Supported by a rise in worldwide unit sales

of 7.7%

Positive product mixNegative impact

from exchange rates

Regulatory News :

In the First Quarter of 2014, PSA Peugeot Citroën (Paris:UG) saw

a rise in worldwide unit sales of 7.7%, supported by the recovery

of the European market and by the strong growth in China. The Group

was, however, impacted by a sharp deterioration in foreign exchange

rates.

The Group pursued its turnaround plans with:

- The unveiling of the « Back in the

race » plan by Carlos Tavares, Chairman of the Managing Board,

setting out the operational framework for a turnaround;

- The success of new launches, with the

Peugeot 308, crowned « Car of the Year», the Citroën C4

Picasso, as well as the announcement of the launches of the Peugeot

108, the Citroën C1 and C4 Cactus, and the Peugeot 408 in Second

Half and the DS 5LS in the Second Quarter in China;

- A strong rise in volumes in China,

while the Russian and Latin American markets remain tough for the

Group ;

- Progess in the restructuring plan,

leading to improved competitiveness in Europe and the reduction of

fixed costs ;

- The successful renewal of the revolving

credit facility, significantly oversubscribed and extended to

€3bn1.

First Quarter 2014 revenues

- Group consolidated revenues of €13.3

bn, up 1,9% compared with the previous year;

- Automotive Division revenues of €8.9bn

excluding China JVs revenues, up 2.0% vs Q1 2013, significantly

impacted by exchange rates ;

- Faurecia revenues of €4.5bn, up

3.4% ; Banque PSA Finance revenues down 7.4%.

Consolidated revenues(in € millions) Q1 2013* Q1 2014

% change

Automotive Division 8 747

8 925 2,0%

Faurecia 4 369 4

518 3,4%

Banque PSA Finance 451 418 (7,4%)

Other businesses andintersegment

eliminations

(524) (574) (9,5%)

_______ _______ ______

PSA Peugeot Citroën

13 043

13 287

1,9%

*2013 consolidated revenues adjusted by €18 million, of which

€25 million for the Automotive Division (IFRS 11).

OutlookIn 2014, PSA Peugeot Citroën expects to see

automotive demand increase by around 3% in Europe2 , by

approximately 10% in China, and a decline around 7% in Latin

America and around 5% in Russia.

The Group positive Group operational free cash flow3 by 2016 at

the latest, and €2 bn cumulated Group operational free cash flow

over 2016-2018. It is also targeting to reach a 2% operating

margin4 in 2018 for the Automotive Division, targeting 5% within

the timing of the next mid -term plan 2019-2023.

AUTOMOTIVE DIVISION

Automotive Division revenues rose by 2.0% in the first quarter

of 2014 to €8,925 million from €8,747 million in the year-earlier

period. Worldwide sales of assembled vehicles rose by 7.7% over the

period, to 726,000 units. This reflected a strong rise in volumes

in both Europe (+16.0%) and China (+18.3%), versus declines in

Latin America (-14.5%) and Russia (-7.9%).

Revenues from new vehicle sales amounted to €6,240 million

compared with €6,070 million in first-quarter 2013, up 2.8%, driven

by a 4.8% rise in unit sales ex-China, a positive 1.7% product mix

effect thanks to recent model launches, and a positive 1.3% price

effect, reflecting the consistency of the Group’s pricing policy in

a market where pricing remains stable at a high level, and a

slightly positive market mix of 0.2%.

These favourable elements partially offset the strong negative

currency effect of 4.5%.

New vehicle inventory stood at 422,000 units at 31 March 2014,

up 8,000 units compared with a year earlier, reflecting the growth

in volumes. The Group continues to tightly manage inventory, in

line with its objectives of operating free cash flow burn

reduction.

PRODUCT HIGHLIGHTS

At end-March, orders for the Peugeot 308 totalled 70,000 units

since launch, ahead of target, driven by the “Car of the Year”

award in March 2014, the launch of the 308 SW version and the Pure

Tech petrol and Blue HDi diesel engines, both of which offer

best-in-class carbon emissions performance. To support the strong

demand, an additional shift was introduced at the Sochaux

plant.

The Peugeot 2008 is going from strength to strength, with 40,000

units sold over the quarter. The Group initiated a second project

to increase production capacity at the Mulhouse plant.

The C4 Picasso and Citroën Grand C4 Picasso delivered another

strong performance with 60,000 orders for the 5-seat version at the

end of March and 35,000 orders for the seven-seater. High level

versions accounted for 70% of sales. The Citroën C3 also returned

to its very good sales performance. In addition, the quarter saw

the reveal of the C4 Cactus, which illustrates Citroën’s new

positioning.

The partnership with Changan for the DS brand in China is

developing, with new models planned in 2014, notably the DS 5LS in

March, and a new DS 6WR SUV, announced at the Beijing Auto

Show.

FAURECIA

Faurecia reported revenues of €4,518 million for the first

quarter of 2014, an increase of 3.4%, and 7% on a comparable

basis5. The Quarter saw strong growth in Europe, Asia and Latin

America, and revenues increased at all divisions.

BANQUE PSA FINANCE

Banque PSA Finance’s revenues declined by 7.4% to €418 million

in the First Quarter 2014, notably due to the effect of a lower

loan book.

Worldwide Automobile Sales – First Quarter

2014(cars and light commercial vehicles)

in units

Jan-Mar 2013

Jan-Mar 2014 % change

EUROPE* Peugeot 202 479 239 161 18,1% Citroën

179 342 203 758 13,6%

PSA 381 821 442

919 16,0% CHINAA

Peugeot 72 427 85 922 18,6% Citroën 70 600 83 275 18,0%

PSA 143 027 169 197 18,3%

LATIN AMERICA Peugeot 38 427 34 201 -11,0%

Citroën 26 480 21 306 -19,5%

PSA 64 907 55

507 -14,5% RUSSIA

Peugeot 8 286 7 133 -13,9% Citroën 5 709 5 754 0,8%

PSA 13 995 12 887 -7,9%

REST OF THE WORLD Peugeot 50 579 33 220 -34,3%

Citroën 19 823 12 115 -38,9%

PSA 70 402 45

335 -35,6%

TOTAL Peugeot 372 198 399 637 7,4%

Assembled Vehicles

Citroën 301 954 326 208 8,0%

PSA 674 152

725 845 7,7%

CKD Peugeot 432 72 - Citroën

PSA 432

72 TOTAL

Assemble vehicle + CKD Peugeot 372 630 399 709 7,3% Citroën 301

954 326 208 8,0%

PSA 674 584 725 917

7,6%

* Europe = EU + EFTA + Albania + Bosnia +

Croatia + Kosovo+Macedonia + Montenegro + Serbia

GROUP HIGHLIGHTS

- On 26 March 2014, the final agreements

were signed between PSA Peugeot Citroën, Dongfeng Motor Group, the

French State and Etablissement Peugeot Frères and FFP. They provide

for the strengthening and deepening the existing manufacturing and

sales partnership with Dongfeng Motor Group and manufacturing

synergies estimated at around €400 million a year for PSA Peugeot

Citroën by 2020, a €3-billion capital increase and free attribution

of equity warrants to existing shareholders. They also provide for

a balanced ownership structure with DFG, the French State and

Etablissements Peugeot Fères / FFP each holding a 14% stake in

Peugeot SA.

- At today’s Annual General Meeting of

25th April 2014, shareholders will be asked to vote on resolutions

concerning, among other things, the capital increases, the free

attribution of warrants to current Peugeot SA shareholders and the

change in the Supervisory Board structure.

- In the first quarter, PSA Peugeot

Citroën also announced that it has entered in exclusive

negotiations with the Santander Group to form a European

partnership. The project would accelerate the end of the use of the

French guarantee; improve Banque PSA Finance’s cost of financing

and competitiveness; a strengthened commercial tool for the Peugeot

and Citroën brands; and potential cash upstream up to €1,5 billion

by 2018 for the Group.

- During the first quarter, the Group

continued to deploy its plan to restructure manufacturing and sales

operations in France; 7,730 files for mobility agreements were

signed at March 31, 2014.

- In April 2014, the Group signed new

€3-billion syndicated credit facility comprising a €2.0-billion

tranche expiring in five years and a €1.0-billion tranche expiring

in three years with two optional one year extensions. The line of

credit is contingent on the completion of the share and rights

issues announced last 19 February.

A conference call hosted by Jean Baptiste de

Chatillon, Chief Financial Officer, will take place on Friday, 25th

April 2014 at 8h30 (Paris) / 7h30 (London). To participate please

dial France : +33 1 70 77 09 40 , UK/ International : +44

(0) 203 367 94 53

You may also follow the conference call and

download the presentation of first-quarter 2014 revenues on our

website (www.psa-peugeot-citroen.com, in the “Analysts/Investors”

section)

Financial Calendar:

- 25 April 2014: Annual Shareholders'

Meeting at 2:00 pm (Paris time)

- 30 July 2014: First-half 2014 results

(before trading hours)

- 22 October 2014: Third-quarter 2014

revenue

1 Contingent on the completion of the capital increases

announced last 19 February2 Vs a market estimated by the Group to

be slightly positive at around 2% in Europe and around 10% in

China, with a 2% decline in Latin America, and a stable market in

Russia on February 19, 20143 Free cash flow of the Manufacturing

and sales companies without restructuring and exceptional4 ROI

relating to revenues5 Same perimeter and exchange rates

PSA Peugeot Citroën - 75 av. de la Grande Armée

- 75116 Pariswww.psa-peugeot-citroen.com

PSA Peugeot CitroënMedia relationsJean-Baptiste

Thomas, +33 (0) 1 40 66 47

59jean-baptiste.thomas@mpsa.comorPierre-Olivier Salmon, +33 (0) 1

40 66 49 94pierreolivier.salmon@mpsa.comorAntonia Krpina, +33 (0) 1

40 66 48 02antonia.krpina@mpsa.comorInvestor RelationsCarole

Dupont-Pietri, +33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comorAnne-Laure Desclèves, +33 (0) 1 40

66 43 65annelaure.descleves@mpsa.comorKarine Douet, +33 (0) 1 40 66

57 45karine.douet@mpsa.com

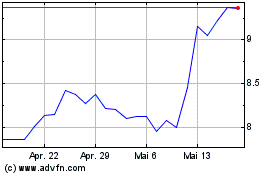

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

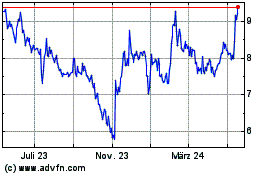

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024