AppTech Payments Reports Positive Second Quarter Financial Results and Strategic Progress

14 August 2024 - 6:35PM

AppTech Payments Corp. (Nasdaq: APCX) (“AppTech” or the “Company”),

a pioneering Fintech company powering frictionless commerce, today

announces its financial results for the second quarter ended June

30, 2024, showcasing strategic progress and continued operational

efficiency.

Financial Highlights

Revenue PerformanceReported revenue of

approximately $76 thousand for Q2 2024, reflecting a decrease of

$134 thousand in the same period last year due to lower merchant

processing revenue. This decrease aligns with the Company’s

strategic decision to prioritize long-term growth through multiple

integrations and the licensing of its innovative product offerings.

These initiatives are expected to contribute positively to future

quarters, subject to market adoption and customer uptake.

Operating EfficiencyOperating expenses were

strategically reduced to approximately $3.0 million, a significant

improvement from $9.4 million in Q2 2023. This reduction is largely

due to the absence of a $6.1 million impairment charge recorded in

the prior year and reflects AppTech’s disciplined cost management

and operational effectiveness.

Substantial Net Loss Improvement The net loss

was approximately $(2.9) million for Q2 2024, a dramatic

improvement compared to $(9.1) million in Q2 2023, driven by

effective cost management and focus on strategic investments that

align with long-term growth objectives.

Earnings Per Share GrowthEarnings per share

improved significantly to approximately $(0.12), compared to

$(0.49) in the same period last year. This improvement reflects

ongoing efforts to enhance shareholder value through strategic

financial stewardship.

Recent Business Highlights

- On August 8, 2024, AppTech entered into a Settlement Agreement

and Mutual Release with Infinios Solutions (Bahrain) W.L.L. The

terms of the Settlement Agreement are confidential. Following the

fulfillment of its terms, both parties will jointly file for the

dismissal and termination of the arbitration, expected to be

completed before the end of September 2024.

- In August 2024, the Company successfully piloted and tested

multiple portfolios, which are now ready to scale to commercial

levels.

- In July 2024, AppTech successfully tested and integrated

payment systems for multiple airports, building custom back-end

payment systems and upgrading the airport's legacy systems. The

Company anticipates rolling out these systems to over 440 airports

over the next 18 months.

- On June 11, 2024, AppTech announced a strategic partnership

with FISB Solutions to modernize legacy core banking systems for

over 250 community banks. This partnership enables these banks to

compete in the digital banking era by providing them with advanced

neobank technologies, including automated underwriting, and

leveraging local Independent Sales Organizations (ISOs) to foster

community engagement and growth. After years of supporting and

driving millions of dollars in revenue to Jack Henry, Jerry

Federico is exclusively committed to AppTech.

- Following a successful pilot program, AppTech officially

launched its Banking-as-a-Service platform in May 2024. The

platform supports the launch of InstaCash, offering virtual

accounts, debit and credit cards, and high-yielding financial

products. This initiative aims to democratize banking by providing

small and medium-sized enterprises with access to financial

products typically reserved for large corporations.

- In May 2024, strategic partner PayToMe.co was honored with six

prestigious Stevie® Awards, including gold, silver, and bronze

awards. These accolades underscore the transformative power of

AppTech’s collaborative approach to technological innovation and

our shared vision of driving long-term shareholder value.

- In May 2024, the Company began integrating multiple credit

union backends, providing the necessary support to offer mobile to

mobile payment systems, ACH capabilities, virtual card issuance,

ledger management, and fraud detection. The Company plans to roll

out these services to 4,000 credit union locations over the next 12

months.

- After acquiring Finzeo last year, AppTech has been focused in

Q1 and Q2 2024 on consolidating, integrating, and streamlining

operations to support the scaling of top-line revenue, which

includes the projects mentioned above.

“We continue to execute our strategy to enhance our technology

platform and expand our market presence,” stated Luke D’Angelo,

Chairman and CEO of AppTech Payments Corp. “The second quarter of

2024 was a period of significant progress in our partnerships and

technology innovation. We remain focused on leveraging our strong

platform to drive future growth and deliver value to our

shareholders.”

About AppTech Payments Corp.

AppTech Payments Corp. (NASDAQ: APCX) provides digital financial

services for financial institutions, corporations, small and

midsized enterprises (“SMEs”), and consumers through the Company’s

scalable cloud-based platform architecture and infrastructure,

coupled with our Specialty Payments development and delivery model.

AppTech maintains exclusive licensing and partnership agreements in

addition to a full suite of patented technology capabilities. For

more information, please visit apptechcorp.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that are

inherently subject to risks and uncertainties. Any statements

contained in this document that are not historical facts are

forward-looking statements as defined in the U.S. Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate, believe, estimate, expect, forecast, intend, may,

plan, project, predict, should, will” and similar expressions as

they relate to AppTech are intended to identify such

forward-looking statements. These risks and uncertainties include

but are not limited to, general economic and business conditions,

effects of continued geopolitical unrest and regional conflicts,

competition, changes in methods of marketing, delays in

manufacturing or distribution, changes in customer order patterns,

changes in customer offering mix, and various other factors beyond

the Company’s control. Actual events or results may differ

materially from those described in this press release due to any of

these factors. AppTech is under no obligation to update or alter

its forward-looking statements, whether as a result of new

information, future events, or otherwise.

Investor Relations Contact

CORE IR

Scott Arnold

scotta@coreir.com

AppTech Payments Corp.

760-707-5959

info@apptechcorp.com

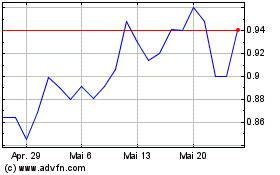

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024