UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

November 1, 2023

BHP GROUP

LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE,

VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒

Form

20-F ☐ Form 40-F

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): n/a

Exchange release

1 November 2023

BHP Annual

General Meeting 2023 speeches and presentation

The following documents are attached and will be presented at the 2023 Annual General Meeting of BHP

Group Limited to be held today:

Authorised for release by Stefanie Wilkinson, Group Company Secretary.

BHP Group Limited ABN 49 004 028

077

|

|

|

| Contacts |

|

|

|

|

| Media |

|

Investor Relations |

| media.relations@bhp.com |

|

investor.relations@bhp.com |

|

|

| Australia and Asia |

|

Australia and Asia |

| Gabrielle Notley |

|

John-Paul Santamaria |

| +61 411 071 715 |

|

+61 499 006 018 |

|

|

| Europe, Middle East and Africa |

|

Europe, Middle East and Africa |

| Neil Burrows |

|

James Bell |

| +44 7786 661 683 |

|

+44 7961 636 432 |

|

|

| Americas |

|

Americas |

| Renata Fernandaz |

|

Monica Nettleton |

| +56 9 8229 5357 |

|

+1 (416) 518-6293 |

|

|

| BHP Group Limited |

|

|

| ABN 49 004 028 077 |

|

|

| LEI WZE1WSENV6JSZFK0JC28 |

|

|

| Registered in Australia |

|

|

| Level 18, 171 Collins Street |

|

|

| Melbourne |

|

|

| Victoria 3000 Australia |

|

|

| Tel: +61 1300 55 4757 Fax: +61 3 9609 3015 |

|

|

| BHP Group is headquartered in Australia |

|

|

|

|

| bhp.com |

|

|

BHP Group Limited ABN 49 004 028

077

BHP Group Limited AGM

1 November 2023

Ken MacKenzie, Chair

Welcome to everyone with us here in South

Australia today and watching online.

Our results for the 2023 financial year demonstrate BHP’s focus on consistently executing our strategy

to deliver results.

Our operating performance and financial results were strong, and we made good progress towards our social value targets and goals.

We believe our company is well positioned to continue to create value today, and for decades to come. I’d like to take this opportunity to explain

why, focusing on:

| |

• |

|

Our approach to safety, culture and capability |

| |

• |

|

Our role in a sustainable global future |

| |

• |

|

Our strong, consistent performance and returns, and |

| |

• |

|

Our focus on social value |

Safety and culture

At BHP, safety is our number one

priority. The two tragic fatalities this year at Western Australia Iron Ore and at Olympic Dam were stark reminders of the reason why safety must always be our number one priority.

Our commitment to the goal of zero fatalities and serious injuries at BHP remains unwavering. We are continuing to drive our safety culture to eliminate

fatalities and serious injuries.

This safety culture goes beyond operational safety and includes addressing sexual harassment, racism and bullying in our

workplace. We still have more work to do, but we are making progress on our commitment to provide a safe, inclusive workplace culture where everyone can bring the best of themselves to work.

Our role in a global future

Mining, and BHP, have a

clear and undeniable role in the critical global energy transition required for more sustainable development.

Metals and minerals produced from mining

are essential for decarbonisation, the energy transition and to meet the demands of a growing population, who are increasingly urbanised and seeking a higher standard of living.

Over the last three years, we have made strategic decisions to reshape our portfolio to align with these global megatrends.

BHP Group Limited ABN 49 004 028

077

We unified our corporate structure to provide greater strategic flexibility, we merged our former petroleum

business with Woodside to create a top 10 global independent energy company, and we approved an investment of $5.7 billion US dollars to develop Stage 1 of the Jansen project in Canada, with first production expected in late 2026.

And just yesterday, the Board approved a further investment of $4.9 billion US dollars for Stage 2 of that project, which Mike will touch on shortly.

This deliberate reshaping of our portfolio, positions BHP to create value for today and into the future. We now have a portfolio that stands to benefit

from the increased demand generated from the global megatrends playing out around us.

Our portfolio includes copper for renewable energy, nickel for

electric vehicles, iron ore and higher-quality metallurgical coal for the steel required to build decarbonisation and other new infrastructure, and we’re moving into potash, which we expect to be vital for food security and more sustainable

farming to support a growing population.

Our recent portfolio changes continue this theme. We are consolidating our metallurgical coal portfolio in

Queensland to focus on the higher-quality metallurgical coals preferred by our steelmaking customers.

Copper South Australia

And our successful acquisition of OZ Minerals in May this year adds complementary copper and nickel assets and creates an exciting opportunity for BHP here in

South Australia.

We are combining the Carrapateena and Prominent Hill mines acquired from OZ Minerals with the Olympic Dam asset and Oak Dam project, to

create a new copper province – which we call Copper South Australia. This new copper province will unlock long-term value and create significant synergies.

But it’s essential to understand – and I know Mike is going to talk about this shortly – that the right conditions will need to be met for

Copper South Australia to compete with other options in our Capital Allocation Framework.

Beyond this available growth from our existing assets, we have

four further levers to pursue growth: technology and innovation, early-stage entry, exploration and mergers & acquisitions. We are making good progress on each of these fronts. But it’s important to note that we are not pursuing growth

for growths sake, but to create value for shareholders.

Strong, consistent performance and returns

We use our Capital Allocation Framework to assess the most effective and efficient way to deploy our capital. It is deeply embedded in our decision making, and

is one of the reasons we have been able to consistently deliver substantial shareholder returns and create financial and social value for our partners and stakeholders.

BHP Group Limited ABN 49 004 028

077

FY23 highlights

In the 2023 Financial Year, we had earnings of more than $13 billion US dollars. These results were delivered against a back drop of global uncertainty,

weaker commodity prices and inflationary pressures.

We also continued to produce strong margins and a consistently high baseline of cash flow. Over the

past decade, we have delivered average margins of 55 per cent and generated average net operating cash flows of $20 billion US dollars per year. This stability is a hallmark for BHP and demonstrates the quality of our portfolio and the

consistency of our returns, despite the cyclical volatility in the resources sector.

Using our Capital Allocation Framework, this year’s result has

flowed through to a full year dividend to shareholders of $1.70 US per share, fully franked, which was a 64 per cent payout ratio. This was the third largest ordinary dividend in our history.

To put these results into context, over the last two years, BHP has been the largest dividend payer globally across all sectors and the largest dividend payer

on the ASX100.

In terms of total shareholder returns, over the past 5 years, our total shareholder return was approximately 15% per annum, and includes

delivering more than $50 billion US dollars in cash dividends to our shareholders.

We also created significant financial value in the communities

where we operate through payments to suppliers, wages to our employees, contributions to communities and taxes and royalties paid to governments. In the 2023 Financial Year, our total economic contribution was over $54 billion US dollars. This

includes $2.6 billion US dollars paid to local suppliers who support our operations.

Social value

We are also continuing to deliver tangible outcomes in each of the six pillars of our social value framework, which are focused on decarbonisation, the

environment, Indigenous partnerships, workforce, communities, and supply chains.

The work we do in these areas is vital to our business. Delivering

social value can help us become a partner of choice with customers, suppliers and communities.

Addressing operational greenhouse gas emissions is an

important part of our commitment to sustainability. We have a Scope 1 and 2 decarbonisation target of at least a 30% reduction in our operational greenhouse gas emissions by the 2030 financial year compared with our baseline 2020 financial year. In

the 2023 Financial Year, we further reduced our operational emissions by 11 per cent from the previous year, and we remain on track to achieve our 2030 target.

Our future progress towards greenhouse gas emissions reductions won’t be linear as we look to grow our business, but we have a comprehensive plan that is

underpinned by clear actions that support emissions reduction now and through to the 2030 Financial Year.

BHP Group Limited ABN 49 004 028

077

Our relationships with Traditional Owners and other Indigenous partners are some of the most important

relationships to BHP. We operate on the traditional lands of Indigenous peoples at many of our locations in Australia and around the world. We partner widely with Indigenous communities and have long-term agreements with Traditional Owners and First

Nations partners.

These are critical relationships for BHP’s ability to start new projects, expand existing projects, and to grow our business.

We recognise that we can contribute positively to the lives and aspirations of Indigenous peoples and communities by providing opportunities for employment

and supporting Indigenous enterprises. This year we spent more than $330 million US dollars with Indigenous suppliers globally. This is more than double last year’s figure.

We are the largest Indigenous employer in the Australian resources sector with over 8 per cent Indigenous employment. In Chile, our Indigenous employment

is close to 10 per cent and at our Jansen Potash Project in Canada it is almost 8 per cent.

Finally, this year we published our Reconciliation

Action Plan which we developed in partnership with Traditional Owners. This was the sixth iteration of our Reconciliation Action Plan since 2007. We remain committed to incorporating Indigenous perspectives and voices into the way we operate and

manage our business, and to working closely with Traditional Owners.

Board and succession, and conclusion

Now, before I hand across to Mike Henry, I would again like to acknowledge and thank Terry Bowen who will retire as a director at the conclusion of this

meeting.

And I am pleased to confirm that Michelle Hinchliffe will step into the role of Chair of the Risk and Audit Committee following Terry’s

retirement. Michelle brings significant experience in risk management and financial controls.

In closing, I believe that BHP is in a strong and exciting

position.

It is a belief powered by the global megatrends – population growth, increased urbanisation... and the energy transition which are all

increasing demand for mineral resources.

We’ve made a number of strategic portfolio and structural changes over the last three years. And we are

further positioning our portfolio to benefit from that demand.

We will continue to drive a culture of safe and reliable operations while maintaining

rigorous capital discipline– and we are making good progress on social value, which is vital for sustainable long term shareholder returns.

Thank

you for your continued support and for investing in the future of BHP. It is now my pleasure to invite your CEO Mike Henry to speak with you.

Thank you.

BHP Group Limited ABN 49 004 028

077

Mike Henry, CEO

Thanks Ken, and thanks to everyone here with us in

Adelaide today and watching online.

Safety

I will

start with safety, and 2023 was a difficult year from a safety perspective for the Company.

Tragically two of our colleagues lost their lives while on

the job. This included a fatal incident at the Olympic Dam asset here in South Australia.

Our thoughts remain with their families, friends and

colleagues. These events underscore the absolute importance of safety first. We remain resolute in our commitment to eliminating fatalities and serious injuries across BHP.

Strong operational performance

Turning now to broader

business performance, as you’ve just heard from Ken, this financial year we delivered another strong set of results.

We met production guidance

across all of our four commodities, and achieved record annual production at Western Australia Iron Ore, Olympic Dam and Spence. We managed inflation well.

We made a significant economic and social contribution to the regions where we operate, and delivered US$8.6 billion cash back to shareholders in

dividends.

We have continued to expand and execute our suite of growth options, and that includes progressing projects, advancing studies, and exploring

new prospects.

We continue to invest in technology, innovation and early-stage options.

And of course, we undertook the successful acquisition of OZ Minerals.

Operational performance

In terms of underlying

operations, this year we demonstrated strong performance across the business, thanks to the efforts of our more than 80,000 employees and contractors.

Now if I unpack that a bit…

Western Australia Iron Ore

achieved record production volumes and remains the lowest cost of the major iron ore producers. In fact, our iron ore operations generate around five US dollars more per tonne in free cash flow than that reported by our largest competitor, and when

you multiply that by the hundreds of millions of tonnes we produce each year you get a sense for the relative performance of this asset. We are ensuring we get maximum returns for every dollar of shareholder capital invested in this business.

BHP Group Limited ABN 49 004 028

077

In Copper, Escondida’s production increased by five per cent, year-on-year. Unit costs increased by 17 per cent, primarily driven by inflationary pressure. This was a solid outcome in the context of what other producers are experiencing; however, we remain very

focused on mitigating the impacts of inflation.

We achieved record production at Spence following higher concentrator throughput, and at Olympic Dam,

with continued strong performance at our concentrator and smelter.

This disciplined operational performance has underpinned continued, strong returns to

shareholders. In fact, BHP was among the highest dividend payers globally in the 2022 calendar year, of any company in any sector.

Portfolio and

growth

Of course our business isn’t just about today, it’s about delivering value for shareholders long-term, so I do want to spend a few

minutes on portfolio and growth.

The resources industry is cyclical, and commodity prices will always impact overall sector profitability.

This cyclicality is a key reason why we seek to have assets that are low on the cost curve. This ensures they are more resilient at all points in the cycle.

This allows us to focus even more intensely on managing the things within our control – safety and productivity. It allows us to do all we can to

maximise the returns from the assets we operate and the capital we have invested in them.

We seek a portfolio of assets that is deliberately structured

to take advantage of the megatrends occurring across the globe.

We see potential for growth in those commodities essential to the needs of urbanisation,

decarbonisation, and a growing population, and we are making the investments needed to unlock productivity, progress towards decarbonising our assets, and deliver growth.

We’re working hard to define the path forward for Escondida which is the world’s largest copper mine and resource1 and which is well-placed to be one of the most responsible copper producers globally, given its transition to full renewable power and desalinated water usage.

At WAIO, we produced 285 million tonnes of iron ore in FY23, progressing towards 305 million tonnes per annum, with studies into reaching

330 million tonnes underway. Iron ore is essential for the steel needed for infrastructure for the energy transition and ongoing urbanisation.

| 1 |

On a contained metals and equity share basis |

BHP Group Limited ABN 49 004 028

077

Significant growth opportunities ahead

We also have a significant, exciting growth path ahead of us in potash in Canada. Potash, used in fertilisers, will be essential for food security and more

sustainable farming, against the backdrop of a growing global population.

We believe the long-term fundamentals for the potash market are compelling and

they have further improved since we sanctioned Jansen Stage 1. Stage 1 is now 32 per cent complete – and remains on budget and ahead of its original schedule, with first production expected late in the 2026 calendar year.

And just yesterday the Board approved the decision to invest US$4.9 billion into Jansen Stage 2, underscoring our confidence in potash and marking the

next phase of our growth in Canada.

Stage 2 will help to transform Jansen into one of the world’s largest potash mines, doubling production capacity

to 8.5 Mtpa, and positioning BHP as one of the leaders in the global potash industry.

And we’re able to deliver Stage 2 at a lower capital intensity

because of the infrastructure delivered in Stage 1.

Jansen is a world-class asset in an investment friendly jurisdiction. It will create value for

generations to come.

We have continued to increase our copper and nickel prospects globally. These interests include Oak Dam in South Australia, Kabanga

Nickel in Tanzania, and Ocelot in the United States. They also include projects in Serbia and Peru, and the Filo del Sol project in Argentina and Chile.

We are also consolidating our coal portfolio to focus on the higher quality metallurgical coals that are increasingly preferred by our customers – most

recently through the up to US$4.1 billion divestment of our Blackwater and Daunia mines, part of the BMA business, which we expect to complete in the fourth quarter of FY24.

Creating potential for future growth

And of course,

there’s OZ Minerals. Bringing OZ into BHP creates the potential for further growth in the near and long term, in the newly aggregated copper province for BHP assets here in South Australia.

We believe that with stable and competitive government policies in place in South Australia, there will be a strong case for future capital investment in

these assets relative to other potential investment options in our portfolio.

I really do want to thank Premier Malinauskas and his government for the

constructive way we are working together towards delivering this shared objective.

Globally, the mining sector is at a crossroads. The energy transition

and broader decarbonisation efforts are expected to progressively shift demand growth towards future-facing commodities. A massive wave of capital investment will be required to meet demand for these minerals.

BHP Group Limited ABN 49 004 028

077

Within this environment of heightened global competition, Australia has a once-in-a-generation opportunity to capture an outsized share of this investment flow, and enjoy the far-reaching future

economic and societal benefits it could deliver. However, we can only succeed if we are willing and able to compete.

This will require government and

industry to work together to improve the competitiveness of Australia’s mining sector so that the nation can enjoy the future benefits this opportunity can bring.

It’s against this backdrop that we are closely watching policy changes at the Australian Federal Government level, some of which risks our national

competitiveness.

In particular, BHP shares concerns of the broader business community that the Australian Government’s Same Job Same Pay proposal

will increase costs and reduce Australia’s investment competitiveness at a time when competition for investment is fierce globally and other nations are working to become more competitive and more attractive.

Prior to the last election, we were on the record as supporting the principle of focused legislative reform to protect vulnerable and low paid workers.

However, the Same Job Same Pay bill goes well and truly beyond this. The proposed changes are not about ‘closing loopholes’ but are the most significant and far-reaching changes to Australian

workplace relations since WorkChoices.

BHP strongly opposed the Same Job Same Pay bill not only because of the damage it threatens to do to our business,

but also for the hit it will have on Australia’s economy, to Australian jobs and to Australia’s productivity and international competitiveness.

The bill could reduce the value of any potential growth plans for a copper province of BHP assets here in South Australia by up to US$2 billion. And it

risks directly impacting dividends for the 17 million Australians who hold BHP shares directly, or indirectly via superannuation.

This is not just

about BHP. These concerns are shared by businesses large and small across the country, and getting these policies wrong risks impacting Australians’ retirement savings.

A competitive labour market with strong links between labour costs and productivity is essential to the long-term success of our industry and the Australian

economy. We will continue to engage the Australian Federal Government constructively, together with the wider business community to highlight the negative impact of these policies.

Delivering strong social value

When it comes to growth,

the opportunities that we’re able to access and develop cannot be realised without delivering strong social value. Social value goes hand in hand with long term shareholder value.

BHP Group Limited ABN 49 004 028

077

Our access to the best resources, markets, partners and talent is contingent on making a positive

contribution to society and building strong relationships with partners, local communities, and First Nations peoples.

Our approach is disciplined and

proactive, and it’s delivering tangible outcomes. This year we:

| |

• |

|

Reduced our operational greenhouse gas emissions by 11% from the year prior, and we remain on track to achieve

our 2030 target to reduce operational GHG emissions by at least 30 per cent from FY2020 levels. |

| |

• |

|

We doubled our spend with Indigenous suppliers globally to more than US$330 million and here in Australia,

we released our sixth Reconciliation Action Plan which was recognised with ‘Elevate’ status by Reconciliation Australia. |

| |

• |

|

And we further advanced female employee participation to more than 35 per cent globally – more than

double from 2016 when we set our aspirational goal to achieve gender balance in our employee workforce by the end of FY2025. |

Social

value is fundamental to our success and future competitiveness and is an important point of differentiation from our competitors.

Creating value now,

and into the future

Before I conclude, I’d like to echo Ken’s thanks to Terry Bowen for his extensive contributions to the Board and the

company. Terry has brought a wealth of experience and insight over his time with BHP, and I wish him the best in his future ventures.

At BHP we’re

focused on creating value now, and into the future. We think and plan in decades.

By 2050 the global population is projected to be around

10 billion, about two-thirds of whom will live in urban areas. These global citizens will quite rightly be seeking to improve their standard of living – raising demand for housing, better food,

consumer goods, cars, infrastructure, power and utilities.

These factors, together with the energy transition, are very metals and minerals intensive.

The two to four-fold increase in demand we expect for key BHP commodities over the next three decades, versus the three decades past, presents both challenge and opportunity.

BHP will continue to plan strategically, responsibly, and consistently in seeking to help meet that demand.

We will maintain our focus on operational performance, delivery, and growth. We will remain disciplined in capital allocation, as we create value and generate

returns.

I am confident in the strength of our company, now and into the future, and greatly appreciate your ongoing support.

Thank you.

BHP Group Limited ABN 49 004 028

077

Copper BHP Group Limited Annual General Meeting 1 November 2023

Disclaimer Forward-looking statements This presentation contains

forward-looking statements, which involve risks and uncertainties. Forward-looking statements include all statements other than statements of historical or present facts, including: statements regarding: trends in commodity prices and currency

exchange rates; demand for commodities; global market conditions; guidance; reserves and resources and production forecasts; expectations, plans, strategies and objectives of management; our expectations, commitments, targets, goals and objectives

with respect to social value or sustainability; climate scenarios; approval of certain projects and consummation of certain transactions; closure, divestment, acquisition or integration of certain assets, operations or facilities (including

associated costs or benefits); anticipated production or construction commencement dates; capital expenditure or costs and scheduling; operating costs, and supply of materials and skilled employees; anticipated productive lives of projects, mines

and facilities; the availability, implementation and adoption of new technologies; provisions and contingent liabilities; and tax, legal and other regulatory developments. Forward-looking statements may be identified by the use of terminology,

including, but not limited to, ‘intend’, ‘aim’, ‘ambition’, ‘aspiration’, ‘goal’, ‘target’, ‘prospect’, ‘project’, ‘see’,

‘anticipate’, ‘estimate’, ‘plan’, ‘objective’, ‘believe’, ‘expect’, ‘commit’, ‘may’, ‘should’, ‘need’, ‘must’,

‘will’, ‘would’, ‘continue’, ‘forecast’, ‘guidance’, ‘outlook’, ‘trend’ or similar words. These statements discuss future expectations or performance, or provide

other forward-looking information. The forward-looking statements are based on management’s expectations and reflect judgements, assumptions, estimates and other information available as at the date made. BHP cautions against reliance on any

forward-looking statements or guidance. Additionally, forward-looking statements in this presentation do not represent guarantees or predictions of future financial or operational performance, and involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained in this presentation. For example, our future revenues from our assets, projects or mines

described in this presentation will be based, in part, upon the market price of the commodities produced, which may vary significantly from current levels. These variations, if materially adverse, may affect the timing or the feasibility of the

development of a particular project, the expansion of certain facilities or mines, or the continuation of existing assets. In addition, there are limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might

eventuate. Scenario analysis is not an indication of probable outcomes and relies on assumptions that may or may not prove to be correct or eventuate. Other factors that may affect the actual construction or production commencement dates, revenues,

costs or production output and anticipated lives of assets, mines or facilities include our ability to profitably produce and deliver the products extracted to applicable markets; the impact of economic and geopolitical factors, including foreign

currency exchange rates on the market prices of the commodities we produce and competition in the markets in which we operate; activities of government authorities in the countries where we sell our products and in the countries where we are

exploring or developing projects, facilities or mines, including increases in taxes and royalties or implementation of trade or export restrictions; changes in environmental and other regulations; political or geopolitical uncertainty; labour

unrest; and other factors identified in the risk factors discussed in section 8.1 of the Operating and Financial Review (OFR) in the BHP Annual Report 2023 and BHP’s filings with the U.S. Securities and Exchange Commission (the

‘SEC’) (including in Annual Reports on Form 20-F) which are available on the SEC’s website at www.sec.gov. Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any

forward-looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance. Presentation of data Unless specified otherwise: variance analysis relates to the relative

performance of BHP and/or its operations during the full year ended 30 June 2023 compared with the full year ended 30 June 2022; operations includes operated assets and non-operated assets; total operations refers to the combination of continuing

and discontinued operations; continuing operations refers to data presented excluding the impacts of Onshore US from the 2017 financial year onwards and excluding Petroleum from the 2021 financial year onwards; copper equivalent production based on

2023 financial year average realised prices; references to Underlying EBITDA margin exclude third party trading activities; data from subsidiaries are shown on a 100% basis and data from equity accounted investments and other operations is

presented, with the exception of net operating assets, reflecting BHP’s share; medium term refers to a five-year horizon, unless otherwise noted. Throughout this presentation, production volumes and financials for the operations from BHP's

acquisition of OZ Minerals Limited (OZL) are for the period of 1 May to 30 June 2023, whilst the acquisition completion date was 2 May 2023. Unless expressly stated, information and data in this presentation related to BHP's social value or

sustainability position or performance does not reflect BHP's acquisition of OZL. Due to the inherent uncertainty and limitations in measuring greenhouse gas (GHG) emissions under the calculation methodologies used in the preparation of such data,

all GHG emissions data or references to GHG emissions (including ratios or percentages) in this presentation are estimates. Emissions calculation and reporting methodologies may change or be progressively refined over time resulting in the need to

restate previously reported data. Numbers presented may not add up precisely to the totals provided due to rounding. Non-IFRS information We use various Non-IFRS information to reflect our underlying performance. For further information, the

reconciliation of non-IFRS financial information to our statutory measures, reasons for usefulness and calculation methodology, please refer to section 10 ‘Non-IFRS financial information’ in the BHP Annual Report 2023. No offer of

securities Nothing in this presentation should be construed as either an offer or a solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, in any jurisdiction, or be treated or relied upon as a

recommendation or advice by BHP. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration

requirements. Reliance on third party information The views expressed in this presentation contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as

to the accuracy, completeness or reliability of the information. This presentation should not be relied upon as a recommendation or forecast by BHP. BHP and its subsidiaries In this presentation, the terms ‘BHP’, the ‘Company, the

‘Group’, ‘BHP Group’, ‘our business’, ‘organisation’, ‘we’, ‘us’, ‘our’ and ourselves’ refer to BHP Group Limited and, except where the context otherwise

requires, our subsidiaries. Refer to note 30 ‘Subsidiaries’ of the Financial Statements in the BHP Annual Report 2023 for a list of our significant subsidiaries. Those terms do not include non-operated assets. This presentation covers

BHP’s functions and assets (including those under exploration, projects in development or execution phases, sites and closed operations) that have been wholly owned and/or operated by BHP or that have been owned as a joint 1 venture operated

by BHP (referred to in this presentation as ‘operated assets’ or ‘operations’) during the period from 1 July 2022 to 30 June 2023. BHP also holds interests in assets that are owned as a joint venture but not operated by BHP

(referred to in this presentation as ‘non-operated joint ventures’ or ‘non-operated assets’). Notwithstanding that this presentation may include production, financial and other information from non-operated assets,

non-operated assets are not included in the BHP Group and, as a result, statements regarding our operations, assets and values apply only to our operated assets unless stated otherwise. 1 References in this presentation to a ‘joint

venture’ are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal relationship between the owners of the asset.

Jack Buckskin Kaurna Country

Ken MacKenzie Chair

Your Board Terry Bowen Ken MacKenzie Xiaoqun Clever Ian Cockerill Gary

Goldberg Michelle Hinchliffe Mike Henry Christine O’Reilly Catherine Tanna Dion Weisler Stefanie Wilkinson Group Company Secretary

Ken MacKenzie Chair

Safety and culture Potash

Our role in a global future Nickel

Copper South Australia Copper

Strong, consistent performance and returns Iron Ore

FY23 highlights Earnings Underlying EBITDA margin Shareholder cash returns

US$13.4 bn 54% 170 US cps FY22 65% Payout ratio of 64% Total Economic Contribution Net debt ROCE US$11.2 bn 28.8% US$54.2 bn FY22 US$0.3 bn FY22 48.1% Note: All comparisons are against FY22. Earnings refers to Underlying attributable profit. Net

debt excludes vessel lease contracts that are priced with reference to a freight index. EBITDA margin and ROCE (Return on Capital Employed) are based on continuing and exclude exceptional items. Shareholder cash returns refers to cash dividends

determined in respect of FY23. 11

Social value Tjiwarl Country

BHP is in a strong position Iron Ore

Mike Henry Chief Executive Officer

Strong operational performance Iron Ore

Portfolio and growth Copper

Significant growth opportunities ahead Potash

Creating potential for future growth Copper

Delivering strong social value Iron Ore

Creating value now, and into the future Copper

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BHP Group Limited |

|

|

|

|

| Date: November 1, 2023 |

|

|

|

By: |

|

/s/ Stefanie Wilkinson |

|

|

|

|

Name: |

|

Stefanie Wilkinson |

|

|

|

|

Title: |

|

Group Company Secretary |

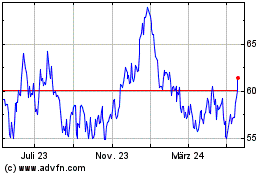

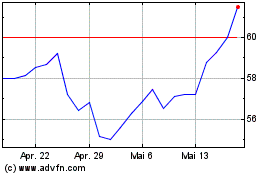

BHP (NYSE:BHP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

BHP (NYSE:BHP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024