Constellation Brands Inc. (STZ), the largest

wine company in the world, is scheduled to release its

first-quarter 2013 financial results before the opening bell on

Friday, June 29, 2012.

The current Zacks Consensus Estimate for earnings for the

quarter is 39 cents a share. For the first quarter, revenue is

expected to be $644 million, according to the Zacks Consensus

Estimate.

Fourth-Quarter 2012 Recap

Constellation delivered adjusted earnings of 69 cents per share

in the fourth quarter of fiscal 2012, outpacing the Zacks Consensus

Estimate of 38 cents and surging nearly two-fold from the

prior-year period earnings of 35 cents. The year-over-year increase

in the bottom line was primarily driven by benefits from negative

tax rates and improved margins.

However, sales in the quarter dropped 12.2% to $628.1 million

from the year-ago quarter. The fall was due to the divestitures of

the Australian and U.K. wine businesses, partially offset by

improved sales at North American business. Sales also missed the

Zacks Consensus Estimate of $633 million. The company’s North

American organic constant currency net sales increased 5% driven by

improved volume and favorable product mix.

Apart from this, Constellation achieved a record free cash flow

of $715.7 million during fiscal 2012, enabling the company to

reduce debt, fund stock repurchases and make acquisitions.

Fiscal 2013 Outlook

The company expects its fiscal 2013 adjusted earnings in the

band of $1.93 to $2.03 per share compared with $2.34 in fiscal

2012.

On a reported basis, the company expects earnings in the range

of $1.89-$1.99 per share compared with $2.13 in fiscal 2012.

Moreover, the company anticipates generating a free cash flow in

the range of $425 million to $475 million.

Zacks Consensus

The analysts covered by Zacks expect Constellation to post

first-quarter 2013 earnings of 39 cents a share, flat compared to

the prior-year quarter. Currently, the Zacks Consensus Estimate

ranges between 38 cents and 41 cents a share.

For fiscal 2013, the Zacks Consensus Estimate stood at $2.00 per

share, lower than the previous fiscal earnings of $2.34 per share.

The current Zacks Consensus Estimate for the fiscal ranges between

$1.95 and $2.04 per share.

Agreement of Estimate

Over the last 7 and 30 days, no movement in estimates has been

noticed either for the first quarter or fiscal 2013.

Magnitude of Estimate Revisions

With no earnings revisions by the analysts over the last 7 or 30

days, the Zacks Consensus Estimates for the first quarter and

fiscal 2013 remained unchanged at 39 cents and $2.00 per share,

respectively.

Surprise History

With respect to earnings surprises, Constellation has topped the

Zacks Consensus Estimate over the last four quarters in an average

range of positive 34.6%, indicating that Constellation Brands has

surpassed the Zacks Consensus Estimate by that measure in the

trailing four quarters.

Our Recommendation

We believe that the company’s strategic initiative of expanding

its foothold in the U.S. wine industry along with focus on brand

building and promotion will accelerate its growth opportunities

while strengthening its market position. Moreover, in an effort to

generate strong margins, Constellation Brands is also focusing on

higher priced segments across all key categories.

Moreover, the stake sale in the Australian and U.K. businesses

will help Constellation to focus on organic growth of its brand

portfolio, margin improvement, return on invested capital and free

cash flow. During the last two years, the Australian and U.K.

businesses were facing challenging market conditions, which were no

longer consistent with Constellation Brands’ business strategy.

In addition, we believe the company’s newly issued $600 million

worth of senior notes along with $1,650 million of new senior

credit facility will strengthen its financial position, and provide

liquidity to pay its current maturities with ease while focusing on

future growth prospects.

However, distilled spirits are subject to excise tax in various

countries. Rising fiscal pressure in the U.S., European and many

emerging markets may lead to increasing risk of a potential excise

tax on spirits by governments of respective countries. We believe

any excise tax increase in the future may have an adverse effect on

Constellation Brands’ financial performance.

Above all, the company faces intense competition from other

well-established players in the industry, including Beam

Inc. (BEAM), Brown-Forman Corporation

(BF.B) and Diageo plc (DEO). Moreover,

Constellation Brands also encounters competition from local and

regional players in the respective countries. Consequently, this

may dent the company’s future operating performance.

Currently, Constellation Brands holds a Zacks #3 Rank, implying

a short-term Hold rating on the stock. In the long term, we have a

Neutral recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

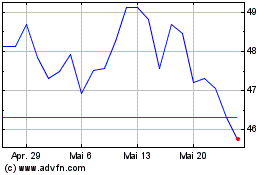

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024