R1 RCM Inc. (NASDAQ: RCM), a leading provider of technology-driven

solutions that transform the patient experience and financial

performance of healthcare providers, today announced results for

the three months ended March 31, 2023.

First Quarter 2023 Results:

- Revenue of $545.6 million, up $159.9 million or 41.5% compared

to the same period last year.

- GAAP net income of $0.3 million, compared to $29.4 million in

the same period last year.

- Adjusted EBITDA of $142.2 million, up $52.9 million or 59.2%

compared to the same period last year.

“Our strong first quarter results demonstrate the

team’s focus on execution and our ability to deliver value to

stakeholders in a dynamic operating environment,” said Lee Rivas,

chief executive officer of R1. “Demand for our services remains

robust and we continue to invest in technology to enhance our value

proposition for healthcare providers.”

“We are pleased with our first quarter results,

which were driven by strong operating discipline and our commitment

to customer delivery,” added Jennifer Williams, chief financial

officer. “With the momentum generated in the first quarter, we are

confident in the balance of 2023. We remain focused on execution to

drive sustained long-term growth.”

2023 Outlook

For 2023, R1 continues to expect to generate:

- Revenue of between $2,280 million and $2,330 million

- GAAP operating income of $115 million to $140 million

- Adjusted EBITDA of $595 million to $630 million

Conference Call and Webcast

Details

R1’s management team will host a conference call

today at 8:00 a.m. Eastern Time to discuss the Company’s financial

results and business outlook. To participate, please dial

888-330-2022 (646-960-0690 outside the U.S. and Canada) using

conference code number 5681952. A live webcast and replay of the

call will be available at the Investor Relations section of the

Company’s website at ir.r1rcm.com.

Non-GAAP Financial Measures

In order to provide a more comprehensive

understanding of the information used by R1’s management team in

financial and operational decision making, the Company supplements

its GAAP consolidated financial statements with certain non-GAAP

financial measures, including adjusted EBITDA, non-GAAP cost of

services, non-GAAP selling, general and administrative expenses,

and net debt. Adjusted EBITDA is defined as GAAP net income before

net interest income/expense, income tax provision/benefit,

depreciation and amortization expense, share-based compensation

expense, CoyCo 2, L.P. (“CoyCo 2”) share-based compensation

expense, and certain other items, including business acquisition

costs, integration costs, strategic initiatives, and the global

business services center expansion project in the Philippines.

Non-GAAP cost of services is defined as GAAP cost of services less

share-based compensation expense, CoyCo 2 share-based compensation

expense, and depreciation and amortization expense attributed to

cost of services. Non-GAAP selling, general and administrative

expenses is defined as GAAP selling, general and administrative

expenses less share-based compensation expense, CoyCo 2 share-based

compensation expense, and depreciation and amortization expense

attributed to selling, general and administrative expenses. Net

debt is defined as debt less cash and cash equivalents, inclusive

of restricted cash. Adjusted EBITDA guidance is reconciled to

operating income guidance, the most closely comparable available

GAAP measure.

Our board of directors and management team use

adjusted EBITDA as (i) one of the primary methods for planning and

forecasting overall expectations and for evaluating actual results

against such expectations and (ii) a performance evaluation metric

in determining achievement of certain executive incentive

compensation programs, as well as for incentive compensation

programs for employees. Non-GAAP cost of services and non-GAAP

selling, general and administrative expenses are used to calculate

adjusted EBITDA. Net debt is used as a supplemental measure of our

liquidity.

Tables 4 through 9 present a reconciliation of

GAAP financial measures to non-GAAP financial measures. Non-GAAP

measures should be considered in addition to, but not as a

substitute for, the information prepared in accordance with

GAAP.

Forward-Looking Statements

This press release contains “forward-looking

statements” made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements generally relate to future events and

relationships, plans, future growth, and future performance. These

statements are often identified by the use of words such as

“anticipate,” “believe,” “contemplate,” “designed,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “designed,” “may,”

“outlook,” “plan,” “predict,” “project,” “see,” “seek,” “target,”

“would,” and similar expressions or variations or negatives of

these words, although not all forward-looking statements contain

these identifying words. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of the Company’s management and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on by any investor as, a

guarantee, assurance, prediction or definitive statement of fact or

probability. Actual outcomes and results may differ materially from

those contemplated by these forward-looking statements as a result

of uncertainties, risks, and changes in circumstances, including

but not limited to risk and uncertainties related to: (i) economic

downturns and market conditions beyond the Company’s control,

including periods of inflation; (ii) the quality of global

financial markets; (iii) the Company’s ability to timely and

successfully achieve the anticipated benefits and potential

synergies of the acquisition of Cloudmed; (iv) the Company’s

ability to retain existing customers or acquire new customers; (v)

the development of markets for the Company’s revenue cycle

management offering; (vi) variability in the lead time of

prospective customers; (vii) competition within the market; (viii)

breaches or failures of the Company’s information security measures

or unauthorized access to a customer’s data; (ix) delayed or

unsuccessful implementation of the Company’s technologies or

services, or unexpected implementation costs; (x) disruptions in or

damages to the Company’s global business services centers and

third-party operated data centers; (xi) the volatility of the

Company’s stock price; (xii) the Company’s substantial

indebtedness; and (xiii) the ongoing impact of the COVID-19

pandemic on the Company’s business, operating results, and

financial condition. Additional risks and uncertainties that could

cause actual outcomes and results to differ materially from those

contemplated by the forward-looking statements are included under

the heading “Risk Factors” in the Company’s annual report on Form

10-K for the year ended December 31, 2022, and any other periodic

reports that the Company may file with the United States Securities

and Exchange Commission. The foregoing list of factors is not

exhaustive. All forward-looking statements included herein are

expressly qualified in their entirety by these cautionary

statements as of the date hereof and involve many risks and

uncertainties that could cause the Company’s actual results to

differ materially from those expressed or implied in the Company’s

forward-looking statements. Subsequent events and developments,

including actual results or changes in the Company’s assumptions,

may cause the Company’s views to change. The Company assumes no

obligation and does not intend to update these forward-looking

statements, except as required by law. You are cautioned not to

place undue reliance on such forward-looking statements.

About R1 RCM

R1 is a leading provider of technology-driven

solutions that transform the patient experience and financial

performance of healthcare providers. R1’s proven and scalable

operating models seamlessly complement a healthcare organization’s

infrastructure, quickly driving sustainable improvements to net

patient revenue and cash flows while reducing operating costs and

enhancing the patient experience. To learn more, visit:

r1rcm.com.

Contact:

R1 RCM Inc.

Investor Relations:

Atif Rahim 312-324-5476

investorrelations@r1rcm.com

Media Relations:

Allison+Partners Amanda Critelli

R1PR@allisonpr.com

|

Table 1 |

|

R1 RCM Inc. |

|

Consolidated Balance Sheets |

|

(In millions) |

|

|

|

(Unaudited) |

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

104.2 |

|

|

$ |

110.1 |

|

|

Accounts receivable, net of $16.0 million and $15.1 million

allowance as of March 31, 2023 and December 31, 2022,

respectively |

|

|

229.4 |

|

|

|

235.2 |

|

|

Accounts receivable, net of $0.1 million and $0.1 million

allowance - related party as of March 31, 2023 and

December 31, 2022, respectively |

|

|

24.9 |

|

|

|

25.0 |

|

|

Current portion of contract assets, net |

|

|

81.8 |

|

|

|

83.9 |

|

|

Prepaid expenses and other current assets |

|

|

105.2 |

|

|

|

110.3 |

|

|

Total current assets |

|

|

545.5 |

|

|

|

564.5 |

|

|

Property, equipment and software, net |

|

|

173.8 |

|

|

|

164.8 |

|

|

Operating lease right-of-use assets |

|

|

81.0 |

|

|

|

80.5 |

|

|

Non-current portion of contract assets, net |

|

|

37.3 |

|

|

|

32.0 |

|

|

Non-current portion of deferred contract costs |

|

|

28.2 |

|

|

|

26.7 |

|

|

Intangible assets, net |

|

|

1,464.4 |

|

|

|

1,514.5 |

|

|

Goodwill |

|

|

2,648.5 |

|

|

|

2,658.2 |

|

|

Deferred tax assets |

|

|

10.5 |

|

|

|

10.4 |

|

|

Other assets |

|

|

83.4 |

|

|

|

88.2 |

|

|

Total assets |

|

$ |

5,072.6 |

|

|

$ |

5,139.8 |

|

|

Liabilities |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

24.6 |

|

|

$ |

33.4 |

|

|

Current portion of customer liabilities |

|

|

45.6 |

|

|

|

57.5 |

|

|

Current portion of customer liabilities - related party |

|

|

9.4 |

|

|

|

7.4 |

|

|

Accrued compensation and benefits |

|

|

84.7 |

|

|

|

109.0 |

|

|

Current portion of operating lease liabilities |

|

|

18.8 |

|

|

|

18.0 |

|

|

Current portion of long-term debt |

|

|

58.3 |

|

|

|

53.9 |

|

|

Accrued expenses and other current liabilities |

|

|

76.7 |

|

|

|

70.6 |

|

|

Total current liabilities |

|

|

318.1 |

|

|

|

349.8 |

|

|

Non-current portion of customer liabilities |

|

|

5.2 |

|

|

|

5.0 |

|

|

Non-current portion of customer liabilities - related party |

|

|

13.2 |

|

|

|

13.7 |

|

|

Non-current portion of operating lease liabilities |

|

|

92.7 |

|

|

|

94.4 |

|

|

Long-term debt |

|

|

1,707.0 |

|

|

|

1,732.6 |

|

|

Deferred tax liabilities |

|

|

192.1 |

|

|

|

200.7 |

|

|

Other non-current liabilities |

|

|

24.9 |

|

|

|

23.1 |

|

|

Total liabilities |

|

|

2,353.2 |

|

|

|

2,419.3 |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

Common stock |

|

|

4.4 |

|

|

|

4.4 |

|

|

Additional paid-in capital |

|

|

3,136.2 |

|

|

|

3,123.2 |

|

|

Accumulated deficit |

|

|

(121.6 |

) |

|

|

(121.9 |

) |

|

Accumulated other comprehensive loss |

|

|

(4.6 |

) |

|

|

(3.4 |

) |

|

Treasury stock |

|

|

(295.0 |

) |

|

|

(281.8 |

) |

|

Total stockholders’ equity |

|

|

2,719.4 |

|

|

|

2,720.5 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

5,072.6 |

|

|

$ |

5,139.8 |

|

|

|

|

|

|

|

|

|

|

|

|

Table 2 |

|

R1 RCM Inc. |

|

Consolidated Statements of Operations

(Unaudited) |

|

(In millions, except share and per share

data) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

2022 |

|

Net operating fees |

|

$ |

361.0 |

|

$ |

322.8 |

|

Incentive fees |

|

|

23.6 |

|

|

30.2 |

|

Modular and other |

|

|

161.0 |

|

|

32.7 |

|

Net services revenue |

|

|

545.6 |

|

|

385.7 |

|

Operating expenses: |

|

|

|

|

|

Cost of services |

|

|

434.7 |

|

|

296.5 |

|

Selling, general and administrative |

|

|

47.0 |

|

|

28.9 |

|

Other expenses |

|

|

30.2 |

|

|

17.1 |

|

Total operating expenses |

|

|

511.9 |

|

|

342.5 |

|

Income from operations |

|

|

33.7 |

|

|

43.2 |

|

Net interest expense |

|

|

30.7 |

|

|

4.7 |

|

Income before income tax provision |

|

|

3.0 |

|

|

38.5 |

|

Income tax provision |

|

|

2.7 |

|

|

9.1 |

|

Net income |

|

$ |

0.3 |

|

$ |

29.4 |

|

|

|

|

|

|

|

Net income per common share: |

|

|

|

|

|

Basic |

|

$ |

— |

|

$ |

0.11 |

|

Diluted |

|

$ |

— |

|

$ |

0.09 |

|

Weighted average shares used in calculating net income per common

share: |

|

|

|

|

|

Basic |

|

|

417,346,840 |

|

|

278,747,261 |

|

Diluted |

|

|

452,925,789 |

|

|

321,043,371 |

|

|

|

|

|

|

|

|

|

Table 3 |

|

R1 RCM Inc. |

|

Consolidated Statements of Cash Flows

(Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating activities |

|

|

|

|

|

Net income |

|

$ |

0.3 |

|

|

$ |

29.4 |

|

|

Adjustments to reconcile net income to net cash provided by

operations: |

|

|

|

|

|

Depreciation and amortization |

|

|

66.0 |

|

|

|

18.9 |

|

|

Amortization of debt issuance costs |

|

|

1.4 |

|

|

|

0.3 |

|

|

Share-based compensation |

|

|

10.5 |

|

|

|

10.1 |

|

|

CoyCo 2 share-based compensation |

|

|

1.8 |

|

|

|

— |

|

|

Loss on disposal and right-of-use asset write-downs |

|

|

— |

|

|

|

2.0 |

|

|

Provision for credit losses |

|

|

1.5 |

|

|

|

— |

|

|

Deferred income taxes |

|

|

1.8 |

|

|

|

7.3 |

|

|

Non-cash lease expense |

|

|

2.9 |

|

|

|

3.2 |

|

|

Other |

|

|

— |

|

|

|

1.5 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable and related party accounts

receivable |

|

|

4.7 |

|

|

|

22.1 |

|

|

Contract assets |

|

|

(4.0 |

) |

|

|

— |

|

|

Prepaid expenses and other assets |

|

|

8.2 |

|

|

|

(20.5 |

) |

|

Accounts payable |

|

|

(10.9 |

) |

|

|

3.2 |

|

|

Accrued compensation and benefits |

|

|

(24.5 |

) |

|

|

(27.5 |

) |

|

Lease liabilities |

|

|

(4.4 |

) |

|

|

(2.1 |

) |

|

Other liabilities |

|

|

9.7 |

|

|

|

1.7 |

|

|

Customer liabilities and customer liabilities -

related party |

|

|

(10.3 |

) |

|

|

(18.7 |

) |

|

Net cash provided by operating activities |

|

|

54.7 |

|

|

|

30.9 |

|

|

Investing activities |

|

|

|

|

|

Purchases of property, equipment, and software |

|

|

(23.4 |

) |

|

|

(10.0 |

) |

|

Other |

|

|

(2.2 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

|

(25.6 |

) |

|

|

(10.0 |

) |

|

Financing activities |

|

|

|

|

|

Repayment of senior secured debt |

|

|

(12.4 |

) |

|

|

(4.4 |

) |

|

Repayments on revolver |

|

|

(10.0 |

) |

|

|

— |

|

|

Exercise of vested stock options |

|

|

0.5 |

|

|

|

0.4 |

|

|

Purchase of treasury stock |

|

|

— |

|

|

|

(0.6 |

) |

|

Shares withheld for taxes |

|

|

(13.4 |

) |

|

|

(21.5 |

) |

|

Other |

|

|

(0.1 |

) |

|

|

(0.1 |

) |

|

Net cash used in financing activities |

|

|

(35.4 |

) |

|

|

(26.2 |

) |

|

Effect of exchange rate changes in cash, cash equivalents and

restricted cash |

|

|

0.4 |

|

|

|

(0.9 |

) |

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

(5.9 |

) |

|

|

(6.2 |

) |

|

Cash, cash equivalents and restricted cash, at beginning of

period |

|

|

110.1 |

|

|

|

130.1 |

|

|

Cash, cash equivalents and restricted cash, at end of period |

|

$ |

104.2 |

|

|

$ |

123.9 |

|

|

|

|

|

|

|

|

|

|

|

|

Table 4 |

|

R1 RCM Inc. |

|

Reconciliation of GAAP Net Income to Non-GAAP Adjusted

EBITDA (Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 vs. 2022 Change |

|

|

|

2023 |

|

2022 |

|

Amount |

|

% |

|

Net income |

|

$ |

0.3 |

|

$ |

29.4 |

|

$ |

(29.1 |

) |

|

(99 |

) |

% |

|

Net interest expense |

|

|

30.7 |

|

|

4.7 |

|

|

26.0 |

|

|

553 |

|

% |

|

Income tax provision |

|

|

2.7 |

|

|

9.1 |

|

|

(6.4 |

) |

|

(70 |

) |

% |

|

Depreciation and amortization expense |

|

|

66.0 |

|

|

18.9 |

|

|

47.1 |

|

|

249 |

|

% |

|

Share-based compensation expense |

|

|

10.5 |

|

|

10.1 |

|

|

0.4 |

|

|

4 |

|

% |

|

CoyCo 2 share-based compensation expense |

|

|

1.8 |

|

|

— |

|

|

1.8 |

|

|

100 |

|

% |

|

Other expenses |

|

|

30.2 |

|

|

17.1 |

|

|

13.1 |

|

|

77 |

|

% |

|

Adjusted EBITDA (non-GAAP) |

|

$ |

142.2 |

|

$ |

89.3 |

|

$ |

52.9 |

|

|

59 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 5 |

|

R1 RCM Inc. |

|

Reconciliation of GAAP Cost of Services to Non-GAAP Cost of

Services (Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

2022 |

|

Cost of services |

|

$ |

434.7 |

|

$ |

296.5 |

|

Less: |

|

|

|

|

|

Share-based compensation expense |

|

|

6.4 |

|

|

4.3 |

|

CoyCo 2 share-based compensation expense |

|

|

0.5 |

|

|

— |

|

Depreciation and amortization expense |

|

|

65.6 |

|

|

18.6 |

|

Non-GAAP cost of services |

|

$ |

362.2 |

|

$ |

273.6 |

|

|

|

|

|

|

|

|

|

Table 6 |

|

R1 RCM Inc. |

|

Reconciliation of GAAP Selling, General and Administrative

to Non-GAAP Selling, General and Administrative

(Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

2022 |

|

Selling, general and administrative |

|

$ |

47.0 |

|

$ |

28.9 |

|

Less: |

|

|

|

|

|

Share-based compensation expense |

|

|

4.1 |

|

|

5.8 |

|

CoyCo 2 share-based compensation expense |

|

|

1.3 |

|

|

— |

|

Depreciation and amortization expense |

|

|

0.4 |

|

|

0.3 |

|

Non-GAAP selling, general and administrative |

|

$ |

41.2 |

|

$ |

22.8 |

|

|

|

|

|

|

|

|

|

Table 7 |

|

R1 RCM Inc. |

|

Consolidated Non-GAAP Financial Information

(Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

2022 |

|

Net operating fees |

|

$ |

361.0 |

|

$ |

322.8 |

|

Incentive fees |

|

|

23.6 |

|

|

30.2 |

|

Modular and other |

|

|

161.0 |

|

|

32.7 |

|

Net services revenue |

|

|

545.6 |

|

|

385.7 |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

Cost of services (non-GAAP) |

|

|

362.2 |

|

|

273.6 |

|

Selling, general and administrative (non-GAAP) |

|

|

41.2 |

|

|

22.8 |

|

Sub-total |

|

|

403.4 |

|

|

296.4 |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

142.2 |

|

$ |

89.3 |

|

|

|

|

|

|

|

|

|

Table 8 |

|

R1 RCM Inc. |

|

Reconciliation of GAAP Operating Income Guidance to

Non-GAAP Adjusted EBITDA Guidance (Unaudited) |

|

(In millions) |

|

|

|

|

|

2023 |

|

GAAP Operating Income Guidance |

$115-140 |

|

Plus: |

|

|

Depreciation and amortization expense |

$260-280 |

|

Share-based compensation expense |

$75-85 |

|

CoyCo 2 share-based compensation expense |

$10-15 |

|

Strategic initiatives, severance and other costs |

$110-135 |

|

Adjusted EBITDA Guidance |

$595-630 |

|

|

|

|

Table 9 |

|

R1 RCM Inc. |

|

Reconciliation of Total Debt to Net Debt

(Unaudited) |

|

(In millions) |

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

2023 |

|

2022 |

|

Senior Revolver |

|

$ |

90.0 |

|

$ |

100.0 |

|

Term A Loans |

|

|

1,200.3 |

|

|

1,211.4 |

|

Term B Loan |

|

|

497.5 |

|

|

498.7 |

|

Total debt |

|

|

1,787.8 |

|

|

1,810.1 |

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

Cash and cash equivalents |

|

|

104.2 |

|

|

110.1 |

|

Net Debt |

|

$ |

1,683.6 |

|

$ |

1,700.0 |

|

|

|

|

|

|

|

|

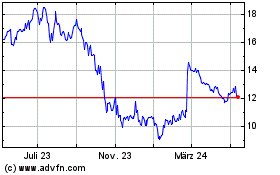

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024