UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): April 20, 2009

Brown-Forman Corporation

(Exact name of registrant as specified in its charter)

Delaware 002-26821 61-0143150

(State or other (Commission (I.R.S. Employer

jurisdiction of File Number) Identification No.)

incorporation)

|

850 Dixie Highway, Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (502) 585-1100

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

2.05. Costs Associated with Exit or Disposal Activities

On April 20, 2009, Brown-Forman Corporation (the "Company") announced that in

response to the current business climate and to reduce costs during fiscal 2010,

which starts May 1, 2009, the Company is implementing a series of cost-cutting

plans, including involuntary employment terminations affecting a total of about

250 employees, and offering voluntary early retirement to eligible employees.

At this time, the Company estimates the total costs associated with the

involuntary and voluntary terminations to be approximately $13 million on a

pre-tax basis. Approximately $12 million of these costs are expected to be

incurred in fiscal 2009, with the remainder expected to be incurred in fiscal

2010. All of these costs are non-recurring employee-related costs and are

expected to result in future cash expenditures. The Company expects this

reduction in workforce to be completed by April 30, 2009.

Item 7.01. Regulation FD Disclosure

On April 20, 2009, the Company issued a news release announcing a reduction in

its workforce and other cost control measures. A copy of this press release is

furnished as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Exhibits.

99.1 Press release issued by Brown-Forman Corporation on April 20, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Brown-Forman Corporation

(Registrant)

Date: April 20, 2009 By: /s/ Nelea A. Absher

Nelea A. Absher

Vice President, Associate

General Counsel, and Assistant

Corporate Secretary

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

BROWN-FORMAN IMPLEMENTS COST-CUTTING PROGRAM; REDUCTION IN FORCE AFFECTS 250

EMPLOYEES

Louisville, KY, April 20, 2009 - Brown-Forman Corporation announced today that

due to the difficult economic conditions around the world, it is implementing

several initiatives to reduce costs during fiscal 2010, which starts May 1,

2009. Included among the cost-cutting plans is a reduction in force affecting

approximately 250 employees out of its global workforce of 4,100 people. The

great majority of these will occur in Mexico and the U.S., with fewer positions

eliminated in Europe and the Asia Pacific region.

"While this was a very difficult decision to make, I believe it is necessary to

best position Brown-Forman for both the difficult times we are confronting today

and the uncertain and challenging environment that we expect ahead of us," said

Brown-Forman Chief Executive Officer Paul Varga.

All employees affected by the reduction in force will be offered severance pay,

career counseling assistance, and other benefits.

Among other cost-cutting initiatives planned for fiscal 2010, Brown-Forman is

offering early retirement to certain eligible U.S. employees, eliminating merit

increases for all employees, and cutting back on discretionary spending,

including travel and meetings.

These actions are projected to save Brown-Forman between $15 million and $25

million in fiscal 2010. The company estimates a fourth quarter charge of

approximately $0.05 to $0.07 per share, for severance and related costs

associated with the workforce reduction and early retirement program. This

one-time charge was anticipated in the company's previously reported earnings

per share guidance, which remains in the range of $2.70 to $2.90 a share.

"I believe these and other key decisions we have made will help Brown-Forman

continue to compete effectively in this tough economy," stated Varga. "We're

confident that our healthy balance sheet, great brands, excellent people, and

committed long-term shareholders will enable our company to remain both strong

and independent for generations to come."

Brown-Forman Corporation is a producer and marketer of fine quality beverage

alcohol brands, including Jack Daniel's, Southern Comfort, Finlandia, Canadian

Mist, Fetzer, Korbel, Gentleman Jack, el Jimador, Tequila Herradura,

Sonoma-Cutrer, Chambord, Tuaca, Woodford Reserve, and Bonterra

IMPORTANT NOTE ON FORWARD-LOOKING STATEMENTS:

This release contains statements, estimates, or projections that constitute

"forward-looking statements" as defined under U.S. federal securities laws.

Generally, the words "expect," "believe," "intend," "estimate," "will,"

"anticipate," and "project," and similar expressions identify a forward-looking

statement, which speaks only as of the date the statement is made. Except as

required by law, we do not intend to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

We believe that the expectations and assumptions with respect to our

forward-looking statements are reasonable. But by their nature, forward-looking

statements involve known and unknown risks, uncertainties and other factors that

in some cases are out of our control. These factors could cause our actual

results to differ materially from Brown-Forman's historical experience or our

present expectations or projections. Here is a non-exclusive list of such risks

and uncertainties:

- Continuation of the global economic downturn or turmoil in world financial

and equity markets (and related credit and capital market instability and

illiquidity; decreased consumer and trade spending; higher unemployment;

supplier, customer and consumer credit or other financial problems, inventory

reductions by distributors, wholesalers, and retailers, bank failures or

governmental nationalizations, etc.);

- pricing, marketing, products, and other competitive activity focused against

our major brands;

- continued or further decline in consumer confidence or spending, whether

related to global economic conditions, war, natural disasters, terrorist

attacks or other factors;

- tax increases, changes in tax rules or accounting standards (e.g., LIFO

treatment for inventory), tariff barriers and/or other restrictions affecting

beverage alcohol, whether at the U.S. federal or state level or in other

major markets around the world, and the unpredictability or suddenness with

which they can occur;

- limitations and restrictions on distribution of products and alcohol

marketing, including advertising and promotion, as a result of stricter

governmental policies adopted either in the United States or in our other

major markets;

- changes in and obligations for employees, former employees and retirees cost

of benefits, and lower returns on pension assets;

- fluctuations in the U.S. Dollar against foreign currencies, especially the

British Pound, Euro, Australian Dollar, Polish Zloty, South African Rand,

Japanese Yen, Russian Ruble and Mexican Peso;

- reduced bar, restaurant, hotel and other on-premise business, consumer shifts

to discount stores and other price sensitive purchases and venues;

- longer-term, changes in consumer preferences, societal attitudes or cultural

trends that result in reduced consumption of our premium spirits brands or

ready-to-drink products;

- distribution arrangement changes in major markets that affect the timing of

our sales or limit our ability to market or sell our products successfully;

- adverse impacts as a consequence of our acquisitions, joint ventures,

business partnerships, acquisition strategies, integration of acquired

businesses, or conforming them to the company's trade practice standards,

financial controls environment and U.S. public company requirements;

- price increases in energy or raw materials, such as grapes, grain, agave,

wood, glass, and plastic;

- changes in climate conditions, agricultural uncertainties, our suppliers'

financial hardships or other supply limitations that adversely affect supply,

price, availability, quality, or health of grapes, agave, grain, glass,

closures or wood;

- negative public media related to our company, brands, personnel, operations,

business performance or prospects;

- counterfeit production, tampering, or contamination of our products and any

resulting negative effect on our sales, intellectual property rights, or

brand equity;

- consumer and trade acceptance of product line extensions and new marketing

initiatives;

- adverse developments stemming from state or federal investigations of

beverage alcohol industry marketing or trade practices of suppliers,

distributors or retailers; and

- impairment in the recorded value of inventory, fixed assets, goodwill

or other acquired intangibles.

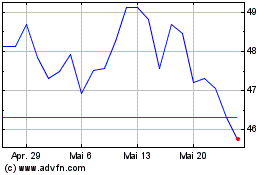

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024