Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

20 Juni 2023 - 5:15PM

Edgar (US Regulatory)

Filed by Arogo Capital

Acquisition Corp.

Pursuant to Rule 425

under the Securities Act of 1933

And deemed filed pursuant

to Rule 14a-12

Under the Securities

Exchange Act of 1934

Subject Company: Arogo

Capital Acquisition Corp.

(Commission File No.

001-41179)

Eon Reality Sets the Stage for NASDAQ Debut

Improved Market Conditions, Ramped up IPO Process & Growth Capital

IRVINE, CA, June 20, 2023 – EON Reality, Inc. (“EON

Reality”), an industry pioneer in spatial artificial intelligence has announced that it has selected its audit firm for its pending

merger with Arogo Capital Acquisition Corp. The completion of the audit will allow Arogo to file an amendment to its Registration Statement

on S-4. The Companies expect the merger to close in the fourth quarter of 2023.

Eon Reality’s CEO states, “We’re excited to move toward closing.

The merger represents a new chapter in Eon Reality’s journey, offering an opportunity to accelerate our innovative solutions in the field

of Spatial AI for Knowledge Transfer. We’re passionate about shaping the future of SPATIAL AI technology and this venture gives us a larger

platform to do just that.”

Furthermore, Arogo Capital’s CEO, expressed their continued support,

stating, “Eon Reality’s innovative approach to spatial AI and their potential for growth is what makes this partnership so exciting.”

Eon Reality is a front-runner in the global spatial artificial intelligence

sector, providing groundbreaking solutions that are timely, accessible, and affordable. With a worldwide presence and comprehensive grant

packages, Eon Reality is democratizing spatial AI. EON Reality is a leading company in Artificial Intelligence-powered Augmented and

Virtual Reality-based experience creation for the education industry with over 20 years of existence. EON Reality’s believes that

knowledge is a human right and should be available, accessible, and affordable for every person on the planet. To carry this out, EON

Reality developed and launched EON-XR, a SaaS-based platform dedicated to the democratization of XR content creation that brings code-free

XR development and publishing to smartphones, tablets, laptops, and any other XR-focused devices. EON-XR can be used in devices of different

sizes: from hand-held mobile devices, to head-mounted displays, to large-scale screens. EON Reality’s global network now comprises

more than 2.4 million subscribers in more than 110 locations. EON Reality has also created an XR library for education and industry with

access to at least 6 million assets. For more information, visit www.Eon Realityreality.com

About Arogo Capital Acquisition Corp.

Arogo Capital Acquisition Corp. is a blank check company. The Company

aims to acquire one and more businesses and assets, via a merger, capital stock exchange, asset acquisition, stock purchase, and reorganization.

For more information, visit www.arogocapital.com.

Advisors

ARC Group Ltd. is serving as sole financial advisor to Arogo. EF Hutton,

division of Benchmark Investments, LLC, is serving as capital markets advisor. Nelson Mullins Riley & Scarborough LLP is serving as

legal advisor to Arogo. Brown Rudnick LLP is serving as legal advisor to EON Reality.

This press release does not constitute an offer to sell or a solicitation

of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or

sale would be unlawful before registration or qualification under the securities laws of any such state or jurisdiction.

Forward-Looking Statements

This communication contains certain statements which may be deemed

as “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities

laws. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives,

expectations and intentions with respect to future operations, products and services; and other statements identified by words such as

“will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,”

“believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning.

These forward-looking statements include, but are not limited to, statements regarding EON Reality’s industry and market sizes,

future opportunities for EON Reality and Arogo, EON Reality’s estimated future results and the proposed business combination between

Arogo and EON Reality, including the implied enterprise value, the expected transaction and ownership structure and the likelihood, timing

and ability of the parties to successfully consummate the proposed transaction. Such forward-looking statements are based upon the current

beliefs and expectations of the management and are inherently subject to significant business, economic and competitive uncertainties

and contingencies, many of which are difficult to predict and generally beyond the management’s control. Actual results and the

timing of events may differ materially from the results anticipated in these forward-looking statements.

In addition to factors previously disclosed in Arogo’s reports

filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results

and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

inability to meet the closing conditions to the business combination, including the occurrence of any event, change, legal proceedings

instituted against EON Reality or against Arogo related to the business combination agreement or the management team, or other circumstances

that could give rise to the termination of the business combination agreement; the inability to complete the transactions contemplated

by the business combination agreement due to the failure to obtain approval of Arogo’s stockholders; redemptions exceeding a maximum

threshold or the failure to meet The Nasdaq Stock Market’s initial listing standards in connection with the consummation of the

contemplated transactions; costs related to the transactions contemplated by the business combination agreement; a delay or failure to

realize the expected benefits from the proposed business combination agreement transaction including EON Reality’s ability to effectively

develop and successfully market new products, solutions and services, and to effectively address cost reductions and other changes in

its industry; risks related to disruption of management’s time from ongoing business operations due to the proposed business combination

transaction; changes in the virtual reality markets in which EON Reality competes, including with respect to its competitive landscape,

technology evolution or regulatory changes on solutions, services, labor matters, international economic, political, legal, compliance

and business factors; developments and uncertainties in domestic and foreign trade policies and regulations, and other regulations which

may cause contractions or affect growth rates and cyclicality of markets EON Reality serve; disruptions relating to war, terrorism, widespread

protests and civil unrest, man-made and natural disasters, public health issues and other events; changes in domestic and global general

economic conditions; risk that EON Reality may not be able to execute its growth strategies; security breaches or other disruptions of

EON Reality information technology systems or violations of data privacy laws; EON Reality’s inability to adequately protect its

intellectual property; risks related to the ongoing COVID-19 pandemic and response, including new variants of the virus; the pace of recovery

in the markets in which EON Reality operates; global supply chain disruptions and potential staffing shortages at potential customers

which may have a trickle-down effect on EON Reality; risk that EON Reality may not be able to develop and maintain effective internal

controls; and other risks and uncertainties indicated in Arogo’s final prospectus, dated December 23, 2021, for its initial public

offering, and those that will be contained in the proxy statement/prospectus relating to the proposed business combination, including

those under “Risk Factors” therein, and in Arogo’s other filings with the SEC. EON Reality and Arogo caution that the

foregoing list of factors is not exclusive. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or

probability.

Actual results, performance or achievements may differ materially,

and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements

are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned

not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and

other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other

factors, many of which are beyond the management’s control. All information set forth herein speaks only as of the date hereof in

the case of information about Arogo and EON Reality or the date of such information in the case of information from persons other than

Arogo or EON Reality, and except to the extent required by applicable law, we disclaim any intention or obligation to update or revise

any forward-looking statements as a result of new information, future events and developments or otherwise occurring after the date of

this communication. Forecasts and estimates regarding EON Reality’s industry and markets are based on sources we believe to be reliable,

however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Projected and estimated numbers

are used for illustrative purpose only, are not forecasts and may not reflect actual results. Neither Arogo nor EON Reality gives any

assurance that either Arogo or EON Reality, respectively, will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed business combination transaction, Arogo

filed relevant materials with the Securities and Exchange Commission (the “SEC”), including a filed registration statement

on Form S-4, which included a draft proxy statement/prospectus of Arogo on October 7, 2022, and on February 13, 2023, and it intends to

file other documents regarding the proposed business combination transaction with the SEC in the future. Arogo’s stockholders and

other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and

the definitive proxy statement and documents incorporated by reference therein filed in connection with the proposed business combination

transaction, as these materials will contain important information about EON Reality, Arogo and the proposed business combination transaction.

Promptly after the Form S-4 is declared effective by the SEC, Arogo will mail the definitive proxy statement/prospectus and a proxy card

to each stockholder entitled to vote at the meeting relating to the approval of the business combination and other proposals set forth

in the proxy statement/prospectus. Before making any voting or investment decision, investors and stockholders of Arogo are urged to carefully

read the entire registration statement and proxy statement/prospectus, now that they are available and when they are declared effective,

and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain

important information about the proposed business combination transaction. The documents filed by Arogo with the SEC may be obtained free

of charge at the SEC’s website at www.sec.gov, (Registration No. 333-259338), or by directing a request to Arogo Capital Acquisition

Corp., 848 Brickell Avenue, Penthouse 5, Miami, FL 33131.

This press release shall not constitute a solicitation of a proxy,

consent, or authorization with respect to any securities or in respect of the proposed business combination. This press release shall

also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Participants in the Solicitation

Arogo and its directors and executive officers may be deemed participants

in the solicitation of proxies from its stockholders with respect to the business combination. A list of the names of those directors

and executive officers and a description of their interests in Arogo will be included in the proxy statement/prospectus for the proposed

business combination when available at www.sec.gov. Information about Arogo’s directors and executive officers and their ownership

of Arogo common stock is set forth in Arogo’s prospectus, dated December 23, 2021, as modified or supplemented by any Form 3 or

Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solicitation

will be included in the proxy statement/prospectus pertaining to the proposed business combination when it becomes available. These documents

can be obtained free of charge from the source indicated above.

EON Reality and its directors and executive officers may also be deemed

to be participants in the solicitation of proxies from the stockholders of Arogo in connection with the proposed business combination.

A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination

will be included in the proxy statement/prospectus for the proposed business combination.

Contact Information

For EON Reality:

avi.sudaley@eonreality.com

For Arogo:

nisachon@arogocapital.com

4

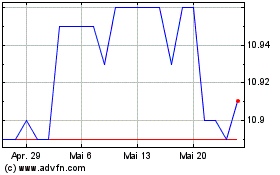

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024