false

0001771910

00-0000000

0001771910

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 13, 2025

ADC Therapeutics SA

(Exact Name of Registrant as Specified in Its Charter)

|

Switzerland

(State or Other Jurisdiction of Incorporation)

|

001-39071

(Commission File Number)

|

N/A

(IRS Employer Identification Number)

|

|

Biopôle

Route de la Corniche 3B

1066 Epalinges

Switzerland

(Address of Principal Executive Offices) (Zip

Code) |

+41 21 653 02 00

(Registrant’s Telephone Number)

|

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Shares, par value CHF 0.08 per share |

ADCT |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 C.F.R. §230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 C.F.R. §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

On January 13, 2025, ADC Therapeutics SA (the

“Company”) made available a corporate presentation that includes the preliminary information regarding ZYNLONTA net

sales and regarding expenses for the year ended December 31, 2024. A copy of the corporate presentation is attached as Exhibit 99.1

to this Current Report on Form 8-K and incorporated by reference herein.

The information contained in these Items and Exhibit 99.1 shall not

be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ADC Therapeutics SA |

| Date: January 13, 2025 |

|

| |

By: |

/s/ Peter J. Graham |

| |

Name: |

Peter J. Graham |

| |

Title: |

Chief Legal Officer |

Exhibit 99.1

JPMorgan 43 rd Annual Healthcare Conference January 2025

2 Forward - Looking Statements This presentation and any accompanying oral presentation have been prepared by ADC Therapeutics SA ("ADC Therapeutics“, “we” or “us”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or ADC Therapeutics or any officer, director, employee, agent or advisor of ADC Therapeutics. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Information provided in this presentation and any accompanying oral presentation speak only as of the date hereof. This presentation contains forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases you can identify forward - looking statements by terminology such as “may”, “will”, “should”, “would”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “future”, “continue”, or “appear” or the negative of these terms or similar expressions, although not all forward - looking statements contain these identifying words. Forward - looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the expected cash runway into mid - 2026; the Company’s ability to grow ZYNLONTA® revenue in the United States; the ability of our partners to commercialize ZYNLONTA in foreign markets, the timing and amount of future revenue and payments to us from such partnerships and their ability to obtain regulatory approval for ZYNLONTA® in foreign jurisdictions; the impact, if any, from the discontinuation of the ADCT 601; the timing, enrollment, and results of the Company’s or its partners’ clinical trials including LOTIS 5 and 7 as well as ADCT 602; the timing, results and publication of investigator - initiated trials including those studying FL and MZL and the potential regulatory and/or compendia strategy and the future opportunity; the timing and results of the Company’s research and development in solid tumors with different targets, linkers and payloads including the Company’s exatecan based platform; the timing and outcome of regulatory submissions for the Company’s products or product candidates; actions by the FDA or foreign regulatory authorities; projected revenue and expenses; the Company’s indebtedness, including Healthcare Royalty Management and Blue Owl and Oaktree facilities, and the restrictions imposed on the Company’s activities by such indebtedness, the ability to comply with the terms of the various agreements and repay such indebtedness and the significant cash required to service such indebtedness; and the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward - looking statements is contained in the “Risk Factors” section of the Company's Annual Report on Form 10 - K and in the Company's other periodic and current reports and filings with the U.S. Securities and Exchange Commission. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward - looking statements. The Company cautions investors not to place undue reliance on the forward - looking statements contained in this document. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. No assurance can be given that such future results will be achieved. Such forward-looking statements contained in this presentation speak only as of the date of this presentation. The Company expressly disclaim any obligation or undertaking to update these forward-looking statements contained in this presentation to reflect any change in our expectations or any change in events, conditions, or circumstances on which such statements are based unless required to do so by applicable law. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Certain information contained in this presentation relates to or is based on studies, publications, surveys, and other data derived from third-party sources and our own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and we make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involve a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, although we believe our own internal research is reliable, such research has not been verified by any independent source. This presentation also includes non-GAAP financial measures. These non-GAAP measures have limitations as financial measures and should be considered in addition to, and not in isolation or as a substitute for, the information prepared in accordance with GAAP. You should refer to the information contained in the company’s first quarter earnings release for definitional information and reconciliations of historical non-GAAP measures to the comparable GAAP financial measures.

3 A Pioneer and Leader in ADCs orporate C Capability Pipeline Commercial - stage pioneer in the field of ADCs, with specialized end - to - end capabilities from discovery to commercialization Seeking expansion of FDA - approved ZYNLONTA® while pursuing early - stage solid tumor portfolio Array of payloads, linkers and conjugation chemistry enabling design of next - gen potent ADCs with enhanced therapeutic index Platform Delivering on our strategy supported by an accomplished and multidisciplinary team and with cash runway expected into mid 2026

4 DLBCL: Diffuse Large B - Cell Lymphoma; FL: Follicular Lymphoma; MZL: Marginal Zone Lymphoma; NSCLC: Non - Small Cell Lung Cancer; ALL: Acute Lymphoblastic Leukemia Focused ADC Portfolio in Hematology and Solid Tumors Hematology ZYNLONTA → Currently commercialized program in 3L+ DLBCL is self - funded → Potential expansion into earlier lines of therapy and with new indications − LOTIS - 5: rituximab combination − LOTIS - 7: bispecific combinations − Indolent lymphomas (FL and MZL) Solid Tumors Next - generation ADCs → Differentiated exatecan - based payload with novel hydrophilic linker − Targeting Claudin - 6, PSMA, NaPi2b, ASCT2 − Advancing one candidate to IND − Seeking research collaborations to advance a broad portfolio

5 *Cash runway assumes receipt of anticipated regulatory milestone payments under the Company’s collaboration agreements and use of the amount it is required to maintain under its loan agreement LOTIS - 5: Acceleration and completion of enrollment LOTIS - 7: Completion of dose escalation with all doses cleared; Initial efficacy/safety update on Part 2 with glofitamab combination r/r FL and r/r MZL IITs: Update at ASH; FL Lancet Hematology publication Research Platform: Shared pre - clinical data on exatecan - based platform and four lead candidates at research event ZYNLONTA stabilized sales despite increased competition ZYNLONTA commercial brand profitability achieved Double - digit cost reduction for second consecutive year driven by disciplined portfolio management Cash runway expected into mid 2026* Derisked Portfolio with Strict Capital Management in 2024

6 Anticipated milestones set forth in this chart are subject to further future adjustment. NTE: Non - Transplant Eligible. 1. DLBCL, FL, MZL AA: Accelerated Approval. Focused Pipeline in Hematology and Solid Tumors Hematology Solid Tumors Phase 3 / Confirmatory Phase 2 Phase 1b Phase 1a Preclinical FDA approved (AA) Confirmatory ZYNLONTA | Targeting CD19 LOTIS - 2 in 3L+ DLBCL LOTIS - 5 with rituximab in 2L+ NTE DLBCL LOTIS - 7 with glofitamab in r/r NHL 1 LOTIS - 7 with mosunetuzumab in r/r NHL 1 U of Miami IIT with rituximab in r/r FL U of Miami IIT single agent in r/r MZL ADCT - 602 | Targeting CD22 Acute Lymphoblastic Leukemia Next - Gen ADCs | Exatecan Payload with Novel Linker Claudin - 6 PSMA N aP i2b ASCT 2

7 Experienced Leadership Patrick van Berkel, PhD Chief Scientific Officer Mohamed Zaki, MD, PhD Chief Medical Officer Kristen Harrington - Smith Chief Commercial Officer Jose Carmona Chief Financial Officer Seasoned team of industry veterans with history of proven expertise in biopharma from pre - clinical research and development to drug approval and commercialization Ameet Mallik Chief Executive Officer ▪ 20+ years industry experience in key strategic, commercial and leadership roles including recently at Novartis as EVP heading US Oncology ▪ Currently serving on the board of directors for ADCT and Atara Biotherapeutics ▪ 20+ years of financial experience in the biotechnology and pharmaceutical industries ▪ Previous role as CFO for multiple early-stage biotech companies and in key leadership roles with Novartis ▪ 20+ years experience in the biotech industry ▪ 9+ years with Genmab in various roles, including VP of Antibody Technology and VP of CMC R&D ▪ 20+ years of global biopharmaceutical experience in hematology and oncology drug development ▪ Previously served as VP and Global Head of Oncology Development at AbbVie ▪ 20+ years experience in the pharmaceutical industry ▪ Most recently CCO of Immunogen, and prior to that VP and Head of US Hematology at Novartis

8 Please visit Zynlonta.com for complete prescribing information including indication, warnings and precautions. → ZYNLONTA is a CD19 - directed ADC indicated as monotherapy for the treatment of adult patients with relapsed or refractory large B - cell lymphoma after two or more lines of systemic therapy → Rapid, deep, and durable efficacy – Median time to CR 1.5 months – 48.3% ORR and 24.8% CR – Median duration of response not yet reached for patients in CR at 2 - year follow - up → Manageable safety profile – No CRS or ICANS and no cumulative irreversible toxicities → Accessibility – Simple Q3W dosing with no REMS or inpatient stay requirements ZYNLONTA is Ideally Suited Across Care Settings for Patients with r/r DLBCL

9 1 As detailed in ASH 2024 oral presentation; 2 As detailed in ASH 2024 poster. Advancing ZYNLONTA Development into 2L+ B - Cell Lymphomas Current Approval Current Development Areas DLBCL F L M ZL 1L 2L+ 3L+ ZYNLONTA+R ZYNLONTA ZYNLONTA+R ZYNLONTA ZYNLONTA PHASE 2 IIT DATA PRESENTED AT ASH 2024 SUGGEST POTENTIAL BENEFIT IN INDOLENT LYMPHOMAS → ZYNLONTA + rituximab in high - risk r/r FL 1 : 97% ORR, 77% CR, n=35 → ZYNLONTA monotherapy in r/r MZL 2 : 91% ORR, 70% CR, n=23 LO T I S - 5 LO T I S - 7 POTENTIAL TO MOVE INTO 2L+ DLBCL → LOTIS - 5 (ZYNLONTA + rituximab) : 20 patient safety run - in data showing ORR of 80 % , CR of 50 % with no new safety signals, complete enrollment in 2024 → LOTIS - 7 (ZYNLONTA + bispecific): Promising initial efficacy data with 94% best ORR and 72% CR rate (n=18) with manageable safety profile (n=29)

10 2L+ Indolent lymphomas (MZL + FL) $100 - 200M ZYNLONTA U.S. Peak Revenue Potential of $600M - 1B $600M - 1B Peak Revenue in DLBCL & Indolent Lymphomas ZYNLONTA 2L+ ZYNLONTA plus bispecific $500M - 800M LOTIS 7 2L+ ZYNLONTA plus rituximab $200 - 300M* LOTIS 5 3L+ Monotherapy CURRENT INDICATION Note: ZYNLONTA Monotherapy is FDA approved under accelerated approval; other potential indications in development *Based on quantitative market research study of 150 physicians

11 *Based on internal review of approved labels for existing modalities; Efficacy refers to rapid, deep, and durable responses. Safety refers to manageable and reversible toxicities. Accessibility refers to availability across treatment settings; 1. Putnam Research & Analysis of 150 physicians (Q3 2024). ZYNLONTA Combinations in Highest Growth r/r DLBCL Modalities → Efficacy approaching CAR - T levels with manageable safety enabling use across care settings, with potential to disrupt treatment paradigm 2L+ DLBCL Market Dynamics* Projected Trend 1 Cell The r a p y Chemo ADCs / mAbs Bispecifics Potential to raise the bar for efficacy in this class with competitive safety and accessibility ZYNLONTA LOTIS 7 ZYNLONTA LOTIS 5 Accessibility Share Efficac y Safety → Physician treatment choice driven by efficacy, safety, and accessibility based on individual patient considerations → Emerging ADC and Bispecific combinations with improved clinical profiles have the potential to reduce chemotherapy and cell therapy use

12 OS: Overall Survival, ORR: Overall Response Rate, CRR: Complete Response Rate, DoR: Duration of Response, PFS: Progression Free Survival Note: Assumes full LOTIS - 5 phase 3 results consistent with initial 20 - patients safety run - in data LOTIS - 5: Phase 3 Confirmatory Trial of ZYNLONTA in Combination with Rituximab in 2L+ DLBCL LOTIS - 5 Overview → Patient Population: 2L+ DLBCL, ASCT ineligible → Primary endpoint: PFS → Secondary endpoints include OS; ORR; CRR; DoR; frequency and severity of adverse events → Initial data: 20 patient safety run - in (SOHO 2023), resulting in 80% ORR and 50% CR, with no new safety signals Expected attributes of ZYNLONTA + Rituximab – Powerful, rapid and durable efficacy – Fixed duration regimen up to 8 cycles – Manageable and familiar safety profile without irreversible toxicities – Easily administered by physicians given dosing regimen and comfort with rituximab Initial data demonstrates that this combination has the potential to provide competitive 2L+ efficacy with a favorable safety profile allowing broad accessibility Current and midterm R/R DLBCL market Status and Next Steps – Full enrollment completed in 2024 – Topline results expected in late 2025 once 262 pre - specified PFS events reached – Potentially submit to regulatory authorities for full approval in Q1 2026 with approval expected in late 2026

13 LOTIS - 5: ZYNLONTA + Rituximab Revenue Potential of $200 - 300M All Other Therapies CA R - T Bispecifics (incl combos) ZYNLONTA +/ - R 78% 36% 22% 22% 28% 14% Future 2L Current 2L Future 3L+ Current 3L+ 45% 35% 21% 15% 24% 27% 9% 22% 0% 100% % of Patients 100% % of Patients Future Treatment Shares by Line of Therapy* 0% → Only ~60% of 2L patient population expected to have access to CAR - T and bispecific therapies due to need for appropriate hospital access (e.g. availability of toci, appropriate ER training) and patient logistical barriers (e.g. unwillingness to travel, lack of social support) → For patients who have access to but are not clinically appropriate for CAR - T and bispecific therapies, ZYNLONTA + R has the potential to be well suited for patients with neuropathy/existing neurological conditions, autoimmune disease, risk of infection, or who are older → For patients who do not have access to CAR - T and bispecific therapies, ZYNLONTA + R has the potential to have the most differentiated clinical profile given potential highest response rates, manageable/reversible safety profile, and ease of administration → The combination is expected to be the preferred ZYNLONTA regimen and grow the overall ZYNLONTA 3L+ share due to the improved clinical profile and bispecific use in earlier lines → The median number of cycles is expected to increase from three with mono - therapy to five with combination use 2L ~12K patients 3L+ ~6K patients *Based on quantitative market research study of 150 physicians Note: Assumes full LOTIS - 5 phase 3 results consistent with initial 20 - patients safety run - in data

14 END OF TREATMENT ZYNLONTA IV (120 or 150 µg/kg3) + glofitamab IV Q3W Enrollment began Apr 2024 Escalating doses of ZYNLONTA IV + mosun SC Q3W2 Enrollment began July 2023 Escalating doses of ZYNLONTA IV + glofitamab IV Q3W1 Enrollment began July 2023 SCREENING PERIOD TREATMENT PERIOD (≤28 DAYS) (CYCLES OF 21 DAYS) r/r DLBCL, FL, MZL for both arms r/r DLBCL Part 1 3+3 Dose escalation (ZYNLONTA 90, 120, and 150 μ g/kg) Part 2 Dose exp a nsion Study Population → Relapsed or Refractory B-NHL patients, ECOG PS 0 – 2, and have received: – Part 1: >2 systemic treatment regimens – Part 2: >1 systemic treatment regimens → Prior autologous SCT or CAR-T (>100 days) is allowed → Measurable disease per 2014 Lugano Classification → Excludes patients with clinically significant 3rd space fluid accumulation Endpoints → Primary: Safety and tolerability; MTD and/or RD → Secondary: – Efficacy: ORR, DOR, CRR, PFS, RFS, OS – Pharmacokinetics and Immunogenicity Trial Status → Dose escalation complete with no DLTs, no high-grade CRS or ICANS and early signs of anti-tumor activity → Dose expansion ongoing in ZYNLONTA (120 or 150 µg/kg) + glofitamab with 20 patients planned for each dosing cohort ZYNLONTA + Glofitamab Treatment Sequence Cycle 1 Cycle 9 to Cycle 12 Day 1 Ho s p ita l i z at i o n required Glofit Cycle 2 to Cycle 8 Day 1: both agents on same day Lo nc a Glofit 1 to 1.5 hrs in - between Day 15 Glofit Day 8 Glofit Day 2 Lo nc a Day 1 Gpt Obinutuzumab pretreatment 1000mg on C1D1; ZYNLONTA administered on C1D2; administration of 1st and 2nd step - up dose(s) of IV glofitamab (2.5mg on C1D8 & 10mg on C1D15); ZYNLONTA plus glofitamab 30mg on C2D1 and beyond (reduce ZYNLONTA to 75 ug/kg at C3 if starting dose is 120 ug/kg or higher) ZYNLONTA plus subcutaneous mosunetuzumab 1st step - up dose of 5 mg on C1D1, followed by mosunetuzumab 2nd step - up & target dose of 45 mg for C1D8 & C1D15; ZYNLONTA plus 45mg of subcutaneous mosunetuzumab on C2D1 and beyond (reduce ZYNLONTA to 75 μ g/kg at C3 if starting dose is 120 ug/kg or higher) ZYNLONTA dose reduced to 75 μ g/kg at C3 LOTIS - 7: Phase 1b Trial of ZYNLONTA in Combination with Glofitamab

15 *As per Investigator reported adverse events TEAE = treatment emergent adverse event, AESI = adverse event of special interest Data cutoff: 20 Nov 2024. Data extracted from live clinical database. Data is subject to change. Safety Population (N=29) as of November 20, 2024 LOTIS - 7 Phase 1b Trial: Safety Summary 16 (55.2%) 6 (42.2%) 8 (61.5%) 2 (66.7%) Grade 3/4 TEAEs (≥ 5% of patients) * 7 (24.1%) 4 (30.8%) 2 (15.4%) 1 (33.3%) Neutropenia 2 (6.9%) 0 1 (7.7%) 1 (33%) Lymphopenia 2 (6.9%) 0 2 (15.4) 0 Hypokalemia 1 (3.4%) 1 (7.7%) 0 0 Febrile neutropenia 1 (3.4%) 1 (7.7%) 0 0 Thrombocytopenia 1 (3.4%) 0 1 (7.7%) 0 GGT increase 1 (3.4%) 0 1 (7.7%) 0 Generalized oedema 1 (3.4%) 0 1 (7.7%) 0 Rash 1 (3.4%) 1 (7.7 %) 0 0 Photosensitivity reaction 1 (3.4%) 0 1 (7.7%) 0 Sepsis 1 (3.4%) 0 1 (7.7%) 0 Upper respiratory infection 1 (3.4%) 0 1 (7.7%) 0 Pneumonia 1 (3.4%) 0 1 (33%) 0 ICANS (glofitamab only discontinued) 1 (3.4%) 1 (33%) 0 0 Pericardial effusion (loncastuximab only discontinued) 1 (3.4%) 0 0 1 (33%) Pleural effusion (loncastuximab and glofitamab both discontinued) All n=29 150 µg/kg n=13 120 µg/kg n=13 90 µg/kg n=3 Grade 3/4 AESI (all patients) * TEAEs leading to study drug discontinuation (one or both drugs discontinued)*

16 * Number of patients who experienced at least 1 event per ASTCT Consensus Grading for Cytokine Release Syndrome and Neurologic Toxicity Associated with Im Data Cutoff 20 Nov2024. Note: Data extracted from live clinical database. Data is subject to change. LOTIS - 7 Phase 1b Trial: CRS/ICANS Profile & Management Safety Population (N=29) as of November 20, 2024 10 (34.5%) 4 (30.8%) 6 (46.2%) 0 Any grade 8 (27.6%) 3 (23.1%) 5 (38.5%) 0 Grade 1 2 (6.9%) 1 (7.7%) 1 (7.7%) 0 Grade 2 0 0 0 0 Grade >3 2 (6.9%) 1 (7.7%) 1 (7.7%) 0 Any grade 0 0 0 0 Grade 1 2 (6.9%) 1 (7.7%) 1 (7.7%) 0 Grade 2 0 0 0 0 Grade >3 → CRS cases managed with tocilizumab, corticosteroids, acetaminophen, and/or fluid bolus → No requirement for ICU admittance or pressor support → Both patients with ICANS had complete resolution of symptoms → One patient resumed treatment and ultimately achieved a CR; one patient elected to discontinue treatment → ICANS managed primarily with corticosteroids in both patients mune Effector Cells; worst grade reported if applicable All n=29 150 µg/kg n=13 120 µg/kg n=13 90 µg/kg n=3 Cytokine Release Syndrome* I C ANS *

17 TOTAL 150 µg/kg 120 µg/kg % v % n=9 % n=9 94% 17 100% 9 89% 8 ORR (CR + PR) 72% 13 78% 7 67% 6 Complete Response (CR) 22% 4 22% 2 22% 2 Partial Response (PR) 6% 1 0% 0 11% 1 Stable Disease 0% 0 0% 0 0% 0 Progressive Disease As of data cut off 20 Nov 2024. Note: Data extracted from live clinical database. Data is subject to change. LOTIS - 7 Phase 1b Trial: Best Overall Response Efficacy Evaluable Population (N=18) as of November 20, 2024

18 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 X X X X X X X X End of Treatment Responses Assessment ongoing Treatment ongoing Complete response Partial response Stable response Progressive disease 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 300 320 340 Study Duration (Days) Best Overall Response CR PR SD No response a s s es s ment As of data cut off 20 Nov 2024. 360 Note: Data extracted from live clinical database. Data is subject to change. Efficacy Evaluable Population (N=18) as of November 20, 2024 LOTIS - 7 Phase 1b Trial: Best Overall Response Dose Level 120 µg/kg Patients | Dose Level 150 µg/kg Patients | Not Efficacy Evaluable Patients (4 patients have not yet reached the 6 - week assessment; 1 patient withdrew prior to any assessment) → 12/13 CRs remain in CR as of the data cut - off → Most responses observed at initial assessment → 5 patients converted from SD/PR to CR over time

19 ^ Data do not include all 2L MZL regimens such as B+O, R - CHOP, R - CVP, or B - R because inclusion based on either front - line data or studies in mixed histologies; 1 . MAGNOLIA Trial (single arm, multicenter ph 2; n = 68) – Best Response; 2. ACE - LY - 003 study (part 2 of multicenter, ph 1/2b; n = 43) – Best Response; 3. AUGMENT study (randomized ph3 of R2 vs. R; total n = 358, total MZL n = 63, R2 MZL n = 31, R mono MZL n = 32) – Best Response; 4. BRUIN study (ph 1/2 of pirtobrutinib in CLL/SLL and NHL, total estimated n = 860, total MZL n = 36) - . 5. Clarivate DRG (2022); 6. Global Data (2017); 7. Cerner Enviza CancerMPact (2023), distribution by line of therapy is based on the incident, drug - treated population. ZYNLONTA Phase 2 IIT Data Show 70% CR Rate in r/r MZL % 65% Len + Rituximab (R2) 3 53% Acalabrutinib 2 CR % 60 - 68% Zanubritinib 1 60 - 40 - 40 - 20 - 20 - 50% Pirtobrutinib 4 0 - 0 - • Adverse events (AE) were most commonly grade 1 or 2. Grade 3 and 4 AEs were observed in 15 and 1 (neutropenia) patients, respectively. Local edema was observed in 10 (43.4%) patients • Three patients needed dose reduction and one patient discontinued treatment after cycle 4 due to cholestatic hepatitis. The patient clinically fully recovered with normalization in liver function test abnormalities U.S. 5 - year Prevalence 7 durable responses, high unmet medical need remains with <30% CR for 2L+ NCCN preferred treatments 1 - 4 ~15 K 2L+ MZL patients Key: 1L 2L 3L+ Current FDA Approved / NCCN Preferred Regimens with r/r MZL Data 80 - 80 - ORR FDA Approved / NCCN Preferred^ N = 63 – 68 NCCN Preferred^ Only N = 36 – 46 r/r MZL Patient Population → Estimated 3 – 4k 2L+ MZL patients are drug - treated in the US annually 5 - 7 ; despite patients achieving University of Miami phase 2 IIT in r/r MZL → Highlights of ASH 2024 poster presentation by Dr. Isodore Lossos on study of ZYNLONTA in patients with r/r MZL: – N = 23 enrolled (as of October 15, 2024) – ORR of 91% (n=21); CR of 70% (n=16) • POD24 patients (N = 11): 64% CR • All but 1 CR currently maintained with longest follow up of 27 months from the start of treatment (reduction, median duration of CR) – Safety consistent with known profile of ZYNLONTA Next Steps → University of Miami expanded study to City of Hope and plans to open 3 additional sites to accelerate enrollment to 50 r/r MZL patients → ADCT plans to potentially pursue regulatory pathway and compendia in parallel as soon as sufficient data are available 29% Len + Rituximab (R2) 3 26% Zanubritinib 1 13% Acalabrutinib 2 3% Pirtobrutinib 4

20 ZYNLONTA + Rituximab Phase 2 IIT Data Show 77% CR Rate in r/r FL University of Miami phase 2 IIT in 2L+ FL ASH 2024 presentation & Lancet Haem publication highlights 11 U.S. 5 - year Prevalenc e 1 ~21k 2L+ FL patients Key: 1L 2L 3L+ Next Steps → University of Miami expanding the trial by increasing target enrollment to 100 high - risk r/r FL patients and opening the study at additional US cancer research centers → ADCT plans to potentially pursue regulatory pathway and compendia in parallel as soon as sufficient data are available 2L+ FL Patient Population → Estimated 6k 2L+ FL patients are drug - treated in the US annually 1 , of which ~20% relapse within the first 24 months of frontline therapy (POD24) and are characterized by an unfavorable prognosis 2 77% 85% 20% 15% Total ( n =39) CR PO D2 4 (n=20) PR 97% 100% → N = 39 patients (all of which were evaluated for safety and 35 of which were evaluated for efficacy) → Best ORR of 97.4% (n=38); CR rate of 76.9% (n=30) → After median follow - up of 15.6 months, median PFS was not reached, and the 12 - month PFS was 94.6% → Safety consistent with known profile of ZYNLONTA – The most common TEAEs were hyperglycemia (n=17; 43.6%), increased alkaline phosphatase (n=16; 41%) and neutropenia, fatigue and increased aspartate aminotransferase and alanine aminotransferase (n=15; 38.5%) – The most common grade ≥3 TEAE were lymphopenia (n=8; 20.5%) followed by neutropenia (n=5; 12.9%) – No Grade 5 TEAEs occurred 2L+ FL Treatment Landscape ^Data do not include all FL FDA approved or NCCN regimens (including R - mono, Obin - mono, Len - mono, B - R, R/Obin - CHOP, or R/Obin - CVP) 1. Cerner Enviza CancerMPact (2023), distribution by line of therapy is based on the incident, drug - treated population; 2. Casulo et al., J Clin Oncol (2015), Casulo et al., Blood (2022); 3. AUGMENT study (randomized ph 3 of R 2 vs. R; total n = 358, total FL n = 295, R 2 FL n = 147, R mono FL n = 148) – Best Response; 4. GADOLIN study (randomized ph3 of B + O vs. B; total n = 396, total FL n= 321, B+O FL n = 155) – Best Response in Label; 5. GO29781 study (single - arm, ph 1/2, n = 90); 6. EPCORE NHL - 1 (single - arm, ph 1/2, n = 128); 7. ELARA (single - arm, ph 2, n = 98); 8. ZUMA - 5 (single - arm, ph 2, FL n = 123); 9. TRANSCEND - FL (single - arm, ph 2, FL n = 114); 10. GALEN study (single arm, multicenter ph 2; n = 89) – Response at end of induction; 11. Alderuccio, Lancet Haem (2024) Best Response FDA Approved / NCCN^ FL N = 90 - 321 35% Len + Rituximab (R2) (2L+) 3 16% Benda + Obin (2L+) 4 CR NCCN ^ Only FL N = 89 80 - 60 - 40 - 20 - 100 - 79% Axi - cel (3L+) 8 94% Liso - cel (3L+) 9 % 0 - 80 - ORR % 60 - 40 - 20 - 79% Len + Obin (2L+) 10 79% Benda + Obin (2L+) 4 100 - 97% Liso - cel (3L+) 9 94% Axi - cel (3L+) 8 86% Tisa - cel (3L+) 7 82% Epcoritamab (3L+) 6 80% Mosunetuzumab (3L+) 5 80% Len + Rituximab (R2) (2L+) 3 69% Tisa - cel (3L+) 7 63% Epcoritamab (3L+) 6 60% Mosunetuzumab (3L+) 5 38% Len + Obin (2L+) 10 0 -

21 Note: 1 DAR: Drug antibody ratio A Growing Toolbox With Novel Payloads, Linkers & Chemistries → Extensive experience identifying and advancing compelling targets with high unmet need → Focus on masking binding, conditional binding moieties, bispecifics and biparatropics → Proprietary linkers that enable increased plasma stability and controlled payload release with tunable DAR 1 − Cleavable linkers − Reducible linkers − Non - cleavable linkers → Forged next - gen PBDs as novel warheads; first to bring PBD ADC from conception to market → Advancing next - gen payloads to improve selectivity, potency, therapeutic index − Camptothecin derivatives − DNA damaging agents − Immunomodulators − Dual payloads → Technologies enabling precise site - specific attachment of diverse payloads − Orthogonal conjugation approaches Antibody Linker Payload Conjugation

22 Note: 1. ADC Therapeutics Internal Studies. 2. Cell line derived xenograft (CDX) model is a renal leiomyoblastoma model, all arms dosed intravenously qdx1; Both ADCs used the same antibody. Source: Weng et al., Cancer Discov (2023) Exatecan Has the Potential to Be Differentiated vs. DXd EXATECAN ADVANTAGE → Increased bystander effect and potency vs. DXd 1 → Exatecan is not an MDR1 substrate; lower risk of multi - drug resistance vs. DXd → Clinical data suggest interstitial lung disease (ILD) is more commonly associated with DXd → Superior therapeutic index vs. DXd EXATECAN V. DXD Exatecan D X d Vehicle Isotype (10 mg/kg) ADC THERAPEUTICS PLATFORM ADVANTAGE → Tested one of our exatecan - based ADCs against a DXd - based ADC with the same antibody, at equivalent doses for each payload → Our exatecan - based ADC achieved a better response vs. the DXd - based ADC at both dose levels EXATECAN ADC V. DXD ADC in CDX MODE L 2 Antibody - DXd (15 mg/kg) Antibody - exatecan (6.6 mg/kg) Antibody - exatecan (10 mg/kg)

23 Note: 1. IND enabling studies have typically averaged approximately 18 months (13 – 24 months) after selection of the candidate; NHP: Non - human primate. Developing Differentiated ADCs With a High Therapeutic Index A novel hydrophilic, highly stable, protease - cleavable linker conjugated to exateca n ASCT2 Amino acid transporter NSCLC Colorectal cancer Heme Malignancies Exatecan Novel, hydrophilic, protease cleavable in vitro characterization in vivo efficacy NHP toxicology – Repeat - dose (Q3Wx2) IND - enabling NaPi2b Phosphate transporter NSCLC Ovarian cancer Endometrial cancer Exatecan Novel, hydrophilic, protease cleavable in vitro characterization in vivo efficacy NHP toxicology – Repeat - dose (Q3Wx2) IND - enabling PSMA Enzymatic glycoprotein Prostate cancer Exatecan Novel, hydrophilic, protease cleavable in vitro characterization in vivo efficacy NHP toxicology – Repeat - dose (Q3Wx2) IND - enabling Claudin - 6 Target description Adhesion protein NSCLC Ovarian cancer Endometrial cancer Tumor types of interest Exatecan T o x i n Payload Novel, hydrophilic, protease cleavable Lin k er in vitro characterization in vivo efficacy NHP toxicology – Repeat - dose (Q3Wx2) Preclinical data IND - enabling Sta g e Company mo ving forward with one drug candidate to IND and seeking research collaboration(s) to advance broad portfolio

24 HEMATOLOGY SOLID TUMORS Business Development Opportunities to Unlock Value Business Development Opportunities to Unlock Value Co - development & Co - promote* Royalty & Milestones to ADCT Accelerate & Expand Asset Development 3 Non - dilutive Financing Business Development Goals: 2 Maximize Deal Value & Value Split 1 DIR E C T P A R T N E R S HI P OVERLAND JOINT VENTURE *Flexible for alternative construct depending on economics Corporate Business Development Strategy for ADCT Portfolio U . S . E X - U .S.

25 2025 2026 Delivering On Our Strategy ZYNLONTA LOTIS - 7 Fuller/more mature data Topline results expected by end of 2025 Advancing a broad portfolio of investigational ADCs for solid tumor indications Potential BLA submission to regulatory authorities Enroll 40 patients ZYNLONTA LOTIS - 5 SOLID TUMORS/ BUSINESS DEVELOPMENT Potential compendia listing and BLA approval Engage regulatory agencies, evaluate compendia pathway Share additional data INDOLENT LYMPHOMAS Upcoming Expected Milestones Additional data to be shared at a medical conference and/or in publication with plans to engage regulatory agencies and evaluate compendia pathway Pursue Business Development to expand the portfolio and fund the early - stage pipeline

Thank You

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

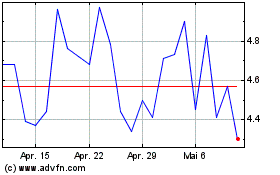

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025