Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

02 Oktober 2024 - 3:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of October 2024

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

SENDAS DISTRIBUIDORA S.A.

Publicly held Company with Authorized

Capital

Tax ID (“CNPJ/MF”) no. 06.057.223/0001-71

NIRE 33.300.272.909

NOTICE TO THE MARKET

Sendas Distribuidora S.A.

(“Company”) informs the market that it successfully completed on October 1, 2024, its 11th issuance of debentures, totaling

R$ 2.8 billion, with a maturity of 5 years and a cost of

CDI + 1.25%, according to the planned schedule.

The funds will be allocated to

the prepayment of debts maturing in 2025 and 2026, totaling R$ 2.8 billion. Thus, the issuance does not change the amount of the Company’s

gross or net debt.

This operation is another important

step for the Company to improve its debt profile, seeking to extend the average maturity and reduce the average cost of debt.

The Company’s Investor Relations

Department remains available to provide shareholders with any further explanation that may be required in connection with the object of

this Notice to Market by the e-mail ri.assai@assai.com.br .

São Paulo, October 02, 2024.

Vitor Fagá de Almeida

Vice President of Finance and Investor Relations

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 2, 2024

Sendas Distribuidora S.A.

By: /s/ Vitor Fagá de Almeida

Name: Vitor Fagá de Almeida

Title: Vice President of Finance and Investor Relations

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

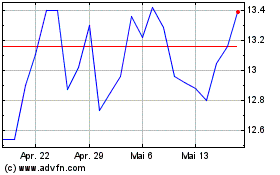

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024