As filed with the Securities and Exchange Commission on June 30, 2023

Registration No. 333-

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Onconova Therapeutics, Inc.

(Exact name of registrant as specified in charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

22-3627252

(I.R.S. Employer

Identification No.)

|

|

12 Penns Trail

Newtown, PA 18940

(267) 759-3680

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven M. Fruchtman, M.D.

President and Chief Executive Officer

Onconova Therapeutics, Inc.

12 Penns Trail

Newtown, PA 18940

(267) 759-3680

(Name, address, including zip code, and telephone number including area code, of agent for service)

Copy to:

Joanne R. Soslow

Morgan, Lewis & Bockius LLP

1701 Market Street

Philadelphia, PA

(215) 963-5000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large accelerated filer

☐

|

|

|

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 30, 2023

PROSPECTUS

Onconova Therapeutics, Inc.

$150,000,000

Common Stock, Preferred Stock,

Debt Securities, Warrants and Units

This prospectus covers our offer and sale from time to time of any combination of common stock, preferred stock, debt securities, warrants or units described in this prospectus in one or more offerings. This prospectus provides a general description of the securities we may offer and sell. Each time we offer and sell securities we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement will also describe the specific manner in which we will offer the securities and may also add, update or change information contained in this prospectus. The aggregate offering price of all securities sold by us under this prospectus may not exceed $150,000,000.

You should read this prospectus and any supplement carefully before you purchase any of our securities. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

The securities may be offered and sold by us from time to time at fixed prices, at market prices or at negotiated prices, and may be offered and sold to or through one or more underwriters, dealers or agents or directly to purchasers on a continuous or delayed basis. See “Plan of Distribution.”

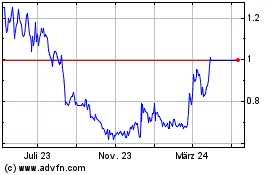

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “ONTX.” On June 29, 2023, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.10 per share.

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information.

Investing in these securities involves risks, including those set forth in the “Risk Factors” section of the applicable prospectus supplement and any related free writing prospectus and in the documents incorporated by reference into this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2023.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

14

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC. This prospectus covers the primary offering by us of up to an aggregate offering price of $150,000,000 of securities. We may offer and sell any combination of the securities described in this prospectus. This prospectus provides you with a general description of the securities we may offer and sell. Each time we offer and sell securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus. You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find More Information,” before investing in any of the securities offered.

We have filed or incorporated by reference exhibits to the registration statement of which this prospectus forms a part. You should read the exhibits carefully for provisions that may be important to you.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and any accompanying supplement to this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or any accompanying prospectus supplement. This prospectus and any accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying supplement to this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings are accessible through the Internet at that website. Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge, as soon as reasonably practicable after these reports are filed with the SEC, at our website at www.onconova.com. The content contained in, or that can be accessed through, our website is not a part of this prospectus.

Unless the context indicates otherwise, as used in this prospectus, the terms “Onconova,” “Onconova Therapeutics,” “Company,” “we,” “us” and “our” refer to Onconova Therapeutics, Inc. and its consolidated subsidiaries.

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below:

•

•

•

•

The description of our common stock contained in our registration statement on Form 8-A filed on July 23, 2013 (Registration no. 001-36020) with the SEC, including any amendment or report filed for the purpose of updating such description;

•

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration statement; and

•

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and before we stop offering the securities under this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus but not delivered with this prospectus excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You can request those documents from us, at no cost, by writing or telephoning us at: Onconova Therapeutics, Inc., 12 Penns Trail, Newtown, Pennsylvania, 18940, (267) 759-3680, Attention: Suzanne Hutchison.

The most recent information that we file with the SEC automatically updates and supersedes older information. The information contained in any such filing will be deemed to be a part of this prospectus, commencing on the date on which the filing is made.

Information furnished under Items 2.02 or 7.01 (or corresponding information furnished under Item 9.01 or included as an exhibit) in any past or future Current Report on Form 8-K that we file with the SEC, unless otherwise specified in such report, is not incorporated by reference in this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain, and any prospectus supplement may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included or incorporated in this prospectus or any prospectus supplement regarding our strategy, future operations, financial position, future revenues, projected costs, prospects, plans and objectives of management are forward-looking statements. We may, in some cases, use terms such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements appear in a number of places throughout this prospectus and the documents incorporated by reference herein, and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, protection of our intellectual property portfolio, the degree of clinical utility of our products, particularly in specific patient populations, our ability to develop commercial and manufacturing functions, expectations regarding clinical trial data, our results of operations, cash needs, financial condition, liquidity, collaborations, partnerships, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics and industry change, and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus and in the documents incorporated by reference herein, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate are consistent with the forward-looking statements contained in this report, they may not be predictive of results or developments in future periods.

Actual results could differ materially and adversely from our forward-looking statements due to a number of factors, including, without limitations, risks related to:

•

our need for additional financing for our clinical-stage programs, continued product development and other operations, and our ability to obtain sufficient funds on acceptable terms when needed, and our plans and future needs to scale back operations if adequate financing is not obtained;

•

our ability to continue as a going concern;

•

our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

•

the success and timing of our preclinical studies and clinical trials, including site initiation and patient enrollment, and regulatory approval of protocols for future clinical trials;

•

our ability to enter into, maintain and perform collaboration agreements with other pharmaceutical companies, for funding and commercialization of our clinical product candidates or preclinical compounds, and our ability to achieve certain milestones under those agreements;

•

the difficulties in obtaining and maintaining regulatory approval of our product candidates, and the labeling under any approval we may obtain;

•

our plans and ability to develop, manufacture and commercialize our product candidates;

•

our failure to recruit or retain key scientific or management personnel or to retain our executive officers;

•

the size and growth of the potential markets for our product candidates and our ability to serve those markets;

•

regulatory developments in the United States and foreign countries;

•

the rate and degree of market acceptance of any of our product candidates;

•

obtaining and maintaining intellectual property protection for our product candidates and our proprietary technology;

•

the successful development of our commercialization capabilities, including sales and marketing capabilities;

•

recently enacted and future legislation and regulation regarding the healthcare system;

•

the success of competing therapies and products that are or become available;

•

our ability to maintain the listing of our securities on a national securities exchange;

•

the potential for third party disputes and litigation;

•

the performance of third parties, including contract research organizations (“CROs”) and third-party manufacturers; and

•

the impact of the novel coronavirus disease, COVID-19, to global economy and capital markets, and to our business and our financial results.

Any forward-looking statements that we make in this prospectus and the documents incorporated by reference herein speak only as of the date of such statement, and we undertake no obligation to update such statements whether as a result of any new information, future events, changed circumstances or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

You should also read carefully the factors described in the “Risk Factors” section of this prospectus and in documents incorporated by reference herein, to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus and in documents incorporated by reference herein will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all.

We obtained the industry, market and competitive position data in this prospectus and in documents incorporated by reference herein from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. We believe this data is accurate in all material respects as of the date of this prospectus.

RISK FACTORS

Our business is influenced by many factors that are difficult to predict, and that involve uncertainties that may materially affect actual operating results, cash flows and financial condition. Before making an investment decision, you should carefully consider these risks set forth in the “Risk Factors” section of our Annual Report on Form 10-K, as filed with the SEC on March 30, 2023, which are incorporated by reference into this prospectus, as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC and any applicable prospectus supplement or any free writing prospectus. You should also carefully consider any other information we include or incorporate by reference in this prospectus. Any such risk could cause our business, financial condition or operating results to suffer. The market price of our common stock could decline if one or more of these risks and uncertainties develop into actual events. You could lose all or part of your investment.

ONCONOVA THERAPEUTICS, INC.

Overview

We are a clinical-stage biopharmaceutical company focused on discovering and developing novel products for patients with cancer. We have proprietary molecularly targeted agents designed to disrupt specific cellular pathways that are important for cancer cell proliferation. We believe that the product candidates in our pipeline have the potential to be efficacious in a variety of cancers with unmet medical need. We have the following two clinical-stage programs: 1. narazaciclib (ON 123300), a multi-targeted kinase inhibitor in solid tumors and hematological malignancies as a single agent or in combination with other anti-cancer therapies; and 2. rigosertib administered alone or in combination for the treatment of various cancers. We are currently evaluating potential compounds for in-licensing opportunities.

Our net losses were $5.8 million and $4.1 million for the three months ended March 31, 2023 and 2022, respectively. As of March 31, 2023, we had an accumulated deficit of $469.5 million.

CORPORATE INFORMATION

We were incorporated in Delaware in December 1998 and commenced operations in January 1999. Our principal executive offices are located at 12 Penns Trail, Newtown, Pennsylvania 18940, and our telephone number is (267) 759-3680. Our website address is www.onconova.com. The information on, or that can be accessed through, our website is not part of this prospectus.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we anticipate that the net proceeds from our sale of any securities will be used to fund the development of our clinical and preclinical programs, for other research and development activities and for general corporate purposes, which may include capital expenditures and funding our working capital needs. We expect from time to time to evaluate the acquisition of businesses, products and technologies for which a portion of the net proceeds may be used, although we currently are not planning or negotiating any such transactions. Pending such uses, we may invest the net proceeds in investment grade interest-bearing securities.

The amounts actually expended for each purpose may vary significantly depending upon numerous factors, including the amount and timing of the proceeds from this offering and progress with our clinical development programs. Expenditures will also depend upon the establishment of collaborative arrangements with other companies, the availability of additional financing and other factors. Investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of securities.

DESCRIPTION OF SECURITIES

We may offer shares of our common stock and preferred stock, various series of debt securities, warrants or units to purchase any of such securities, with a total value of up to $150,000,000, from time to time in one or more offerings under this prospectus at prices and on terms to be determined by market conditions at the time of the offering. This prospectus provides you with a general description of the securities that we may offer. In connection with each offering, we will provide a prospectus supplement that will describe the specific amounts, prices and terms of the securities being offered, including, to the extent applicable:

•

designation or classification;

•

aggregate offering price;

•

rates and times of payment of dividends;

•

redemption, conversion or exchange terms;

•

conversion or exchange prices or rates and any provisions for changes to or adjustments in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange;

•

restrictive covenants;

•

voting or other rights; and

•

important federal income tax considerations.

The prospectus supplement also may add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement will offer a security that is not included in the Registration Statement at the time of its effectiveness or offer a security of a type that is not described in this prospectus.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock consists of 125,000,000 shares of common stock, par value $0.01 per share, and 5,000,000 shares of preferred stock, par value $0.01 per share. As of June 29, 2023, 20,977,625 shares of our common stock, and no shares of our preferred stock, were outstanding.

Common Stock

Subject to the preferences that may be applicable to any outstanding preferred stock, holders of our common stock are entitled to receive ratably any dividends that may be declared by our board of directors out of funds legally available for that purpose. Holders of our common stock are entitled to one vote for each share on all matters voted on by stockholders, including the election of directors. Holders of our common stock do not have any conversion, redemption, sinking fund or preemptive rights. In the event of our dissolution, liquidation or winding up, holders of our common stock are entitled to share ratably in any assets remaining after the satisfaction in full of the prior rights of creditors and the aggregate liquidation preference of any preferred stock then outstanding. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future. All outstanding shares of our common stock are, and any shares of common stock that we may issue in the future will be, fully paid and non-assessable.

Preferred Stock

We may issue any class of preferred stock in any series. Our board of directors has the authority, subject to limitations prescribed under Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation,

powers, preferences and rights of the shares of each series and any of its qualifications, limitations and restrictions. Our board of directors can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of our company and may adversely affect the market price of our common stock and the voting and other rights of the holders of common stock.

In 2018, our board of directors designated 1,044,488 shares of preferred stock as Series A Convertible Preferred Stock and 1,796,875 shares of preferred stock as Series B Convertible Preferred Stock, As of June 30, 2023, we had no shares of preferred stock outstanding.

Delaware Anti-Takeover Law and Provisions in Our Certificate of Incorporation and Bylaws

Delaware Anti-Takeover Law

We are subject to Section 203 of the Delaware General Corporation Law. Section 203 generally prohibits a public Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

•

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder;

•

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding specified shares; or

•

at or subsequent to the date of the transaction, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 662/3% of the outstanding voting stock which is not owned by the interested stockholder.

Section 203 defines a “business combination” to include:

•

any merger or consolidation involving the corporation and the interested stockholder;

•

any sale, lease, exchange, mortgage, pledge, transfer or other disposition of 10% or more of the assets of the corporation to or with the interested stockholder;

•

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

•

subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

•

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

In general, Section 203 defines an “interested stockholder” as any person that is:

•

the owner of 15% or more of the outstanding voting stock of the corporation;

•

an affiliate or associate of the corporation who was the owner of 15% or more of the outstanding voting stock of the corporation at any time within three years immediately prior to the relevant date; or

•

the affiliates and associates of the above.

Under specific circumstances, Section 203 makes it more difficult for an “interested stockholder” to effect various business combinations with a corporation for a three-year period, although the stockholders

may, by adopting an amendment to the corporation’s certificate of incorporation or bylaws, elect not to be governed by this section, effective 12 months after adoption.

Our Tenth Amended and Restated Certificate of Incorporation, as amended, or our “certificate of incorporation,” and our Amended and Restated Bylaws, or our “bylaws,” do not exclude us from the restrictions of Section 203. We anticipate that the provisions of Section 203 might encourage companies interested in acquiring us to negotiate in advance with our board of directors since the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder.

Certificate of Incorporation and Bylaws

Provisions of our certificate of incorporation and bylaws may delay or discourage transactions involving an actual or potential change of control or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares, or transactions that our stockholders might otherwise deem to be in their best interests. Therefore, these provisions could adversely affect the price of our common stock. Among other things, our certificate of incorporation and bylaws will:

•

permit our board of directors to issue up to 5,000,000 shares of preferred stock, with any rights, preferences and privileges as they may designate (as of April 24, 2020, 1,044,488 shares have been designated as Series A Convertible Preferred Stock and 1,796,875 shares have been designated as Series B Convertible Preferred Stock);

•

provide that all vacancies on our board of directors, including as a result of newly created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum;

•

require that any action to be taken by our stockholders must be effected at a duly called annual or special meeting of stockholders and not be taken by written consent;

•

provide that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors at a meeting of stockholders must provide advance notice in writing, and also specify requirements as to the form and content of a stockholder’s notice;

•

not provide for cumulative voting rights, thereby allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election; and

•

provide that special meetings of our stockholders may be called only by the board of directors or by such person or persons requested by a majority of the board of directors to call such meetings.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is EQ Shareowner Services.

Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol “ONTX.”

DESCRIPTION OF DEBT SECURITIES

This prospectus describes certain general terms and provisions of our debt securities. When we offer to sell a particular series of debt securities, we will describe the specific terms of the series in a supplement to this prospectus. The following description of debt securities will apply to the debt securities offered by this prospectus unless we provide otherwise in the applicable prospectus supplement. The applicable prospectus supplement for a particular series of debt securities may specify different or additional terms.

We may offer under this prospectus up to $150,000,000 aggregate principal amount of secured or unsecured debt securities, or if debt securities are issued at a discount, or in a foreign currency or composite currency, such principal amount as may be sold for an initial public offering price of up to $150,000,000. The debt securities may be either senior debt securities, senior subordinated debt securities or subordinated

debt securities. The debt securities offered hereby will be issued under an indenture between us and a trustee. A form of indenture, which will be qualified under, subject to, and governed by, the Trust Indenture Act of 1939, as amended, is filed as an exhibit to the registration statement.

General

The terms of each series of debt securities will be established by or pursuant to a resolution of our board of directors and detailed or determined in the manner provided in a board of directors’ resolution, an officers’ certificate or by an indenture. The particular terms of each series of debt securities will be described in a prospectus supplement relating to the series, including any pricing supplement.

We can issue debt securities that may be in one or more series with the same or various maturities, at par, at a premium or at a discount. We will set forth in a prospectus supplement, including any pricing supplement, relating to any series of debt securities being offered, the initial offering price, the aggregate principal amount and the following terms of the debt securities:

•

the title of the debt securities;

•

the price or prices (expressed as a percentage of the aggregate principal amount) at which we will sell the debt securities;

•

any limit on the aggregate principal amount of the debt securities;

•

the date or dates on which we will pay the principal on the debt securities;

•

the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date;

•

the place or places where the principal of, and premium and interest on, the debt securities will be payable;

•

the terms and conditions upon which we may redeem the debt securities;

•

any obligation we have to redeem or purchase the debt securities pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities;

•

the dates on which and the price or prices at which we will repurchase the debt securities at the option of the holders of debt securities and other detailed terms and provisions of these repurchase obligations;

•

the denominations in which the debt securities will be issued, if other than denominations of $1,000 and any integral multiple thereof;

•

whether the debt securities will be issued in the form of certificated debt securities or global debt securities;

•

the portion of principal amount of the debt securities payable upon declaration of acceleration of the maturity date, if other than the principal amount;

•

the currency of denomination of the debt securities;

•

the designation of the currency, currencies or currency units in which payment of principal of, and premium and interest on, the debt securities will be made;

•

if payments of principal of, and premium or interest on, the debt securities will be made in one or more currencies or currency units other than that or those in which the debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined;

•

the manner in which the amounts of payment of principal of, and premium or interest on, the debt securities will be determined, if these amounts may be determined by reference to an index based on a currency or currencies other than that in which the debt securities are denominated or designated to be payable or by reference to a commodity, commodity index, stock exchange index or financial index;

•

any provisions relating to any security provided for the debt securities;

•

any addition to or change in the events of default described in this prospectus or in the indenture with respect to the debt securities and any change in the acceleration provisions described in this prospectus or in the indenture with respect to the debt securities;

•

any addition to or change in the covenants described in this prospectus or in the indenture with respect to the debt securities;

•

any other terms of the debt securities, which may modify or delete any provision of the indenture as it applies to that series; and

•

any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities.

We may issue debt securities that are exchangeable and/or convertible into shares of our common stock or any class or series of preferred stock. The terms, if any, on which the debt securities may be exchanged and/or converted will be set forth in the applicable prospectus supplement. Such terms may include provisions for conversion, either mandatory, at the option of the holder or at our option, in which case the number of shares of common stock, preferred stock or other securities to be received by the holders of debt securities would be calculated as of a time and in the manner stated in the prospectus supplement.

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the federal income tax considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

If we denominate the purchase price of any of the debt securities in a foreign currency or currencies or a foreign currency unit or units, or if the principal of and any premium and interest on any series of debt securities is payable in a foreign currency or currencies or a foreign currency unit or units, we will provide you with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of debt securities and such foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Payment of Interest and Exchange

Each debt security will be represented by either one or more global securities registered in the name of The Depository Trust Company, as Depositary, or a nominee of the Depositary (we will refer to any debt security represented by a global debt security as a book-entry debt security), or a certificate issued in definitive registered form (we will refer to any debt security represented by a certificated security as a certificated debt security), as described in the applicable prospectus supplement.

Certificated Debt Securities

You may transfer or exchange certificated debt securities at the trustee’s office or paying agencies in accordance with the terms of the indenture. No service charge will be made for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with a transfer or exchange.

You may transfer certificated debt securities and the right to receive the principal of, and premium and interest on, certificated debt securities only by surrendering the old certificate representing those certificated debt securities and either we or the trustee will reissue the old certificate to the new holder or we or the trustee will issue a new certificate to the new holder.

Book-Entry Debt Securities

We may issue the debt securities of a series in the form of one or more book-entry debt securities that would be deposited with a depositary or its nominee identified in the prospectus supplement. We may issue book-entry debt securities in either temporary or permanent form. We will describe in the prospectus

supplement the terms of any depositary arrangement and the rights and limitations of owners of beneficial interests in any book-entry debt security.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase debt securities, common stock, preferred stock or other securities or any combination of the foregoing. We may issue warrants independently or together with other securities. Warrants sold with other securities may be attached to or separate from the other securities. We will issue warrants under one or more warrant agreements between us and a warrant agent that we will name in the prospectus supplement.

The prospectus supplement relating to any warrants that we may offer will include specific terms relating to the offering. We will file the form of any warrant agreement with the SEC, and you should read the warrant agreement for provisions that may be important to you. The prospectus supplement will include some or all of the following terms:

•

the title of the warrants;

•

the aggregate number of warrants offered;

•

the designation, number and terms of the debt securities, common stock, preferred stock or other securities purchasable upon exercise of the warrants, and procedures by which those numbers may be adjusted;

•

the exercise price of the warrants;

•

the dates or periods during which the warrants are exercisable;

•

the designation and terms of any securities with which the warrants are issued;

•

if the warrants are issued as a unit with another security, the date, if any, on and after which the warrants and the other security will be separately transferable;

•

if the exercise price is not payable in U.S. dollars, the foreign currency, currency unit or composite currency in which the exercise price is denominated;

•

any minimum or maximum amount of warrants that may be exercised at any one time;

•

any terms, procedures and limitations relating to the transferability, exchange, exercise, amendment or termination of the warrants; and

•

any adjustments to the terms of the warrants resulting from the occurrence of certain events or from the entry into or consummation by us of certain transactions.

As of June 29, 2023, we had (i) non-tradable warrants with an expiration date ranging from September 2023 to December 2024 to purchase 344,990 shares of common stock at a weighted average exercise price of $4.58 per share, and (iii) non-tradable pre-funded warrants expiring either in July 2023 or with no expiration date to purchase 8,522 shares of common stock at an exercise price of $2.25 per share.

DESCRIPTION OF UNITS

As specified in any applicable prospectus supplement, we may issue units consisting of one or more warrants, debt securities, shares of preferred stock, shares of common stock or any combination of such securities.

PLAN OF DISTRIBUTION

We may sell the securities in one or more of the following ways (or in any combination) from time to time:

•

to or through one or more underwriters or dealers in a public offering and sale by them;

•

directly to a limited number of purchasers or to a single purchaser;

•

through agents;

•

through block trades in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction; or

•

in any manner, as provided in the applicable prospectus supplement.

Each time we offer and sell securities under this prospectus, we will file a prospectus supplement. The prospectus supplement will state the terms of the offering of the securities, including:

•

the name or names of any underwriters, dealers or agents;

•

the purchase price of such securities and the proceeds to be received by us, if any;

•

any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation;

•

any public offering price;

•

any discounts or concessions allowed or reallowed or paid to dealers; and

•

any securities exchanges on which the securities may be listed.

Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

If we use underwriters in the sale, the securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including:

•

negotiated transactions;

•

at a fixed public offering price or prices, which may be changed;

•

at market prices prevailing at the time of sale;

•

at prices related to prevailing market prices; or

•

at negotiated prices.

Unless otherwise stated in a prospectus supplement, the obligations of the underwriters to purchase any securities will be conditioned on customary closing conditions and the underwriters will be obligated to purchase all of such series of securities, if any are purchased.

We may sell the securities through agents from time to time. The prospectus supplement will name any agent involved in the offer or sale of the securities and any commissions we pay to them. Generally, any agent will be acting on a best efforts basis for the period of its appointment.

We may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the securities from us at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

Underwriters and agents may be entitled under agreements entered into with us to indemnification by us against certain civil liabilities, including liabilities under the Securities Act, or to contribution with respect to payments which the underwriters or agents may be required to make. Underwriters and agents may be customers of, engage in transactions with, or perform services for us and our affiliates in the ordinary course of business.

Each series of securities will be a new issue of securities and will have no established trading market other than the common stock which is listed on the Nasdaq Capital Market. Any underwriters to whom securities are sold for public offering and sale may make a market in the securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice. The securities, other than the common stock, may or may not be listed on a national securities exchange.

EXPERTS

The consolidated financial statements of Onconova Therapeutics, Inc. appearing in Onconova Therapeutics, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2022 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern as described in Note 1 to the consolidated financial statements), included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

LEGAL MATTERS

The validity of the securities being offered by this prospectus will be passed upon by Morgan, Lewis & Bockius LLP, Philadelphia, Pennsylvania.

PART II

Information Not Required in Prospectus

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the expenses (other than underwriting discounts and commissions) to be incurred by us in connection with the registration, issuance and distribution of the securities described in this registration statement being registered hereby.

| |

Securities and Exchange Commission registration fee

|

|

|

|

$ |

11,665.68(1) |

|

|

| |

FINRA fee (if applicable)

|

|

|

|

|

*

|

|

|

| |

Printing expenses

|

|

|

|

|

*

|

|

|

| |

Legal fees and expenses

|

|

|

|

|

*

|

|

|

| |

Accounting fees and expenses

|

|

|

|

|

*

|

|

|

| |

Transfer agent and trustee fees and expenses

|

|

|

|

|

*

|

|

|

| |

Miscellaneous

|

|

|

|

|

*

|

|

|

| |

Total

|

|

|

|

$ |

*

|

|

|

(1)

See Exhibit 107 to this Form S-3.

*

These fees are dependent on the type and number of securities offered and cannot be determined at this time. Additional information regarding estimated fees and expenses will be provided at the time that such information is required to be included in a prospectus supplement in accordance with Rule 430B.

Item 15. Indemnification of Directors and Officers

We are incorporated under the laws of the State of Delaware. Section 145 of the Delaware General Corporation Law provides that a Delaware corporation may indemnify any persons who are, or are threatened to be made, parties to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person was an officer, director, employee or agent of such corporation, or is or was serving at the request of such person as an officer, director, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided that such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal. A Delaware corporation may indemnify any persons who are, or are threatened to be made, a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason of the fact that such person was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit provided that such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses which such officer or director has actually and reasonably incurred. Our certificate of incorporation and bylaws provide for the indemnification of our directors and officers to the fullest extent permitted under the Delaware General Corporation Law.

Section 102(b)(7) of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duties as a director, except for liability for any:

•

transaction from which the director derives an improper personal benefit;

•

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

•

unlawful payment of dividends or redemption of shares; or

•

breach of a director’s duty of loyalty to the corporation or its stockholders.

Our certificate of incorporation includes such a provision. Expenses incurred by any officer or director in defending any such action, suit or proceeding in advance of its final disposition shall be paid by us upon delivery to us of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to be indemnified by us.

As permitted by the Delaware General Corporation Law, we have entered into indemnification agreements with our directors and executive officers. These agreements, among other things, require us to indemnify each director and officer to the fullest extent permitted by law and advance expenses to each indemnitee in connection with any proceeding in which indemnification is available.

At present, there is no pending litigation or proceeding involving any of our directors or executive officers as to which indemnification is required or permitted, and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

We have an insurance policy covering our officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act.

Item 16. Exhibits

A list of exhibits filed herewith is contained in the exhibit index that immediately precedes such exhibits and is incorporated herein by reference.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6)

That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(8)

To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Act.

EXHIBIT INDEX

|

Exhibit No.

|

|

|

Description of Exhibit

|

|

|

1.1*

|

|

|

Underwriting Agreement

|

|

|

3.1

|

|

|

Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc. (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on July 30, 2013)

|

|

|

3.2

|

|

|

Certificate of Amendment to Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc. (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on May 31, 2016)

|

|

|

3.3

|

|

|

Certificate of Amendment to Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc., as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on March 22, 2018)

|

|

|

3.4

|

|

|

Certificate of Amendment to Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc., as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on June 8, 2018)

|

|

|

3.5

|

|

|

Certificate of Amendment to Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc., as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on September 25, 2018)

|

|

|

3.6

|

|

|

Certificate of Designation of Series A Convertible Preferred Stock (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on February 8, 2018)

|

|

|

3.7

|

|

|

Certificate of Designation of Series B Convertible Preferred Stock (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on April 30, 2018)

|

|

|

3.8

|

|

|

Certificate of Amendment to the Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc., as amended (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on May 20, 2021).

|

|

|

3.9

|

|

|

Certificate of Amendment to the Tenth Amended and Restated Certificate of Incorporation of Onconova Therapeutics, Inc., as amended (Incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on May 20, 2021).

|

|

|

3.10

|

|

|

Amended and Restated Bylaws of Onconova Therapeutics, Inc. (Incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on July 30, 2013)

|

|

|

4.1

|

|

|

Form of Certificate of Common Stock (Incorporated by reference to Exhibit 4.1 to Pre-Effective Amendment No. 1 the Company’s Registration Statement on Form S-1 filed on July 11, 2013)

|

|

|

4.2

|

|

|

Eighth Amended and Restated Stockholders’ Agreement, effective as of July 27, 2012, by and among Onconova Therapeutics, Inc. and certain stockholders named therein (Incorporated by reference to Exhibit 4.2 to Pre-Effective Amendment No. 1 to the Company’s Registration Statement on Form S-1 filed on July 11, 2013)

|

|

|

4.3

|

|

|

Amendment No. 1 to Eighth Amended and Restated Stockholders’ Agreement, effective as of July 9, 2013 (Incorporated by reference to Exhibit 4.2 to Pre-Effective Amendment No. 1 the Company’s Registration Statement on Form S-1 filed on July 11, 2013)

|

|

|

4.4

|

|

|

Form of Warrant Certificate issued pursuant to Warrant Agreement, dated as of July 27, 2016, by and between Onconova Therapeutics, Inc. and Wells Fargo Bank, N.A., as Warrant Agent (Incorporated by reference to Exhibit 4.1 to the Company’s Quarterly Report on Form 10-Q filed on August 15, 2016)

|

|

|

4.5

|

|

|

Warrant Agreement, dated as of July 27, 2016, by and between Onconova Therapeutics, Inc. and Wells Fargo Bank, N.A., as Warrant Agent (Incorporated by reference to Exhibit 4.2 to the Company’s Quarterly Report on Form 10-Q filed on August 15, 2016)

|

|

|

4.6

|

|

|

Form of Pre-Funded Warrants issued as of July 27, 2016 (Incorporated by reference to Exhibit 4.3 to the Company’s Quarterly Report on Form 10-Q filed on August 15, 2016)

|

|

|

Exhibit No.

|

|

|

Description of Exhibit

|

|

|

4.7

|

|

|

Form of Underwriter Warrant issued as of February 12, 2018 ((Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on February 8, 2018)

|

|

|

4.8

|

|

|

Form of Preferred Stock Warrant issued as of February 12, 2018 (Incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed on February 8, 2018)

|

|

|

4.9

|

|

|

Form of Pre-Funded Warrant issued as of February 12, 2018 (Incorporated by reference to Exhibit 4.3 to the Company’s Current Report on Form 8-K filed on February 8, 2018)

|

|

|

4.10

|

|

|

Form of Preferred Stock Warrant issued as of May 1, 2018 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on April 30, 2018)

|

|

|

4.11

|

|

|

Form of Pre-Funded Warrant issued as of May 1, 2018 (Incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed on April 30, 2018)

|

|

|

4.12

|

|

|

First Amendment to Underwriter Series A Convertible Preferred Stock Purchase Warrant, dated as of September 24, 2018 (Incorporated by reference to Exhibit 4.1 to the Company’s Quarterly Report on Form 10-Q filed on November 14, 2018)

|

|

|

4.13

|

|

|

Form of Placement Agent Common Stock Purchase Warrant issued as of September 25, 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on September 25, 2019).

|

|

|

4.14

|

|

|

Form of Letter Amendment to Warrants, dated as of September 23, 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Quarterly Report on Form 10-Q filed on November 12, 2019).

|

|

|

4.15

|

|

|

Form of Common Stock Purchase Warrant, issued on November 25, 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on November 26, 2019).

|

|

|

4.16

|

|

|

Form of Pre-Funded Common Stock Warrant, issued on November 25, 2019 (Incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed on November 26, 2019).

|

|

|

4.17

|

|

|

Form of Placement Agent Common Stock Purchase Warrant, issued on November 25, 2019 (Incorporated by reference to Exhibit 4.3 to the Company’s Current Report on Form 8-K filed on November 26, 2019).

|

|

|

4.18

|

|

|

Form of Common Stock Purchase Warrant, issued on December 10, 2019 (Incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K filed on December 10, 2019).

|

|

|

4.19

|

|

|

Form of Placement Agent Common Stock Purchase Warrant, issued on December 10, 2019 (Incorporated by reference to Exhibit 4.2 of the Company’s Current Report on Form 8-K filed on December 10, 2019).

|

|

|

4.20

|

|

|

Form of Common Stock Purchase Warrant, issued on December 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 19, 2019).

|

|

|

4.21

|

|

|

Form of Placement Agent Common Stock Purchase Warrant issued as of December 19, 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 19, 2019).

|

|

|

4.22*

|

|

|

Form of Placement Agent Common Stock Purchase Warrant issued as of December 19, 2019 (Incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 19, 2019).

|

|

|

4.23*

|

|

|

Form of any Certificate of Designation setting forth the preferences and rights with respect to any preferred stock issued hereunder

|

|

|

4.24

|

|

|

Form of Indenture (Incorporated by reference to Exhibit 4.6 to the Company’s Registration Statement on Form S-3 filed on October 8, 2014)

|

|

|

4.25*

|

|

|

Form of Debt Securities

|

|

*

To be filed by amendment or as an exhibit to a report pursuant to Section 13(a), 13(c) or 15(d) of the Exchange Act.

**

To be filed by amendment in accordance with the requirements of Section 305(b)(2) of the Trust Indenture Act of 1939 and Rule 5b-3 thereunder.

***

Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Newtown, Pennsylvania on June 30, 2023.

Onconova Therapeutics, Inc.

By:

/s/ Steven M. Fruchtman, M.D.

Name:

Steven M. Fruchtman, M.D.

Title:

President and Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that the undersigned officers and directors of Onconova Therapeutics, Inc., a Delaware corporation (the “Corporation”), hereby constitute and appoint each of Steven M. Fruchtman and Mark Guerin the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority in said agents and attorneys-in-fact, and in any one or more of them, to sign for the undersigned and in their respective names as an officer/director of the Corporation, any and all amendments (including post-effective amendments) to this registration statement on Form S-3 (or any other registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act) and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, and with full power of substitution, hereby ratifying and confirming all that each of said attorneys-in-fact, or his substitute or substitutes, may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on June 30, 2023.

| |

Name

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ Steven M. Fruchtman, M.D.

Steven M. Fruchtman, M.D.

|

|

|

Director, President and Chief Executive Officer (Principal Executive Officer)

|

|

|

June 30, 2023

|

|

| |

/s/ Mark Guerin

Mark Guerin

|

|

|

Chief Operating Officer and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

|

|

June 30, 2023

|

|

| |