Algonquin Power, American Electric Mutually End $2.65 Billion Kentucky Asset Sale

17 April 2023 - 1:55PM

Dow Jones News

By Adriano Marchese

Algonquin Power & Utilities Corp. and American Electric

Power Co. have agreed to terminate the $2.65 billion acquisition of

the Kentucky assets.

On Monday, the Canadian renewable energy and utility company

said its indirect subsidiary Liberty Utilities Co. came to a mutual

agreement with American Electric Power to terminate the stock

purchase agreement for Kentucky Power Co. and AEP Kentucky

Transmission Co.

In October 2021, Algonquin Power agreed to buy the assets from

American Electric Power as Algonquin looked to shift its assets

toward cleaner energy sources and meet its net-zero greenhouse gas

emissions target within its operations by 2050.

Analysts had shown a good measure of skepticism regarding the

deal, worried about the high price tag associated with the deal and

the regulatory challenges that came with closing the sale.

To reflect the challenges, the two companies had agreed to a

price reduction from $2.85 billion to $2.65 billion.

Algonquin Chief Executive Arun Banskota said Monday that the

decision to end the deal was due largely to the evolving macro

environment and that bringing the Kentucky assets into the fold was

no longer in the company's best interest.

American Electric said it would re-imagine its strategy for the

Kentucky assets to maximize the full potential of the operations.

The company said there is no change in its equity financing

forecast.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

April 17, 2023 07:40 ET (11:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

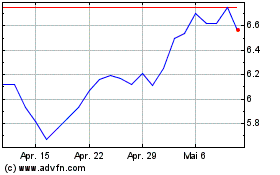

Algonquin Power (NYSE:AQN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Algonquin Power (NYSE:AQN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024