ECARX Holdings, Inc. (Nasdaq: ECX) ("ECARX" or the “Company”), a

global mobility tech provider, today reported financial results for

the quarter ended June 30, 2023.

Commenting on the results, ECARX Co-founder, Chairman and CEO

Ziyu Shen said: “The pace of business accelerated in the second

quarter, reflecting strong demand for our customers’ vehicles. Our

automotive OEM partners are capturing the imagination of new car

buyers with modern and exciting in-car experiences enabled by our

products. We recently announced powerful new digital cockpit

solutions that are both enabling existing customers to create a

more innovative experience in their vehicles and attracting

interest from new automotive OEMs. Our experience in both hardware

and software, and roots in both automotive and tech, give us a

unique position in the industry.”

Second Quarter 2023 Financial Results

During the quarter, ECARX acquired a controlling financial

interest in JICA Intelligent Robotics Co. Ltd. (“JICA”), an entity

under common control. Comparative financial information is

presented by combining assets, liabilities, revenues, expenses and

equity of ECARX and JICA using the pooling-of interests method. All

intercompany transactions and balances between the combining

entities have been eliminated.

- Total revenue of RMB952.3 million (US$131.4

million), up 45% year-over-year (“YoY”)

- Sales of goods revenue of RMB670.4 million

(US$92.5 million), up 87% YoY, primarily driven by the ramp-up of

new digital cockpit sales volumes and the shift in portfolio

revenue mix shift from infotainment head unit (IHU) to digital

cockpit, which has a higher total revenue per unit

- Software license revenue of

RMB113.3 million (US$15.6 million), up 212% YoY, mostly due to

revenue generated from two procurement framework agreements for

intellectual property licenses

- Service revenue of RMB168.6 million (US$23.3

million), down 36% YoY, mostly as a result of timing differences in

non-recurring engineering revenue (NRE), which is expected to now

be booked in the second half of 2023

- Total cost of revenue was RMB654.7 million

(US$90.3 million), up 77% YoY, as a result of certain non-recurring

strategic engineering contracts and the incurrence of outsourcing

costs in relation to our connected services contracts during the

quarter

- Gross profit of RMB297.6 million (US$41.1

million), up 3% YoY, giving a gross margin of 31%

- Research and development expenses were

RMB243.7 million (US$33.6 million), down 21% YoY as a result of the

cessation of our ADAS perception software development last

year

- Selling, general and administrative expenses and

others, net were RMB221.8 million (US$30.6 million), down

30% YoY, due to much lower share-based compensation expense during

the quarter

- Net loss of RMB191.8 million (US$26.5

million), a 31% improvement YoY and a 13% improvement QoQ

- Adjusted EBITDA (non-GAAP) loss of RMB158.0

million (US$21.8 million), up from a loss of RMB95.0 million from

the same period last year, as a result of higher foreign currency

exchange losses and lower government grants on a YoY basis

- Total cash of RMB925.4 million (US$127.6

million) – including RMB75.0 million (US$10.3 million) in

restricted cash) as of June 30, 2023

Second Quarter 2023 Operational and Product

Updates

- Expanding international presence

- San-Diego-based Chief Technology Officer appointed to lead

ECARX’s advanced automotive IP development and drive ECARX's

technology strategy

- ECARX products deployed in more than 5.2 million vehicles as of

June 30, 2023

- Powering the evolution of advanced driver-assistance

systems (ADAS) and software-defined vehicles

- Increased investment from 50% to 70% to gain a controlling

stake in JICA, a technology company focusing on developing

intelligent automotive products.

- Launching Lynk &Co 08 with ECARX Antora 1000 Pro, ECARX

Cloudpeak, assisted and automated driving control unit with L2+

ADAS and Flyme Auto, co-developed with Xingji Meizu Group

Conference Call and Webcast DetailsECARX will

host a webcast of its earnings conference call today, Wednesday,

August 9, 2023, at 8:00 a.m. EDT. To access the webcast, visit the

Events & Presentations section of the ECARX Investor Relations

website, or visit the following link –

https://edge.media-server.com/mmc/p/szjs3bnj.

To join the earnings call by telephone, participants must

pre-register at

https://register.vevent.com/register/BIa5f55fa373b04b9da735e023219fe58a

to receive dial-in information.

A replay of the webcast and presentation materials will be

available on the Company’s Investor Relations website under the

results and reports section following the event.

About ECARXECARX (Nasdaq: ECX) is a global

mobility tech provider partnering with OEMs to reshape the

automotive landscape as the industry transitions to an all-electric

future. As OEMs develop new vehicle platforms from the ground up,

ECARX is developing a full-stack solution – central computer,

System-on-a-Chip (SoCs) and software to help continuously improve

the in-car user experience. The Company’s products have been

integrated into more than 5.2 million cars worldwide, and it

continues to shape the interaction between people and vehicles by

rapidly advancing the technology at the heart of smart

mobility.

ECARX was founded in 2017 and today we have around 2,000 team

members. The co-founders are two automotive entrepreneurs, Chairman

and CEO Ziyu Shen, and Eric Li (Li Shufu), who is also the founder

and chairman of Zhejiang Geely Holding Group – one of the largest

automotive groups in the world, with ownership interests in

international brand OEMs including Lotus, Lynk & Co, Polestar,

smart and Volvo Cars.

Forward-Looking StatementsThis release contains

statements that are forward-looking statements within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995. These

statements are based on management’s beliefs and expectations as

well as on assumptions made by and data currently available to

management, appear in a number of places throughout this document

and include statements regarding, amongst other things, results of

operations, financial condition, liquidity, prospects, growth,

strategies and the industry in which we operate. The use of words

“expects,” “intends,” “anticipates,” “estimates,” “predicts,”

“believes,” “should,” “potential,“ “may,” “preliminary,”

“forecast,” “objective,” “plan,” or “target,” and other similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance and are subject to a number of risks and uncertainties

that could cause actual results to differ materially, including,

but not limited to statements regarding our intentions, beliefs or

current expectations concerning, among other things, results of

operations, financial condition, liquidity, prospects, growth,

strategies, future market conditions or economic performance and

developments in the capital and credit markets and expected future

financial performance, and the markets in which we operate.

For a discussion of these and other risks and uncertainties that

could cause actual results to differ materially from those

expressed in any forward-looking statement, see ECARX’s filings

with the U.S. Securities and Exchange Commission. ECARX undertakes

no obligation to update or revise and forward-looking statements to

reflect subsequent events or circumstances, except as required by

applicable law.

Translation of results into U.S. dollarsThis

announcement contains translations of certain renminbi (RMB)

amounts into U.S dollars (US$) at a specified rate solely for the

convenience of the reader. Unless otherwise noted, the translation

of renminbi into U.S. dollars has been made at RMB7.2513 to

US$1.00, the noon buying rate in effect on June 30, 2023 as set

forth in the H.10 Statistical Release of The Board of Governors of

the Federal Reserve System. We make no representation that any

renminbi or U.S. dollar amounts could have been, or could be,

converted into U.S. dollars or renminbi, as the case may be, at any

particular rate, or at all.

Non-GAAP Financial MeasureThe Company uses

adjusted EBITDA (non-GAAP) in evaluating its operating results and

for financial and operational decision-making purposes. Adjusted

EBITDA is defined as net loss excluding interest income, interest

expense, income tax expenses, depreciation of property and

equipment, amortization of intangible assets, and share-based

compensation expenses.

The Company presents the non-GAAP financial measure because it

is used by the management to evaluate the Company’s operating

performance and formulate business plans. The Company believes that

the non-GAAP measure helps identify underlying trends in its

business that could otherwise be distorted by the effects of

foreign currency translation and certain expenses that are included

in net loss. The Company also believes that the use of the non-GAAP

measure facilitates investors’ assessment of its operating

performance. To calculate revenue growth rates in constant

currency, the Company converts actual net sales from local currency

to U.S. dollars using constant foreign currency exchange rates in

the current and prior period.

Adjusted EBITDA (non-GAAP) should not be considered in isolation

or construed as alternatives to net loss or any other measures of

performance or as indicators of the Company’s operating

performance. Investors are encouraged to compare the Company’s

historical adjusted EBITDA (non-GAAP) to the most directly

comparable GAAP measure, net loss. Adjusted EBITDA (non-GAAP)

presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to the Company’s data. The Company encourages

investors and others to review the financial information in its

entirety and not rely on a single financial measure.

For more information on the non-GAAP financial measure, please

see the table captioned “Unaudited Reconciliation of GAAP and

Non-GAAP Results” set forth at the end of this press release.

Investor Contacts:Adam Kay, +44 (0)7796 954086,

ir@ecarxgroup.com

Media Contacts:ECARX@blueshirtgroup.com

ECARX Holdings Inc.Condensed Balance Sheets

| |

|

|

|

| |

|

As of December 31, 2022 |

As of June 30,

2023(Unaudited) |

|

Millions, otherwise noted |

|

RMB |

RMB |

USD |

| ASSETS |

|

|

|

|

| Current

assets |

|

|

|

|

| Cash |

|

860.5 |

850.4 |

117.3 |

| Restricted cash |

|

41.0 |

75.0 |

10.3 |

| Accounts receivable – third

parties, net |

|

418.2 |

288.2 |

39.7 |

| Account receivable – related

parties, net |

|

835.3 |

804.3 |

110.9 |

| Notes receivable |

|

179.1 |

78.0 |

10.8 |

| Inventories |

|

182.6 |

186.2 |

25.7 |

| Amounts due from related

parties |

|

911.7 |

140.2 |

19.3 |

| Prepayments and other current

assets |

|

424.9 |

678.1 |

93.6 |

| Total current

assets |

|

3,853.3 |

3,100.4 |

427.6 |

| |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Long-term investments |

|

353.9 |

363.6 |

50.1 |

| Operating lease right-of-use

assets |

|

99.7 |

121.3 |

16.7 |

| Property and equipment,

net |

|

139.6 |

130.4 |

18.0 |

| Intangible assets, net |

|

44.9 |

38.8 |

5.4 |

| Other non-current assets –

third parties |

|

26.0 |

28.6 |

3.9 |

| Other non-current assets –

related parties |

|

213.7 |

218.9 |

30.2 |

| Total non-current

assets |

|

877.8 |

901.6 |

124.3 |

| Total

assets |

|

4,731.1 |

4,002.0 |

551.9 |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Short-term borrowings |

|

870.0 |

870.0 |

120.0 |

| Accounts payable - third

parties |

|

1,445.2 |

1,138.0 |

156.9 |

| Accounts payable - related

parties |

|

241.8 |

101.1 |

13.9 |

| Notes payable |

|

168.4 |

116.4 |

16.1 |

| Amounts due to related

parties |

|

42.8 |

341.2 |

47.1 |

| Contract liabilities, current

- third parties |

|

4.7 |

6.1 |

0.8 |

| Contract liabilities, current

- related parties |

|

316.7 |

386.3 |

53.3 |

| Current operating lease

liabilities |

|

31.1 |

30.2 |

4.2 |

| Accrued expenses and other

current liabilities |

|

785.3 |

511.7 |

70.6 |

| Income tax payable |

|

21.6 |

21.5 |

3.0 |

| Total current

liabilities |

|

3,927.6 |

3,522.5 |

485.9 |

| |

|

|

|

|

| Non-current

liabilities |

|

|

|

|

| Contract liabilities,

non-current - third parties |

|

0.1 |

- |

- |

| Contract liabilities,

non-current - related parties |

|

282.0 |

204.0 |

28.1 |

| Convertible notes payable, non

current |

|

439.9 |

464.3 |

64.0 |

| Operating lease liabilities,

non-current |

|

68.8 |

108.3 |

14.9 |

| Warrant liabilities,

non-current |

|

16.5 |

12.5 |

1.7 |

| Other non-current

liabilities |

|

30.7 |

35.0 |

4.8 |

| Total non-current

liabilities |

|

838.0 |

824.1 |

113.5 |

| Total

liabilities |

|

4,765.6 |

4,346.6 |

599.4 |

| |

|

|

|

|

ECARX Holdings Inc.Condensed Balance Sheets

(continued)

| |

|

|

|

| |

|

As of December 31, 2022 |

As of June 30,

2023(Unaudited) |

|

Millions, otherwise noted |

|

RMB |

RMB |

USD |

| SHAREHOLDERS'

DEFICIT |

|

|

|

|

| Ordinary Shares |

|

- |

- |

- |

| Additional paid-in

capital |

|

5,919.7 |

5,971.9 |

823.6 |

| Accumulated deficit |

|

(5,730.2) |

(6,110.8) |

(842.7) |

| Accumulated other

comprehensive loss |

|

(385.9) |

(336.9) |

(46.5) |

| Total

deficit attributable to ordinary shareholders |

(196.4) |

(475.8) |

(65.6) |

| Non-redeemable non-controlling

interests |

|

161.9 |

131.2 |

18.1 |

| Total shareholders'

deficit |

|

(34.5) |

(344.6) |

(47.5) |

| Liabilities and

shareholders' deficit |

|

4,731.1 |

4,002.0 |

551.9 |

| |

|

|

|

|

ECARX Holdings Inc.Condensed Consolidated

Statement of Operations

| |

|

|

|

| |

Six Months Ended |

|

Three Months Ended |

|

June 30 |

|

June 30 |

|

(Unaudited) |

|

(Unaudited) |

|

|

2022 |

2023 |

2023 |

|

2022 |

2023 |

2023 |

| Millions, otherwise noted |

RMB |

RMB |

USD |

|

RMB |

RMB |

USD |

| Revenue |

|

|

|

|

|

|

|

| Sales of goods revenue |

858.1 |

1,264.3 |

174.4 |

|

358.9 |

670.4 |

92.5 |

| Software license revenue |

79.0 |

215.6 |

29.7 |

|

36.3 |

113.3 |

15.6 |

| Service revenue |

376.9 |

237.5 |

32.8 |

|

262.6 |

168.6 |

23.3 |

| Total

revenue |

1,314.0 |

1,717.4 |

236.9 |

|

657.8 |

952.3 |

131.4 |

| Cost of goods sold |

(687.2) |

(1,000.2) |

(137.9) |

|

(282.9) |

(529.2) |

(73.0) |

| Cost of software licenses |

(29.6) |

(37.2) |

(5.1) |

|

(7.3) |

(7.0) |

(1.0) |

| Cost of services |

(169.2) |

(172.5) |

(23.8) |

|

(78.8) |

(118.5) |

(16.3) |

| Total cost of

revenue |

(886.0) |

(1,209.9) |

(166.8) |

|

(369.0) |

(654.7) |

(90.3) |

| Gross

profit |

428.0 |

507.5 |

70.1 |

|

288.8 |

297.6 |

41.1 |

|

|

32.57% |

29.55% |

|

|

43.90% |

31.25% |

|

| Research and development

expenses |

(644.0) |

(481.6) |

(66.4) |

|

(309.1) |

(243.7) |

(33.6) |

| Selling, General and

administrative expenses and others, net |

(461.6) |

(407.8) |

(56.2) |

|

(316.0) |

(221.8) |

(30.6) |

| Total operating

expenses |

(1,105.6) |

(889.4) |

(122.6) |

|

(625.1) |

(465.5) |

(64.2) |

| Loss from

operation |

(677.6) |

(381.9) |

(52.5) |

|

(336.3) |

(167.9) |

(23.1) |

| |

|

|

|

|

|

|

|

| Interest income |

5.3 |

17.9 |

2.5 |

|

3.4 |

9.5 |

1.3 |

| Interest expenses |

(15.8) |

(38.2) |

(5.3) |

|

(7.6) |

(20.1) |

(2.8) |

| Share of results of equity method

investments |

(52.5) |

(25.4) |

(3.5) |

|

(14.8) |

(13.5) |

(1.9) |

| Gain on deconsolidation of a

subsidiary |

72.0 |

- |

- |

|

- |

- |

- |

| Foreign currency exchange

gains/(losses) |

(10.7) |

(34.7) |

(4.8) |

|

(8.0) |

(36.9) |

(5.1) |

| Others, net |

92.8 |

51.4 |

7.1 |

|

91.2 |

37.2 |

5.1 |

| Loss before income

taxes |

(586.5) |

(410.9) |

(56.5) |

|

(272.1) |

(191.7) |

(26.5) |

| Income tax expenses |

(7.9) |

(0.3) |

- |

|

(7.6) |

(0.1) |

- |

| Net loss |

(594.4) |

(411.2) |

(56.5) |

|

(279.7) |

(191.8) |

(26.5) |

| Net loss attributable to

non-redeemable non-controlling interests |

12.7 |

30.7 |

4.2 |

|

2.1 |

15.9 |

2.2 |

| Net loss attributable to

redeemable non-controlling interests |

0.5 |

- |

- |

|

- |

- |

- |

| Net loss attributable to

ECARX Holdings Inc. |

(581.2) |

(380.5) |

(52.3) |

|

(277.6) |

(175.9) |

(24.3) |

| Accretion of redeemable

non-controlling interests |

(0.7) |

- |

- |

|

- |

- |

- |

| Net loss available to

ECARX Holdings Inc. |

(581.9) |

(380.5) |

(52.3) |

|

(277.6) |

(175.9) |

(24.3) |

| Accretion of Redeemable

Convertible Preferred Shares |

(177.8) |

- |

- |

|

(91.8) |

- |

- |

| Net loss attributable to

ECARX Holdings Inc. ordinary shareholders |

(759.7) |

(380.5) |

(52.3) |

|

(369.4) |

(175.9) |

(24.3) |

| |

|

|

|

|

|

|

|

ECARX Holdings Inc.Condensed Consolidated

Statement of Operations (continued)

| |

|

|

|

| |

Six Months Ended |

|

Three Months Ended |

|

June 30 |

|

June 30 |

|

(Unaudited) |

|

(Unaudited) |

|

|

2022 |

2023 |

2023 |

|

2022 |

2023 |

2023 |

| Millions, otherwise noted |

RMB |

RMB |

USD |

|

RMB |

RMB |

USD |

| Net loss |

(594.4) |

(411.2) |

(56.5) |

|

(279.7) |

(191.8) |

(26.5) |

| Other comprehensive

loss: |

|

|

|

|

|

|

|

| Foreign currency translation

adjustments, net of nil income taxes |

(214.3) |

49.0 |

6.8 |

|

(223.1) |

50.6 |

7.0 |

| Comprehensive

loss |

(808.7) |

(362.2) |

(49.7) |

|

(502.8) |

(141.2) |

(19.5) |

| Comprehensive loss attributable

to non-redeemable non-controlling interests |

12.7 |

30.7 |

4.2 |

|

2.1 |

15.9 |

2.2 |

| Comprehensive loss attributable

to redeemable non-controlling interests |

0.5 |

- |

- |

|

- |

- |

- |

| Comprehensive loss

attributable to ECARX Holdings Inc. |

(795.5) |

(331.5) |

(45.5) |

|

(500.7) |

(125.3) |

(17.3) |

|

|

|

|

|

|

|

|

|

| Loss per ordinary

share |

|

|

|

|

|

|

|

| – Basic and diluted loss per

share, ordinary shares |

(3.22) |

(1.13) |

(0.16) |

|

(1.56) |

(0.52) |

(0.07) |

| Weighted average number

of ordinary shares used in computing loss per ordinary

share |

|

|

|

|

|

|

|

| – Weighted average number of

ordinary shares |

236,248,112 |

337,395,390 |

337,395,390 |

|

236,248,112 |

337,395,390 |

337,395,390 |

| |

|

|

|

|

|

|

|

ECARX Holdings Inc.Unaudited Reconciliation of

GAAP and Non-GAAP Results

Adjusted EBITDAWe use adjusted EBITDA in

evaluating our operating results and for financial and operational

decision-making purposes. Adjusted EBITDA is defined as net loss

excluding interest income, interest expense, income tax expenses,

depreciation of property and equipment, amortization of intangible

assets, and share-based compensation expenses.

Adjusted EBITDA should not be considered in isolation or

construed as alternatives to net loss or any other measures of

performance or as indicators of our operating performance.

Investors are encouraged to compare our historical adjusted EBITDA

to the most directly comparable GAAP measure, net loss. Adjusted

EBITDA presented here may not be comparable to similarly titled

measures presented by other companies. Other companies may

calculate similarly titled measures differently, limiting their

usefulness as comparative measures to our data. We encourage

investors and others to review our financial information in its

entirety and not rely on a single financial measure.

| |

|

|

| |

Six Months Ended |

Three Months Ended |

|

|

June 30 |

June 30 |

|

|

2022 |

2023 |

2023 |

2022 |

2023 |

2023 |

|

|

RMB |

RMB |

USD |

RMB |

RMB |

USD |

| Millions, otherwise noted |

|

|

|

|

|

|

| Net Loss |

(594.4) |

(411.2) |

(56.5) |

(279.7) |

(191.8) |

(26.5) |

| Interest income |

(5.3) |

(17.9) |

(2.5) |

(3.4) |

(9.5) |

(1.3) |

| Interest expense |

15.8 |

38.2 |

5.3 |

7.6 |

20.1 |

2.8 |

| Income tax expenses |

7.9 |

0.3 |

- |

7.6 |

0.1 |

- |

| Depreciation of property and

equipment |

24.4 |

27.1 |

3.7 |

11.2 |

13.0 |

1.8 |

| Amortization of intangible

assets |

11.8 |

12.0 |

1.7 |

5.8 |

5.7 |

0.8 |

| EBITDA |

(539.8) |

(351.5) |

(48.3) |

(250.9) |

(162.4) |

(22.4) |

| Share-based compensation

expenses |

195.0 |

52.2 |

7.2 |

155.9 |

4.4 |

0.6 |

|

Adjusted EBITDA |

(344.8) |

(299.3) |

(41.1) |

(95.0) |

(158.0) |

(21.8) |

|

|

|

|

|

|

|

|

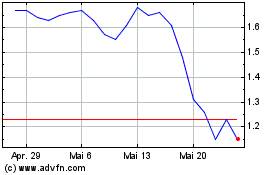

ECARX (NASDAQ:ECX)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

ECARX (NASDAQ:ECX)

Historical Stock Chart

Von Nov 2023 bis Nov 2024