Perficient, Inc. (Nasdaq: PRFT) (“Perficient”), the leading

global digital consultancy transforming the world’s largest

enterprises and biggest brands, today reported its financial

results for the quarter ended June 30, 2024.

Financial Highlights

For the quarter ended June 30, 2024:

- Revenues decreased 4% to $222.8 million from $231.1 million in

the second quarter of 2023;

- Net income decreased 34% to $17.4 million, compared to $26.4

million in the second quarter of 2023;

- GAAP earnings per share results on a fully diluted basis

decreased 33% to $0.49 from $0.73 in the second quarter of

2023;

- Adjusted earnings per share results (a non-GAAP measure; see

attached schedule, which reconciles to GAAP earnings per share) on

a fully diluted basis decreased 8% to $0.92 from $1.00 in the

second quarter of 2023; and

- Adjusted EBITDA (a non-GAAP measure; see attached schedule,

which reconciles to GAAP net income) decreased 10% to $43.3 million

from $48.2 million in the second quarter of 2023.

“We remain well positioned to continue to execute against our

long-term strategy and goals,” said Tom Hogan, President and CEO.

“We’re excited to move forward on our global growth journey.”

Other Highlights

Among other recent achievements, Perficient:

- Was named a Major Player in the “IDC MarketScape: Worldwide

Cloud Professional Services” 2024 Vendor Assessment and was

described as “a midsized cloud services provider that can combine

client intimacy with industrial-strength capabilities in technology

transformation and experience design and build;”

- Launched Scarlett, an AI-powered virtual assistant, to its

global workforce. Scarlett was built by Perficient’s AI experts to

help colleagues increase their efficiency with work-related tasks

by answering questions, connecting them with internal resources,

providing translation services, sending timely reminders, and

more;

- Was listed as a System Integrator Services and Consultancy in

the “IDC Market Glance: Digital Commerce, Q2 2024” and the “IDC

Market Glance: Commerce Layer Software and Services, Q2 2024”

reports, acknowledging Perficient’s deep understanding of commerce

software and ability to deliver experience-driven commerce

solutions;

- Achieved the Adobe Customer Journey Analytics Specialization,

underscoring Perficient’s commitment to delivering exceptional

Adobe solutions and services and its ability to integrate data into

a single interface that enables real-time omnichannel analysis and

visualization;

- Earned the Salesforce Data Cloud Expert Specialization, serving

as a testament to Perficient’s commitment to revolutionizing how

businesses leverage their data to drive business outcomes, unlock

trapped data, and enhance the customer experience; and

- Launched the PRISM Employee Resource Group, which is empowering

the LGBTQ+ community and its allies through community building and

education, advancing inclusive business practices, and fostering a

supportive work environment.

Transaction with EQT

Perficient previously announced it has entered into a definitive

agreement to be acquired by an affiliate of BPEA Private Equity

Fund VIII (“EQT”), part of EQT AB. As a result of that pending

transaction, Perficient will not host an earnings conference call

to discuss its second quarter results or provide financial guidance

in conjunction with its second quarter earnings release.

About Perficient

Perficient is the leading global digital consultancy. We

imagine, create, engineer, and run digital transformation solutions

that help our clients exceed customers’ expectations, outpace

competition, and grow their business. With unparalleled strategy,

creative, and technology capabilities, we bring big thinking and

innovative ideas, along with a practical approach to help the

world’s largest enterprises and biggest brands succeed. Traded on

the Nasdaq Global Select Market, Perficient is a member of the

Russell 2000 index and the S&P SmallCap 600 index. For more

information, visit www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are

not purely historical statements discuss future expectations or

state other forward-looking information. Those statements are

subject to known and unknown risks, uncertainties, and other

factors that could cause the actual results to differ materially

from those contemplated by the statements. The forward-looking

information is based on management’s current intent, belief,

expectations, estimates, and projections regarding our company and

our industry. You should be aware that those statements only

reflect our predictions. Actual events or results may differ

substantially. Important factors that could cause our actual

results to be materially different from the forward-looking

statements include (but are not limited to) those disclosed under

the heading “Risk Factors” in our most recently filed annual report

on Form 10-K and other securities filings, and the following:

(1)

the impact of the general economy and

economic and political uncertainty on our business;

(2)

risks associated with potential changes to

U.S. and foreign laws, regulations, and policies;

(3)

risks associated with the operation of our

business generally, including:

a. client demand for our services and

solutions;

b. effectively competing in a highly

competitive market;

c. risks from international operations

including fluctuations in exchange rates;

d. adapting to changes in technologies and

offerings;

e. ongoing transition of our executive

leadership team;

f. obtaining favorable pricing to reflect

services provided;

g. risk of loss of one or more significant

software vendors;

h. maintaining a balance of our supply of

skills and resources with client demand;

i. changes to immigration policies;

j. protecting our clients’ and our data

and information;

k. changes to tax levels, audits,

investigations, tax laws or their interpretation;

l. making appropriate estimates and

assumptions in connection with preparing our consolidated financial

statements; and

m. maintaining effective internal

controls;

(4)

risks associated with managing growth

organically and through acquisitions;

(5)

risks associated with servicing our debt,

the potential impact on the value of our common stock from the

conditional conversion features of our debt and the associated

convertible note hedge transactions;

(6)

legal liabilities, including intellectual

property protection and infringement or the disclosure of

personally identifiable information;

(7)

the risks detailed from time to time

within our filings with the Securities and Exchange Commission (the

“SEC”);

(8)

uncertainties associated with the proposed

merger of Perficient with an affiliate of BPEA Private Equity Fund

VIII (“EQT”);

(9)

the occurrence of any event, change or

other circumstances that could give rise to the termination of the

merger agreement entered into in connection with the proposed

merger;

(10)

risks related to disruption of management

time from ongoing business operations due to the proposed

merger;

(11)

the risk that the conditions to the

proposed merger may not be satisfied in a timely manner or at

all;

(12)

the risk of any unexpected costs or

expenses resulting from the proposed merger;

(13)

restrictions imposed on our business

during the pendency of the proposed merger;

(14)

the risk of any litigation relating to the

proposed merger; and

(15)

the risk that the proposed merger and its

announcement could have an adverse effect on the ability of

Perficient to retain and hire key personnel and to maintain

relationships with customers, vendors, partners, employees,

stockholders and other business relationships and on its operating

results and business generally.

This list is not exhaustive but is designed to highlight

important factors that may impact our forward-looking statements.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance, or achievements.

This cautionary statement is provided pursuant to Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements in this release are made only as of the date hereof and

we undertake no obligation to update publicly any forward-looking

statement for any reason, even if new information becomes available

or other events occur in the future.

Perficient, Inc.

Unaudited Consolidated

Statements of Operations

(in thousands, except per

share information)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenues

Services excluding reimbursable

expenses

$

219,543

$

228,573

$

430,873

$

456,957

Reimbursable expenses

2,911

2,127

6,492

4,596

Total services

222,454

230,700

437,365

461,553

Software and hardware

363

405

756

960

Total revenues

222,817

231,105

438,121

462,513

Cost of revenues (exclusive of

depreciation and amortization, shown separately below)

Cost of services

139,535

143,560

279,134

285,248

Stock compensation

2,535

2,608

5,042

5,132

Total cost of revenues

142,070

146,168

284,176

290,380

Selling, general and administrative

40,027

39,390

79,270

78,994

Stock compensation

3,731

4,787

13,654

9,103

Total selling, general and

administrative

43,758

44,177

92,924

88,097

Depreciation

1,840

2,224

3,851

4,529

Amortization

4,862

5,523

9,748

11,340

Acquisition costs

132

(71

)

1,050

8

Transaction expenses

6,688

—

7,163

—

Adjustment to fair value of contingent

consideration

67

(2,701

)

108

(4,727

)

Income from operations

23,400

35,785

39,101

72,886

Net interest (income) expense

(729

)

296

(1,496

)

801

Net other (income) expense

(15

)

387

(60

)

462

Income before income taxes

24,144

35,102

40,657

71,623

Provision for income taxes

6,706

8,740

11,664

18,461

Net income

$

17,438

$

26,362

$

28,993

$

53,162

Basic net income per share

$

0.51

$

0.78

$

0.85

$

1.57

Diluted net income per share

$

0.49

$

0.73

$

0.81

$

1.48

Shares used in computing basic net income

per share

34,353

33,988

34,251

33,951

Shares used in computing diluted net

income per share

37,072

36,717

36,988

36,707

Net income used in computing diluted net

income per share

$

17,989

$

26,935

$

30,081

$

54,295

Perficient, Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

June 30, 2024

(unaudited)

December 31, 2023

Assets

Current assets:

Cash, cash equivalents and restricted

cash

$

112,937

$

128,886

Accounts receivable, net

195,954

178,998

Prepaid expenses

6,219

5,638

Other current assets

23,298

12,431

Total current assets

338,408

325,953

Property and equipment, net

8,504

11,996

Operating lease right-of-use assets

22,521

21,786

Goodwill

608,774

581,387

Intangible assets, net

70,529

71,118

Other non-current assets

64,542

52,364

Total assets

$

1,113,278

$

1,064,604

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

15,083

$

18,688

Other current liabilities

66,355

59,784

Total current liabilities

81,438

78,472

Long-term debt, net

398,018

396,874

Operating lease liabilities

17,420

16,446

Other non-current liabilities

45,600

42,189

Total liabilities

$

542,476

$

533,981

Stockholders’ equity:

Preferred stock

$

—

$

—

Common stock

54

53

Additional paid-in capital

454,853

432,160

Accumulated other comprehensive loss

(12,504

)

(5,461

)

Treasury stock

(377,790

)

(373,325

)

Retained earnings

506,189

477,196

Total stockholders’ equity

570,802

530,623

Total liabilities and stockholders’

equity

$

1,113,278

$

1,064,604

Perficient, Inc.

Unaudited Condensed

Consolidated Statements of Cash Flow

(in thousands)

Six Months Ended June

30,

2024

2023

Net income

$

28,993

$

53,162

Adjustments to reconcile net income to net

cash provided by operations

24,948

18,662

Changes in operating assets and

liabilities, net of business acquisitions

(24,689

)

(6,713

)

Net cash provided by operating

activities

29,252

65,111

Net cash used in investing

activities

(36,180

)

(3,553

)

Net cash used in financing

activities

(8,305

)

(31,830

)

Effect of exchange rate on cash, cash

equivalents and restricted cash

(716

)

613

Change in cash, cash equivalents and

restricted cash

(15,949

)

30,341

Cash, cash equivalents and restricted cash

at beginning of period

128,886

30,130

Cash, cash equivalents and restricted cash

at end of period

$

112,937

$

60,471

See the Company's Form 10-Q for

the full consolidated statements of cash flows.

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a

description of these non-GAAP financial measures, including the

reasons management uses each measure, and reconciliations of these

non-GAAP financial measures to the most directly comparable

financial measures prepared in accordance with Generally Accepted

Accounting Principles (“GAAP”), please see the section entitled

“About Non-GAAP Financial Measures” and the accompanying tables

entitled “Reconciliation of GAAP to Non-GAAP Measures.”

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for adjusted

EBITDA (earnings before income taxes, interest, depreciation,

amortization, acquisition costs, adjustment to fair value of

contingent consideration, stock compensation and the impact of

other infrequent or unusual transactions), adjusted net income, and

adjusted earnings per share data as supplemental information

regarding Perficient’s business performance. Perficient believes

that these non-GAAP financial measures are useful to investors

because they provide investors with a better understanding of

Perficient’s past financial performance and future results.

Perficient’s management uses these non-GAAP financial measures when

it internally evaluates the performance of Perficient’s business

and makes operating decisions, including internal operating

budgeting, performance measurement, and the calculation of bonuses

and discretionary compensation. Management excludes stock-based

compensation related to restricted stock awards, the amortization

of intangible assets, amortization of debt issuance costs related

to convertible senior notes, acquisition costs, transaction

expenses, adjustments to the fair value of contingent

consideration, net other income and expense, the impact of other

infrequent or unusual transactions, and income tax effects of the

foregoing, when making operational decisions.

Perficient believes that providing the non-GAAP financial

measures to its investors is useful because it allows investors to

evaluate Perficient’s performance using the same methodology and

information used by Perficient’s management. Specifically, adjusted

net income is used by management primarily to review business

performance and determine performance-based incentive compensation

for executives and other employees. Management uses adjusted EBITDA

to measure operating profitability, evaluate trends, and make

strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations

because they do not include all of the expenses included under GAAP

and because they involve the exercise of discretionary judgment as

to which charges are excluded from the non-GAAP financial measure.

However, Perficient’s management compensates for these limitations

by providing the relevant disclosure of the items excluded in the

calculation of adjusted EBITDA, adjusted net income, and adjusted

earnings per share. In addition, some items that are excluded from

adjusted net income and adjusted earnings per share can have a

material impact on cash. Management compensates for these

limitations by evaluating the non-GAAP measure together with the

most directly comparable GAAP measure. Perficient has historically

provided non-GAAP financial measures to the investment community as

a supplement to its GAAP results to enable investors to evaluate

Perficient’s business performance in the way that management does.

Perficient’s definition may be different from similar non-GAAP

financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are

outlined below:

Amortization

Perficient has incurred expense on amortization of intangible

assets primarily related to various acquisitions. Management

excludes these items for the purposes of calculating adjusted

EBITDA, adjusted net income, and adjusted earnings per share.

Perficient believes that eliminating this expense from its non-GAAP

financial measures is useful to investors because the amortization

of intangible assets can be inconsistent in amount and frequency,

and is significantly impacted by the timing and magnitude of

Perficient’s acquisition transactions, which also vary

substantially in frequency from period to period.

Acquisition Costs

Perficient incurs transaction costs related to merger and

acquisition-related activities which are expensed in its GAAP

financial statements. Management excludes these items for the

purposes of calculating adjusted EBITDA, adjusted net income, and

adjusted earnings per share. Perficient believes that excluding

these expenses from its non-GAAP financial measures is useful to

investors because these are expenses associated with each

transaction and are inconsistent in amount and frequency causing

comparison of current and historical financial results to be

difficult.

Transaction Expenses

Perficient has incurred a variety of expenses in connection with

the transactions contemplated by the Merger Agreement with EQT.

Management excludes these items for the purposes of calculating

adjusted EBITDA. Perficient believes that excluding these expenses

from its non-GAAP financial measures is useful to investors because

these are one-time expenses that are not reflective of the

underlying operations of the business.

Adjustment to Fair Value of Contingent Consideration

Perficient is required to remeasure its contingent consideration

liability related to acquisitions each reporting period until the

contingency is settled. Any changes in fair value are recognized in

earnings. Management excludes these items for the purposes of

calculating adjusted EBITDA, adjusted net income, and adjusted

earnings per share. Perficient believes that excluding these

adjustments from its non-GAAP financial measures is useful to

investors because they are related to acquisitions and are

inconsistent in amount and frequency from period to period.

Amortization of Debt Issuance Costs

On November 9, 2021, Perficient issued $380.0 million aggregate

principal amount of 0.125% Convertible Senior Notes due 2026, and

on August 14, 2020, Perficient issued $230.0 million aggregate

principal amount of 1.250% Convertible Senior Notes due 2025 (the

“2026 Notes,” and “2025 Notes,” respectively, and collectively, the

“Notes”) in private placements to qualified institutional

purchasers. Issuance costs attributable to the Notes, in addition

to issuance costs related to Perficient’s credit agreement, are

being amortized to interest expense over their respective terms.

Perficient believes that excluding these non-cash expenses from its

non-GAAP financial measures is useful to investors because the

expenses are not reflective of Perficient’s business

performance.

Foreign Exchange Loss (Gain)

Non-operating foreign currency exchange gains and losses,

inclusive of gains and losses on related foreign exchange forward

contracts not designated as hedging instruments for accounting

purposes, are reported in net other (income) expense in our

consolidated statements of operations. As our operations expand

into countries outside of the United States, foreign exchange gains

and losses have and will become increasingly material. Perficient

believes that excluding these gains and losses from its non-GAAP

financial measures is useful to investors because foreign exchange

gains and losses will vary as the underlying currencies fluctuate,

which makes it difficult to compare current and historical

results.

Stock Compensation

Perficient incurs stock-based compensation expense under

Financial Accounting Standards Board Accounting Standards

Codification Topic 718, Compensation - Stock Compensation.

Perficient excludes stock-based compensation expense and the

related tax effects for the purposes of calculating adjusted

EBITDA, adjusted net income, and adjusted earnings per share

because stock-based compensation is a non-cash expense, which

Perficient believes is not reflective of its business performance.

The nature of stock-based compensation expense also makes it very

difficult to estimate prospectively, since the expense will vary

with changes in the stock price and market conditions at the time

of new grants, varying valuation methodologies, subjective

assumptions, and different award types, making the comparison of

current results with forward-looking guidance potentially difficult

for investors to interpret. The tax effects of stock-based

compensation expense may also vary significantly from period to

period, without any change in underlying operational performance,

thereby obscuring the underlying profitability of operations

relative to prior periods. Perficient believes that non-GAAP

measures of profitability, which exclude stock-based compensation,

are widely used by analysts and investors.

Dilution Offset from Convertible Note Hedge Transactions

It is Perficient’s current intent to settle conversions of the

Notes through combination settlement, which involves repayment of

the principal portion in cash and any excess of the conversion

value over the principal amount in shares of our common stock.

Perficient excludes the shares that are issuable upon conversions

of the Notes because Perficient expects that the dilution from such

shares will be offset by the convertible note hedge transactions

entered into in November 2021 and August 2020 in connection with

the issuance of the Notes.

Perficient, Inc.

Reconciliation of GAAP to

Non-GAAP Measures

(unaudited)

(in thousands, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP Net Income

$

17,438

$

26,362

$

28,993

$

53,162

Adjustments:

Provision for income taxes

6,706

8,740

11,664

18,461

Amortization

4,862

5,523

9,748

11,340

Acquisition costs

132

(71

)

1,050

8

Transaction expenses

6,688

—

7,163

—

Adjustment to fair value of contingent

consideration

67

(2,701

)

108

(4,727

)

Amortization of debt issuance costs

631

631

1,262

1,239

Foreign exchange (gain) loss

(14

)

382

(37

)

471

Stock compensation

6,266

7,395

18,696

14,235

Adjusted Net Income Before Tax

42,776

46,261

78,647

94,189

Adjusted income tax (1)

10,865

11,843

20,055

24,207

Adjusted Net Income

$

31,911

$

34,418

$

58,592

$

69,982

GAAP Earnings Per Share (diluted)

$

0.49

$

0.73

$

0.81

$

1.48

Adjusted Earnings Per Share (diluted)

$

0.92

$

1.00

$

1.70

$

2.04

Shares used in computing GAAP Earnings Per

Share (diluted)

37,072

36,717

36,988

36,707

Dilution offset from convertible note

hedge transactions

(2,430

)

(2,430

)

(2,430

)

(2,430

)

Shares used in computing Adjusted Earnings

Per Share (diluted)

34,642

34,287

34,558

34,277

Net income used in computing GAAP Earnings

Per Share (diluted)

$

17,989

$

26,935

$

30,081

$

54,295

(1)

The estimated adjusted effective tax rate

of 25.4% and 25.6% for the three months ended June 30, 2024 and

2023, respectively, and 25.5% and 25.7% for the six months ended

June 30, 2024 and 2023, respectively, has been used to calculate

the provision for income taxes for non-GAAP purposes.

Perficient, Inc.

Reconciliation of GAAP to

Non-GAAP Measures

(unaudited)

(in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP Net Income

$

17,438

$

26,362

$

28,993

$

53,162

Adjustments:

Provision for income taxes

6,706

8,740

11,664

18,461

Net interest (income) expense

(729

)

296

(1,496

)

801

Net other (income) expense

(15

)

387

(60

)

462

Depreciation

1,840

2,224

3,851

4,529

Amortization

4,862

5,523

9,748

11,340

Acquisition costs

132

(71

)

1,050

8

Transaction expenses

6,688

—

7,163

—

Adjustment to fair value of contingent

consideration

67

(2,701

)

108

(4,727

)

Stock compensation

6,266

7,395

18,696

14,235

Adjusted EBITDA (1)

$

43,255

$

48,155

$

79,717

$

98,271

(1)

Adjusted EBITDA is a non-GAAP performance

measure and is not intended to be a performance measure that should

be regarded as an alternative to or more meaningful than either

GAAP operating income or GAAP net income. Adjusted EBITDA measures

presented may not be comparable to similarly titled measures

presented by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808500764/en/

Bill Davis, Perficient, 314-529-3555

bill.davis@perficient.com

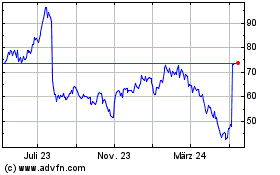

Perficient (NASDAQ:PRFT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

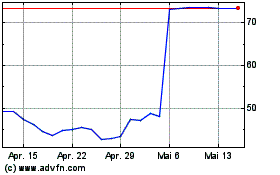

Perficient (NASDAQ:PRFT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024