UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

KEITH R. MESTRICH

BETTY SILFA

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used to solicit votes for

the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

On January 31, 2024, Driver

issued the following letter to shareholders of the Company:

January 31, 2024

Fellow AmeriServ Shareholders,

On January 23, 2023, Jack Babich,

AmeriServ Financial Inc.’s (“AmeriServ”) former Senior Vice President and Chief Human Resources Officer & Corporate

Services Officer, contacted Abbott Cooper, the managing member of Driver Management Company LLC (together with Driver Opportunity Partners

I LP, “Driver”) via a message on LinkedIn.

Prior to Mr. Babich’s initial

message, not only had Mr. Cooper not communicated with Mr. Babich, but he was unaware of Mr. Babich’s existence.

On January 24, 2023, Mr. Babich and

Mr. Cooper spoke by phone. Mr. Babich informed Mr. Cooper that he had been forced to “retire” from AmeriServ during October

2020 (with such “retirement” becoming effective as of December 31, 2020). Mr. Babich provided Mr. Cooper with an account

of the facts and circumstances surrounding his “retirement.” Based on Mr. Babich’s account, Mr. Cooper understood that

another AmeriServ senior officer had been caught engaging in illegal misconduct, that Jeffery Stopko, AmeriServ’s Chief Executive

Officer, and Craig Ford, then Chairman of AmeriServ’s board of directors (the “Board”) had failed to hold the senior

officer accountable for his illegal misconduct, choosing instead to let the senior officer retire, and that, when Mr. Babich—as

head of human resources—objected to how Mr. Stopko and Mr. Ford were handling the matter, he was forced to retire and paid for

his silence.

Mr. Babich also informed Mr. Cooper

that AmeriServ had agreed to pay (and had paid) Mr. Babich his salary and benefits after his “retirement” on December 31,

2020 through June 30, 2022.

In order to verify Mr. Babich’s

account of the facts and circumstances surrounding his “retirement,” on January 25, 2023, Driver made a demand pursuant to

15 Pa. C.S. § 1508, to inspect certain of AmeriServ’s books and records relating to Mr. Babich’s departure from AmeriServ.

AmeriServ has refused to comply with Driver’s demand and that refusal is currently the subject of litigation.

Driver is continuing to pursue its

right to inspect AmeriServ’s books and records in an effort to independently verify the facts and circumstances of Mr. Babich’s

“retirement” as relayed to Mr. Cooper by Mr. Babich.

On June 6, 2023, AmeriServ filed

a complaint against Mr. Babich in the U.S. District Court for the Western District of Pennsylvania (the “Western District”)

alleging that Mr. Babich had violated the confidentiality provisions of an agreement between Mr. Babich and AmeriServ in connection with

his retirement (the “Babich Agreement”). In response, Mr. Babich has argued that, among other things, to the extent that

AmeriServ is attempting to use the confidentiality provisions of the Babich Agreement to conceal a crime, the Babich Agreement is void

as against public policy.

On January 26, 2024, AmeriServ brought

a claim in the Western District against Mr. Cooper alleging that he had “tortiously interfered” with AmeriServ’s contract

to pay Mr. Babich for twenty months following Mr. Babich’s retirement. Mr. Cooper believes AmeriServ’s claims are meritless

and intends to vigorously defend against them, including by asserting that, among other things, the Babich Agreement is void as against

public policy.

Driver anticipates that both Mr.

Babich and Mr. Cooper will engage in extensive discovery to determine if AmeriServ is using the confidentiality provisions of the Babich

Agreement to conceal a crime.

Driver believes that AmeriServ’s

claim against Mr. Cooper is nothing more than a transparent attempt to intimidate Mr. Cooper and create confusion in an upcoming proxy

contest.

While AmeriServ may try to use the

allegations in its claim against Mr. Cooper to distract shareholders and impugn Mr. Cooper’s reputation, AmeriServ shareholders

should be asking the following questions:

First, why did AmeriServ pay

Mr. Babich his salary and benefits for twenty months after reportedly forcing him to “retire?” How did continuing to pay

Mr. Babich after he stopped working at AmeriServ benefit either AmeriServ or its shareholders? If paying Mr. Babich didn’t benefit

AmeriServ or its shareholders, who did it benefit?

Second, after reporting a

$0.20 per share loss for 2023, why isn’t the Board focused on trying to return AmeriServ to profitability rather than attempting

to bury Mr. Cooper and Mr. Babich in meritless litigation? A casual observer might think that the Board’s priority is providing

for the full employment of its attorneys, not repairing the damage caused to shareholder value.

Third, are the facts and circumstances

surrounding Mr. Babich’s “retirement” the real reason why the Board is so determined to prevent shareholders from having

the opportunity to elect anyone other than its carefully chosen candidates for director? Is ensuring that no one likely to ask questions

about Mr. Babich’s departure from AmeriServ the real reason why the Board spent $2.2 million in 2023—and may well spend millions

of dollars more in 2024—to deny shareholders the right to vote for Driver’s nominees?

Driver believes that these questions

are of the utmost importance since the answers will demonstrate whether the Board has the judgment required to best serve your—not

their—interests. Driver encourages you to contact Mike Adams, the Chairman of the Board, to ask these questions directly.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used

to solicit votes for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION

WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper,

Keith R. Mestrich and Betty Silfa.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 426,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 426,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own

the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date

hereof, neither Mr. Mestrich nor Ms. Silfa beneficially own any securities of the Company.

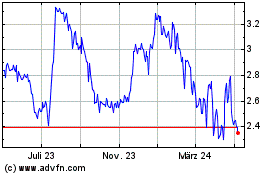

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

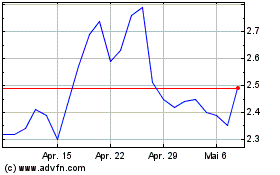

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025