XOMA Reports Third Quarter 2023 Financial Results and Highlights Upcoming Events Expected to Drive Shareholder Value

07 November 2023 - 1:30PM

XOMA Corporation (Nasdaq: XOMA), the biotech royalty aggregator,

reported its third quarter 2023 financial results and highlighted

recent portfolio activities expected to drive long-term shareholder

value.

“Our existing royalty portfolio continues to mature, driven by

increasing cash receipts of VABYSMO® and IXINITY® and the

advancement of several assets, most notably the New Drug

Application (NDA) filing of tovorafenib by Day One

Biopharmaceuticals,” stated Owen Hughes, Executive Chairman of

XOMA. “With additional regulatory and development milestones

forthcoming by year-end, we believe a solid foundation for future

growth is upon us.”

|

Key Third Quarter Events |

|

|

Partner |

Event |

|

Day One Biopharmaceuticals |

Tovorafenib NDA filed in mid-September |

| Zevra

Therapeutics |

Zevra confirmed arimoclomol

NDA to be filed in 4Q |

|

Medexus |

Pediatric label expansion accepted for review - 1H 2024

decision |

| |

Financial ResultsXOMA recorded total revenues

of $0.8 million for the third quarter of 2023 and $0.5 million for

the third quarter of 2022. The increase for the three months

ended September 30, 2023, as compared to the same period in 2022,

was primarily due to $0.2 million of milestone revenue earned under

XOMA’s license agreement with Janssen.

General and administrative (“G&A”) expenses were $6.4

million for the third quarter of 2023, compared to $4.8 million for

the third quarter of 2022. The additional $1.6 million during

the third quarter of 2023 reflects an increase in stock-based

compensation expenses of $1.9 million, partially offset by a

decrease of $0.6 million for legal and consulting costs.

In the third quarter of 2023, G&A expenses included $2.7

million in non-cash stock-based compensation expense, compared with

$0.8 million in the third quarter of 2022. The increase in

the 2023 period reflects $1.1 million of stock-based compensation

expense related to the issuance of performance-based stock unit

awards and $0.9 million related to stock options granted to our new

executives at the beginning of 2023. During the quarter, XOMA

received approximately $6.6 million from royalties and milestone

payments. XOMA’s net cash used in operations in the third

quarter of 2023 was $2.1 million, as compared with $3.7 million

during the third quarter of 2022.

Other income, net was $0.3 million for the third quarter of 2023

and $0.2 million in the corresponding quarter of 2022. The

increase in other income, net between quarters is primarily due to

an increase in investment income.

Net loss for the third quarter of 2023 was $5.5 million,

compared to net loss of $4.2 million for the third quarter of

2022.

On September 30, 2023, XOMA had cash of $33.5 million. In

September 2023, XOMA received a $4.9 million cash payment from

Roche representing XOMA’s 0.5% royalty interest related to VABYSMO®

sales during the first six months of 2023. The payment was

recorded in the Company’s condensed consolidated balance sheet as

of September 30, 2023, as a reduction of short-term royalty and

commercial payment receivables. On October 16, 2023, the

Company paid total cash dividends of $1.4 million on the 8.625%

Series A Cumulative Perpetual Preferred Stock (Nasdaq: XOMAP) and

on the 8.375% Series B Cumulative Perpetual Preferred Stock

(Nasdaq: XOMAO). The Company ended December 31, 2022, with

cash of $57.8 million. Based upon the cash flows XOMA expects

to receive from VABYSMO® and IXINITY® sales in addition to its

current cash position, the Company continues to believe its current

cash position will be sufficient to fund XOMA’s operations for

multiple years.

Subsequent EventsOn October 30, 2023, XOMA

earned a $5 million milestone related to the FDA’s acceptance of

Day One Biopharmaceuticals’ NDA for tovorafenib as a monotherapy in

relapsed or progressive pediatric low-grade glioma. The FDA

assigned a Prescription Drug User Fee Act target date of April 30,

2024.

On October 23, 2023, Organon notified XOMA Corporation of its

termination of the License Agreement pertaining to the development

of ebopiprant, an investigational, orally active, selective

prostaglandin F2α (PGF2α) receptor antagonist being evaluated as a

potential treatment for preterm labor by reducing inflammation and

uterine contractions. Based on the existing human clinical

data generated by ObsEva SA and the lack of adequate treatments to

treat preterm labor, XOMA will seek to out-license ebopiprant in

order to address this critical unmet need.

About XOMA CorporationXOMA is a biotechnology

royalty aggregator playing a distinctive role in helping biotech

companies achieve their goal of improving human health. XOMA

acquires the potential future economics associated with

pre-commercial and commercial therapeutic candidates that have been

licensed to pharmaceutical or biotechnology companies. When

XOMA acquires the future economics, the seller receives

non-dilutive, non-recourse funding they can use to advance their

internal drug candidate(s) or for general corporate purposes.

The Company has an extensive and growing portfolio with more than

70 assets (asset defined as the right to receive potential future

economics associated with the advancement of an underlying

therapeutic candidate). For more information about the

Company and its portfolio, please visit www.xoma.com.

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the timing and

amount of potential commercial payments to XOMA and other

developments related to VABYSMO® (faricimab-svoa), IXINITY®

[coagulation factor IX (recombinant)], tovorafenib, and

arimoclomol; the potential out-licensing of ebopiprant to an

external partner for further development; the anticipated timings

of regulatory filings and approvals related to assets in XOMA’s

portfolio; the potential of XOMA’s portfolio of partnered programs

and licensed technologies generating substantial milestone and

royalty proceeds over time; and XOMA’s cash sufficiency

forecast. In some cases, you can identify such

forward-looking statements by terminology such as “anticipate,”

“intend,” “believe,” “estimate,” “plan,” “seek,” “project,”

“expect,” “may,” “will”, “would,” “could” or “should,” the negative

of these terms or similar expressions. These forward-looking

statements are not a guarantee of XOMA’s performance, and

you should not place undue reliance on such statements. These

statements are based on assumptions that may not prove accurate,

and actual results could differ materially from those anticipated

due to certain risks inherent in the biotechnology industry,

including those related to the fact that our product candidates

subject to out-license agreements are still being developed, and

our licensees may require substantial funds to continue development

which may not be available; we do not know whether there will be,

or will continue to be, a viable market for the products in which

we have an ownership or royalty interest; if the therapeutic

product candidates to which we have a royalty interest do not

receive regulatory approval, our third-party licensees will not be

able to market them; and the impact to the global economy as a

result of the COVID-19 pandemic. Other potential risks to

XOMA meeting these expectations are described in more detail in

XOMA's most recent filing on Form 10-Q and in other filings with

the Securities and Exchange Commission. Consider such risks

carefully when considering XOMA's prospects. Any

forward-looking statement in this press release represents XOMA's

beliefs and assumptions only as of the date of this press release

and should not be relied upon as representing its views as of any

subsequent date. XOMA disclaims any obligation to update any

forward-looking statement, except as required by applicable

law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to “assets” in this press release refer strictly to

milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, all assets in XOMA’s

milestone and royalty portfolio, except VABYSMO® (faricimab) and

IXINITY® [coagulation factor IX (recombinant)], are investigational

compounds. Efficacy and safety have not been

established. There is no guarantee that any of the

investigational compounds will become commercially available.

|

XOMA CORPORATION |

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

|

(unaudited) |

|

|

(in thousands, except per share amounts) |

|

| |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Revenue from contracts with customers |

$ |

225 |

|

|

$ |

25 |

|

|

$ |

1,350 |

|

|

$ |

3,300 |

|

|

|

Revenue recognized under units-of-revenue method |

|

605 |

|

|

|

426 |

|

|

|

1,575 |

|

|

|

1,241 |

|

|

|

Total revenues |

|

830 |

|

|

|

451 |

|

|

|

2,925 |

|

|

|

4,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

25 |

|

|

|

29 |

|

|

|

118 |

|

|

|

125 |

|

|

|

General and administrative |

|

6,368 |

|

|

|

4,794 |

|

|

|

18,341 |

|

|

|

15,620 |

|

|

|

Royalty purchase agreement asset impairment |

|

- |

|

|

|

- |

|

|

|

1,575 |

|

|

|

- |

|

|

|

Arbitration settlement costs |

|

- |

|

|

|

- |

|

|

|

4,132 |

|

|

|

- |

|

|

|

Amortization of intangible assets |

|

224 |

|

|

|

- |

|

|

|

673 |

|

|

|

- |

|

|

|

Total operating expenses |

|

6,617 |

|

|

|

4,823 |

|

|

|

24,839 |

|

|

|

15,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(5,787 |

) |

|

|

(4,372 |

) |

|

|

(21,914 |

) |

|

|

(11,204 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

278 |

|

|

|

194 |

|

|

|

1,192 |

|

|

|

76 |

|

|

|

Net loss and comprehensive loss |

$ |

(5,509 |

) |

|

$ |

(4,178 |

) |

|

$ |

(20,722 |

) |

|

$ |

(11,128 |

) |

|

|

Less: accumulated dividends on Series A and Series B preferred

stock |

|

(1,368 |

) |

|

|

(1,368 |

) |

|

|

(4,104 |

) |

|

|

(4,104 |

) |

|

|

Net loss and comprehensive loss attributable to common

stockholders, basic and diluted |

$ |

(6,877 |

) |

|

$ |

(5,546 |

) |

|

$ |

(24,826 |

) |

|

$ |

(15,232 |

) |

|

|

Basic and diluted net loss per share attributable to common

stockholders |

$ |

(0.60 |

) |

|

$ |

(0.48 |

) |

|

$ |

(2.17 |

) |

|

$ |

(1.34 |

) |

|

|

Weighted average shares used in computing basic and diluted net

loss per share attributable to common stockholders |

|

11,473 |

|

|

|

11,447 |

|

|

|

11,466 |

|

|

|

11,400 |

|

|

|

|

|

XOMA CORPORATION |

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

(in thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

ASSETS |

(unaudited) |

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

33,472 |

|

|

$ |

57,826 |

|

|

|

Short-term equity securities |

|

214 |

|

|

|

335 |

|

|

|

Trade and other receivables, net |

|

43 |

|

|

|

1 |

|

|

|

Short-term royalty and commercial payment receivables |

|

- |

|

|

|

2,366 |

|

|

|

Prepaid expenses and other current assets |

|

776 |

|

|

|

725 |

|

|

|

Total current assets |

|

34,505 |

|

|

|

61,253 |

|

|

|

Property and equipment, net |

|

5 |

|

|

|

7 |

|

|

|

Operating lease right-of-use assets |

|

- |

|

|

|

29 |

|

|

|

Long-term royalty and commercial payment receivables |

|

74,696 |

|

|

|

63,683 |

|

|

|

Intangible assets, net |

|

14,477 |

|

|

|

15,150 |

|

|

|

Other assets - long term |

|

411 |

|

|

|

260 |

|

|

|

Total assets |

$ |

124,094 |

|

|

$ |

140,382 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

728 |

|

|

$ |

524 |

|

|

|

Accrued and other liabilities |

|

2,160 |

|

|

|

2,918 |

|

|

|

Contingent consideration under RPAs, AAAs and CPPAs |

|

4,000 |

|

|

|

75 |

|

|

|

Operating lease liabilities |

|

- |

|

|

|

34 |

|

|

|

Unearned revenue recognized under units-of-revenue method |

|

2,078 |

|

|

|

1,899 |

|

|

|

Preferred stock dividend accrual |

|

1,368 |

|

|

|

1,368 |

|

|

|

Total current liabilities |

|

10,334 |

|

|

|

6,818 |

|

|

|

Unearned revenue recognized under units-of-revenue method –

long-term |

|

7,796 |

|

|

|

9,550 |

|

|

|

Total liabilities |

|

18,130 |

|

|

|

16,368 |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

Preferred Stock, $0.05 par value, 1,000,000 shares authorized: |

|

|

|

|

|

8.625% Series A cumulative, perpetual preferred stock, 984,000

shares issued and outstanding at September 30, 2023 and December

31, 2022 |

|

49 |

|

|

|

49 |

|

|

|

8.375% Series B cumulative, perpetual preferred stock, 1,600 shares

issued and outstanding at September 30, 2023 and December 31,

2022 |

|

— |

|

|

|

— |

|

|

|

Convertible preferred stock, 5,003 issued and outstanding at

September 30, 2023 and December 31, 2022 |

|

— |

|

|

|

— |

|

|

|

Common stock, $0.0075 par value, 277,333,332 shares authorized,

11,472,808 and 11,454,025 shares issued and outstanding at

September 30, 2023 and December 31, 2022, respectively |

|

86 |

|

|

|

86 |

|

|

|

Additional paid-in capital |

|

1,308,943 |

|

|

|

1,306,271 |

|

|

|

Accumulated deficit |

|

(1,203,114 |

) |

|

|

(1,182,392 |

) |

|

|

Total stockholders’ equity |

|

105,964 |

|

|

|

124,014 |

|

|

|

Total liabilities and stockholders’ equity |

$ |

124,094 |

|

|

$ |

140,382 |

|

|

|

|

|

XOMA CORPORATION |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

$ |

(20,722 |

) |

|

$ |

(11,128 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Stock-based compensation expense |

|

6,450 |

|

|

|

2,620 |

|

|

Royalty purchase agreement asset impairment |

|

1,575 |

|

|

|

— |

|

|

Change in fair value of contingent consideration under RPAs, AAAs,

and CPPAs |

|

(75 |

) |

|

|

— |

|

|

Common stock contribution to 401(k) |

|

123 |

|

|

|

85 |

|

|

Amortization of intangible assets |

|

673 |

|

|

|

— |

|

|

Depreciation |

|

2 |

|

|

|

7 |

|

|

Non-cash lease expense |

|

115 |

|

|

|

127 |

|

|

Change in fair value of equity securities |

|

121 |

|

|

|

330 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Trade and other receivables, net |

|

(42 |

) |

|

|

193 |

|

|

Prepaid expenses and other assets |

|

(202 |

) |

|

|

(343 |

) |

|

Accounts payable and accrued liabilities |

|

(554 |

) |

|

|

596 |

|

|

Income taxes payable |

|

— |

|

|

|

(91 |

) |

|

Operating lease liabilities |

|

(120 |

) |

|

|

(144 |

) |

|

Unearned revenue recognized under units-of-revenue method |

|

(1,575 |

) |

|

|

(1,241 |

) |

|

Net cash used in operating activities |

|

(14,231 |

) |

|

|

(8,989 |

) |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Payments of consideration under RPAs, AAAs and CPPAs |

|

(14,650 |

) |

|

|

(8,000 |

) |

|

Receipts under RPAs, AAAs and CPPAs |

|

8,428 |

|

|

|

3,026 |

|

|

Net cash used in investing activities |

|

(6,222 |

) |

|

|

(4,974 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payment of preferred stock dividends |

|

(4,104 |

) |

|

|

(4,104 |

) |

|

Proceeds from exercise of options and other share-based

compensation |

|

208 |

|

|

|

2,373 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(5 |

) |

|

|

(1,398 |

) |

|

Net cash used in financing activities |

|

(3,901 |

) |

|

|

(3,129 |

) |

|

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

(24,354 |

) |

|

|

(17,092 |

) |

|

Cash, cash equivalents and restricted cash at the beginning of the

period |

|

57,826 |

|

|

|

95,377 |

|

|

Cash, cash equivalents and restricted cash at the end of the

period |

$ |

33,472 |

|

|

$ |

78,285 |

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Information: |

|

|

|

|

|

Cash paid for taxes |

$ |

— |

|

|

$ |

95 |

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities |

$ |

85 |

|

|

$ |

— |

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

Preferred stock dividend accrual |

$ |

1,368 |

|

|

$ |

1,368 |

|

|

Estimated fair value of contingent consideration under the LadRx

Agreements |

$ |

1,000 |

|

|

$ |

— |

|

|

Accrual of contingent consideration under the Affitech CPPA |

$ |

3,000 |

|

|

$ |

— |

|

| |

|

Investor contact: |

Media

contact: |

| Juliane Snowden |

Kathy Vincent |

| XOMA |

KV Consulting & Management |

| +1-646-438-9754 |

+1-310-403-8951 |

| juliane.snowden@xoma.com |

kathy@kathyvincent.com |

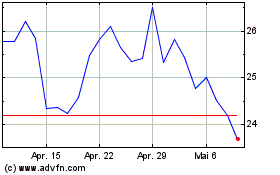

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024