Earnings Preview: Brown-Forman - Analyst Blog

29 August 2011 - 5:26PM

Zacks

Brown-Forman Corporation (BF.B), one of the

world's leading producers and distributors of premium alcoholic

beverages, is scheduled to report its first-quarter 2012 financial

results before the market opens on August 31, 2011.

The current Zacks Consensus Estimates for the quarter is

earnings of 83 cents a share. For the quarter under review, revenue

is expected at $769.0 million, according to the Zacks Consensus

Estimate.

Fourth-Quarter 2011 Synopsis

On June 09, 2011, Brown-Forman reported fourth-quarter 2011

earnings of $1.13 a share compared with 49 cents in the year-ago

quarter. The Zacks Consensus Estimate for the quarter was 64 cents

a share. The robust increase in quarterly earnings was primarily

driven by strong top-line growth and improved margin along with

benefit from sale of the Hopland wine business and low tax

rate.

Brown-Forman's net sales recorded a growth of 8.0% to $791.3

million from $733.0 million in the prior-year quarter. The growth

was primarily attributable to solid performance in Australia, the

U.K., Mexico, Turkey, Germany, and France.

During the quarter, Brown-Forman's gross profit grew 12.0% from

the prior-year quarter to $423.3 million, while gross margin

increased 200 basis points (bps) year over year to 53.5%.

Advertising expense climbed 11.0% year over year to $99.7 million,

primarily due to higher spending to support Jack Daniel's Tennessee

Honey brand.

Guidance for Fiscal 2012

Brown-Forman anticipates moderate improvement in global economic

conditions and customer trends in fiscal 2012. Accordingly, the

company has delivered its earnings guidance in the range of $3.45

to $3.85 per share.

First-Quarter 2012 Zacks Consensus

The analyst covered by Zacks expects Brown-Forman to post

first-quarter 2012 earnings of 83 cents a share, significantly

higher than earnings of 76 cents delivered in the prior-year

quarter. The current Zacks Consensus Estimate ranges between 80

cents and 85 cents a share.

Zacks Agreement & Magnitude

Not a single analyst has revisited their estimate for the

upcoming first-quarter 2012, over the last 7 and 30 days, thereby

keeping the Zacks Consensus Estimate constant at 83 cents.

Mixed Earnings Surprise History

With respect to earnings surprises, Brown-Forman has missed as

well as topped the Zacks Consensus Estimate over the last four

quarters in the range of approximately negative 9.5% to positive

25.0%. The average remained at approximately 8.0%. This suggests

that Brown-Forman has beaten the Zacks Consensus Estimate by an

average of 8.0% in the trailing four quarters.

Our View

Brown-Forman is one of the leading producers and distributors of

premium alcoholic beverages in the world. The company commands a

strong portfolio of globally recognized brands, such as Jack

Daniel's, Finlandia, Southern Comfort and Canadian Mist. This

provides a competitive edge to the company and bolsters its

well-established position in the market.

Moreover, in a streak to optimize shareholders' return,

Brown-Forman has divested its California based asset, Fetzer

Vineyards to Vina Concha y Toro S.A., a Chilean wine producer for

$238.0 million. The divestment has improved its earnings by 26

cents per share for fiscal 2011. Moreover, the deal will help

Brown-Forman to concentrate on those markets, which offer better

growth prospect and higher returns.

Further, Brown-Forman plans to expand Jack Daniel's market share

in developed markets, such as France and the U.S., and emerging

markets such as Russia, Poland, and Mexico, where the whiskey

category is in early stages of development. In near future, the

company also seeks to expand the sphere of other brands, such as

Gentleman Jack, Jack Daniel's Single Barrel and Jack Daniel's

ready-to-drinks within Jack Daniel.

However, the company faces intense competition from other

well-established players in the industry, including Fortune

Brands Inc. (FO) and Diageo plc (DEO).

Moreover, Brown-Forman also encounters competition from local and

regional players in the respective countries. Consequently, this

may dent the company's future operating performance.

Brown Forman's shares maintain a Zacks #3 Rank, which translates

into a short-term Hold rating. Our long-term recommendation on the

stock remains Outperform.

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

FORTUNE BRANDS (FO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

Zacks Investment Research

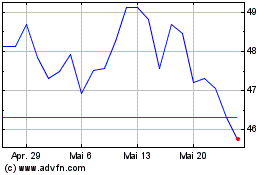

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024