0001037868FALSE00010378682024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 8-K

__________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

__________________

AMETEK, Inc.

(Exact name of registrant as specified in its charter)

__________________

| | | | | | | | | | | |

| Delaware | 1-12981 | 14-1682544 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

1100 Cassatt Road | | |

Berwyn, | Pennsylvania | | 19312 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (610) 647-2121

Not Applicable

(Former name or former address, if changed since last report)

__________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value (voting) | | AME | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2024, AMETEK, Inc. (the “Company”) issued a press release announcing its financial results for the three months and year ended December 31, 2023. A copy of the release is furnished as Exhibit 99.1 and incorporated by reference herein. This Current Report on Form 8-K and the press release attached hereto are being furnished pursuant to Item 2.02 of Form 8-K.

The information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | AMETEK, Inc. |

| | | |

| February 6, 2024 | | By: | /s/ THOMAS M. MONTGOMERY |

| | | Name: Thomas M. Montgomery |

| | | Title: Senior Vice President – Comptroller |

AMETEK Announces Record Fourth Quarter and Full Year Results

Berwyn, Pa., Feb. 6, 2024 – AMETEK, Inc. (NYSE: AME) today announced its financial results for the fourth quarter ended December 31, 2023.

AMETEK’s fourth quarter 2023 sales were a record $1.73 billion, a 6.5% increase over the fourth quarter of 2022. Operating income increased 12% to a record $445.0 million and operating margins were 25.7%, up 120 basis points from the fourth quarter of 2022. Operating cash flow in the quarter was a record $540.7 million, up 40% versus the prior year.

On a GAAP basis, fourth quarter earnings per diluted share were $1.48. Adjusted earnings in the quarter were a record $1.68 per diluted share, up 11% from the fourth quarter of 2022. Adjusted earnings adds back non-cash, after-tax, acquisition-related intangible amortization of $0.20 per diluted share. A reconciliation of reported GAAP results to adjusted results is included in the financial tables accompanying this release and on the AMETEK website.

"AMETEK's fourth quarter and full year performance was exceptional,” noted David A. Zapico, AMETEK Chairman and Chief Executive Officer. “Contributions from organic sales growth and recent acquisitions, along with tremendous operating performance, led to robust margin expansion, record earnings and impressive cash flow growth in the quarter and the full year. We also continued to strengthen our portfolio in 2023, deploying approximately $2.25 billion in capital on acquisitions, including our most recent acquisition, Paragon Medical.”

For the full year, AMETEK’s sales were a record $6.60 billion, an increase of 7% over 2022. Operating income was $1.71 billion, up 14% versus the prior year, and operating income margins were 25.9%, expanding 150 basis points over last year’s margins.

On a GAAP basis, full year 2023 earnings were $5.67 per diluted share. Full year adjusted earnings were $6.38 per share, an increase of 12% over 2022’s comparable adjusted earnings of $5.68 per share. AMETEK established annual records for sales, operating income, operating margin, and earnings per share.

Electronic Instruments Group (EIG)

EIG sales in the fourth quarter were a record $1.24 billion, up 7% from the same quarter in 2022. EIG’s operating income in the quarter increased 17% to a record $359.0 million and operating

income margins were 29.0%, an increase of 250 basis points compared to the fourth quarter of 2022.

"EIG delivered outstanding results in the fourth quarter," commented Mr. Zapico. "The sales growth was driven by continued solid organic growth and contributions from recent acquisitions. Our EIG businesses drove exceptional margin expansion, a testament to the quality of our businesses and our team’s focus on driving continuous operational improvements."

Electromechanical Group (EMG)

EMG sales in the fourth quarter were $494.7 million, up 6% from the fourth quarter of 2022. EMG’s fourth quarter operating income was $112.3 million, while operating income margins were 22.7% in the quarter.

"EMG also delivered a strong fourth quarter performance with continued excellent growth across our aerospace and defense businesses and solid core margin expansion in the quarter," stated Mr. Zapico.

2024 Outlook

"AMETEK's businesses delivered exceptional results in the fourth quarter and for the full year. The strength of the AMETEK Growth Model, alongside the outstanding contributions of our colleagues, allowed us to deliver strong, high-quality growth. The strength of our niche businesses, diverse market exposures, record backlog and robust operating capabilities position us for sustained growth. With a flexible balance sheet and strong cash flows, we are well positioned to invest in our organic growth initiatives and pursue strategic acquisitions to drive long-term value creation," noted Mr. Zapico.

“For 2024, we expect overall sales to be up low double digits on a percentage basis compared to 2023. Adjusted earnings per diluted share are expected to be in the range of $6.70 to $6.85, an increase of 5% to 7% over the comparable basis for 2023,” he added.

"For the first quarter of 2024, overall sales are expected to be up low double digits on a percentage basis compared to the same period last year. Adjusted earnings in the quarter are anticipated to be in the range of $1.56 to $1.60 per share, up 5% to 7% compared to the first quarter of 2023," concluded Mr. Zapico.

Conference Call

AMETEK will webcast its fourth quarter 2023 investor conference call on Tuesday, February 6, 2024, beginning at 8:30 AM ET. The live audio webcast will be available and later archived in the Investors section of www.ametek.com.

About AMETEK

AMETEK (NYSE: AME) is a leading global provider of industrial technology solutions serving a diverse set of attractive niche markets with annualized sales over $7.0 billion. The AMETEK Growth Model integrates the Four Growth Strategies - Operational Excellence, New Product Development, Global and Market Expansion, and Strategic Acquisitions - with a disciplined focus on cash generation and capital deployment. AMETEK's objective is double-digit percentage growth in earnings per share over the business cycle and a superior return on total capital. Founded in 1930, AMETEK has been listed on the NYSE for over 90 years and is a component of the S&P 500. For more information, visit www.ametek.com.

Forward-looking Information

Statements in this news release relating to future events, such as AMETEK’s expected business and financial performance are "forward-looking statements." Forward-looking statements are subject to various factors and uncertainties that may cause actual results to differ significantly from expectations. These factors and uncertainties include risks related to AMETEK’s ability to consummate and successfully integrate future acquisitions; risks with international sales and operations, including supply chain disruptions; AMETEK’s ability to successfully develop new products, open new facilities or transfer product lines; the price and availability of raw materials; compliance with government regulations, including environmental regulations; changes in the competitive environment or the effects of competition in our markets; the ability to maintain adequate liquidity and financing sources; and general economic conditions affecting the industries we serve. A detailed discussion of these and other factors that may affect our future results is contained in AMETEK’s filings with the U.S. Securities and Exchange Commission, including its most recent reports on Forms 10-K, 10-Q and 8-K. AMETEK disclaims any intention or obligation to update or revise any forward-looking statements.

Contact:

Kevin Coleman

Vice President, Investor Relations and Treasurer

kevin.coleman@ametek.com

Phone: 610.889.5247

AMETEK, Inc.

Consolidated Statement of Income

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 1,730,885 | | | $ | 1,625,667 | | | $ | 6,596,950 | | | $ | 6,150,530 | |

| | | | | | | |

| Cost of sales | 1,115,850 | | | 1,063,657 | | | 4,212,485 | | | 4,005,261 | |

| Selling, general and administrative | 170,043 | | | 163,920 | | | 677,006 | | | 644,577 | |

| Total operating expenses | 1,285,893 | | | 1,227,577 | | | 4,889,491 | | | 4,649,838 | |

| Operating income | 444,992 | | | 398,090 | | | 1,707,459 | | | 1,500,692 | |

| Interest expense | (24,117) | | | (23,021) | | | (81,795) | | | (83,186) | |

| Other (expense) income, net | (3,939) | | | 3,435 | | | (19,252) | | | 11,186 | |

| Income before income taxes | 416,936 | | | 378,504 | | | 1,606,412 | | | 1,428,692 | |

| Provision for income taxes | 74,072 | | | 71,422 | | | 293,224 | | | 269,150 | |

| Net income | $ | 342,864 | | | $ | 307,082 | | | $ | 1,313,188 | | | $ | 1,159,542 | |

| | | | | | | |

| Diluted earnings per share | $ | 1.48 | | | $ | 1.33 | | | $ | 5.67 | | | $ | 5.01 | |

| Basic earnings per share | $ | 1.49 | | | $ | 1.34 | | | $ | 5.70 | | | $ | 5.04 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Diluted shares | 231,794 | | 231,118 | | 231,509 | | 231,536 |

| Basic shares | 230,782 | | 229,750 | | 230,519 | | 230,208 |

| | | | | | | |

| Dividends per share | $ | 0.25 | | | $ | 0.22 | | | $ | 1.00 | | | $ | 0.88 | |

AMETEK, Inc.

Information by Business Segment

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales: | | | | | | | |

| Electronic Instruments | $ | 1,236,227 | | | $ | 1,159,222 | | | $ | 4,624,250 | | | $ | 4,229,353 | |

| Electromechanical | 494,658 | | | 466,445 | | | 1,972,700 | | | 1,921,177 | |

| Consolidated net sales | $ | 1,730,885 | | | $ | 1,625,667 | | | $ | 6,596,950 | | | $ | 6,150,530 | |

| | | | | | | |

| Operating income: | | | | | | | |

| Segment operating income: | | | | | | | |

| Electronic Instruments | $ | 358,992 | | | $ | 307,126 | | | $ | 1,310,962 | | | $ | 1,089,729 | |

| Electromechanical | 112,316 | | | 114,546 | | | 496,569 | | | 503,593 | |

| Total segment operating income | 471,308 | | | 421,672 | | | 1,807,531 | | | 1,593,322 | |

| Corporate administrative expenses | (26,316) | | | (23,582) | | | (100,072) | | | (92,630) | |

| Consolidated operating income | $ | 444,992 | | | $ | 398,090 | | | $ | 1,707,459 | | | $ | 1,500,692 | |

AMETEK, Inc.

Condensed Consolidated Balance Sheet

(In thousands)

| | | | | | | | | | | |

| December 31, | | December 31, |

| 2023 | | 2022 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 409,804 | | | $ | 345,386 | |

| Receivables, net | 1,012,932 | | | 919,335 | |

| Inventories, net | 1,132,471 | | | 1,044,284 | |

| Other current assets | 269,461 | | | 219,053 | |

| Total current assets | 2,824,668 | | | 2,528,058 | |

| | | |

| Property, plant and equipment, net | 891,293 | | | 635,641 | |

| Right of use asset, net | 229,723 | | | 170,295 | |

| Goodwill | 6,447,629 | | | 5,372,562 | |

| Other intangibles, investments and other assets | 4,630,220 | | | 3,724,564 | |

| Total assets | $ | 15,023,533 | | | $ | 12,431,120 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings and current portion of long-term debt, net | $ | 1,417,915 | | | $ | 226,079 | |

| Accounts payable and accruals | 1,464,658 | | | 1,338,123 | |

| Total current liabilities | 2,882,573 | | | 1,564,202 | |

| | | |

| Long-term debt, net | 1,895,432 | | | 2,158,928 | |

| Deferred income taxes and other long-term liabilities | 1,515,337 | | | 1,231,478 | |

| Stockholders' equity | 8,730,191 | | | 7,476,512 | |

| Total liabilities and stockholders' equity | $ | 15,023,533 | | | $ | 12,431,120 | |

| | | | | | | | | | | | | | | | | | | | |

| AMETEK, Inc. |

| Reconciliations of GAAP to Non-GAAP Financial Measures |

| (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Diluted Earnings Per Share |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Diluted earnings per share (GAAP) | $ | 1.48 | | | $ | 1.33 | | | $ | 5.67 | | | $ | 5.01 | |

| Pretax amortization of acquisition-related intangible assets | 0.26 | | | 0.25 | | | 0.93 | | | 0.89 | |

| Income tax benefit on amortization of acquisition-related intangible assets | (0.06) | | | (0.06) | | | (0.22) | | | (0.22) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted Diluted earnings per share (Non-GAAP) | $ | 1.68 | | | $ | 1.52 | | | $ | 6.38 | | | $ | 5.68 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Forecasted Diluted Earnings Per Share |

| Three Months Ended | | Year Ended |

| March 31, 2024 | | December 31, 2024 |

| Low | | High | | Low | | High |

| | | | | | | |

| Diluted earnings per share (GAAP) | $ | 1.35 | | | $ | 1.39 | | | $ | 5.88 | | | $ | 6.03 | |

| Pretax amortization of acquisition-related intangible assets | 0.27 | | | 0.27 | | | 1.08 | | | 1.08 | |

| Income tax benefit on amortization of acquisition-related intangible assets | (0.06) | | | (0.06) | | | (0.26) | | | (0.26) | |

| Adjusted Diluted earnings per share (Non-GAAP) | $ | 1.56 | | | $ | 1.60 | | | $ | 6.70 | | | $ | 6.85 | |

Use of Non-GAAP Financial Information

The Company supplements its consolidated financial statements presented on a U.S. generally accepted accounting principles (“GAAP”) basis with certain non-GAAP financial information to provide investors with greater insight, increased transparency and allow for a more comprehensive understanding of the information used by management in its financial and operational decision-making. Reconciliation of non-GAAP measures to their most directly comparable GAAP measures are included in the accompanying financial tables. These non-GAAP financial measures should be considered in addition to, and not as a replacement for, or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

The Company believes that these measures provide useful information to investors by reflecting additional ways of viewing AMETEK’s operations that, when reconciled to the comparable GAAP measure, helps our investors to better understand the long-term profitability trends of our business, and facilitates easier comparisons of our profitability to prior and future periods and to our peers.

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity Registrant Name |

AMETEK, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-12981

|

| Entity Tax Identification Number |

14-1682544

|

| Entity Address, Address Line One |

1100 Cassatt Road

|

| Entity Address, City or Town |

Berwyn,

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19312

|

| City Area Code |

610

|

| Local Phone Number |

647-2121

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value (voting)

|

| Trading Symbol |

AME

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001037868

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

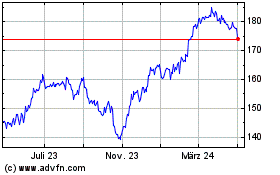

Ametek (NYSE:AME)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Ametek (NYSE:AME)

Historical Stock Chart

Von Mai 2023 bis Mai 2024