false

0001037676

0001037676

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported): March 6, 2024

Arch

Resources, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

1-13105 |

|

43-0921172 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

CityPlace

One

One

CityPlace Drive, Suite 300

St.

Louis, Missouri

63141

(Address, including zip code, of principal

executive offices)

Registrant’s

telephone number, including area code: (314)

994-2700

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, $.01 par value |

|

ARCH |

|

New

York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth

company, indicated by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On March 6, 2024, Arch Resources, Inc.

(the “Company”) announced that the Company had retired 315,721 of its outstanding shares via the unwinding of capped calls

associated with its now-retired convertible senior notes.

A copy of the Company’s press release is

attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth in this Item 7.01, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set

forth in this Item 7.01, including Exhibit 99.1, shall not be deemed incorporated by reference into any other filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 6, 2024 |

Arch Resources, Inc. |

| |

|

| |

By: |

/s/ Rosemary L. Klein |

| |

|

Rosemary L. Klein |

| |

|

Senior Vice President - Law, General Counsel and Secretary |

Exhibit 99.1

NEWS

RELEASE

Investor

Relations

314/994-2916

FOR

IMMEDIATE RELEASE

Arch

Resources Announces Retirement of 315,721 Shares via the Termination and Unwinding of Capped Call Transactions

Represents

a reduction of nearly 2% of the company’s outstanding share count

Increases

total net reduction in share count to 6.4 million shares, or 26% of shares outstanding, since May 2017

ST. LOUIS, March 6, 2024 –

Arch Resources, Inc. (NYSE: ARCH) today announced that it had retired 315,721 of its outstanding shares via the unwinding of capped

calls associated with its now-retired convertible senior notes. With the completion of the cashless transaction, Arch’s diluted

share count declined from 18.9 million shares to 18.6 million shares outstanding.

“With the completion of these

transactions, Arch has taken another significant step in the reduction in our share count, having now retired more than a quarter of

our initial outstanding shares,” said Matthew C. Giljum, Arch’s chief financial officer. “When combined with our intensifying

focus on share repurchases – which the board views as a value-driving investment in the company’s powerful, high-quality,

long-lived coking coal portfolio – we expect to continue to substantially reduce the number of outstanding shares over the course

of 2024.”

These transactions will not result in

any changes to Arch’s financial position or any impact on its first quarter financial results. Arch ended 2023 with $320.5 million

of cash, cash equivalents and short-term investments on its balance sheet, and – given its total indebtedness of $142.1 million

– a net positive cash position of $178.4 million.

Arch

Resources is a premier producer of high-quality metallurgical products for the global steel industry. The company operates large, modern

and highly efficient mines that consistently set the industry standard for both mine safety and environmental stewardship. Arch Resources

from time to time utilizes its website – www.archrsc.com – as a channel of distribution

for material company information. To learn more about us and our premium metallurgical products, go to www.archrsc.com.

Forward-Looking

Statements: This press release contains “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended

- that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future

business and financial performance, and future plans, and often contain words such as “should,” “could,” “appears,”

“estimates,” “projects,” “targets,” “expects,” “anticipates,” “intends,”

“may,” “plans,” “predicts,” “believes,” “seeks,” “strives,” “will”

or variations of such words or similar words. Actual results or outcomes may vary significantly, and adversely, from those anticipated

due to many factors, including: loss of availability, reliability and cost-effectiveness of transportation facilities and fluctuations

in transportation costs; operating risks beyond our control, including risks related to mining conditions, mining, processing and plant

equipment failures or maintenance problems, weather and natural disasters, the unavailability of raw materials, equipment or other critical

supplies, mining accidents, and other inherent risks of coal mining that are beyond our control; inflationary pressures and availability

and price of mining and other industrial supplies; changes in coal prices, which may be caused by numerous factors beyond our control,

including changes in the domestic and foreign supply of and demand for coal and the domestic and foreign demand for steel and electricity;

volatile economic and market conditions; the effects of foreign and domestic trade policies, actions or disputes on the level of trade

among the countries and regions in which we operate, the competitiveness of our exports, or our ability to export; the effects of significant

foreign conflicts; the loss of, or significant reduction in, purchases by our largest customers; our relationships with, and other conditions

affecting our customers and our ability to collect payments from our customers; risks related to our international growth; competition,

both within our industry and with producers of competing energy sources, including the effects from any current or future legislation

or regulations designed to support, promote or mandate renewable energy sources; alternative steel production technologies that may reduce

demand for our coal; our ability to secure new coal supply arrangements or to renew existing coal supply arrangements; cyber-attacks

or other security breaches that disrupt our operations, or that result in the unauthorized release of proprietary, confidential or personally

identifiable information; our ability to acquire or develop coal reserves in an economically feasible manner; inaccuracies in our estimates

of our coal reserves; defects in title or the loss of a leasehold interest; the availability and cost of surety bonds, including potential

collateral requirements; we may not have adequate insurance coverage for some business risks; disruptions in the supply of coal from

third parties; decreases in the coal consumption of electric power generators could result in less demand and lower prices for thermal

coal; our ability to pay dividends or repurchase shares of our common stock according to our announced intent or at all; the loss of

key personnel or the failure to attract additional qualified personnel and the availability of skilled employees and other workforce

factors; public health emergencies, such as pandemics or epidemics, could have an adverse effect on our business; existing and future

legislation and regulations affecting both our coal mining operations and our customers’ coal usage, governmental policies and

taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter

or greenhouse gases; increased pressure from political and regulatory authorities, along with environmental and climate change activist

groups, and lending and investment policies adopted by financial institutions and insurance companies to address concerns about the environmental

impacts of coal combustion; increased attention to environmental, social or governance matters (“ESG”); our ability to obtain

and renew various permits necessary for our mining operations; risks related to regulatory agencies ordering certain of our mines to

be temporarily or permanently closed under certain circumstances; risks related to extensive environmental regulations that impose significant

costs on our mining operations and could result in litigation or material liabilities; the accuracy of our estimates of reclamation and

other mine closure obligations; the existence of hazardous substances or other environmental contamination on property owned or used

by us and risks related to tax legislation and our ability to use net operating losses and certain tax credits; All forward-looking statements

in this press release, as well as all other written and oral forward-looking statements attributable to us or persons acting on our behalf,

are expressly qualified in their entirety by the cautionary statements contained in this section and elsewhere in this press release.

These factors are not necessarily all of the important factors that could cause actual results or outcomes to vary significantly, and

adversely, from those anticipated at the time such statements were first made. These risks and uncertainties, as well as other risks

of which we are not aware or which we currently do not believe to be material, may cause our actual future results and outcomes to be

materially, and adversely, different than those expressed in our forward-looking statements. For these reasons, readers should not place

undue reliance on any such forward-looking statements. These forward-looking statements speak only as of the date on which such

statements were made, and we do not undertake, and expressly disclaim, any duty to update our forward-looking statements, whether as

a result of new information, future events or otherwise, except as may be required by the federal securities laws. For a description

of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time

in the reports we file with the Securities and Exchange Commission.

#

# #

v3.24.0.1

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity File Number |

1-13105

|

| Entity Registrant Name |

Arch

Resources, Inc.

|

| Entity Central Index Key |

0001037676

|

| Entity Tax Identification Number |

43-0921172

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

CityPlace

One

|

| Entity Address, Address Line Two |

One

CityPlace Drive, Suite 300

|

| Entity Address, City or Town |

St.

Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63141

|

| City Area Code |

314

|

| Local Phone Number |

994-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $.01 par value

|

| Trading Symbol |

ARCH

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

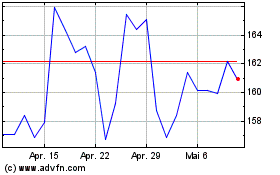

Arch Resources (NYSE:ARCH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

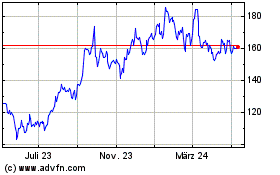

Arch Resources (NYSE:ARCH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024