As filed with the Securities

and Exchange Commission on July 29, 2024

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ANAVEX

LIFE SCIENCES CORP.

(Exact Name of Registrant as

Specified in Its Charter)

| Nevada |

|

|

98-0608404

|

| (State

or Other Jurisdiction of Incorporation or Organization) |

|

|

(I.R.S.

Employer Identification Number) |

630 5th Avenue, 20th Floor

New York, NY USA 10111

Telephone: (844) 689-3939

(Address, Including Zip Code,

and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher U. Missling,

PhD

Chief Executive Officer

630 5th Avenue, 20th Floor

New York, NY USA 10111

Telephone: (844) 689-3939

(Name, Address, Including Zip

Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Clayton Parker, Esq.

K&L Gates LLP

200 S. Biscayne Blvd., Ste.

3900

Miami, Florida 33131

Telephone: (305) 539-3306

Approximate date of commencement

of proposed sale to public: From time to time after this Registration Statement becomes effective.

If the only securities being

registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

| Large

accelerated filer |

|

|

☒ |

|

|

Accelerated

filer |

|

|

☐ |

| Non-accelerated

filer |

|

|

☐ |

|

|

Smaller

reporting company |

|

|

☒ |

| |

|

|

|

|

|

Emerging

growth company |

|

|

☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and subject to change. We may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

JULY 29, 2024

PROSPECTUS

ANAVEX LIFE SCIENCES CORP.

$150,000,000

of

Common Stock

Anavex Life Sciences Corp.,

a Nevada corporation (“us”, “we”, “our”, “Anavex” or the

“Company”) may offer and sell from time to time, in one or more series or issuances and on terms that we will determine

at the time of the offering, shares of our common stock, par value $0.001 per share described in this prospectus, up to an aggregate

amount of $150,000,000.

This prospectus describes

some of the general terms that may apply to an offering of our common stock. Each time we sell common stock pursuant to this prospectus,

we will file a prospectus supplement to this prospectus that contains specific information about the offering. Such supplements may also

add, update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus

supplement before you invest in our common stock. This prospectus may not be used to consummate sales of common stock unless accompanied

by a prospectus supplement.

Common stock may be sold directly

by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods.

See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering

of the common stock in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any common

stock in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them

in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in the sales agreement prospectus

as well as a prospectus supplement to this base prospectus.

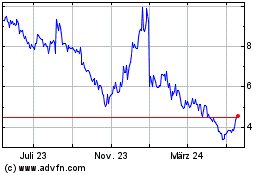

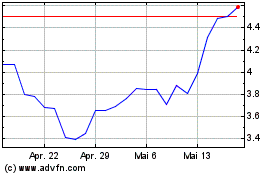

Our common stock is currently

quoted on The Nasdaq Capital Market under the symbol “AVXL”. On July 22, 2024, the last reported sale price of our common

stock was $5.91 per share.

Investing in our securities

involves a high degree of risk. See the section entitled “Risk Factors” on page 11 of this prospectus and in the documents

we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks and uncertainties

you should consider.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2024.

TABLE OF CONTENTS

No dealer, salesperson

or other person has been authorized to give any information or to make any representations other than those contained or incorporated

by reference in this prospectus or any accompanying prospectus supplement in connection with the offer made by this prospectus or any

accompanying prospectus supplement and, if given or made, such information or representations must not be relied upon as having been

authorized by Anavex Life Sciences Corp. or any such person. Neither the delivery of this prospectus or any accompanying prospectus supplement

nor any sale made hereunder and thereunder shall under any circumstances create an implication that there has been no change in the affairs

of Anavex Life Sciences Corp. since the date hereof. This prospectus or any accompanying prospectus supplement does not constitute an

offer or solicitation by anyone in any state in which such offer or solicitation is not authorized or in which the person making such

offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

ABOUT THIS PROSPECTUS

This prospectus of Anavex

Life Sciences Corp., a Nevada corporation (collectively with all of its subsidiaries, the “Company”, “Anavex”,

or “we”, “us”, or “our”) is a part of a registration statement on Form S-3 that

we filed with the Securities and Exchange Commission (“SEC”) utilizing a “shelf” registration process.

Under this shelf registration process, we may, from time to time, sell shares of common stock in one or more offerings up to a total

dollar amount of $150,000,000 as described in this prospectus.

The registration statement

of which this prospectus is a part provides additional information about us and the securities offered under this prospectus. The registration

statement, including the exhibits and the documents incorporated herein by reference, can be read on the SEC website or at the SEC offices

mentioned under the heading “Prospectus Summary - Where You Can Find More Information.”

We will provide a prospectus

supplement containing specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus

supplement may add, update or change information in this prospectus. If the information in the prospectus is inconsistent with a prospectus

supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable,

any prospectus supplement. See “Prospectus Summary — Where You Can Find More Information” for more information.

You should rely only on the

information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation

is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful

to make an offer or solicitation. You should not assume that the information in this prospectus or any prospectus supplement, as well

as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement,

is accurate as of any date other than the date of such document. Our business, financial condition, results of operations and prospects

may have changed since those dates.

PROSPECTUS SUMMARY

The items in the following

summary are described in more detail later in this prospectus. This summary does not contain all of the information you should consider.

Before investing in our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning

on page 10 and the financial statements incorporated by reference.

Our Business

Anavex Life Sciences Corp.

is a clinical stage biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine

to central nervous system (“CNS”) diseases with high unmet need. We analyze genomic data from clinical trials to identify

biomarkers, which we use in the analysis of our clinical trials.

Our lead product candidate,

ANAVEX®2-73 (blarcamesine), is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially

other central nervous system diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder

caused by mutations in the X-linked gene, methyl-CpG-binding protein 2 (“MECP2”).

We currently have two core

programs and two seed programs. Our core programs are at various stages of clinical and preclinical development, in neurodegenerative

and neurodevelopmental diseases.

Clinical Trials Overview

Alzheimer’s Disease

In November 2016, we completed

a Phase 2a clinical trial, consisting of Part A and Part B, which lasted a total of 57 weeks, for ANAVEX®2-73 in mild-to-moderate

Alzheimer’s patients. This open-label randomized trial in Australia met both primary and secondary endpoints and was designed to

assess the safety and exploratory efficacy of ANAVEX®2-73 in 32 patients. ANAVEX®2-73 targets sigma-1 and

muscarinic receptors, which have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular

homeostasis and to reverse the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented positive pharmacokinetic

(“PK”) and pharmacodynamic (“PD”) data from the Phase 2a clinical trial, which established a concentration-effect

relationship between ANAVEX®2-73 and trial measurements. These measures obtained from all patients who participated in

the entire 57 weeks include exploratory cognitive and functional scores as well as biomarker signals of brain activity. Additionally,

the clinical trial appeared to show that ANAVEX®2-73 activity was enhanced by its active metabolite (ANAVEX19-144), which

also targets the SIGMAR1 receptor and has a half-life approximately twice as long as the parent molecule.

Two consecutive trial extensions

for the Phase 2a trial have allowed participants who completed the 52-week Part B of the trial to continue taking ANAVEX®2-73,

providing an opportunity to gather extended safety data for a cumulative time period of five years. In August 2020, patients completing

these Phase 2a trial extensions were granted continued access to treatment with ANAVEX®2-73 through the Australian Government

Department of Health - Therapeutic Goods Administration’s compassionate use Special Access Scheme.

A larger Phase 2b/3 double-blind,

placebo-controlled trial of ANAVEX®2-73 in Alzheimer’s disease commenced in August 2018. The Phase 2b/3 trial enrolled

509 patients, which were treated with a convenient once-daily oral formulation of ANAVEX®2-73 for 48 weeks, randomized

1:1:1 to two different ANAVEX®2-73 doses or placebo. The trial took place at 52 sites across North America, Europe and

Australia. Primary and secondary endpoints to assess safety and both cognitive and functional efficacy, were measured through the Alzheimer’s

Disease Assessment Scale - Cognitive Subscale test (“ADAS-Cog”), Alzheimer’s Disease Cooperative Study - Activities

of Daily Living (“ADCS-ADL”) and Clinical Dementia Rating - Sum of Boxes for cognition and function (“CDR-SB”).

In addition to the primary endpoints, the ANAVEX®2-73 Phase 2b/3 trial design incorporated pre-specified statistical analyses

related to potential genomic precision medicine biomarkers previously identified in the ANAVEX®2-73 Phase 2a clinical

trial. The trial was completed in mid-2022 and, in December 2022, the Company presented positive topline results from the Phase 2b/3

clinical trial.

Blarcamesine

significantly slowed clinical progression by 38.5% and 34.6% at 48 weeks

in 50 mg and 30 mg groups vs. placebo, respectively, on the prespecified primary cognitive endpoint ADAS-Cog13. The protocol was

designed with ADAS-Cog13 and ADCS-ADL as co-primary endpoints. The functional co-primary endpoint, ADCS-ADL, was trending positive but

did not reach significance at Week 48. The prespecified key secondary composite endpoint CDR-SB, was significant at both 30 mg and 50

mg at Week 48. The findings are supported by biomarkers, including plasma Aβ42/40-ratio and reduction of brain atrophy. Blarcamesine

significantly slowed brain atrophy in key regions of interest, including the whole brain by 37.6%, total grey matter by 63.5%, and lateral

ventricles by 25.1%.

For the

primary endpoint ADAS-Cog13, blarcamesine is significantly better than placebo for both 50 mg (−2.149; P = 0.021) at 48 weeks and

for 30 mg blarcamesine dosage groups (−1.934; P = 0.026) at 48 weeks. The key secondary endpoint CDR-SB was significantly improved

vs. placebo in both 50 mg (−0.465; P = 0.045) and 30 mg (−0.502; P = 0.020) assigned dose groups. CGI-I was significantly

improved in both 50 mg (−0.314; P = 0.008) and 30 mg (−0.248; P = 0.024) groups.

In the respective safety population,

common treatment-emergent adverse events included dizziness, which was transient and mostly mild to moderate in severity, and occurred

in 120 participants (35.8%) during titration and in 76 participants (25.2%) during maintenance with ANAVEX®2-73 and 10 (6.0%) during

titration and 9 (5.6%) during maintenance with placebo.

A subsequent long-term open

label extension study of ANAVEX®2-73, entitled the ATTENTION-AD trial was initiated for patients who completed the 48-week

Phase 2b/3 placebo-controlled trial referenced above. This trial extension for a duration of up to 96 additional weeks was completed

in June 2024. The trial will provide longer term safety and efficacy of ANAVEX®2-73 in persons with Alzheimer’s

disease.

Rett Syndrome

In February 2016, we presented

positive preclinical data for ANAVEX®2-73 in Rett syndrome, a rare neurodevelopmental disease. The data demonstrated dose

related and significant improvements in an array of behavioral and gait paradigms in a mouse model with an MECP2-null mutation that causes

neurological symptoms that mimic Rett syndrome. The study was funded by the International Rett Syndrome Foundation (“Rettsyndrome.org”).

In January 2017, we were awarded a financial grant from Rettsyndrome.org of a minimum of $0.6 million to cover some of the costs of a

multicenter Phase 2 clinical trial of ANAVEX®2-73 for the treatment of Rett syndrome. This award was received in quarterly

instalments which commenced during fiscal 2018.

In March 2019, we commenced

the first Phase 2 clinical trial in a planned Rett syndrome program of ANAVEX®2-73 for the treatment of Rett syndrome.

The clinical trials are being conducted in a range of patient age demographics and geographic regions, utilizing an oral liquid once-daily

formulation of ANAVEX®2-73.

The first Phase 2 trial, (ANAVEX®2-73-RS-001),

which took place in the United States, was completed in December 2020. This trial was a randomized double-blind, placebo-controlled safety,

tolerability, PK and efficacy trial of oral liquid ANAVEX®2-73 formulation in 25 adult female patients with Rett syndrome

over a 7-week treatment period including ANAVEX®2-73-specific genomic precision medicine biomarkers. The primary endpoint

of the trial was safety. The dosing of 5 mg ANAVEX®2-73 was well-tolerated and demonstrated dose-proportional PK. All

secondary efficacy endpoints of the trial showed statistically significant and clinically meaningful response in the Rett Syndrome Behaviour

Questionnaire (“RSBQ”) response, when compared to placebo, in the intent to treat (“ITT”) cohort

(all participants, p = 0.011). 66.7% of ANAVEX®2-73 treated subjects showed a statistically significant improvement in

RSBQ response as compared to 10% of the subjects on placebo in the ITT cohort (all participants, p = 0.011). ANAVEX®2-73

treatment resulted in a sustained improvement in Clinical Global Impression Improvement (CGI-I) response throughout the 7-week clinical

trial, when compared to placebo in the ITT cohort (all participants, p = 0.014). Consistent with previous ANAVEX®2-73

clinical trials, patients carrying the common form of the SIGMAR1 gene treated with ANAVEX®2-73 experienced stronger improvements

in the prespecified efficacy endpoints.

The second, international

trial of ANAVEX®2-73 for the treatment of Rett syndrome, called the AVATAR trial, commenced in June 2019. This trial took

place in Australia and the United Kingdom using a higher dose than the U.S. based Phase 2 trial for Rett syndrome. The trial was a Phase

3 randomized, double-blind, placebo-controlled trial to evaluate the safety and efficacy of ANAVEX®2-73 in 33 adult patients

over a 7-week treatment period including ANAVEX®2-73 specific precision medicine biomarkers. Based upon the input from

the successful U.S. Phase 2 Rett syndrome trial (ANAVEX®2-73-RS-001), we updated the endpoints for the AVATAR trial (ANAVEX®2-73-RS-002)

to appropriately assess the clinically meaningful outcome following International Conference on Harmonization (ICH) guidelines. These

updates were approved by the respective regulatory authorities in the U.K. and in Australia, respectively, where the AVATAR trial was

conducted.

The data from the AVATAR trial

was released in February 2022. The clinical trial met all primary and secondary efficacy and safety endpoints, with consistent improvements

in primary efficacy endpoint, RSBQ response (p = 0.037), and secondary efficacy endpoints, Anxiety, Depression, and Mood Scale (ADAMS)

(p = 0.010) and CGI-I (p = 0.037) response. Efficacy endpoints demonstrated statistically significant and clinically meaningful reductions

in Rett syndrome symptoms. Convenient once daily oral liquid doses of up to 30 mg of ANAVEX®2-73 were also well tolerated

with good medication compliance. All patients who participated in the trial were eligible to receive ANAVEX®2-73 under

a voluntary open label extension protocol and subsequent Compassionate Use Program.

The very first trial of ANAVEX®2-73

in pediatric Rett syndrome patients, the EXCELLENCE trial, completed enrollment in February 2023. This randomized, double-blind, placebo-controlled

Phase 2/3 trial in pediatric patients with Rett syndrome included trial sites in Canada, Australia, and the United Kingdom. 92 pediatric

patients with Rett syndrome between the ages of 5 through 17 years were treated daily with up to 30 mg ANAVEX®2-73. Participants

were randomized 2:1 (ANAVEX®2-73:placebo) for 12 weeks, followed by a week 16 safety visit and topline results from this

trial were announced in early January 2024.

After 12 weeks, the study

showed improvement on the key co-primary endpoint RSBQ, which is a detailed 45-item questionnaire for assessing multiple Rett syndrome

characteristics by the patients’ caregivers. The other co-primary endpoint, the CGI-I, which represents a less granular assessment

by the site investigators using a seven-point scoring (one=“very much improved” to seven=“very much worse”),

was not met.

In an ad-hoc analysis, using

the predefined mixed-effect model for repeated measure (MMRM) method, after 12 weeks of treatment, ANAVEX®2-73-treated

patients improved LS Mean (SE) -12.93 (2.150) points on their RSBQ total score compared to LS Mean (SE) -8.32 (2.537) points in placebo-treated

patients. The LS Mean difference (SE) of -4.61 (2.439) points between treated and placebo groups did not reach statistical significance

(n=77; p=0.063). ANAVEX®2-73-treated patients demonstrated a rapid onset of action with improvements at 4 weeks after

treatment with a RSBQ total score LS Mean (SE) -10.32 (2.086) points in the drug-treated group compared to a LS Mean (SE) -5.67 (2.413)

points in placebo-treated patients. The LS Mean difference of -4.65 (2.233) points between treated and placebo groups was statistically

significant (n=77; p=0.041).

The key secondary endpoint,

the ADAMS, trended favorably. In the same analysis, scores for all RSBQ and ADAMS subscales improved over the course of the study. Collectively,

the RSBQ and ADAMS demonstrated improvements in multiple areas, impacting positively in particular repetitive movements, nighttime disruptive

behaviors, and social avoidance.

A preliminary review of the

safety results indicates there were no new safety signals in the EXCELLENCE study, reinforcing the favorable and manageable safety profile

observed with ANAVEX®2-73 to date.

All patients who participated

in the trial were eligible to receive ANAVEX®2-73 under a voluntary open label extension protocol.

A high enrollment rate in

the OLE of over 91% and the high level of requests for the Compassionate Use Program (93%) provide solid numerical evidence for the reported

positive Real World Evidence (RWE) from patients with Rett syndrome under Compassionate Use Authorization. Families whose children were

previously on drug or placebo in the placebo-controlled trial commented favorably on the improvement of their child’s daily life

due to ANAVEX®2-73 treatment in the Compassionate Use Program.

Parkinson’s Disease

In September 2016, we presented

positive preclinical data for ANAVEX®2-73 in an animal model of Parkinson’s disease, which demonstrated significant

improvements on behavioral, histopathological, and neuroinflammatory endpoints. The study was funded by the Michael J. Fox Foundation.

Additional data announced in October 2017 indicated that ANAVEX®2-73 induced robust neurorestoration in experimental Parkinsonism.

We believe the encouraging results we have gathered in this preclinical model, coupled with the favorable profile of this product candidate

in the Alzheimer’s disease trial, support the notion that ANAVEX®2-73 has the potential to treat Parkinson’s

disease dementia.

In October 2020, we completed

a double-blind, randomized, placebo-controlled proof-of-concept Phase 2 trial with ANAVEX®2-73 in Parkinson’s disease

dementia in Spain and Australia, to study the effect of the compound on both the cognitive and motor impairment of Parkinson’s

disease. The Phase 2 trial enrolled approximately 132 patients for 14 weeks, randomized 1:1:1 to two different ANAVEX®2-73

doses, 30 mg and 50 mg, or placebo. The ANAVEX®2-73 Phase 2 Parkinson’s disease dementia trial design incorporated

genomic precision medicine biomarkers identified in the ANAVEX®2-73 Phase 2a Alzheimer’s disease trial.

The trial demonstrated that

ANAVEX®2-73 was safe and well tolerated in oral doses up to 50 mg once daily. The results showed clinically meaningful,

dose-dependent, and statistically significant improvements in the Cognitive Drug Research (“CDR”) computerized assessment

system analysis. Treatment with ANAVEX®2-73 also resulted in clinically meaningful improvements as measured by the global

composite score of Parkinson’s disease symptom severity, MDS-Unified Parkinson’s Disease Rating Scale (“MDS-UPDRS”)

total score on top of standard of care including dopaminergic therapy, levodopa and other anti-PD medications after 14 weeks of treatment,

suggesting ANAVEX®2-73’s potential capability of slowing and reversing symptoms that progress in Parkinson’s

disease. In addition, the trial confirmed the precision medicine approach of targeting SIGMAR1 as a genetic biomarker in response to

ANAVEX®2-73 may result in improved clinical outcomes.

A 48-week Open Label Extension

(“OLE”) ANAVEX2-73-PDD-EP-001 Phase 2 trial was offered to participants after completion of the double-blind placebo-controlled

ANAVEX2-73-PDD-001 Phase 2 trial discussed above. The OLE trial assessed safety, tolerability and efficacy, measuring among others, MDS-Unified

Parkinson’s Disease Rating Scale Parts I, II, III, REM Sleep Behavior Disorder Screening Questionnaire (RBDSQ), Clinical Global

Impression - Improvement (CGI-I), as well as cognitive efficacy endpoint Montreal Cognitive Assessment (MoCA) over a 48-week period.

In March 2023, we reported

the preliminary ANAVEX2-73-PDD-EP-001 OLE trial data, which demonstrated longitudinal beneficial effects of ANAVEX®2-73

on the pre-specified primary and secondary objectives. Preliminary analysis reveals that ANAVEX®2-73 was found to be generally

safe and well tolerated; and safety findings in this trial were consistent with the known safety profile of ANAVEX®2-73.

In respect to efficacy, across all efficacy endpoints, patients performed better while on ANAVEX®2-73. While all patients

were on drug holiday due to COVID-19 between the DB EOT and the OLE Baseline, the respective efficacy endpoints, including the MDS-UPDRS

Part II + III and CGI-I, measured at the end of trial of the double-blind study (DB EOT) and the OLE Baseline, were worsening, as expected

in a progressive disease like Parkinson’s. However, when patients resumed daily oral ANAVEX®2-73 treatment, a consistent

improvement was observed during the extension phase from OLE Baseline through each of OLE Week 24 and OLE Week 48. These results are

consistent with the pattern observed for all efficacy measures in the extension phase. The two endpoints, MDS-UPDRS Part II + III and

CGI-I measured in this study are the planned primary and key secondary endpoints in our forthcoming pivotal 6-month Parkinson’s

disease study.

In January 2021, we were awarded

a research grant of $1.0 million from The Michael J. Fox Foundation for Parkinson’s Research to develop ANAVEX®2-73

for the treatment of Parkinson’s disease. The award will explore utilization of PET imaging biomarkers to enable measurement of

target engagement and pathway activation of the SIGMAR1 with clinically relevant doses including in people with Parkinson’s disease.

Schizophrenia, Frontotemporal

Dementia and Alzheimer’s disease

In July 2020, we commenced

the First-in-Human Phase 1 clinical trial of ANAVEX®3-71. ANAVEX®3-71 was previously granted orphan drug

designation for the treatment of Frontotemporal Dementia (“FTD”) by the FDA. ANAVEX®3-71 is an orally

administered small molecule targeting sigma-1 and M1 muscarinic receptors that is designed to be beneficial for neurodegenerative diseases.

In preclinical studies, ANAVEX®3-71 demonstrated disease-modifying activity against the major hallmarks of Alzheimer’s

disease in transgenic (3xTg-AD) mice, including cognitive deficits, amyloid and tau pathologies, as well as beneficial effects on mitochondrial

dysfunction and neuroinflammation.

The Phase 1 clinical trial

was a prospective double-blind, randomized, placebo-controlled trial in Australia. A total of 36 healthy male and female subjects were

included. Single escalating doses of ANAVEX®3-71 were administered in order to evaluate the safety, tolerability, and

PK of ANAVEX®3-71 and the effects of food and gender on its PK in healthy volunteers.

The trial met its primary

and secondary endpoints of safety, with no serious adverse events (“SAEs”) or dose-limiting toxicities observed. ANAVEX®3-71

was well tolerated in all cohorts receiving ANAVEX®3-71 in single doses ranging from 5 mg to 200 mg daily with no SAEs

and no significant lab abnormalities in any subject. In the trial, ANAVEX®3-71 exhibited linear PK. Its pharmacokinetics

was also dose proportional for doses up to 160 mg. Gender had no effect on the PK of the drug and food had no effect on the bioavailability

of ANAVEX®3-71. The trial also met the secondary objective of characterizing the effect of ANAVEX®3-71

on electrocardiogram (“ECG”) parameters. There were no clinically significant ECG parameters throughout the trial.

Participant QTcF measures were normal across all dose groups with no difference between ANAVEX®3-71 and placebo.

In October 2023 a peer-reviewed

publication in the journal Neurobiology of Aging, titled “Early treatment with an M1 and sigma-1 receptor agonist prevents cognitive

decline in a transgenic rat model displaying Alzheimer’s-like amyloid pathology”, featured the orally available small molecule

ANAVEX®3-71 (AF710B). The preclinical study described the potential disease-modifying properties of ANAVEX®3-71

on Alzheimer’s disease pathology as a possible drug candidate for a potential once daily oral preventive strategy for Alzheimer’s

disease.

In January 2024, in another

peer-reviewed publication in the journal Clinical Pharmacology in Drug Development, entitled, ‘Population-Based Characterization

of the Pharmacokinetics and Food Effect of ANAVEX3-71, a Novel Sigma-1 Receptor and Allosteric M1 Muscarinic Receptor Agonist in Development

for Treatment of Frontotemporal Dementia, Schizophrenia, and Alzheimer’s Disease’, reported the Population-based characterization

of the PK and food effect of ANAVEX®3-71 as part of the single ascending dose study in healthy participants with the primary

objective of assessing dose proportionality of ANAVEX®3-71, and to characterize the effect of food on the PK of ANAVEX®3-71.

The results from this PK evaluation demonstrated that ANAVEX®3-71, at single ascending doses of 5 to 200 mg, is linear,

dose proportional, and time invariant. Food had no effect on the PK of ANAVEX®3-71. This data also expands the safety

objectives met in this first-in-human study of ANAVEX®3-71, further supporting its drug development program.

Based on these results, and

ANAVEX®3-71’s pre-clinical profile, we intend to advance ANAVEX®3-71 into a biomarker-driven clinical

development dementia program for the treatment of schizophrenia, FTD and Alzheimer’s disease, evaluating longitudinal effect of

treatment with ANAVEX®3-71.

Schizophrenia

In March 2024, we commenced

the U.S. FDA cleared ANAVEX®3-71-SZ-001 clinical trial, a double-blind, placebo-controlled Phase 2 trial in schizophrenia.

The trial consists of two parts to explore multiple ascending doses in individuals with schizophrenia followed by a 28-day treatment

period in a larger cohort. The trial will utilize standard clinical outcome measures for schizophrenia including the Positive and Negative

Symptoms Scale (PANSS), and novel fluid and electrophysiological biomarkers will also be assessed, leveraging several advances in electroencephalography/event-related

potential (EEG/ERP) biomarkers in schizophrenia developed in collaboration with the industry-led ERP Biomarker Qualification Consortium.

In addition to the electrophysiological biomarkers, we are also applying novel neuroinflammatory, metabolomic, and transcriptomic biomarkers

at the intersection of schizophrenia pathophysiology and ANAVEX®3-71’s novel, dual mechanism of action.

Recent Developments

In May 2024, we announced

the addition and appointment of new senior team members including the appointment of Juan Carlos Lopez-Talavera, MD, PhD as Senior Vice

President, Head of Research and Development, Terrie Kellmeyer, PhD as Senior Vice President of Clinical Development, and Jeffrey Edwards,

PhD as Vice President of Clinical Pharmacology and Science. Each of these team members bring valuable industry experience with a track

record of successfully bringing drugs to market.

Corporate Information

Our principal executive office

is located at 630 5th Avenue, 20th Floor, New York, NY 10111-0100, and our telephone number is (844) 689-3939. Our website address is

www.anavex.com. Information contained in our website is not a part of, nor incorporated by reference into, this prospectus. Also, this

prospectus may include the names of various government agencies or the trade names of other companies. Unless specifically stated otherwise,

the use or display by us of such other parties’ names and trade names in this prospectus is not intended to and does not imply

a relationship with, or endorsement or sponsorship of us by, any of these other parties.

RISK FACTORS

An investment in our common

stock involves significant risks. You should carefully consider the risk factors contained in our filings with the SEC, as well as all

of the information contained in any prospectus supplement, free writing prospectus and amendments thereto, before you decide to invest

in our common stock. Our business, prospectus, financial condition and results of operations may be materially and adversely affected

as a result of any of such risks. The value of our common stock could decline as a result of any of these risks. You could lose all or

part of your investment in our common stock. Some of our statements in sections entitled “Risk Factors” are forward-looking

statements. You should also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk

Factors” of our most recent Annual Report on Form 10-K for the year ended September 30, 2023, which is incorporated herein by reference,

as may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business, prospectus, financial condition and results of operations.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements. All statements other than statements of historical facts contained in this prospectus, including statements regarding our

anticipated future clinical and regulatory milestone events, future financial position, business strategy and plans and objectives of

management for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “expect” “should,” “forecast,”

“potential,” “predict”, “could,” “would,” “will,” “suggest,”

“plan” and similar expressions, as they relate to us, are intended to identify forward-looking statements. Such

forward-looking statements include, without limitation, statements regarding:

| ● | volatility

in our stock price and in the markets in general, and the potential for a positive return

on investment in our securities; |

| ● | our

ability to successfully conduct preclinical studies and clinical trials for our product candidates; |

| ● | our

ability to raise additional capital on favorable terms and the impact of such activities

on our stockholders and stock price; |

| ● | our

ability to generate any revenue or to continue as a going concern; |

| ● | our

ability to execute our research and development plan on time and on budget; |

| ● | our

products candidates’ ability to demonstrate efficacy or an acceptable safety profile; |

| ● | our

ability to obtain the support of qualified scientific collaborators; |

| ● | our

ability, whether alone or with commercial partners, to successfully commercialize any of

our product candidates that may be approved for sale; |

| ● | our

ability to identify and obtain additional product candidates; |

| ● | our

reliance on third parties in non-clinical studies and clinical trials; |

| ● | our

ability to defend against product liability claims; |

| ● | our

ability to safeguard against security breaches; |

| ● | our

ability to obtain and maintain sufficient intellectual property protection for our product

candidates; |

| ● | our

ability to comply with our intellectual property licensing agreements; |

| ● | our

ability to defend against claims of intellectual property infringement; |

| ● | our

ability to comply with the maintenance requirements of the government patent agencies; |

| ● | our

ability to protect our intellectual property rights throughout the world; |

| ● | the

anticipated start dates, durations and completion dates of our ongoing and future clinical

trials; |

| ● | the

anticipated designs of our future clinical trials; |

| ● | our

ability to attract and retain qualified employees; |

| ● | the

impact of Fast Track designation on receipt of actual FDA approval; |

| ● | our

anticipated future regulatory submissions and our ability to receive regulatory approvals

to develop and market our product candidates, including any orphan drug or Fast Track designations;

and |

| ● | our

anticipated future cash position and ability to obtain funding for our operations. |

We

have based these forward-looking statements largely on our current expectations and projections

about future events, including the responses we expect from regulatory authorities and financial trends that we believe may affect our

financial condition, results of operations, business strategy, preclinical studies and clinical trials, and financial needs. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions including without limitation the risks described in “Risk

Factors” in Part I, Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on November 27,

2023 and our subsequent Quarterly reports on Form 10-Q. These risks are not exhaustive. Moreover, we operate in a very competitive and

rapidly changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk

factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements. You should not rely upon forward-looking

statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements

will be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Any

forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only as of

the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We will retain broad discretion

over the use of the net proceeds to us from the sale of our securities under this prospectus. Unless otherwise provided in the applicable

prospectus supplement, we currently expect to use the net proceeds that we receive from this offering for working capital and other general

corporate purposes. The expected use of net proceeds of this offering represents our current intentions based on our present plans and

business conditions. We cannot specify with certainty all of the particular uses for the net proceeds to be received upon the closing

of this offering.

PLAN OF DISTRIBUTION

We may sell the securities from time to time

pursuant to underwritten public offerings, “at-the-market” offerings, negotiated transactions, block trades or a combination

of these methods. We may sell the securities to or through one or more underwriters or dealers (acting as principal or agent), through

agents, or directly to one or more purchasers. We may distribute securities from time to time in one or more transactions:

| |

● |

at

a fixed price or prices, which may be changed; |

| |

|

|

| |

● |

at

market prices prevailing at the time of sale; |

| |

|

|

| |

● |

at

prices related to such prevailing market prices; or |

| |

|

|

| |

● |

at

negotiated prices. |

A prospectus supplement or supplements (and any

related free writing prospectus that we may authorize to be provided to you) will describe the terms of the offering of the securities,

including, to the extent applicable:

| |

● |

the name or names of the

underwriters, dealers or agents, if any; |

| |

|

|

| |

● |

the purchase price of the

securities or other consideration therefor, and the proceeds, if any, we will receive from the sale; |

| |

|

|

| |

● |

any over-allotment or other

options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

any agency fees or underwriting

discounts and other items constituting agents’ or underwriters’ compensation; |

| |

|

|

| |

● |

any public offering price; |

| |

|

|

| |

● |

any discounts or concessions

allowed or reallowed or paid to dealers; and |

| |

|

|

| |

● |

any securities exchange

or market on which the securities may be listed. |

Only underwriters named in the prospectus supplement

will be underwriters of the securities offered by the prospectus supplement. Dealers and agents participating in the distribution of

the securities may be deemed to be underwriters, and compensation received by them on resale of the securities may be deemed to be underwriting

discounts. If such dealers or agents were deemed to be underwriters, they may be subject to statutory liabilities under the Securities

Act.

If underwriters are used in the sale, they will

acquire the securities for their own account and may resell the securities from time to time in one or more transactions at a fixed public

offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase the securities will

be subject to the conditions set forth in the applicable underwriting agreement. We may offer the securities to the public through underwriting

syndicates represented by managing underwriters or by underwriters without a syndicate. Subject to certain conditions, the underwriters

will be obligated to purchase all of the securities offered by the prospectus supplement, other than securities covered by any over-allotment

option. If a dealer is used in the sale of securities, we or an underwriter will sell the securities to the dealer, as principal. The

dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale. To the extent

required, we will set forth in the prospectus supplement the name of the dealer and the terms of the transaction. Any public offering

price and any discounts or concessions allowed or reallowed or paid to dealers may change from time to time.

We may sell securities directly or through agents

we designate from time to time. We will name any agent involved in the offering and sale of securities and we will describe any commissions

payable to the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, the agent will act on a best-efforts

basis for the period of its appointment.

We may provide agents, underwriters and dealers

with indemnification against civil liabilities, including liabilities under the Securities Act, or contribution with respect to payments

that the agents, underwriters or dealers may make with respect to these liabilities. Agents, underwriters and dealers, or their affiliates,

may engage in transactions with, or perform services for, us in the ordinary course of business.

All securities we may offer, other than common

stock, will be new issues of securities with no established trading market. Any underwriters may make a market in these securities, but

will not be obligated to do so and may discontinue any market making at any time without notice. We cannot guarantee the liquidity of

the trading markets for any securities.

Any underwriter may engage in over-allotment,

stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. Over-allotment

involves sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids to purchase the underlying

security so long as the stabilizing bids do not exceed a specified maximum price. Syndicate-covering or other short-covering transactions

involve purchases of the securities, either through exercise of the over-allotment option or in the open market after the distribution

is completed, to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities

originally sold by the dealer are purchased in a stabilizing or covering transaction to cover short positions. Those activities may cause

the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities

at any time.

Any underwriters that are qualified market makers

on the Nasdaq Capital Market may engage in passive market making transactions in the common stock on the Nasdaq Capital Market in accordance

with Regulation M under the Exchange Act, during the business day prior to the pricing of the offering, before the commencement of offers

or sales of the common stock. Passive market makers must comply with applicable volume and price limitations and must be identified as

passive market makers. In general, a passive market maker must display its bid at a price not in excess of the highest independent bid

for such security; if all independent bids are lowered below the passive market maker’s bid, however, the passive market maker’s

bid must then be lowered when certain purchase limits are exceeded. Passive market making may stabilize the market price of the securities

at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

DESCRIPTION OF CAPITAL

STOCK

Common Stock

We are authorized to issue 200,000,000 shares of common

stock with a par value of $0.001. As of July 22, 2024, we had 84,795,517 shares of common stock outstanding. Upon liquidation, dissolution

or winding up of the corporation, the holders of common stock are entitled to share ratably in all net assets available for distribution

to stockholders after payment to creditors. The common stock is not convertible or redeemable and has no preemptive, subscription or conversion

rights. There are no conversion, redemption, sinking fund or similar provisions regarding the common stock. Each outstanding share of

common stock is entitled to one vote on all matters submitted to a vote of stockholders. There are no cumulative voting rights.

Each stockholder is entitled to receive the dividends

as may be declared by our board of directors out of funds legally available for dividends and, in the event of liquidation, to share

pro rata in any distribution of our assets after payment of liabilities. Our board of directors is not obligated to declare a dividend.

Any future dividends will be subject to the discretion of our board of directors and will depend upon, among other things, future earnings,

the operating and financial condition of our Company, its capital requirements, general business conditions and other pertinent factors.

It is not anticipated that dividends will be paid in the foreseeable future.

Nevada Anti-Takeover Law and Charter and Bylaws Provisions

Nevada Revised Statutes sections 78.378 to 78.3793

provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation

or bylaws of the corporation provide that the provisions of these sections do not apply. The statute creates a number of restrictions

on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions

in any acquisition attempt, among other things. Our bylaws provide that these sections do not apply.

There are no provisions in our articles of incorporation

or our bylaws that would delay, defer or prevent a change in control of our Company.

Indemnification Of Directors And Executive Officers And Limitation

On Liability.

Our Bylaws provide that any person who was or

is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative, by reason of the fact that such person is or was a director, officer, employee or agent of the Company

(or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint

venture, trust or other enterprise) shall be indemnified and held harmless by the Company to the fullest extent permitted by Nevada law

against expenses including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by

such person in connection with such proceeding.

The Bylaws also provide that the expenses of

officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the Company as they are incurred

and in advance of the final disposition of the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director

or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified

by the Company. Such right of indemnification shall be a contract right which may be enforced in any manner desired by such person. Such

right of indemnification shall not be exclusive of any other right which such directors, officers or representatives may have or hereafter

acquire and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification

under any bylaw, agreement, vote of stockholders, provision of law or otherwise, as well as their rights under the Bylaws.

The Bylaws provide that the Board of Directors

may cause the Company to purchase and maintain insurance on behalf of any person who is or was a director or officer of the Company,

or is or was serving at the request of the Company as a director or officer of another Company, or as its representative in a partnership,

joint venture, trust or other enterprise against any liability asserted against such person and incurred in any such capacity or arising

out of such status, whether or not the Company would have the power to indemnify such person.

Nevada Revised Statutes 78.751 and 78.7502 have

provisions that provide for discretionary and mandatory indemnification of officers, directors, employees, and agents of a corporation.

Under these provisions, such persons may be indemnified by a corporation against expenses, including attorney’s fees, judgment,

fines and amounts paid in settlement, actually and reasonably incurred by him in connection with the action, suit or proceeding, if he

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation and

with respect to any criminal action or proceeding had no reasonable cause to believe his conduct was unlawful.

To the extent that a director, officer, employee

or agent has been successful on the merits or otherwise in defense of any action, suit or proceeding, or in defense of any claim, issue

or matter, the Nevada Revised Statues provide that he must be indemnified by the Company against expenses, including attorney’s

fees, actually and reasonably incurred by him in connection with the defense.

Section 78.7502 of the Nevada Revised Statues

also provides that any discretionary indemnification, unless ordered by a court or advanced by the Company, may be made only as authorized

in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances.

The determination must be made:

| |

● |

By the stockholders; |

| |

|

|

| |

● |

By the Company’s Board of Directors by majority

vote of a quorum consisting of directors who were not parties to that act, suit or proceeding; |

| |

|

|

| |

● |

If a majority vote of a quorum consisting of directors

who were not parties to the act, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion; or |

| |

|

|

| |

● |

If a quorum consisting of directors who were not parties

to the act, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion. |

Transfer Agent and Registrar

The transfer agent and registrar

for our common stock is Nevada Agency and Transfer Company. The transfer agent and registrar’s address is 50 West Liberty Street,

Suite 880, Reno, NV 89501.

Listing on the Nasdaq Capital Market

Our common stock is listed

on the Nasdaq Capital Market under the symbol “AVXL”.

LEGAL MATTERS

Unless otherwise specified

in the applicable prospectus supplement, the validity of the securities offered hereby will be passed upon for us by Snell & Wilmer,

L.L.P., Reno, Nevada. If legal matters in connection with offerings made by this prospectus are passed on by counsel for the underwriters,

dealers or agents, if any, that counsel will be named in the applicable prospectus supplement.

EXPERTS

The audited financial statements

incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance

upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting

and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and other reports and

other information with the SEC under the Exchange Act. Our filings with the SEC are also available to the public from commercial document

retrieval services and at the SEC’s website at www.sec.gov.

We make available free of charge on our internet

website at www.anavex.com our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any

amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the

SEC. Information contained on our website is not incorporated by reference into this prospectus and you should not consider such information

as part of this prospectus.

DOCUMENTS INCORPORATED

BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain information that we file with the SEC, which means that we can disclose important information

to you by referring you to other documents separately filed by us with the SEC that contain such information. The information we incorporate

by reference is considered to be part of this prospectus and information we later file with the SEC will automatically update and supersede

the information in this prospectus. The following documents filed by us with the SEC pursuant to Section 13(a) of the Exchange Act and

any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange Act, except for information furnished under Item

2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before the termination of the offering are incorporated

by reference herein:

| ● | our

Annual Report on Form

10-K for the fiscal year ended September 30, 2023, filed with the SEC on November 27,

2023; |

| ● | our

Quarterly Report on Form

10-Q for the quarter ended December 31, 2023 that we filed with the SEC on February 7,

2024 and our Quarterly Report on Form

10-Q for the quarter ended March 31, 2024 that we filed with the SEC on May 9, 2024; |

| ● | our

Current Report on Form

8-K filed with the SEC on June 21, 2024, to the extent information therein is filed and

not furnished; and |

| ● | the

description of our common stock contained in the registration statement on Form

8-A, filed with the SEC on October 23, 2015, as updated by Exhibit

4.1 to our Annual Report on Form 10-K for the fiscal year ended September 30, 2022, filed

with the SEC on November 28, 2022, together with any amendment or report filed for the purpose

of updating such description. |

You should rely only on the

information incorporated by reference or provided in this prospectus. We have authorized no one to provide you with different information.

You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document.

In addition, all documents subsequently filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than any

such documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including

any exhibits included with such Items) before the date the offering of securities hereunder is terminated or complete are deemed to be

incorporated by reference into, and to be a part of, this prospectus.

We will provide to each person,

including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated

by reference in the prospectus contained in the registration statement but not delivered with the prospectus, other than an exhibit to

these filings unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request and at

no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Anavex Life Sciences Corp.

630 5th Avenue, 20th Floor

New York, NY 10111-0100

(844) 689-3939

Anavex Life Sciences Corp.

Up to $150,000,000 of

Common Stock

PROSPECTUS

__________, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth

the various expenses (other than underwriting discounts and commissions) in connection with the issuance and distribution of the securities

registered hereby. The Company will bear all of these expenses. All amounts are estimated except for the SEC registration fee:

| SEC registration fee |

|

$ |

22,140 |

|

| Legal fees and expenses |

|

|

50,000 |

|

| Accounting fees and expenses |

|

|

30,000 |

|

| Miscellaneous fees and expenses |

|

$ |

2,500 |

|

| Total expenses |

|

$ |

104,640 |

|

Item 15. Indemnification of Directors and Officers.

Under the Nevada Revised Statutes

(“NRS”), director immunity from liability to a company or its shareholders for monetary liabilities applies automatically

unless it is specifically limited by a company’s Articles of Incorporation.

Section 78.7502 of the NRS

allows, and the Company wishes to adopt, discretionary indemnification of its directors, officers, employees, and agents as provided

below.

Subsection (1) of Section

78.7502 of the NRS empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party of any threatened,

pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by

or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation,

or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, or as a manager of a limited-liability company, against expenses (including attorneys’

fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by him or her in connection with the action,

suit, or proceeding if the person (a) is not in breach of their fiduciary duty which breach involved intentional misconduct, fraud or

a knowing violation of law, or (b) acted in good faith and in a manner in which he or she reasonably believed to be in, or not opposed

to, the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe

the conduct was unlawful.

Subsection (2) of Section

78.7502 of the NRS empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending, or completed action or suit by or in the right of the corporation to procure a judgment in favor by reason of the fact that

such person acted in any of the capacities set forth in subsection (1) enumerated above, against expenses, including amounts paid in

settlement and attorneys’ fees actually and reasonably incurred by the person in connection with the defense or settlement of such

action or suit if the person (a) was not in breach of their fiduciary duty, which breach involved intentional misconduct, fraud or a

knowing violation of law, or (b) acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best

interests of the corporation except that no indemnification may be made for any claim, issue, or matter as to which such person shall

have been adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable to the corporation

or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought

or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is

fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Subsection (3) of Section

78.7502 of the NRS provides that, unless a court orders indemnification or amounts are advanced pursuant to NRS 78.751(2) or any discretionary

indemnification under Subsections (1) or (2) of NRS 75.7502 must be authorized by a determination that such indemnification is proper.

This determination must be made by the stockholders, the majority vote of a quorum of the board of the directors not parties to the action,

suit or proceeding, or a written opinion by independent legal counsel ordered by a majority of the directors who were not parties to

the action, suit, or proceeding, or a quorum of directors who were not parties to the action, suit or proceeding cannot be obtained.

Subsection (1) of Section

78.751 of the NRS provides for mandatory indemnification of any person who is a director, officer, employee or agent to the extent that

the person is successful on the merits or otherwise in defense of (i) any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative, including, without limitation, an action by or in the right of the corporation,

by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the

request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other

enterprise; or (ii) any claim, issue or matter therein, against expenses actually and reasonably incurred by the person in connection

with defending the action, including, without limitation, attorney’s fees.

Additionally, NRS 78.138(7)

provides, with limited statutory exceptions relating to a director’s duty when confronted with a change or potential change in

control of the corporation, or unless the articles of incorporation or an amendment thereto (in each case filed on or after October 1,

2003) provide for greater individual liability, that a director or officer is not individually liable to a corporation or its stockholders

or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven

that: (i) the presumption that a director has acted in good faith, on an informed basis and with a view to the interest of the corporation

has been overcome; (ii) the act or failure to act constituted a breach of his or her fiduciary duties as a director or officer; and (ii)

the breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

Our Bylaws provide that any

person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative, by reason of the fact that such person is or was a director, officer, employee

or agent of the Company (or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation,

partnership, joint venture, trust or other enterprise) shall be indemnified and held harmless by the Company to the fullest extent permitted

by Nevada law against all expenses, liability and loss (including attorneys’ fees, judgments, fines and amounts paid or to be paid

in settlement) reasonably incurred by such person in connection. The expenses of officers and directors incurred in defending a civil

or criminal action, suit or proceeding must be paid by the Company as they are incurred and in advance of the final disposition of the

action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately

determined by a court of competent jurisdiction that he is not entitled to be indemnified by the Company. Insofar as indemnification

for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors, officers, and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer,

or controlling person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling

person connected with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

The articles and bylaws provide

that we will indemnify our directors and officers and may indemnify its employees or agents to the fullest extent permitted by law against

liabilities and expenses incurred in connection with litigation in which they may be involved because of their offices with us. However,

nothing in our articles of incorporation or bylaws protects or indemnifies a director, officer, employee or agent against any liability

to which he would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties

involved in the conduct of his office. To the extent that a director has been successful in defense of any proceeding, the Nevada Revised

Statutes provide that he shall be indemnified against reasonable expenses incurred in connection therewith.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant

to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public

policy and is, therefore, unenforceable.

Item 16. Exhibits.

† Filed herewith.

* To be filed by amendment or as an exhibit to a document to be incorporated

by reference herein in connection with an offering of the offered securities.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(a) (1) To file,

during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

| |

(i) |

to include any prospectus required by Section

10(a)(3) of the Securities Act of 1933, as amended; |

| |

(ii) |

to reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of

prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than

20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” exhibit

attached to the effective registration statement; and |

| |

|

|

| |

(iii) |

to include any material information with respect to the plan of distribution

not previously disclosed in the registration statement or any material change to such information in the registration statement; |

Provided, however, Paragraphs

(a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| |

(2) |

That, for the purpose of determining any

liability under the Securities Act of 1933, as amended, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a

post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| |

(4) |

That, for the purpose of determining liability

under the Securities Act of 1933, as amended, to any purchaser: |

| |

(i) |

Each prospectus filed by the registrant pursuant

to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of

and included in the registration statement; and

|

| |

(ii) |

Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant

to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act

of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus

is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus.

As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall

be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which

the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that

is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede