0001600620FALSE00016006202024-01-052024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 5, 2024

Aurinia Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Canada | | 001-36421 | | 98-1231763 |

(State or Other Jurisdiction of Incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

#140, 14315 - 118 Avenue

Edmonton, Alberta

T5L 4S6

(250) 744-2487

(Address and telephone number of registrant's principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on which Registered |

| Common Shares, without par value | | AUPH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On January 5, 2024, Aurinia Pharmaceuticals Inc. (Aurinia or the Company) issued a press release announcing its preliminary unaudited fourth quarter and full-year 2023 net revenue results and providing preliminary net product revenue guidance for 2024. The Company also announced its preliminary unaudited amount of cash, cash equivalents, restricted cash and investments as of December 31, 2023. These amounts are preliminary and are subject to completion of financial closing procedures. As a result, these amounts may differ materially from the amounts that will be reflected in the Company's consolidated financial statements for the year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The preliminary financial data included in this Current Report on Form 8-K has been prepared by, and is the responsibility of, management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

The information in this Current Report on Form 8-K and the exhibit hereto are being furnished pursuant to this Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, the information included in this Current Report on Form 8-K and the exhibit hereto, that is furnished pursuant to this Item 2.02 shall not be incorporated by reference in any of Aurinia's filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 4, 2024

| | | | | | | | |

| | |

| | AURINIA PHARMACEUTICALS INC. |

| | |

| By: | /s/ Joseph Miller |

| Name: | Joseph Miller |

| Title: | Chief Financial Officer |

AURINIA PROVIDES PRELIMINARY UNAUDITED FOURTH QUARTER AND FULL-YEAR 2023 NET REVENUE RESULTS

Preliminary unaudited total net revenue for the fourth quarter and full year 2023 of approximately $45 million and $176 million

Preliminary unaudited net product revenue for the fourth quarter and full year 2023 of approximately $42 million and $159 million

Approximately $351 million of cash, cash equivalents, restricted cash and investments as of December 31, 2023 (unaudited)

Net product revenue guidance for 2024 in the range of $200 -$220 million; targeting to be cash flow positive in the second half of 2024

ROCKVILLE, Maryland and EDMONTON, Alberta – January 5, 2024 - Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the Company) today provided an update on its 2023 fourth quarter and full year business performance. Preliminary unaudited net product revenue was approximately $42 million for the three months ended December 31, 2023, and $28.3 million for the same period in 2022, representing growth of approximately 49%. Preliminary unaudited net product revenue was approximately $159 million for the full year, and $103.5 million for the same period in 2022, representing growth of approximately 53%.

Preliminary unaudited total net revenue was approximately $45 million for the three months ended December 31, 2023 and $28.4 million for the same period 2022, representing growth of approximately 59%. Preliminary unaudited total net revenue was approximately $176 million for the year and $134.0 million for the same period 2022, representing growth of approximately 31%.

The Company had unaudited cash, cash equivalents, restricted cash and investments of approximately $351 million as of December 31, 2023. The Company is expecting to become cash flow positive on a go forward basis in the second half of 2024.

As previously announced, the Company initiated a robust strategic review at the end of June 2023 and is continuing to review all strategic options for the Company, which include a variety of possibilities including, but not limited to, a potential sale, merger, or other strategic transaction. At this time, there are no further updates on the matter, other than that the process is continuing. The Board of Directors and the Executive Leadership team remain committed to running a fulsome process that reflects the best interests of the Company, our shareholders, and other key stakeholders, including our patients, healthcare providers, and our employees.

“We are extremely proud of the strong performance and growth for LUPKYNIS throughout 2023, including publication and presentation of the AURORA 2 extension study and the renal biopsy sub-study, both of which further differentiate and support LUPKYNIS as foundation therapy in treating patients with active lupus nephritis. Our collaboration partner, Otsuka Pharmaceuticals Co., Ltd. filed for approval of LUPKYNIS to treat lupus nephritis (LN) with Japanese authorities, received pricing and reimbursement approvals in the UK, Italy, and Spain, and are continuing their commercialization efforts across Europe. At the end of the year, we also advanced our pipeline with the submission of an Investigational New Drug application to the FDA for AUR200, a potential next generation therapy for B-cell mediated autoimmune diseases. We are looking forward to continuing our momentum throughout 2024,” said Peter Greenleaf, President, and CEO of Aurinia.

Preliminary Fourth Quarter 2023 LUPKYNIS Product Metrics

•There were approximately 2,066 patients on LUPKYNIS therapy at December 31, 2023, compared with 1,525 at prior year end and 1,939 at September 30, 2023.

•Aurinia added approximately 438 patient start forms (PSFs) in the fourth quarter of 2023. In addition, the Company added approximately 101 new patients, as restarts (patients coming back onto therapy), as well as an estimate of new patients beginning therapy in the hospital channel. The fourth quarter PSFs of 438 compare to 406 PSFs in the fourth quarter of 2022 and 436 in the third quarter of 2023. The addition of patient restarts and estimated patients coming

through the hospital channel are newly reported in the fourth quarter since they have achieved numerical significance for the first time.

About Lupus Nephritis

LN is a serious manifestation of SLE, a chronic and complex autoimmune disease. About 200,000-300,000 people live with SLE in the U.S. and about one-third of these people are diagnosed with lupus nephritis at the time of their SLE diagnosis. About 50 percent of all people with SLE may develop lupus nephritis. If poorly controlled, LN can lead to permanent and irreversible tissue damage within the kidney. Black and Asian individuals with SLE are four times more likely to develop LN and individuals of Hispanic ancestry are approximately twice as likely to develop the disease when compared with Caucasian individuals. Black and Hispanic individuals with SLE also tend to develop LN earlier and have poorer outcomes when compared to Caucasian individuals.

About Aurinia

Aurinia is a fully integrated biopharmaceutical company focused on delivering therapies to treat targeted patient populations with a high unmet medical need that are impacted by autoimmune, kidney and rare diseases. In January 2021, the Company introduced LUPKYNIS® (voclosporin), the first FDA-approved oral therapy for the treatment of adult patients with active lupus nephritis (LN). The Company’s head office is in Edmonton, Alberta and its U.S. commercial office is in Rockville, Maryland. The Company focuses its development efforts globally.

Forward-Looking Statements

Certain statements made in this press release may constitute forward-looking information within the meaning of applicable Canadian securities law and forward-looking statements within the meaning of applicable United States securities law. These forward-looking statements or information include but are not limited to statements or information with respect to: Aurinia’s estimates as to preliminary unaudited net revenue of approximately $176 million for the full year 2023 and approximately $45 million for the fourth quarter of 2023; Aurinia’s estimates as to preliminary unaudited fourth quarter and full year net product revenues of approximately $42 million and $159 million, respectively; Aurinia’s estimates as to holding approximately $351 million in cash, cash equivalents, restricted cash and investments as of December 31, 2023; Aurinia's target to be cash flow positive in the second half of 2024; Aurinia’s estimates as to net product revenue for 2024 in the range of $200 - $220 million; Aurinia’s estimates as to the number of patients on LUPKYNIS therapy at December 31, 2023 and the number of patient start forms added in the fourth quarter of 2023; Aurinia’s belief that it has achieved its 2023 full year net product revenue guidance; and Aurinia’s estimates as to the number of patients with SLE in the U.S. and the proportion of those persons who have developed LN at time of SLE diagnosis. It is possible that such results or conclusions may change. Words such as “anticipate”, “will”, “believe”, “estimate”, “expect”, “intend”, “target”, “plan”, “goals”, “objectives”, “may” and other similar words and expressions, identify forward-looking statements. We have made numerous assumptions about the forward-looking statements and information contained herein, including among other things, assumptions about: the accuracy of reported data from third party studies and reports; the number, and timing of receipt, of PSFs and their rate of conversion into patients on therapy; assumptions relating to pricing for LUPKYNIS and patient persistency and adherence to on the product; assumptions related to the number of patients on LUPKYNIS therapy; that Aurinia’s intellectual property rights are valid and do not infringe the intellectual property rights of third parties; Aurinia’s assumptions relating to the capital required to fund operations; the assumption that Aurinia’s current good relationships with its suppliers, service providers and other third parties will be maintained; assumptions relating to the burn rate of Aurinia’s cash for operations; assumptions related to timing of interactions with regulatory bodies; and that Aurinia’s third party service providers will comply with their contractual obligations. Even though the management of Aurinia believes that the assumptions made, and the expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

Forward-looking information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Aurinia to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Such risks, uncertainties and other factors include, among others, the following: Aurinia’s actual future financial and operational results may differ from its expectations; difficulties Aurinia may experience in completing the commercialization of voclosporin; the market for the LN business may not be as estimated; Aurinia may have to pay unanticipated expenses; Aurinia may not be able to obtain sufficient supply to meet commercial demand for voclosporin in a timely fashion; unknown impact and difficulties imposed by widespread health concerns on Aurinia’s business operations including nonclinical, clinical, regulatory and commercial activities; the results from Aurinia’s clinical studies and from third party studies and reports may not be accurate; Aurinia’s third party service providers

may not, or may not be able to, comply with their obligations under their agreements with Aurinia; regulatory bodies may not grant approvals on conditions acceptable to Aurinia and its business partners, or at all; and Aurinia’s assets or business activities may be subject to disputes that may result in litigation or other legal claims. Although Aurinia has attempted to identify factors that would cause actual actions, events, or results to differ materially from those described in forward-looking statements and information, there may be other factors that cause actual results, performances, achievements, or events to not be as anticipated, estimated or intended. Also, many of the factors are beyond Aurinia’s control. There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on forward-looking statements or information. All forward-looking information contained in this press release is qualified by this cautionary statement. Additional information related to Aurinia, including a detailed list of the risks and uncertainties affecting Aurinia and its business, can be found in Aurinia’s most recent Annual Report on Form 10-K and its other public available filings available by accessing the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca or the U.S. Securities and Exchange Commission’s Electronic Document Gathering and Retrieval System (EDGAR) website at www.sec.gov/edgar, and on Aurinia’s website at www.auriniapharma.com.

Media Inquiries:

Andrea Christopher

Corporate Communications Director, Aurinia

achristopher@auriniapharma.com

Investor/Media Contact:

ir@auriniapharma.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

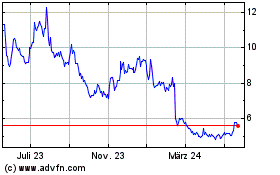

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

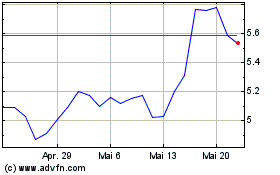

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024