Earnings Preview: Constellation - Analyst Blog

02 April 2012 - 10:15AM

Zacks

Constellation Brands

Inc. (STZ), the largest wine company in the world, is

scheduled to release its fourth-quarter 2012 results before the

opening bell on Thursday, April 5, 2012.

The current Zacks Consensus

Estimate for earnings for the quarter is 38 cents a share. For the

fourth quarter, revenue is expected at $633 million, according to

the Zacks Consensus Estimate.

Third-Quarter

Recap

Constellation Brands posted

earnings of 50 cents per share for third-quarter 2012, missing the

Zacks Consensus Estimate of 52 cents and declining over 24% from

the prior-period level of 66 cents.

Sales in the quarter dropped 27% to

$701 million from the year-ago quarter. The decline was due to the

divestitures of the Australian and U.K. wine businesses. Sales also

missed the Zacks Consensus forecast of $718.0 million.

The company’s organic constant

currency net sales decreased 8% due to a decline in volume that

stemmed from the overlap of distributor inventory build in the

third quarter of fiscal 2011 as part of the U.S. distributor

consolidation initiative.

Fiscal 2012

Outlook

The company expects its fiscal 2012

adjusted EPS in the band of $2.00 to $2.10 compared with $1.91 in

fiscal 2011. The guidance factors in an interest expense

expectation in the range of approximately $180–$185 million, an

approximate tax rate of 27% and weighted average diluted shares

outstanding of approximately 209 million.

On a reported basis, the company

expects EPS in the range of $1.96-$2.06 compared with $2.62 in

fiscal 2011.

Constellation Brands’ third-quarter

release points to a $100 million growth in its free cash flow

target for fiscal 2012, bringing the guidance to a range of $700

million to $750 million.

Zacks

Consensus

The analysts covered by Zacks

expect Constellation Brands to post fourth-quarter 2012 earnings of

38 cents a share, higher than 35 cents registered in the prior-year

quarter. Currently, the Zacks Consensus Estimate ranges between 34

cents and 42 cents a share.

For fiscal 2012, the Zacks

Consensus Estimate stood at $2.05 per share, higher than the

previous fiscal earnings of $1.91. The current Zacks Consensus

Estimate for the fiscal ranges between $2.00 and $2.09 per

share.

Agreement of

Estimate

Over the last 7 and 30 days, no

movement in estimates has been noticed either for the fourth

quarter or for fiscal 2012.

Magnitude of Estimate

Revisions

With no earnings revisions by the

analysts over the last 30 days, the Zacks Consensus Estimates for

the fourth quarter of 2012 and fiscal 2012 remained unchanged at 38

cents and $2.05 per share, respectively.

Surprise

History

With respect to earnings surprises,

Constellation Brands has topped the Zacks Consensus Estimate over

the last four quarters in the range of flat to 34.6%. The average

remained at positive 18.9%, suggesting that Constellation Brands

has surpassed the Zacks Consensus Estimate by that measure in the

trailing four quarters.

Our

Take

We believe that the company’s

strategic initiative of expanding its foothold in the U.S wine

industry along with focus on brand building and promotion will

accelerate its growth opportunities while strengthening its market

position. Moreover, in an effort to generate strong margins,

Constellation Brands is also focusing on higher priced segments

across all key categories.

Moreover, the company’srecent stake

sale in the Australian and U.K. businesses will help it to focus on

organic growth of its brand portfolio, margin improvement, return

on invested capital and free cash flow. During the last two years,

the Australian and U.K. businesses were facing challenging market

conditions, which were no longer consistent with Constellation

Brands’ business strategy.

However, distilled spirits are

subject to excise tax in various countries. Rising fiscal pressure

in the U.S., European and many emerging markets may lead to

increasing risk of a potential excise tax on spirits by governments

of respective countries. We believe any excise tax increase in

future may have an adverse effect on Constellation Brands’

financial performance.

Above all, the company faces

intense competition from other well-established players in the

industry, including Beam Inc. (BEAM),

Brown-Forman Corporation (BF.B) and Diageo

plc (DEO). Moreover, Constellation Brands also encounters

competition from local and regional players in the respective

countries. Consequently, this may dent the company’s future

operating performance.

Currently, Constellation Brands

holds a Zacks #2 Rank, implying a short-term 'Buy' rating on the

stock. However, in the long term, we have a 'Neutral'

recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

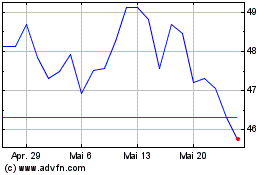

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024