Adjustment of the Exercise Ratio of the Peugeot SA Warrants

23 Mai 2014 - 6:27PM

Business Wire

Regulatory News:

Following the capital increase with preferential subscription

rights completed by Peugeot SA (Paris:UG) (the “Company”) on May

23rd, 2014 (the characteristics of the capital increase are set out

in the prospectus that received from the Autorité des marchés

financiers (the « AMF ») the visa number 14-162 dated April 28th,

2014), the holders of Peugeot warrants (ISIN: FR0011832237) are

informed that, pursuant to the terms and conditions set out in

paragraph 4.2.7.4 .1. a) of the securities note included in the

prospectus for the admission of the warrants that received from the

AMF the visa number 14-121 on April 2nd, 2014, the Exercise Ratio

of the warrants has been modified.

On the basis of the new Exercise Ratio, holders of warrants are

from now on entitled to subscribe to 3.50 new shares through the

exercise of 10 warrants for an aggregate amount of €22.50

(corresponding to an implied subscription price of €6.43 per new

share).

Each holder of warrants will be entitled to subscribe to a

number of new shares in the Company calculated by applying to the

number of warrants exercised the applicable Exercise Ratio. If the

number of shares to be received is not a whole number, each holder

will be entitled to receive:

- either the number of shares rounded

down to the nearest whole number and a cash indemnification

corresponding to the fractional share, equal to the last price on

the trading day preceding the day on which the request for the

exercise of the warrants is filed;

- or the number of shares rounded up to

the nearest whole number, subject to an additional cash payment

equal to the value of the fraction of the additional share so

requested.

Where the holder of the warrants does not indicate the option he

wants to pursue, he will be delivered the number of shares rounded

down to the nearest whole number plus a payment in cash as

described above.

The Company reminds that holders of warrants have the

possibility at any time from April 29th, 2015 until

April 29th, 2017(inclusive) to subscribe new shares by

exercising their warrants.

PSA Peugeot Citroën

With its three world-renowned brands, Peugeot, Citroën and DS,

the Group sold 2.8 million vehicles worldwide in 2013, out of which

42% outside Europe. As Europe’s second largest carmaker, it

recorded sales of €54 billion in 2013. PSA Peugeot Citroën has

sales offices in 160 countries. The Group confirms its position of

European leader in terms of CO2 emissions, with an average of 116.2

grams of CO2/km in 2013. Its activities also include financing

activities (Banque PSA Finance) and automotive equipment

(Faurecia). For more information go to

http://www.psa-peugeot-citroen.com

Investors RelationsCarole Dupont-Pietri+33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comAnne-Laure Descleves+33 (0) 1 40 66

43 65annelaure.descleves@mpsa.comKarine Douet+33 (0) 1 40 66 57

45karine.douet@mpsa.com

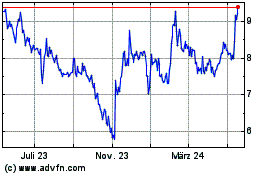

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

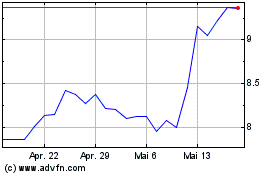

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024