportunities and the smaller market capitalizations (which make it easier to acquire a significant stake with a modest investment) and (2) subject to extensive regulation with respect to governance,

operations and board independence Congress has taken notice. The House This vulnerability is also why The SEC has also acknowledged recently passed, with a bipartisan BlackRock’s Corporate that, unlike operating companies, majority, The

Increasing Investor proxy voting guidelines CEFs are subject to extensive Opportunities Act , which removes the treat CEFs differently than regulation with respect to loophole allowing activists to force operating companies governance, operations

and CEFs into liquidity events or radically board independence, that could change their investment strategies A classified board structure may justify exempting CEFs from also be justified at non-operating

certain governance requirements ICI Thanks House for Protecting Closed-End companies, e.g., closed-end funds such as the universal proxy rules Fund Investors or business

development companies (“BDC”), in certain “Depending on what actions activists force, CEFs’ circumstances. long-term shareholders may find themselves The Proposed [universal proxy card] Rules invested in a radically different

product with an excluded funds. . . . [F]und shareholders Excerpt from BlackRock Investment also have important rights granted to entirely new and unexpected strategy, the same Stewardship Proxy Voting product but with fewer assets and them under

the Investment Company Act Guidelines for U.S. Securities, of 1940 that distinguishes funds from correspondingly higher fees and expenses, or no effective as of January 2024 product at all.” operating companies. Excerpt from press release by

the Investment Excerpt from the SEC Universal Proxy Card Company Institute, March 7, 2024 Final Rule, November 17, 2021

This is how the Funds’ governance practices compare to their peers and the two funds Saba has taken over Quorum Requirement for

Voting Standard for Board Structure Shareholder Meetings Uncontested Elections 10% 6% 2% 10% 20% 33% 50% 50% 65% 90% 94% 80% 100% 90% 100% Contested Saba CEF Market3 Contested CEF Market Contested Saba Saba BLK CEFs CEFs1,2 BLK CEFs CEFs1 BLK CEFs

CEFs1 (Excluding BlackRock Classified Plurality CEFs)4 Unclassified Majority Majority Outstanding 33 1/3% or 30% Majority Present Other Voting Standard for Shareholders Can Call Special Control Share Limitations Contested Elections Meetings 10% 20%

30% 70% 50% 50% 70% 100% 100% 100% Contested Saba Contested Saba Contested Saba BLK CEFs CEFs1 BLK CEFs5 CEFs1 BLK CEFs CEFs1 Plurality Yes Yes Majority Outstanding No No Majority Present 1. Based on latest publicly filed documents by BRW and SABA.

2. SABA has submitted a proposal to declassify its board in connection with the 2024 annual meeting. 3. ICI, The Closed-End Fund Market 2023—Supplemental Tables (May 2024), available at https://www.ici.org/system/files/2024-05/per30-05-data.xlsx. Note that CEF Market data is unavailable for the other metrics. 4. Based

on a review of the governing documents of 363 CEFs, not including 7 any CEFs advised by BlackRock. 5. BlackRock closed-end funds domiciled in MD will not apply the statute to the 2024 and 2025 annual meetings.

The Funds’ quorum requirements track market practice and protect shareholders â–ª Requiring a majority of

outstanding shares to establish quorum for 20% the transaction of business is consistent with market practice – 65% of CEFs (excluding those advised by BlackRock) use a 80% majority standard for quorum1 Contested – Both CEFs advised by

Saba use a majority quorum CEFs standard Contested BLK Funds â–ª A majority quorum standard ensures that at least 25% of shareholders must support a proposal for it to be enacted – A lesser quorum threshold would permit small

minorities of shareholders to bind the remainder of the shareholder 100% base, which would enable opportunistic shareholders to enact drastic changes without much, if any, support â–ª In addition, the rules of the NYSE, the exchange

on which the Saba CEFs1 Funds’ shares are listed, state that the opinion of the NYSE is that 2% the quorum required for any meeting of shareholders should 33% be sufficiently high to ensure a representative vote – In authorizing listing,

the NYSE gives careful consideration to 65% provisions fixing any proportion “less than a majority of the outstanding shares as the quorum for shareholders’ meetings” CEF Market (Excluding BlackRock CEFs)2 Majority 33 1/3% or 30%

Other 1. Based on latest publicly filed documents by BRW and SABA. 2. Based on a review of the governing documents of 363 CEFs, not including any CEFs advised by BlackRock. 8

Quarterly performance information The Board receives the following performance information for all BlackRock-advised closed-end funds: â–ª Quarterly Performance Summary Report – This report is the primary performance report for all closed-end funds that includes a

comprehensive set of current and historical performance measures customized to each strategy and informed by the Board’s and BlackRock’s research on factors that affect discounts, including, but not limited to: • Gross and Net

Performance on Net Asset Value relative to benchmark: 1-, 3- and 5-year periods • Total Return on Net Asset Value Peer

Percentile Rankings (as applicable)1: 1, 3- and 5-year periods • Yield on Net Asset Value Peer Rankings: current and 1-year

period • Premium / Discount Peer Rankings: current and 3-year average â–ª Quarterly Outcome-Oriented Performance and Dashboard Report – This reporting highlights a select list of

“outcome-oriented” closed-end funds. BlackRock provides this supplemental performance information for evaluation with metrics that differ from the traditional benchmark comparison framework –

BlackRock considers these funds to be products that aim to provide investors targeted solutions to set objectives – Typical characteristics of the funds may include: 1) not being managed to a specific benchmark, 2) targeting outcomes such as a

specific yield or volatility target, and 3) targeting a specific return and risk level, and 4) a minimum allocation to specific investments (i.e., meeting certain ESG criteria) â–ª Overall Performance Score Methodology – Certain

reports, such as the Quarterly Performance Summary Report, include a numerical (1 to 100) and color-coded (Red/Amber/Green) performance score – This overall performance score measures a fund’s performance against its active return and peer

group across multiple time periods; it is a combination of a fund’s alpha score, its peer score based on net total return, and its peer score based on 1-year net yield 1. Morningstar category is the

default peer group, however, peer groups may be customized to include only funds that have similar investment strategies. Select funds do not have a valid peer group and, in these cases, only a benchmark is used for performance assessment. 9

Discount analysis information Each Board receives a Quarterly Closed-End Fund Review Report,

with the following discount-related information: â–ª The primary focus is the closed-end fund industry market price trending (discounts) across all asset classes: municipals, fixed-income,

equity â–ª Board considerations to reduce the discount and actions that may be considered, including, but not limited to: amending investment policies, distribution rate changes, open-market share repurchases, tender offers and the

conversion of a Fund to an open-end investment company or exchange-traded fund â–ª BlackRock advised closed-end funds are reviewed in relation to the

broader closed-end fund industry for consideration of macro and micro factors influencing discount (and premium) levels by asset class and fund – Closed-end fund

industry and asset class discount data – Median discount information for BlackRock Funds compared to the CEF Industry median – Summary of BlackRock efforts supporting closed-end funds in the

secondary market and measures taken to enhance shareholder value • Marketing • Client Events • Strategic Actions • Research coverage / distribution platform due diligence – In-depth

reviews of performance reports (including, for any Funds that has lagging performance, detailed commentary and additional information, including remedial actions, provided for the Boards’ deliberations) 10

Discount analysis information (cont’d) In addition to the quarterly materials that are provided to the Boards, materials are also

provided to the Discount Committee as requested and for consideration in the annual contract renewal process Working with the Discount Committee in 2023, BlackRock conducted, an update to a prior discount study exploring the historical relationship

between closed-end fund premiums/discounts and various fund characteristics. Key findings reported to the Boards included the below, which formed and influenced, in part, recent actions taken by each Board and

management to mitigate market price discounts to NAV: – CEF discounts are cyclical in nature with a large proportion of monthly changes explained by changes in equity market returns, volatility, credit spreads and interest rate levels, factors

outside the control of the Boards and management – Prior returns have an inverse relationship with fund discounts (stronger long-term returns -> narrower discount), particularly for Equity funds (Exhibit 1) – Distribution Yields have an

inverse relationship with Municipal and Equity fund discounts (higher yield -> narrower discount) while the relationship in Taxable Fixed-Income funds is inconclusive (Exhibit 2) – Secondary market liquidity has an inverse relationship with

fund discounts (higher liquidity -> narrower discount), particularly for Equity funds (Exhibit 3) – Category group (i.e., competition) has an inverse relationship with fund discounts (larger category group -> deeper discount and wider

spread) (Exhibit 4 and Exhibit 5) • This analysis was one of several additions to the prior discount study at the request of the Discount Committee

Discount Analysis—Exhibits

Exhibit 1 Does good performance lead to narrower discounts? â–ª There appears to be an inverse relationship between 5Y

Annualized performance and discount level (i.e., higher returns -> narrower discount) â–ª This relationship holds better for Equity and Taxable Bond Charts below detail the distribution across deciles of 5Y Annualized Performance

and discounts (Decile 1 is lowest returns while Decile 10 is highest returns) 75th %-le Median 25th %-le Asset Class Decile Median Return Asset Class Decile

Median Return Asset Class Decile Median Equity 1 -8.36 Municipal Bond 1 3.81 Return Equity 2 -2.05 Municipal Bond 2 4.81 Taxable Bond 1 0.98 Equity 3 1.20 Municipal

Bond 3 5.19 Taxable Bond 2 3.41 Equity 4 3.43 Municipal Bond 4 5.57 Taxable Bond 3 4.77 Equity 5 5.26 Municipal Bond 5 5.81 Taxable Bond 4 5.51 Equity 6 7.23 Municipal Bond 6 6.05 Taxable Bond 5 6.25 Equity 7 9.10 Municipal Bond 7 6.29 Taxable Bond

6 6.91 Equity 8 11.34 Municipal Bond 8 6.49 Taxable Bond 7 7.61 Equity 9 13.45 Municipal Bond 9 6.79 Taxable Bond 8 8.47 Equity 10 18.14 Municipal Bond 10 7.39 Taxable Bond 9 9.98 13 Taxable Bond 10 12.23

Exhibit 2 Do higher distribution yields lead to narrower discounts? â–ª There appears to be an inverse relationship

between distribution yield and discount level (i.e., higher yield -> narrower discount). However, the relationship varies by asset class â–ª The inverse relationship is most prominent for Muni funds and Equity funds to some

extent, less so for Taxable Bond Charts below detail the distribution across deciles of fund distribution yield and discounts (Decile 1 is lowest NAV Yield while Decile 10 is Highest NAV Yield) 75th %-le

Median 25th %-le 14

Exhibit 3 Does fund secondary market liquidity affect discounts? â–ª For Equity funds, there appears to be an inverse

relationship between secondary market liquidity and discount levels (i.e., higher liquidity -> narrower discount) â–ª The least frequently traded Equity CEFs have traded at wider discounts compared to more frequently traded CEFs

â–ª There is no clear observable relationship for Muni and Taxable Funds Charts below detail the distribution across deciles of fund secondary market liquidity (traded volume*) and discounts (Decile 1 is least traded while Decile 10

is most traded) 75th %-le Median 25th %-le • Defined as % of outstanding shares traded on a monthly basis 15

Exhibit 4 Is there any correlation between the category size to median discount? â–ª There seems to be a negative

correlation between the size of the category group and discount level (i.e., larger category group -> wider discount). This relationship holds most of the time Chart below shows the correlation between size of fund categories and the median

discount • The categories used are equity and Morningstar Classification for fixed income

Exhibit 5 Is there any correlation between category size and discount spread? â–ª There seems to be a positive

correlation between the size of the category and the discount spread of the category (i.e., more funds within a category -> wider discount spread). This relationship holds most of the time Chart below shows the correlation between size of fund

categories and the discount spread • The categories used are equity and Morningstar Classification for fixed income • Discount spread refers to the interquartile spread of the discount within each group

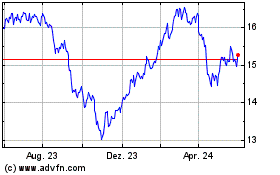

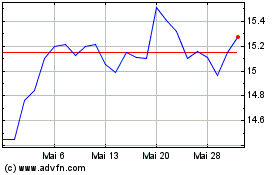

BlackRock Health Science... (NYSE:BMEZ)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

BlackRock Health Science... (NYSE:BMEZ)

Historical Stock Chart

Von Nov 2023 bis Nov 2024