“Back in the Race” Plan well on

track

Unit sales up in the Third Quarter

Regulatory News:

PSA Peugeot Citroën (Paris:UG):

- Worldwide unit sales up 5.4%, driven

by strong increases in China (+44.4%) and Europe (+7%).

- Automotive Division revenues of €8

billion, supported by successful launches and a young 3.4 year

average age of the range.

- Automotive Division pro forma

revenues1 including sales in China, up strongly by

2.7% to €9.1 billion.

- All Back in the Race plan levers in

action.

In the third quarter of 2014, sales of assembled vehicles

rose by 5.4% to 643,598 units from the prior-year period. Growth

was significant in Europe (+7%) and very strong in Asia (+44.4%).

Unit sales decreased in other regions, impacted in particular by a

sharp decline in demand.

The European market expanded by 5.8% over the period,

with certain countries experiencing strong growth (United Kingdom

+7.6%, Spain +16.9%, Italy +5.3% and Germany +4.5%) and the French

market that was almost stable (+0.5%).In this environment, PSA

Peugeot Citroën unit sales rose by 7% (o/w +8.7% in France) and

market share of the Group in Europe held steady at 11.8%2 (down 0.1

point) by the end of September compared to the prior-year period.

The Group pursued its pricing power policy for the three brands,

Peugeot, Citroën and DS.

In Asia, unit sales rose by a robust 44.4%, lifted by the

recent launches of the Peugeot 301, 2008 and 408, the Citroën

C-Elysée and C4L and the start-up of the DS brand with the DS 5, DS

5 LS and DS 6. The increase in unit sales greatly exceeded the

market’s growth of 8% in China, and the Group’s market share

widened by 0.7 point compared with the same period in 2013 to

4.4%2.

In Latin America and Eurasia, unit sales declined by

38.2% and 62.4%, respectively. The market in both regions

contracted noticeably, by 10.4% and 23.8%. The Group pursued its

Back in the Race action plans - in particular, these plans focus on

rationalising fixed costs and adjusting the line-up - with the goal

of returning to breakeven in 2017.

In the Middle East and Africa and the

India-Pacific region, the decline in PSA Peugeot Citroën’s

key markets pushed down unit sales by 11.3% and 10.5%,

respectively. These markets represent future opportunities for the

Group.

In the third quarter of 2014, Group revenues totalled

€12,296 million, a 1.6% rise over the prior-year period.

Automotive Division revenues, excluding Chinese joint

ventures contribution, edged back by 0.8% from third-quarter 2013

to €7,971 million, with revenues related to new car activity

declining by 1.3% as the positive product mix and price effects

only partially offset the negative volume and currency effects.

Pro forma Automotive Division revenues1 including our

share in Chinese JVs amounted to €9,085 million, reflecting the

very strong increase in revenues in China.

Faurecia reported revenues up 6.5%, to €4,386 million in

the third quarter.

Banque PSA Finance‘s revenues are down 2% to €438 million

in the third quarter.

At 30 September 2014, total inventory, including

independent dealers, stood at 393,000 vehicles, down 15,000 units

from the prior-year period. This performance confirms the

Automotive Division’s good inventory management.

During the third quarter, all Back in the Race action plan

levers are in action, with continued initiatives to reduce

inventories and optimise working capital requirement, maintain

Automotive Division CAPEX and R&D between 7 and 8% of revenues,

differentiate the positioning the brands and improve their price

positioning.

The Group is pursuing its global core model strategy, focusing

on profitable growth worldwide, its positioning in attractive

technologies. Competitiveness improves, notably in Europe, along

with increased savings and improved product costs. Lastly, the

partnership agreement between Banque PSA Finance and Santander is

moving forward, with regulatory approvals ongoing. This partnership

will help the Bank regain its competitiveness in Europe.

Commenting on the publication of the third-quarter

results, Carlos Tavares, Chairman of the Managing Board,

declared: “I would like to thank all our employees for their deep

commitment to the Back in the Race plan. All levers are now

activated and first results are visible. Nonetheless, the road back

to a full recovery is still long and we should remain collectively

focused on execution”.

Outlook

In 2014, PSA Peugeot Citroën expects to see automotive demand

increase by around 4 to 5 % in Europe and by approximately 10% in

China, but decline by some 10% in Latin America and around 15% in

Russia3.

It is aiming to deliver recurring positive Group operating free

cash flow4 by 2016 at the latest, and an aggregate €2 billion in

Group operating free cash flow over the 2016-2018 period. It is

also targeting an operating margin5 of 2% in 2018 in the Automotive

Division, with the objective of reaching 5% over the period of the

next medium-term plan, covering 2019-2023.

PSA Peugeot Citroën will organise a conference

call in English with Jean Baptiste de Chatillon, Chief Financial

Officer, on Wednesday, 22 October 2014 at 8:30 am (Paris) / 7:30 am

(London). To participate, please dial:

France: 01 70 77 09 42 UK: +44 (0) 203 367 94

54

You may also follow the conference call and

download the presentation of third-quarter 2014 revenues on our

website (www.psa-peugeot-citroen.com, in the “Analysts/Investors”

section)

Financial Calendar

- 18 February 2015: 2014 Annual

Results

- 29 April 2015: First-quarter 2015

revenues

Appendices

Worldwide Automobile Sales – Q3 2014 an YTD September 2014

(cars and light commercial vehicles)

Consolidated World Sales 2013 2013

2014 2014 Δ 14/13 Δ 14/13 in thousands

of units Q3 YTD Sept. Q3 YTD

Sept. Q3 YTD Sept.

China - South East Asia Peugeot

64.0 207.0 99.2 288.3 55.0% 39.3% Citroën 61.7 199.5 78.4 238.7

27.1% 19.6% DS 0.7 1.7 4.9 15.4 ++

++

PSA 126.4

408.2 182.6

542.5 44.4%

32.9% Eurasia Peugeot 10.3

30.5 3.7 18.9 -64.0% -38.0% Citroën 8.1 23.9 3.2 14.6 -60.1% -38.9%

DS 0.4 1.3 0.1 0.7 -68.3% -47.3%

PSA

18.9

55.7 7.1

34.2 -62.4%

-38.6% Europe Peugeot 178.9 638.9 197.9 719.8 10.6%

12.7% Citroën 137.9 470.0 145.8 529.6 5.8% 12.7% DS 22.2 85.6 18.9

69.0 -14.9% -19.4%

PSA 339.0

1,194.5 362.6 1,318.5 7.0%

10.4% India - Pacific Peugeot 4.1 11.1 3.9

10.9 -5.2% -2.0% Citroën 0.8 2.3 0.8 2.6 3.4% 11.6% DS 0.7 2.2 0.3

1.1 -58.8% -47.2%

PSA 5.6

15.5 5.0

14.6 -10.5%

-6.2%

Latin America Peugeot 48.5 135.8 28.9 93.4 -40.4% -31.2%

Citroën 27.5 83.6 18.3 59.8 -33.3% -28.5% DS 0.7 3.0 0.1 1.0 -82.1%

-67.8%

PSA 76.6

222.4 47.4

154.2 -38.2%

-30.7%

Middle East - Africa Peugeot 29.0 119.0 25.4 81.0 -12.7%

-32.0% Citroën 14.4 53.0 13.1 38.2 -8.6% -27.9% DS 0.5 2.0 0.5 1.5

-7.0% -26.7%

PSA 44.0

174.0 39.0

120.6 -11.3%

-30.7%

Total Assembled Vehicles

Peugeot 334.7 1,142.3 358.9

1,212.3 7.2% 6.1% Citroën 250.4

832.3 259.8 883.5 3.8% 6.2%

DS 25.3 95.8 24.9 88.7

-1.5% -7.5% PSA

610.4 2,070.5 643.6

2,184.5 5.4% 5.5%

Estimated data.

Assembled vehicles, exc. CKD units

Europe = EU + EFTA + Albania + Bosnia + Croatia + Kosovo +

Macedonia + Montenegro + Serbia

GROUP HIGHLIGHTS SINCE H1 2014

- July, 2nd 2014 - Dongfeng Peugeot

Citroën Automobile (DPCA) Announces Plans to Build Fourth Car

Plant

- July 3rd 2014 - Press release of the

Supervisory Board

- July 10th, 2014 - Banque PSA Finance

announces the Signing of a Framework Agreement with Santander

- July 16th, 2014 - PSA Peugeot Citroen

and PAN Nigeria Limited sign an assembly and sale of cars agreement

in Nigeria

- July 30th 2014 - “Back in the Race”,

the PSA Peugeot Citroën strategic plan, delivers its first

results

- October 7th, 2014 – Peugeot Scooters

presents its plan to revive the business and strengthen brand and

products

1 Automotive Division revenues including the contribution (50%)

of Chinese joint ventures DPCA and CAPSA. Automotive Division

revenues totalled €7,971 million at 30 September 2014, down 0.8% on

the prior-year period.

2 Market share for the nine months to 30 September 2014.

3 This compares with an estimated increase of 3% in Europe at 31

July 2014 and estimated declines of 5% at 31 March 2014 and 10% at

30 June 2014 in Russia, and of 7% in Latin America at end-June.

4 Free cash flow excluding exceptional and restructuring

items.

5 Recurring operating income/(loss) as a percentage of

revenues

PSA Peugeot CitroënMedia RelationsJean-Baptiste

Thomas, +33 (0) 1 40 66 47

59jean-baptiste.thomas@mpsa.comPierre-Olivier Salmon, +33 (0) 1 40

66 49 94pierreolivier.salmon@mpsa.comCaroline Brugier-Corbière, +33

(0) 1 40 66 58 54caroline.brugier-corbiere@mpsa.comorInvestor

RelationsCarole Dupont-Pietri, +33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comAnne-Laure Desclèves, +33 (0) 1 40

66 43 65annelaure.descleves@mpsa.comKarine Douet, +33 (0) 1 40 66

57 45karine.douet@mpsa.com

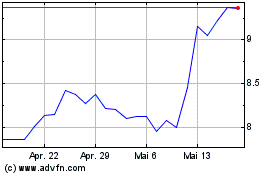

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

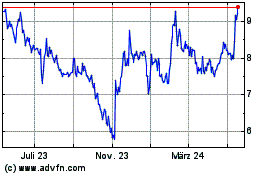

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024