Successful execution of Push to Pass strategic plan

- Automotive recurring operating

income at €1,442 million up by 10.7%, representing a record

recurring operating margin of 7.3%1

- Group revenue at €29,165 million, up

5% vs 2016 H1

- Record Faurecia recurring operating

margin1 at 5.7%

- Record Net income, group share, at

€1,256 million

- Growth of net financial position at

€7,631 million thanks to a positive €1,116 million Free Cash

Flow2

Regulatory News:

Groupe PSA (Paris:UG):

"Groupe PSA record performance was achieved thanks to our

customers who have made our last commercial launches great

successes, and thanks to the continuous commitment of all Group

employees in the execution of the Push to Pass plan, combining

agility and business sense. The way the teams overcame headwinds

brings confidence for the coming challenges." said Carlos

Tavares, Chairman of Groupe PSA Managing Board.

Group revenues amounted to €29,165 million in the first

half of 2017, up 5.0% compared to €27,779 million in the first half

of 2016. The cumulated growth since the beginning of Push to Pass,

excluding exchange rates impact, stands at +8.2%3.

Automotive revenues amounted to €19,887 million, also up

3.6% compared to the first half of 2016, benefiting from the

success of the new models and the pricing discipline.

Group recurring operating income amounted to

€2,041 million, up 11.5% compared to the first half of 2016. The

Automotive recurring operating income grew by 10.7% compared to

the first half of 2016 at €1,442 million. This 7.3% record

profitability level was reached despite raw material cost increases

and exchange rate headwinds, thanks to a positive product mix and

further cost reductions.

Group non-recurring operating income and expenses had a

negative impact of -€112 million, compared to -€207 million in the

first half of 2016.

Group net financial expenses decreased to €121 million,

compared to €150 million in the first half of 2016.

Consolidated net income reached €1,474 million, up by €91

million, in spite of the negative impact of operations in China.

Net income, Group share, reached €1,256 million, compared to €1,212

million in the first half of 2016.

Banque PSA Finance reported recurring operating

income4 of €312 million, up 5.1% compared to the first

half of 2016.

Faurecia recurring operating income amounted to €587

million, an increase of

19.8% compared to the first half of 2016.

The Free Cash Flow of manufacturing and sales companies

amounted to €1,116 million, driven by the improved profitability of

operations.

Total inventory, including independent dealers, stood at

374,000 vehicles at 30 June 2017, down 25,000 units from end June

2016.

The manufacturing and sales companies' net financial

position at 30 June 2017 was a positive €7,631 million, up €818

million compared to 31 December 2016.

Market outlook: for 2017, the Group expects the

automotive market to grow by approximatively 3% in Europe, and 5%

in China, Latin America and Russia.

Operational targets

The Push to Pass plan sets the following targets:

- Deliver over 4.5% Automotive recurring

operating margin5 on average in 2016-2018, and target over 6% by

2021;

- Deliver 10% Group revenue growth by

20186 vs 2015, and target additional 15% by 20216.

Link to the presentation of 2017 H1 Results

Financial Calendar – 25 October 2017: third-quarter 2017

Revenue

Groupe PSA consolidated financial statements at 30 June 2017

were approved by the Managing Board on 20 July 2017 and reviewed by

the Supervisory Board on 25 July 2017. The Group's Statutory

Auditors have completed their audit and are currently issuing their

report on the consolidated financial statements.

The interim results report and interim financial results

presentation for 2017 are available at www.groupe-psa.com, in the

“Analysts and Investors” section.

About Groupe PSA

With sales and revenue of €54 billion in 2016, the Groupe

PSA designs unique automotive experiences and delivers mobility

solutions that provide freedom and enjoyment to customers around

the world. The Group has three car brands, Peugeot, Citroën and DS,

as well as a wide array of mobility and smart services under its

Free2Move brand, to meet the evolving needs and expectations of

automobile users. The automobile manufacturer PSA is the European

leader in terms of CO2 emissions, with average emissions of

102.4 grams per kilometre in 2016, and an early innovator in

the field of autonomous and connected cars, with 2.3 million

such vehicles worldwide. It is also involved in financing

activities through Banque PSA Finance and in automotive equipment

via Faurecia. Find out more at groupe-psa.com/en.

Media library: https://medialibrary.groupe-psa.com/ / Twitter:

@GroupePSA

1 Recurring operating income related to revenue2 Sales and

Manufacturing companies3 Versus 2015 H1 at constant (2015) exchange

rates4 100% of the results of Banque PSA Finance. In the financial

statements of Groupe PSA, the joint ventures are accounted for at

equity.5 Recurring operating income as a proportion of revenue6 At

constant (2015) exchange rates

Appendices

Consolidated Income Statement

First-half 2016 First-half 2017

(in million euros)

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL Revenue 27,684

102 (7)

27,779 29,089 87

(11)

29,165 Recurring operating income (loss)

1,823 7 -

1,830 2,026

15 -

2,041 Operating income (loss)

1,616 7 -

1,623 1,914

15 -

1,929 Net financial income

(expense) (154) 4 -

(150)

(121) - -

(121) Income taxes

(299) (11) -

(310) (440)

(6) -

(446) Share in net earnings of companies

at equity 62 87 -

149 (1)

113 -

112 Profit (loss) from operations

held for sale or to be continued in partnership 47 24

-

71 - - -

- Consolidated profit (loss) for the period 1,272

111 -

1,383 1,352 122

-

1,474 Attributable to equity holders of the

parent 1,102 110 -

1,212

1,137 119 -

1,256 Attributable to

minority interests 170 1 -

171

215 3 -

218 Basic earnings per

€1 par value share attributable to equity holders of the parent

1.51

1.44

Consolidated balance sheet

ASSETS

31 December 2016 30 June 2017

(in million euros)

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL Total non-current assets

22,311 1,654 -

23,965

23,219 1,648 -

24,867 Total current

assets 20,133 1,087 (32)

21,188

22,947 1,167 (39)

24,075 Total

assets of operations held for sale or to be continued in

partnership - - -

- -

- -

- TOTAL ASSETS

42,444

2,741 (32) 45,153

46,166 2,815 (39)

48,942

EQUITY AND LIABILITIES

31 December 2016 30 June 2017 (in

million euros)

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL

Manufacturing

and sales companies

Finance companies

Eliminations

TOTAL Total equity

14,618

15,683 Total non-current

liabilities 10,123 15 -

10,138

11,323 6 -

11,329 Total current

liabilities 19,797 632 (32)

20,397 21,351 618 (39)

21,930 Transferred liabilities of operations held for sale

or to be continued in partnership - - -

- - - -

- TOTAL EQUITY

& LIABILITIES

45,153

48,942

Consolidated Statement of Cash Flows

First half of 2016 First half of

2017 (in million euros)

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL

Manufacturing

and sales companies

Finance companies

Eliminations TOTAL Consolidated profit

(loss) from continuing operations 1,225 76 -

1,301 1,352 122 - 1,474 Funds

from operations 2,798 69 - 2,867

2,927 56 - 2,983

Net cash from (used in)

operating activities of continuing operations

3,187 907 (74)

4,020 3,047 61 -

3,108 Net cash from (used in) investing activities

of continuing operations (1,560) 21

14 (1,525) (1,931)

3 - (1,928) Net cash from

(used in) financing activities of continuing operations

(903) (173) (104)

(1,180) 669 - (1)

668 Net cash related to the non-transferred debt

of finance companies to be continued in partnership

- (2,258) 175

(2,083) - - -

- Net cash from the transferred assets and

liabilities of operations held for sale or to be continued in

partnership (78) 1,201

(11) 1,112 - -

- - Effect of changes in exchange rates

(95) 10 - (85) (58) (1)

- (59)

Increase (decrease) in cash from continuing

operations and from operations held for sale or to be continued in

partnership 551 (292)

- 259 1,727 63

(1) 1,789 Net cash and cash equivalents

at beginning of period 10,453 893 (54)

11,292 11,464 530 (8) 11,986

Net

cash and cash equivalents of continuing operations at end of

period 11,004 601

(54) 11,551 13,191

593 (9) 13,775

Communications Division - www.groupe-psa.com -

+33 1 40 66 42 00 - @GroupePSA

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170725006652/en/

Groupe PSAMedia contact+33 1 40 66 42

00presse-psa@mpsa.com

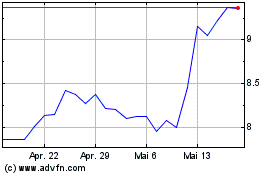

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

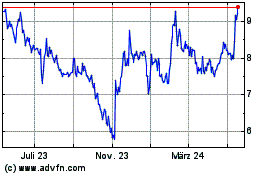

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024