0001759824false00017598242024-11-122024-11-120001759824us-gaap:PreferredStockMember2024-11-122024-11-120001759824altg:CommonStocksClassUndefinedMember2024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2024

ALTA EQUIPMENT GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38864 |

|

83-2583782 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13211 Merriman Road

Livonia, Michigan 48150

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (248) 449-6700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

ALTG |

|

The New York Stock Exchange |

Depositary Shares representing a 1/1000th fractional interest in a share of 10% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value per share |

|

ALTG PRA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.*

On November 12, 2024, Alta Equipment Group Inc. (“Alta” or the “Company”) issued a press release announcing its results of operations and financial condition for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

* The information furnished under Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALTA EQUIPMENT GROUP INC. |

|

|

Dated: November 12, 2024 |

By: |

|

/s/ Ryan Greenawalt |

|

|

|

Name: Ryan Greenawalt |

|

|

|

Title: Chief Executive Officer |

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

Exhibit 99.1

Alta Equipment Group Announces Third Quarter 2024 Financial Results

Third Quarter Financial Highlights:

•Total revenues decreased $17.4 million year over year to $448.8 million

•Construction Equipment and Material Handling revenues of $262.3 million and $168.9 million, respectively

•Product support revenues increased 7.8% year over year with Parts sales increasing to $75.6 million and Service revenues increasing to $64.6 million

•New and used equipment sales decreased 13.3% year over year to $219.8 million

•Net loss available to common stockholders of $(28.4) million

•Basic and diluted net loss per share of $(0.86)

•Adjusted basic and diluted net loss per share* of $(0.72)

•Adjusted EBITDA* of $43.2 million

•Third quarter 2024 net loss was impacted by a $14.0 million discrete tax expense from increasing the valuation allowance on our deferred tax assets, specifically related to 163(j) interest limitations

Additionally, on October 30, 2024, the Company's Board of Directors approved an increase to the share buyback authorization from $12.5 million to $20.0 million

Livonia, MI. – November 12, 2024 – Alta Equipment Group Inc. (NYSE: ALTG) (“Alta”, "we", "our" or the “Company”), a leading provider of premium material handling, construction and environmental processing equipment and related services, today announced financial results for the third quarter ended September 30, 2024.

CEO Comment:

Ryan Greenawalt, Chief Executive Officer of Alta, said “Our third quarter results continued to be impacted by the ongoing uncertainty in our end-user markets as it relates to customers committing to capital investment and purchasing new equipment. This dynamic has been most impactful in our Construction Equipment segment, where new and used equipment revenues decreased by $44.5 million, or 29.5%, from a year ago on an organic basis. Some customers put capital investments on hold in the third quarter while they waited for the election outcome and more clarity on interest rates. In the immediate aftermath post-election, it appears that sentiment has already improved, and we believe our customers will deploy capital more broadly in 2025.”

Mr. Greenawalt continued, “While the equipment sales market has been disappointing in 2024, our dealership model with diverse revenue streams has protected our overall business from equipment market cyclicality. As evidence, our steady and high-margin product support business continues to perform well with revenues increasing 7.8% to $140.2 million versus a year ago. Additionally, given our rent-to-sell approach to the equipment rental market we are able to react quickly to perceived softness by selling off lightly used fleet and right-sizing our balance sheet in an efficient manner, and we are proud of the progress we made with the balance sheet as reductions in rental fleet and working capital allowed us to reduce net debt by $38.7 million in the quarter. Additionally, demand in our Material Handling segment remained steady, with revenues increasing slightly to $168.9 million as we continue to work through a sizeable backlog. During the third quarter, we also began to see positive impacts from our business optimization initiatives, as we were able to reduce general and administrative expenses when compared to the first two quarters of the year.”

Mr. Greenawalt added, “Overall, while we and the overall equipment markets have underperformed initial projections for 2024, our expectations for 2025 are positive. In terms of our Construction Equipment segment, we expect the oversupply of new equipment to normalize in the first half of 2025 and construction equipment spending to be positively impacted by easing interest rates and more favorable lending conditions. Infrastructure related project pipelines continue to be significant and still in the early stages and state DOT budgets are forecast to remain elevated in 2025. The opportunities in our Material Handling business remain favorable as we believe our strong relationship with Hyster-Yale, unmatched product support capabilities and resilient and diversified end markets will result in continued gains in market share in 2025. Lastly, we expect our electric vehicles business to gain further traction in 2025 as customers begin the transformational shift to electrify commercial vehicle fleets. Given this perspective on our future prospects, our Board of Directors has expanded our share buyback program to $20

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

million which we will deploy to support shareholders should opportunistic dislocations between the Company’s long-term intrinsic value and our share price present themselves.”

In conclusion, Mr. Greenawalt said, “Despite a challenging market in 2024, our 3,000 employees have demonstrated unprecedented dedication to our business and our customers. I am extremely proud of their commitment to our guiding principles which are predicated on teamwork and fostering customers for life.”

Full Year 2024 Financial Guidance and Other Financial Notes:

•The Company updates our guidance range and now expects to report Adjusted EBITDA between $170.0 million and $175.0 million for the 2024 fiscal year.

•Reduced rental fleet original equipment cost from $617.2 million as of June 30 to $599.0 as of September 30.

•Reduced Adjusted total net debt and floor plan payables from $858.1 million as of June 30 to $819.4 million as of September 30 (see Reconciliation of non-GAAP financial measures below).

CONDENSED CONSOLIDATED RESULTS OF OPERATIONS (Unaudited)

(amounts in millions unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Increase (Decrease) |

|

|

Nine Months Ended September 30, |

|

|

Increase (Decrease) |

|

|

2024 |

|

|

2023 |

|

|

2024 versus 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 versus 2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

$ |

219.8 |

|

|

$ |

253.6 |

|

|

$ |

(33.8 |

) |

|

|

(13.3 |

)% |

|

$ |

699.9 |

|

|

$ |

727.8 |

|

|

$ |

(27.9 |

) |

|

|

(3.8 |

)% |

Parts sales |

|

75.6 |

|

|

|

69.5 |

|

|

|

6.1 |

|

|

|

8.8 |

% |

|

|

226.5 |

|

|

|

209.2 |

|

|

|

17.3 |

|

|

|

8.3 |

% |

Service revenues |

|

64.6 |

|

|

|

60.6 |

|

|

|

4.0 |

|

|

|

6.6 |

% |

|

|

194.8 |

|

|

|

180.5 |

|

|

|

14.3 |

|

|

|

7.9 |

% |

Rental revenues |

|

53.7 |

|

|

|

54.0 |

|

|

|

(0.3 |

) |

|

|

(0.6 |

)% |

|

|

155.9 |

|

|

|

147.1 |

|

|

|

8.8 |

|

|

|

6.0 |

% |

Rental equipment sales |

|

35.1 |

|

|

|

28.5 |

|

|

|

6.6 |

|

|

|

23.2 |

% |

|

|

101.4 |

|

|

|

90.7 |

|

|

|

10.7 |

|

|

|

11.8 |

% |

Total revenues |

|

448.8 |

|

|

|

466.2 |

|

|

|

(17.4 |

) |

|

|

(3.7 |

)% |

|

|

1,378.5 |

|

|

|

1,355.3 |

|

|

|

23.2 |

|

|

|

1.7 |

% |

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

|

184.4 |

|

|

|

212.0 |

|

|

|

(27.6 |

) |

|

|

(13.0 |

)% |

|

|

588.7 |

|

|

|

601.3 |

|

|

|

(12.6 |

) |

|

|

(2.1 |

)% |

Parts sales |

|

50.0 |

|

|

|

45.3 |

|

|

|

4.7 |

|

|

|

10.4 |

% |

|

|

149.2 |

|

|

|

138.2 |

|

|

|

11.0 |

|

|

|

8.0 |

% |

Service revenues |

|

26.3 |

|

|

|

26.5 |

|

|

|

(0.2 |

) |

|

|

(0.8 |

)% |

|

|

80.2 |

|

|

|

77.0 |

|

|

|

3.2 |

|

|

|

4.2 |

% |

Rental revenues |

|

5.6 |

|

|

|

5.7 |

|

|

|

(0.1 |

) |

|

|

(1.8 |

)% |

|

|

18.5 |

|

|

|

18.0 |

|

|

|

0.5 |

|

|

|

2.8 |

% |

Rental depreciation |

|

30.6 |

|

|

|

29.6 |

|

|

|

1.0 |

|

|

|

3.4 |

% |

|

|

88.5 |

|

|

|

80.1 |

|

|

|

8.4 |

|

|

|

10.5 |

% |

Rental equipment sales |

|

27.3 |

|

|

|

21.0 |

|

|

|

6.3 |

|

|

|

30.0 |

% |

|

|

76.2 |

|

|

|

66.5 |

|

|

|

9.7 |

|

|

|

14.6 |

% |

Total cost of revenues |

|

324.2 |

|

|

|

340.1 |

|

|

|

(15.9 |

) |

|

|

(4.7 |

)% |

|

|

1,001.3 |

|

|

|

981.1 |

|

|

|

20.2 |

|

|

|

2.1 |

% |

Gross profit |

|

124.6 |

|

|

|

126.1 |

|

|

|

(1.5 |

) |

|

|

(1.2 |

)% |

|

|

377.2 |

|

|

|

374.2 |

|

|

|

3.0 |

|

|

|

0.8 |

% |

General and administrative expenses |

|

110.6 |

|

|

|

106.8 |

|

|

|

3.8 |

|

|

|

3.6 |

% |

|

|

339.7 |

|

|

|

316.0 |

|

|

|

23.7 |

|

|

|

7.5 |

% |

Non-rental depreciation and amortization |

|

7.2 |

|

|

|

5.4 |

|

|

|

1.8 |

|

|

|

33.3 |

% |

|

|

21.3 |

|

|

|

16.0 |

|

|

|

5.3 |

|

|

|

33.1 |

% |

Total operating expenses |

|

117.8 |

|

|

|

112.2 |

|

|

|

5.6 |

|

|

|

5.0 |

% |

|

|

361.0 |

|

|

|

332.0 |

|

|

|

29.0 |

|

|

|

8.7 |

% |

Income from operations |

|

6.8 |

|

|

|

13.9 |

|

|

|

(7.1 |

) |

|

|

(51.1 |

)% |

|

|

16.2 |

|

|

|

42.2 |

|

|

|

(26.0 |

) |

|

|

(61.6 |

)% |

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, floor plan payable – new equipment |

|

(3.2 |

) |

|

|

(2.4 |

) |

|

|

(0.8 |

) |

|

|

33.3 |

% |

|

|

(8.7 |

) |

|

|

(5.8 |

) |

|

|

(2.9 |

) |

|

|

50.0 |

% |

Interest expense – other |

|

(19.4 |

) |

|

|

(12.8 |

) |

|

|

(6.6 |

) |

|

|

51.6 |

% |

|

|

(49.2 |

) |

|

|

(35.1 |

) |

|

|

(14.1 |

) |

|

|

40.2 |

% |

Other income |

|

(0.3 |

) |

|

|

1.4 |

|

|

|

(1.7 |

) |

|

|

(121.4 |

)% |

|

|

1.6 |

|

|

|

2.6 |

|

|

|

(1.0 |

) |

|

|

(38.5 |

)% |

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6.7 |

) |

|

|

— |

|

|

|

(6.7 |

) |

|

NM |

|

Total other expense, net |

|

(22.9 |

) |

|

|

(13.8 |

) |

|

|

(9.1 |

) |

|

|

65.9 |

% |

|

|

(63.0 |

) |

|

|

(38.3 |

) |

|

|

(24.7 |

) |

|

|

64.5 |

% |

(Loss) income before taxes |

|

(16.1 |

) |

|

|

0.1 |

|

|

|

(16.2 |

) |

|

NM |

|

|

|

(46.8 |

) |

|

|

3.9 |

|

|

|

(50.7 |

) |

|

NM |

|

Income tax provision (benefit) |

|

11.6 |

|

|

|

(7.3 |

) |

|

|

18.9 |

|

|

NM |

|

|

|

4.7 |

|

|

|

(6.9 |

) |

|

|

11.6 |

|

|

NM |

|

Net (loss) income |

|

(27.7 |

) |

|

|

7.4 |

|

|

|

(35.1 |

) |

|

NM |

|

|

|

(51.5 |

) |

|

|

10.8 |

|

|

|

(62.3 |

) |

|

NM |

|

Preferred stock dividends |

|

(0.7 |

) |

|

|

(0.7 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2.2 |

) |

|

|

(2.2 |

) |

|

|

— |

|

|

|

— |

|

Net (loss) income available to common stockholders |

$ |

(28.4 |

) |

|

$ |

6.7 |

|

|

$ |

(35.1 |

) |

|

NM |

|

|

$ |

(53.7 |

) |

|

$ |

8.6 |

|

|

$ |

(62.3 |

) |

|

NM |

|

NM - calculated change not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call Information:

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

Alta management will host a conference call and webcast today at 5:00 p.m. Eastern Time today to discuss and answer questions about the Company’s financial results for the quarter ended September 30, 2024. Additionally, supplementary presentation slides will be accessible on the “Investor Relations” section of the Company’s website at https://investors.altaequipment.com.

Conference Call Details:

|

|

What: |

Alta Equipment Group Third Quarter 2024 Earnings Call and Webcast |

Date: |

Tuesday, November 12, 2024 |

Time: |

5:00 p.m. Eastern Time |

Live call: |

(833) 470-1428 |

International: |

Global Dial-In Number: (404) 975-4839 |

Live call access code: |

388692 |

Audio replay: |

(866) 813-9403 |

Replay access code: |

825767 |

Webcast: |

https://events.q4inc.com/attendee/484882805 |

The audio replay will be archived through November 26, 2024.

About Alta Equipment Group Inc.

Alta owns and operates one of the largest integrated equipment dealership platforms in North America. Through our branch network, we sell, rent, and provide parts and service support for several categories of specialized equipment, including lift trucks and other material handling equipment, heavy and compact earthmoving equipment, crushing and screening equipment, environmental processing equipment, cranes and aerial work platforms, paving and asphalt equipment, other construction equipment and allied products. Alta has operated as an equipment dealership for 40 years and has developed a branch network that includes over 85 total locations across Michigan, Illinois, Indiana, Ohio, Pennsylvania, Massachusetts, Maine, Connecticut, New Hampshire, Vermont, Rhode Island, New York, Virginia, Nevada and Florida and the Canadian provinces of Ontario and Quebec. Alta offers its customers a one-stop-shop for their equipment needs through its broad, industry-leading product portfolio. More information can be found at www.altg.com.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Alta’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Alta’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: supply chain disruptions, inflationary pressures resulting from supply chain disruptions or a tightening labor market; negative impacts on customer payment policies and adverse banking and governmental regulations, resulting in a potential reduction to the fair value of our assets; the performance and financial viability of key suppliers, contractors, customers, and financing sources; economic, industry, business and political conditions including their effects on governmental policy and government actions that disrupt our supply chain or sales channels; fluctuations in interest rates; the demand and market price for our equipment and product support; collective bargaining agreements and our relationship with our union-represented employees; our success in identifying acquisition targets and integrating acquisitions; our success in expanding into and doing business in additional markets; our ability to raise capital at favorable terms; the competitive environment for our products and services; our ability to continue to innovate and develop new business lines; our ability to attract and retain key personnel, including, but not limited to, skilled technicians; our ability to maintain our listing on the New York Stock Exchange; the impact of cyber or other security threats or other disruptions to our businesses; our ability to realize the anticipated benefits of acquisitions or divestitures, rental fleet and other organic investments or internal reorganizations; federal, state, and local government budget uncertainty, especially as it relates to infrastructure projects and taxation; currency risks and other risks associated with international operations; and other risks and uncertainties identified in this presentation or indicated from time to time in the section entitled “Risk Factors” in Alta’s annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission. Alta cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. Alta does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions, or circumstances on which any such statement is based.

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

*Use of Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States (“GAAP”), we disclose non-GAAP financial measures, including Adjusted EBITDA, Adjusted total net debt and floor plan payables, Adjusted net income, and Adjusted basic and diluted net income per share, in this press release because we believe they are useful performance measures that assist in an effective evaluation of our operating performance when compared to our peers, without regard to financing methods or capital structure. We believe such measures are useful for investors and others in understanding and evaluating our operating results in the same manner as our management. However, such measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for, or in isolation from, net income, revenues, operating profit, debt, or any other operating performance measures calculated in accordance with GAAP.

We define Adjusted EBITDA as net income before interest expense (not including floorplan interest paid on new equipment), income taxes, depreciation and amortization, adjustments for certain one-time or non-recurring items, other items not necessarily indicative of our underlying operating performance and other items. We exclude these items from net income in arriving at Adjusted EBITDA because these amounts are either non-recurring or can vary substantially within the industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Management uses Adjusted total net debt and floor plan payables to reflect the Company's estimated financial obligations less cash and floor plan payables on new equipment ("FPNP"). The FPNP is used to finance the Company's new inventory, with its principal balance changing daily as equipment is purchased and sold and the sale proceeds are used to repay the notes. Consequently, in managing the business, management views the FPNP as interest bearing accounts payable, representing the cost of acquiring the equipment that is then repaid when the equipment is sold, as the Company's floor plan credit agreements require repayment when such pieces of equipment are sold. The Company believes excluding the FPNP from the Company's total debt for this purpose provides management with supplemental information regarding the Company's capital structure and leverage profile and assists investors in performing analysis that is consistent with financial models developed by Company management and research analysts. Adjusted total net debt and floor plan payables should be considered in addition to, and not as a substitute for, the Company's debt obligations, as reported in the Company's Consolidated Balance Sheets in accordance with U.S. GAAP. Adjusted net income is defined as net income adjusted to reflect certain one-time or non-recurring items, other items not necessarily indicative of our underlying operating performance and other items. Adjusted basic and diluted net income per share is defined as adjusted net income divided by the weighted average number of basic and diluted shares, respectively, outstanding during the period. Certain items excluded from Adjusted EBITDA, Adjusted total net debt and floor plan payables, Adjusted net income, Adjusted basic and diluted net income per share are significant components in understanding and assessing a company’s financial performance. For example, items such as a company’s cost of capital and tax structure, certain one-time or non-recurring items as well as the historic costs of depreciable assets, are not reflected in Adjusted EBITDA or Adjusted net income. Our presentation of Adjusted EBITDA, Adjusted total net debt and floor plan payables, Adjusted net income, Adjusted basic and diluted net income per share should not be construed as an indication that results will be unaffected by the items excluded from these metrics. Our computation of Adjusted EBITDA, Adjusted total net debt and floor plan payables, Adjusted net income, Adjusted basic and diluted net income per share may not be identical to other similarly titled measures of other companies. For a reconciliation of non-GAAP measures to their most comparable measures under GAAP, please see the table entitled “Reconciliation of Non-GAAP Financial Measures” at the end of this press release.

Contacts

Investors:

Kevin Inda

SCR Partners, LLC

kevin@scr-ir.com

(225) 772-0254

Media:

Glenn Moore

Alta Equipment Group, LLC

glenn.moore@altg.com

(248) 305-2134

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

Cash |

|

$ |

14.6 |

|

|

$ |

31.0 |

|

Accounts receivable, net of allowances of $15.5 and $12.4 as of September 30, 2024 and December 31, 2023, respectively |

|

|

217.4 |

|

|

|

249.3 |

|

Inventories, net |

|

|

565.2 |

|

|

|

530.7 |

|

Prepaid expenses and other current assets |

|

|

29.2 |

|

|

|

27.0 |

|

Total current assets |

|

|

826.4 |

|

|

|

838.0 |

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

Property and equipment, net |

|

|

85.0 |

|

|

|

73.4 |

|

Rental fleet, net |

|

|

385.3 |

|

|

|

391.4 |

|

Operating lease right-of-use assets, net |

|

|

108.9 |

|

|

|

110.9 |

|

Goodwill |

|

|

81.1 |

|

|

|

76.7 |

|

Other intangible assets, net |

|

|

58.0 |

|

|

|

66.3 |

|

Other assets |

|

|

4.4 |

|

|

|

14.2 |

|

TOTAL ASSETS |

|

$ |

1,549.1 |

|

|

$ |

1,570.9 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Floor plan payable – new equipment |

|

$ |

309.2 |

|

|

$ |

297.8 |

|

Floor plan payable – used and rental equipment |

|

|

86.7 |

|

|

|

99.5 |

|

Current portion of long-term debt |

|

|

10.1 |

|

|

|

7.7 |

|

Accounts payable |

|

|

93.7 |

|

|

|

97.0 |

|

Customer deposits |

|

|

13.2 |

|

|

|

17.4 |

|

Accrued expenses |

|

|

65.1 |

|

|

|

59.7 |

|

Current operating lease liabilities |

|

|

15.1 |

|

|

|

15.9 |

|

Current deferred revenue |

|

|

12.3 |

|

|

|

16.2 |

|

Other current liabilities |

|

|

6.9 |

|

|

|

23.9 |

|

Total current liabilities |

|

|

612.3 |

|

|

|

635.1 |

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

Line of credit, net |

|

|

197.3 |

|

|

|

315.9 |

|

Long-term debt, net of current portion |

|

|

478.7 |

|

|

|

312.3 |

|

Finance lease obligations, net of current portion |

|

|

36.6 |

|

|

|

31.1 |

|

Deferred revenue, net of current portion |

|

|

4.2 |

|

|

|

4.2 |

|

Long-term operating lease liabilities, net of current portion |

|

|

99.2 |

|

|

|

99.6 |

|

Deferred tax liabilities |

|

|

11.2 |

|

|

|

7.7 |

|

Other liabilities |

|

|

13.9 |

|

|

|

15.3 |

|

TOTAL LIABILITIES |

|

|

1,453.4 |

|

|

|

1,421.2 |

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Preferred stock, $0.0001 par value per share, 1,000,000 shares authorized, 1,200 shares issued and outstanding at both September 30, 2024 and December 31, 2023 (1,200,000 Depositary Shares representing a 1/1000th fractional interest in a share of 10% Series A Cumulative Perpetual Preferred Stock) |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value per share, 200,000,000 shares authorized; 33,092,441 and 32,369,820 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

242.6 |

|

|

|

233.8 |

|

Treasury stock at cost, 1,093,516 and 862,182 shares of common stock held at September 30, 2024 and December 31, 2023, respectively |

|

|

(7.9 |

) |

|

|

(5.9 |

) |

Accumulated deficit |

|

|

(136.0 |

) |

|

|

(76.4 |

) |

Accumulated other comprehensive loss |

|

|

(3.0 |

) |

|

|

(1.8 |

) |

TOTAL STOCKHOLDERS’ EQUITY |

|

|

95.7 |

|

|

|

149.7 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

1,549.1 |

|

|

$ |

1,570.9 |

|

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in millions, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

$ |

219.8 |

|

|

$ |

253.6 |

|

|

$ |

699.9 |

|

|

$ |

727.8 |

|

Parts sales |

|

75.6 |

|

|

|

69.5 |

|

|

|

226.5 |

|

|

|

209.2 |

|

Service revenues |

|

64.6 |

|

|

|

60.6 |

|

|

|

194.8 |

|

|

|

180.5 |

|

Rental revenues |

|

53.7 |

|

|

|

54.0 |

|

|

|

155.9 |

|

|

|

147.1 |

|

Rental equipment sales |

|

35.1 |

|

|

|

28.5 |

|

|

|

101.4 |

|

|

|

90.7 |

|

Total revenues |

|

448.8 |

|

|

|

466.2 |

|

|

|

1,378.5 |

|

|

|

1,355.3 |

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

|

184.4 |

|

|

|

212.0 |

|

|

|

588.7 |

|

|

|

601.3 |

|

Parts sales |

|

50.0 |

|

|

|

45.3 |

|

|

|

149.2 |

|

|

|

138.2 |

|

Service revenues |

|

26.3 |

|

|

|

26.5 |

|

|

|

80.2 |

|

|

|

77.0 |

|

Rental revenues |

|

5.6 |

|

|

|

5.7 |

|

|

|

18.5 |

|

|

|

18.0 |

|

Rental depreciation |

|

30.6 |

|

|

|

29.6 |

|

|

|

88.5 |

|

|

|

80.1 |

|

Rental equipment sales |

|

27.3 |

|

|

|

21.0 |

|

|

|

76.2 |

|

|

|

66.5 |

|

Total cost of revenues |

|

324.2 |

|

|

|

340.1 |

|

|

|

1,001.3 |

|

|

|

981.1 |

|

Gross profit |

|

124.6 |

|

|

|

126.1 |

|

|

|

377.2 |

|

|

|

374.2 |

|

General and administrative expenses |

|

110.6 |

|

|

|

106.8 |

|

|

|

339.7 |

|

|

|

316.0 |

|

Non-rental depreciation and amortization |

|

7.2 |

|

|

|

5.4 |

|

|

|

21.3 |

|

|

|

16.0 |

|

Total operating expenses |

|

117.8 |

|

|

|

112.2 |

|

|

|

361.0 |

|

|

|

332.0 |

|

Income from operations |

|

6.8 |

|

|

|

13.9 |

|

|

|

16.2 |

|

|

|

42.2 |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

Interest expense, floor plan payable – new equipment |

|

(3.2 |

) |

|

|

(2.4 |

) |

|

|

(8.7 |

) |

|

|

(5.8 |

) |

Interest expense – other |

|

(19.4 |

) |

|

|

(12.8 |

) |

|

|

(49.2 |

) |

|

|

(35.1 |

) |

Other (expense) income |

|

(0.3 |

) |

|

|

1.4 |

|

|

|

1.6 |

|

|

|

2.6 |

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(6.7 |

) |

|

|

— |

|

Total other expense, net |

|

(22.9 |

) |

|

|

(13.8 |

) |

|

|

(63.0 |

) |

|

|

(38.3 |

) |

(Loss) income before taxes |

|

(16.1 |

) |

|

|

0.1 |

|

|

|

(46.8 |

) |

|

|

3.9 |

|

Income tax provision (benefit) |

|

11.6 |

|

|

|

(7.3 |

) |

|

|

4.7 |

|

|

|

(6.9 |

) |

Net (loss) income |

|

(27.7 |

) |

|

|

7.4 |

|

|

|

(51.5 |

) |

|

|

10.8 |

|

Preferred stock dividends |

|

(0.7 |

) |

|

|

(0.7 |

) |

|

|

(2.2 |

) |

|

|

(2.2 |

) |

Net (loss) income available to common stockholders |

$ |

(28.4 |

) |

|

$ |

6.7 |

|

|

$ |

(53.7 |

) |

|

$ |

8.6 |

|

Basic (loss) income per share |

$ |

(0.86 |

) |

|

$ |

0.21 |

|

|

$ |

(1.62 |

) |

|

$ |

0.27 |

|

Diluted (loss) income per share |

$ |

(0.86 |

) |

|

$ |

0.20 |

|

|

$ |

(1.62 |

) |

|

$ |

0.26 |

|

Basic weighted average common shares outstanding |

|

33,207,768 |

|

|

|

32,368,112 |

|

|

|

33,185,437 |

|

|

|

32,320,346 |

|

Diluted weighted average common shares outstanding |

|

33,207,768 |

|

|

|

32,729,517 |

|

|

|

33,185,437 |

|

|

|

32,631,082 |

|

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

OPERATING ACTIVITIES |

|

|

|

|

|

Net (loss) income |

$ |

(51.5 |

) |

|

$ |

10.8 |

|

Adjustments to reconcile net (loss) income to net cash flows provided by (used in) operating activities |

|

|

|

|

|

Depreciation and amortization |

|

109.8 |

|

|

|

96.1 |

|

Amortization of debt discount and debt issuance costs |

|

2.6 |

|

|

|

1.4 |

|

Imputed interest |

|

0.3 |

|

|

|

0.8 |

|

Loss on sale of property and equipment |

|

— |

|

|

|

0.3 |

|

Gain on sale of rental equipment |

|

(25.2 |

) |

|

|

(24.2 |

) |

Provision for inventory obsolescence |

|

1.4 |

|

|

|

3.1 |

|

Provision for losses on accounts receivable |

|

5.2 |

|

|

|

5.1 |

|

Loss on debt extinguishment |

|

6.7 |

|

|

|

— |

|

Change in fair value of derivative instruments |

|

(2.2 |

) |

|

|

2.2 |

|

Stock-based compensation expense |

|

3.9 |

|

|

|

3.3 |

|

Changes in deferred income taxes |

|

5.2 |

|

|

|

(7.4 |

) |

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

|

Accounts receivable |

|

26.5 |

|

|

|

(32.7 |

) |

Inventories |

|

(152.2 |

) |

|

|

(247.4 |

) |

Proceeds from sale of rental equipment - rent-to-sell |

|

92.5 |

|

|

|

87.0 |

|

Prepaid expenses and other assets |

|

3.2 |

|

|

|

(5.5 |

) |

Manufacturers floor plans payable |

|

8.4 |

|

|

|

97.9 |

|

Accounts payable, accrued expenses, customer deposits, and other current liabilities |

|

(13.6 |

) |

|

|

(6.9 |

) |

Leases, deferred revenue, net of current portion and other liabilities |

|

1.1 |

|

|

|

(7.0 |

) |

Net cash provided by (used in) operating activities |

|

22.1 |

|

|

|

(23.1 |

) |

INVESTING ACTIVITIES |

|

|

|

|

|

Expenditures for rental equipment |

|

(45.6 |

) |

|

|

(48.7 |

) |

Expenditures for property and equipment |

|

(11.4 |

) |

|

|

(8.6 |

) |

Proceeds from sale of property and equipment |

|

2.3 |

|

|

|

0.8 |

|

Proceeds from sale of rental equipment - rent-to-rent |

|

8.9 |

|

|

|

3.7 |

|

Acquisitions of businesses, net of cash acquired |

|

— |

|

|

|

(1.6 |

) |

Other investing activities |

|

(2.2 |

) |

|

|

(2.5 |

) |

Net cash used in investing activities |

|

(48.0 |

) |

|

|

(56.9 |

) |

FINANCING ACTIVITIES |

|

|

|

|

|

Expenditures for debt issuance costs |

|

(1.9 |

) |

|

|

— |

|

Extinguishment of long-term debt |

|

(319.4 |

) |

|

|

— |

|

Proceeds from line of credit and long-term borrowings |

|

899.6 |

|

|

|

278.5 |

|

Principal payments on line of credit, long-term debt, and finance lease obligations |

|

(546.1 |

) |

|

|

(197.0 |

) |

Proceeds from non-manufacturer floor plan payable |

|

101.3 |

|

|

|

148.3 |

|

Payments on non-manufacturer floor plan payable |

|

(110.6 |

) |

|

|

(138.5 |

) |

Preferred stock dividends paid |

|

(2.2 |

) |

|

|

(2.2 |

) |

Common stock dividends declared and paid |

|

(5.9 |

) |

|

|

(5.7 |

) |

Repurchases of common stock |

|

(2.0 |

) |

|

|

— |

|

Other financing activities |

|

(3.1 |

) |

|

|

(5.2 |

) |

Net cash provided by financing activities |

|

9.7 |

|

|

|

78.2 |

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

(0.2 |

) |

|

|

0.5 |

|

NET CHANGE IN CASH |

|

(16.4 |

) |

|

|

(1.3 |

) |

|

|

|

|

|

|

Cash, Beginning of year |

|

31.0 |

|

|

|

2.7 |

|

Cash, End of period |

$ |

14.6 |

|

|

$ |

1.4 |

|

Supplemental schedule of noncash investing and financing activities: |

|

|

|

|

|

Noncash asset purchases: |

|

|

|

|

|

Net transfer of assets from inventory to rental fleet |

$ |

105.6 |

|

|

$ |

143.0 |

|

Contingent and non-contingent consideration for business acquisitions |

|

0.2 |

|

|

|

— |

|

Supplemental disclosures of cash flow information |

|

|

|

|

|

Cash paid for interest |

$ |

43.8 |

|

|

$ |

33.8 |

|

Cash paid for income taxes |

$ |

1.5 |

|

|

$ |

4.0 |

|

ALTA EQUIPMENT GROUP INC.

EARNINGS PRESS RELEASE

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (Unaudited)

(in millions, except share and per share amounts)

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

Debt and Floor Plan Payables Analysis |

2024 |

|

|

2023 |

|

Senior secured second lien notes |

$ |

500.0 |

|

|

$ |

315.0 |

|

Line of credit |

|

200.6 |

|

|

|

317.5 |

|

Floor plan payable – new equipment |

|

309.2 |

|

|

|

297.8 |

|

Floor plan payable – used and rental equipment |

|

86.7 |

|

|

|

99.5 |

|

Finance lease obligations |

|

46.7 |

|

|

|

38.8 |

|

Total debt |

$ |

1,143.2 |

|

|

$ |

1,068.6 |

|

Adjustments: |

|

|

|

|

|

Floor plan payable – new equipment |

|

(309.2 |

) |

|

|

(297.8 |

) |

Cash |

|

(14.6 |

) |

|

|

(31.0 |

) |

Adjusted total net debt and floor plan payables(1) |

$ |

819.4 |

|

|

$ |

739.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net (loss) income available to common stockholders |

$ |

(28.4 |

) |

|

$ |

6.7 |

|

|

$ |

(53.7 |

) |

|

$ |

8.6 |

|

Depreciation and amortization |

|

37.8 |

|

|

|

35.0 |

|

|

|

109.8 |

|

|

|

96.1 |

|

Interest expense |

|

22.6 |

|

|

|

15.2 |

|

|

|

57.9 |

|

|

|

40.9 |

|

Income tax provision (benefit) |

|

11.6 |

|

|

|

(7.3 |

) |

|

|

4.7 |

|

|

|

(6.9 |

) |

EBITDA(1) |

$ |

43.6 |

|

|

$ |

49.6 |

|

|

$ |

118.7 |

|

|

$ |

138.7 |

|

Transaction costs(2) |

|

— |

|

|

|

0.3 |

|

|

|

0.3 |

|

|

|

1.0 |

|

Loss on debt extinguishment(3) |

|

— |

|

|

|

— |

|

|

|

6.7 |

|

|

|

— |

|

Stock-based incentives(4) |

|

1.3 |

|

|

|

1.4 |

|

|

|

3.9 |

|

|

|

3.3 |

|

Other expenses(5) |

|

0.8 |

|

|

|

1.4 |

|

|

|

4.5 |

|

|

|

2.3 |

|

Preferred stock dividend(6) |

|

0.7 |

|

|

|

0.7 |

|

|

|

2.2 |

|

|

|

2.2 |

|

Showroom-ready equipment interest expense(7) |

|

(3.2 |

) |

|

|

(2.4 |

) |

|

|

(8.7 |

) |

|

|

(5.8 |

) |

Adjusted EBITDA(1) |

$ |

43.2 |

|

|

$ |

51.0 |

|

|

$ |

127.6 |

|

|

$ |

141.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net (loss) income available to common stockholders |

$ |

(28.4 |

) |

|

$ |

6.7 |

|

|

$ |

(53.7 |

) |

|

$ |

8.6 |

|

Transaction costs(2) |

|

— |

|

|

|

0.3 |

|

|

|

0.3 |

|

|

|

1.0 |

|

Loss on debt extinguishment(3) |

|

— |

|

|

|

— |

|

|

|

6.7 |

|

|

|

— |

|

Stock-based incentives(4) |

|

1.3 |

|

|

|

1.4 |

|

|

|

3.9 |

|

|

|

3.3 |

|

Other expenses(5) |

|

0.8 |

|

|

|

1.4 |

|

|

|

4.5 |

|

|

|

2.3 |

|

Intangible amortization(8) |

|

2.5 |

|

|

|

2.0 |

|

|

|

7.7 |

|

|

|

6.4 |

|

Adjusted net (loss) income available to common stockholders(1) |

$ |

(23.8 |

) |

|

$ |

11.8 |

|

|

$ |

(30.6 |

) |

|

$ |

21.6 |

|

Basic net (loss) income per share |

$ |

(0.86 |

) |

|

$ |

0.21 |

|

|

$ |

(1.62 |

) |

|

$ |

0.27 |

|

Diluted net (loss) income per share |

$ |

(0.86 |

) |

|

$ |

0.20 |

|

|

$ |

(1.62 |

) |

|

$ |

0.26 |

|

Adjusted basic net (loss) income per share(1) |

$ |

(0.72 |

) |

|

$ |

0.36 |

|

|

$ |

(0.92 |

) |

|

$ |

0.67 |

|

Adjusted diluted net (loss) income per share(1) |

$ |

(0.72 |

) |

|

$ |

0.36 |

|

|

$ |

(0.92 |

) |

|

$ |

0.66 |

|

Basic weighted average common shares outstanding |

|

33,207,768 |

|

|

|

32,368,112 |

|

|

|

33,185,437 |

|

|

|

32,320,346 |

|

Diluted weighted average common shares outstanding |

|

33,207,768 |

|

|

|

32,729,517 |

|

|

|

33,185,437 |

|

|

|

32,631,082 |

|

(1) Non-GAAP measure

(2) Expenses related to corporate development and acquisition activities, including capital raise and debt refinancing activities

(3) One-time expense associated with the extinguishment of debt

(4) Non-cash equity-based compensation expenses

(5) Other non-recurring expenses inclusive of severance payments, greenfield startup, cost redundancies, non-cash adjustments to earnout contingencies, legal and consulting costs

(6) Expenses related to preferred stock dividend payments

(7) Interest expense associated with showroom-ready new equipment interest included in total interest expense above

(8) Incremental expense associated with the amortization of other intangible assets relating to acquisition accounting

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=altg_CommonStocksClassUndefinedMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

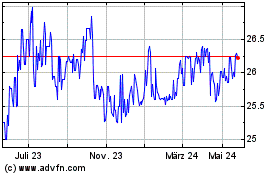

Alta Equipment (NYSE:ALTG-A)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

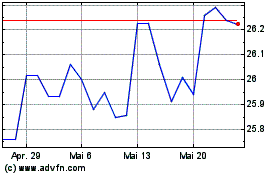

Alta Equipment (NYSE:ALTG-A)

Historical Stock Chart

Von Dez 2023 bis Dez 2024