Anika Therapeutics, Inc. (NASDAQ: ANIK), a global joint

preservation company in early intervention orthopedics, today

reported financial results for its fourth quarter and full year

ended December 31, 2023.

Fourth Quarter

2023 Financial

Summary

- Revenue in the fourth quarter of 2023 was $43.0 million, up 8%

compared to $39.6 million in the fourth quarter of 2022.

- OA Pain Management revenue of $25.1 million, up 12%, on growing

global commercial adoption and some order timing

- Joint Preservation and Restoration revenue of $15.3 million, up

7%

- Non-Orthopedic revenue of $2.6 million, down 8%

- Gross margin was 61%, including $1.6 million of non-cash

acquisition-related intangible asset amortization; Adjusted gross

margin1 was 65%.

- Recorded a non-recurring, non-cash impairment charge in the

fourth quarter of $62.2 million for the intangible assets

associated with the Q1-2020 acquisitions of Arthrosurface and

Parcus Medical.

- Including the non-cash impairment charge, net loss was ($63.0)

million, or ($4.30) per share, compared to net loss of ($4.9)

million, or ($0.34) per share, in the prior year period.

- Adjusted net income1 was $0.8 million, or $0.05 per diluted

share, compared to adjusted net loss1 of ($3.0) million, or ($0.21)

per share, in the fourth quarter of 2022.

- Adjusted EBITDA1 was $5.8 million, compared to $1.4 million in

the fourth quarter of 2022.

- Cash from operations was $3.6 million; ending cash balance rose

to $72.9 million.

Full Year 2023 Financial

Summary

- Revenue for fiscal 2023 increased 7% to $166.7 million,

compared with $156.2 million in 2022.

- OA Pain Management revenue of $101.9 million, up 11%

- Joint Preservation and Restoration revenue of $54.9 million, up

9%

- Non-Orthopedic revenue of $9.9 million, down 29%

- Gross margin was 62%, including $6.2 million of non-cash

acquisition-related intangible asset amortization and $0.7 million

of product rationalization charges. Adjusted gross margin1,

excluding these charges, was 66%.

- Including the fourth quarter non-cash impairment charge, net

loss was ($82.7) million, or ($5.64) per share, compared to net

loss of ($14.9) million, or ($1.02) per share, in 2022. Net loss

also included $18.1 million, or ($1.23) per share, for charges

associated with product rationalization, acquisition related

amortization, discontinuation of software development, Parcus

arbitration settlement and shareholder activism.

- Adjusted net loss1 for the year was ($4.3) million, or ($0.30)

per share, compared to adjusted net loss of ($7.1) million, or

($0.49) per share in 2022.

- Adjusted EBITDA1 for the year was $15.5 million, compared to

$12.6 million in 2022.

- Cash used in operations was $1.8 million.

1 See description of non-GAAP financial

information contained in this release.

“We are pleased to report strong fourth quarter

and full year results, including a record year in OA Pain

Management. These results reflect the evolution of our

differentiated HA franchise and the launch of exciting new products

in Regenerative, Sports Medicine and Arthrosurface Joint

Solutions,” said Cheryl R. Blanchard, Ph.D., Anika’s President and

CEO. “Over the course of the year, we achieved key milestones,

learned a lot about the business, and are taking decisive action to

further reduce spending and focus our strategy on driving the

products that provide the greatest growth opportunities. Our plan

to optimize performance is designed to capitalize on the

significant growth potential across the business while accelerating

our pivot to profitability, with adjusted EBITDA expected to grow

over 75% at the midpoint in 2024.”

Dr. Blanchard continued, “We begin 2024 with

renewed energy and strong momentum across the new products in our

portfolio. Our HA-based Integrity Implant System is receiving very

positive feedback, and its full market release is on track for

mid-2024. We also remain focused on bringing Hyalofast and Cingal

to the U.S. market. As we focus the business on our core strengths

and highest value opportunities, we are confident that we will

enhance value for shareholders.”

Fiscal 2023 and Recent Business

Highlights

- Strengthening Leadership Position in OA Pain

Management

- Achieved record annual revenues of $102 million in OA Pain

Management on global growth of its Monovisc® single injection

viscosupplement and continued double-digit international growth of

its Cingal® next generation non-opioid single injection pain

product, on growing global commercial adoption and some order

timing; increasing #1 U.S. market share position2.

- Awaiting FDA feedback on proposed non-clinical next steps

regarding Cingal U.S. regulatory approval following a Type C

meeting with the FDA in early 2023 and its success in meeting its

latest Phase III Pivotal primary endpoint in the fall of 2022.

- Continuing to explore commercial partnerships for Cingal in the

U.S. and select Asian markets.

- Advancing a Highly Differentiated Portfolio of HA-Based

Regenerative Solutions

- Successfully completed over 100 cases with the Integrity™

Implant System, Anika’s HA-based regenerative rotator cuff patch

system, following the limited market release in late November 2023;

on-track for full market release in mid-2024

- Fully enrolled Phase III clinical trial for

Hyalofast®, Anika’s HA, off-the-shelf,

single-stage cartilage repair product; modular PMA submission with

break-through device designation commencing in 2024; final PMA

module filing expected in 2025 with product launching by 2026.

- Launched Key Products in Sports

Medicine and Arthrosurface

Joint Solutions

- X-Twist™ Biocomposite Fixation System launched in Q1-2024,

compliments the PEEK version launched in early 2023, together

addressing the more than $600 million U.S. rotator cuff

market2.

- RevoMotion™ Reverse Shoulder Arthroplasty System full market

release in September 2023, expanding Anika’s shoulder arthroplasty

portfolio into the more than $1 billion U.S. reverse shoulder

market2.

2 SmartTRAK Q3-2023 data

Cost Reductions In 2023, Anika

launched multiple meaningful new products and made considerable

progress addressing the new MDR regulatory requirements in Europe.

With the progress made in 2023, and in recognition of the slower

than expected pace of growth in some of its more mature product

lines, the Company has decided to further reduce its planned

spending for 2024 and to reduce approximately 9% of its workforce,

effective the end of the first quarter. The cost reductions, on an

annualized basis, are expected to provide savings of approximately

$10 million, excluding the impact of one-time costs. These actions

position Anika to focus on its strengths and preserve the Company’s

significant opportunities with its strong, growing and

differentiated product lines and pipeline, and accelerate Anika’s

pivot to profitability.

Fiscal 2024 Guidance In 2024,

Anika is prioritizing accelerated growth in profitability, with a

focus on the products with the greatest growth opportunities and

where the Company has the most differentiated right-to-win.

As such, Anika expects revenue for fiscal year

2024 of $168 to $173 million, representing growth of 1% to 4%

compared to 2023. Revenue ranges by product family are:

- OA Pain Management of $102 to $104 million, up 0% to 2%, on

sustained above-market growth offset by some unfavorable order

timing

- Joint Preservation and Restoration of $58 to $60.5 million, up

6% to 10%

- Non-Orthopedic of $8 to $8.5 million, down 14% to 19%

The Company expects adjusted EBITDA for 2024 to be

$25 to $30 million, up over 75% at the midpoint, representing an

adjusted EBITDA margin of at least 15%, up over 6 points compared

to 2023. Anika’s expectations around improved profitability in 2024

reflect only partial-year cost savings as well as the early-stage

ramp from Anika’s new products.

Strategic Business Update

Beginning in mid-2023, Anika engaged Piper Sandler and conducted a

company-wide strategic review, evaluating a wide range of strategic

alternatives for the company to increase shareholder value,

including a potential sale. Anika remains open to all value

enhancing opportunities and regularly reviews what makes the most

sense for the business.

Conference Call and Webcast

Information Anika’s management will hold a conference call

and webcast to discuss its financial results and business

highlights today, Wednesday, March 13, 2024, at 5:00 pm ET. The

conference call can be accessed by dialing 1-888-886-7786

(toll-free domestic) or 1-416-764-8658 (international) and

providing the conference ID number 19479013. A live audio webcast

will be available in the Investor Relations section of Anika’s

website, www.anika.com. A slide presentation with highlights from

the conference call will be available in the Investor Relations

section of the Anika website. A replay of the webcast will be

available on Anika’s website approximately two hours after the

completion of the event.

About Anika Anika Therapeutics,

Inc. (NASDAQ: ANIK), is a global joint preservation company that

creates and delivers meaningful advancements in early intervention

orthopedic care. Leveraging our core expertise in hyaluronic acid

and implant solutions, we partner with clinicians to provide

minimally invasive products that restore active living for people

around the world. Our focus is on high opportunity spaces within

orthopedics, including Osteoarthritis Pain Management, Regenerative

Solutions, Sports Medicine and Arthrosurface Joint Solutions, and

our products are efficiently delivered in key sites of care,

including ambulatory surgery centers. Anika’s global operations are

headquartered outside of Boston, Massachusetts. For more

information about Anika, please visit www.anika.com.

ANIKA, ANIKA THERAPEUTICS, ARTHROSURFACE, CINGAL,

HYALOFAST, INTEGRITY, MONOVISC, PARCUS MEDICAL, REVOMOTION,

X-TWIST, and the Anika logo are trademarks of Anika Therapeutics,

Inc. or its subsidiaries or are licensed to Anika Therapeutics,

Inc. for its use.

Non-GAAP Financial Information

Non-GAAP financial measures should be considered supplemental to,

and not a substitute for, the Company’s reported financial results

prepared in accordance with GAAP. Furthermore, the Company’s

definition of non-GAAP measures may differ from similarly titled

measures used by others. Because non-GAAP financial measures

exclude the effect of items that will increase or decrease the

Company’s reported results of operations, Anika strongly encourages

investors to review the Company’s consolidated financial statements

and publicly filed reports in their entirety. The Company presents

these non-GAAP financial measures because it uses them as

supplemental measures in internally assessing the Company’s

operating performance, and, in the case of Adjusted EBITDA, it is

set as a key performance metric to determine executive

compensation. The Company also recognizes that these non-GAAP

measures are commonly used in determining business performance more

broadly and believes that they are helpful to investors, securities

analysts, and other interested parties as a measure of comparative

operating performance from period to period.

Adjusted Gross Margin Adjusted gross margin is

defined by the Company as adjusted gross profit divided by total

revenue. The Company defines adjusted gross profit as GAAP gross

profit excluding amortization of certain acquired assets and

non-cash product rationalization charges.

Adjusted EBITDA Adjusted EBITDA is defined by the

Company as GAAP net income (loss) excluding depreciation and

amortization, interest and other income (expense), income taxes,

stock-based compensation expense, acquisition related expenses,

non-cash charges related to goodwill impairment, non-cash product

rationalization charges and charges related to discontinuation of a

software project.

Adjusted Net Income (Loss) and Adjusted EPS

Adjusted net income (loss) is defined by the Company as GAAP net

income excluding acquisition related expenses, inclusive of the

impact of purchase accounting, on a tax effected basis, non-cash

charges related to goodwill impairment, non-cash product

rationalization charges and charges related to discontinuation of a

software project. Adjusted diluted EPS is defined by the Company as

GAAP diluted EPS excluding acquisition related expenses and the

impact of purchase accounting, each on a tax-adjusted per share

basis, non-cash product rationalization charges and charges related

to discontinuation of a software development project.

A reconciliation of adjusted gross profit to gross

profit (and the associated adjusted gross margin calculation),

adjusted EBITDA to net income (loss), adjusted net income (loss) to

net income (loss) and adjusted diluted EPS to diluted EPS, the most

directly comparable financial measures calculated and presented in

accordance with GAAP, is shown in the tables at the end of this

release.

Forward-Looking Statements This

press release may contain forward-looking statements, within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

concerning the Company's expectations, anticipations, intentions,

beliefs or strategies regarding the future which are not statements

of historical fact, including statements in the sub-headings, Dr.

Blanchard’s quote, and the section titled Cost Reductions about

potential cost savings and future profitability, the statements in

Dr. Blanchard’s quote and the section titled Fiscal 2023 and Recent

Business Highlights about the timing of future product launches,

and the statements made in the section titled Fiscal 2024 Guidance.

These statements are based upon the current beliefs and

expectations of the Company's management and are subject to

significant risks, uncertainties, and other factors. The Company's

actual results could differ materially from any anticipated future

results, performance, or achievements described in the

forward-looking statements as a result of a number of factors

including, but not limited to, (i) the Company's ability to

successfully commence and/or complete clinical trials of its

products on a timely basis or at all; (ii) the Company's ability to

obtain pre-clinical or clinical data to support domestic and

international pre-market approval applications, 510(k)

applications, or new drug applications, or to timely file and

receive FDA or other regulatory approvals or clearances of its

products; (iii) that such approvals will not be obtained in a

timely manner or without the need for additional clinical trials,

other testing or regulatory submissions, as applicable; (iv) the

Company's research and product development efforts and their

relative success, including whether we have any meaningful sales of

any new products resulting from such efforts; (v) the cost

effectiveness and efficiency of the Company's clinical studies,

manufacturing operations, and production planning; (vi) the

strength of the economies in which the Company operates or will be

operating, as well as the political stability of any of those

geographic areas; (vii) future determinations by the Company to

allocate resources to products and in directions not presently

contemplated; (viii) the Company's ability to successfully

commercialize its products, in the U.S. and abroad; (ix)

the Company's ability to provide an adequate and timely supply of

its products to its customers; and (x) the Company's ability to

achieve its growth targets. Additional factors and risks are

described in the Company's periodic reports filed with

the Securities and Exchange Commission, and they are available

on the SEC's website

at www.sec.gov. Forward-looking statements

are made based on information available to the Company on the date

of this press release, and the Company assumes no obligation to

update the information contained in this press release.

For Investor Inquiries: Anika

Therapeutics, Inc. Mark Namaroff, 781-457-9287 Vice President,

Investor Relations, ESG and Corporate Communications

investorrelations@anika.com

|

|

|

Anika Therapeutics, Inc. and Subsidiaries |

|

Consolidated Statements of Operations |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue |

$ |

42,971 |

|

|

$ |

39,622 |

|

|

$ |

166,662 |

|

|

$ |

156,236 |

|

|

Cost of Revenue |

16,642 |

|

|

15,491 |

|

|

63,574 |

|

|

62,660 |

|

|

Gross Profit |

26,329 |

|

|

24,131 |

|

|

103,088 |

|

|

93,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

7,585 |

|

|

7,749 |

|

|

32,690 |

|

|

28,182 |

|

|

Selling, general and administrative |

20,335 |

|

|

23,049 |

|

|

95,847 |

|

|

84,794 |

|

|

Impairment of intangible assets |

62,190 |

|

|

- |

|

|

62,190 |

|

|

- |

|

|

Total operating expenses |

90,110 |

|

|

30,798 |

|

|

190,727 |

|

|

112,976 |

|

|

Loss from operations |

(63,781 |

) |

|

(6,667 |

) |

|

(87,639 |

) |

|

(19,400 |

) |

|

Interest and other income (expense), net |

577 |

|

|

276 |

|

|

2,312 |

|

|

654 |

|

|

Loss before income taxes |

(63,204 |

) |

|

(6,391 |

) |

|

(85,327 |

) |

|

(18,746 |

) |

|

Benefit from income taxes |

(204 |

) |

|

(1,483 |

) |

|

(2,660 |

) |

|

(3,887 |

) |

|

Net loss |

$ |

(63,000 |

) |

|

$ |

(4,908 |

) |

|

$ |

(82,667 |

) |

|

$ |

(14,859 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(4.30 |

) |

|

$ |

(0.34 |

) |

|

$ |

(5.64 |

) |

|

$ |

(1.02 |

) |

|

Diluted |

$ |

(4.30 |

) |

|

$ |

(0.34 |

) |

|

$ |

(5.64 |

) |

|

$ |

(1.02 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

14,647 |

|

|

14,640 |

|

|

14,656 |

|

|

14,561 |

|

|

Diluted |

14,647 |

|

|

14,640 |

|

|

14,656 |

|

|

14,561 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Anika Therapeutics, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

ASSETS |

2023 |

|

2022 |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

72,867 |

|

|

$ |

86,327 |

|

|

Accounts receivable, net |

35,961 |

|

|

34,627 |

|

|

Inventories, net |

46,386 |

|

|

39,765 |

|

|

Prepaid expenses and other current assets |

8,095 |

|

|

8,828 |

|

|

Total current assets |

163,309 |

|

|

169,547 |

|

|

Property and equipment, net |

46,198 |

|

|

48,279 |

|

|

Right-of-use assets |

28,767 |

|

|

30,696 |

|

|

Other long-term assets |

18,672 |

|

|

17,219 |

|

|

Deferred tax assets |

1,489 |

|

|

1,449 |

|

|

Intangible assets, net |

4,626 |

|

|

74,599 |

|

|

Goodwill |

7,571 |

|

|

7,339 |

|

|

Total assets |

$ |

270,632 |

|

|

$ |

349,128 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

9,860 |

|

|

$ |

9,074 |

|

|

Accrued expenses and other current liabilities |

21,199 |

|

|

18,840 |

|

|

Total current liabilities |

31,059 |

|

|

27,914 |

|

|

Other long-term liabilities |

404 |

|

|

398 |

|

|

Deferred tax liability |

- |

|

|

6,436 |

|

|

Lease liabilities |

26,904 |

|

|

28,817 |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.01 par value |

147 |

|

|

146 |

|

|

Additional paid-in-capital |

90,009 |

|

|

81,141 |

|

|

Accumulated other comprehensive loss |

(5,943 |

) |

|

(6,443 |

) |

|

Retained earnings |

128,052 |

|

|

210,719 |

|

|

Total stockholders’ equity |

212,265 |

|

|

285,563 |

|

|

Total liabilities and stockholders’ equity |

$ |

270,632 |

|

|

$ |

349,128 |

|

| |

|

|

|

|

|

|

Anika Therapeutics, Inc. and

Subsidiaries |

|

Reconciliation of GAAP Gross Profit to Adjusted Gross

Profit |

|

(in thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Gross Profit |

$ |

26,329 |

|

|

$ |

24,131 |

|

|

$ |

103,088 |

|

|

$ |

93,576 |

|

|

Product rationalization related charges |

- |

|

|

563 |

|

|

748 |

|

|

3,199 |

|

|

Acquisition related intangible asset amortization |

1,560 |

|

|

1,560 |

|

|

6,244 |

|

|

6,240 |

|

|

Adjusted Gross Profit |

$ |

27,889 |

|

|

$ |

26,254 |

|

|

$ |

110,080 |

|

|

$ |

103,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unadjusted Gross Margin |

61 |

% |

|

61 |

% |

|

62 |

% |

|

60 |

% |

|

Adjusted Gross Margin |

65 |

% |

|

66 |

% |

|

66 |

% |

|

66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Anika Therapeutics, Inc. and

Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted

EBITDA |

|

(in

thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net loss |

$ |

(63,000 |

) |

|

$ |

(4,908 |

) |

|

$ |

(82,667 |

) |

|

$ |

(14,859 |

) |

|

Interest and other (income) expense, net |

(577 |

) |

|

(276 |

) |

|

(2,312 |

) |

|

(654 |

) |

|

Benefit from income taxes |

(204 |

) |

|

(1,483 |

) |

|

(2,660 |

) |

|

(3,887 |

) |

|

Depreciation and amortization |

1,787 |

|

|

1,880 |

|

|

7,069 |

|

|

7,340 |

|

|

Stock-based compensation |

3,815 |

|

|

3,813 |

|

|

15,243 |

|

|

14,315 |

|

|

Product rationalization |

- |

|

|

563 |

|

|

748 |

|

|

3,199 |

|

|

Arbitration settlement |

- |

|

|

- |

|

|

3,250 |

|

|

- |

|

|

Acquisition related intangible asset amortization |

1,787 |

|

|

1,786 |

|

|

7,148 |

|

|

7,147 |

|

|

Impairment of intangible assets |

62,190 |

|

|

- |

|

|

62,190 |

|

|

- |

|

|

Discontinuation of software development project |

- |

|

|

- |

|

|

4,473 |

|

|

- |

|

|

Costs of shareholder activism |

- |

|

|

- |

|

|

3,033 |

|

|

- |

|

|

Adjusted EBITDA |

$ |

5,798 |

|

|

$ |

1,375 |

|

|

$ |

15,515 |

|

|

$ |

12,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anika Therapeutics, Inc. and

Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted Net

Income |

|

(in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net loss |

$ |

(63,000 |

) |

|

$ |

(4,908 |

) |

|

$ |

(82,667 |

) |

|

$ |

(14,859 |

) |

|

Product rationalization, tax effected |

- |

|

|

456 |

|

|

725 |

|

|

2,410 |

|

|

Arbitration settlement, tax effected |

- |

|

|

- |

|

|

3,148 |

|

|

- |

|

|

Acquisition related intangible asset amortization, tax

effected |

1,781 |

|

|

1,446 |

|

|

6,926 |

|

|

5,386 |

|

|

Impairment of intangible assets, tax effected |

61,991 |

|

|

- |

|

|

60,250 |

|

|

- |

|

|

Discontinuation of software development project, tax effected |

- |

|

|

- |

|

|

4,333 |

|

|

- |

|

|

Costs of shareholder activism, tax effected |

- |

|

|

- |

|

|

2,938 |

|

|

- |

|

|

Adjusted net income (loss) |

$ |

772 |

|

|

$ |

(3,006 |

) |

|

$ |

(4,347 |

) |

|

$ |

(7,063 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anika Therapeutics, Inc. and

Subsidiaries |

|

Reconciliation of GAAP Diluted Earnings Per Share to

Adjusted Diluted Earnings Per

Share |

|

(in thousands, except per share

data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Diluted net loss per share |

$ |

(4.30 |

) |

|

$ |

(0.34 |

) |

|

$ |

(5.64 |

) |

|

$ |

(1.02 |

) |

|

Product rationalization, tax effected |

- |

|

|

0.03 |

|

|

0.05 |

|

|

0.17 |

|

|

Arbitration settlement, tax effected |

- |

|

|

- |

|

|

0.21 |

|

|

- |

|

|

Acquisition related intangible asset amortization, tax

effected |

0.12 |

|

|

0.10 |

|

|

0.47 |

|

|

0.36 |

|

|

Impairment of intangible assets, tax effected |

4.23 |

|

|

- |

|

|

4.11 |

|

|

- |

|

|

Discontinuation of software development project, tax effected |

- |

|

|

- |

|

|

0.30 |

|

|

- |

|

|

Costs of shareholder activism, tax effected |

- |

|

|

- |

|

|

0.20 |

|

|

- |

|

|

Adjusted diluted net income (loss) per share |

$ |

0.05 |

|

|

$ |

(0.21 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.49 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation, tax effected |

3,803 |

|

|

3,088 |

|

|

14,767 |

|

|

10,783 |

|

|

Stock-based compensation (EPS impact) |

$ |

0.26 |

|

|

$ |

0.21 |

|

|

$ |

1.01 |

|

|

$ |

0.74 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Anika Therapeutics, Inc. and Subsidiaries |

|

Revenue by Product Family |

|

(in thousands, except percentages) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

For the Twelve Months Ended December 31, |

|

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

OA Pain Management |

$ |

25,072 |

|

$ |

22,451 |

|

$ |

2,621 |

|

|

12 |

% |

|

$ |

101,927 |

|

$ |

91,984 |

|

$ |

9,943 |

|

|

11 |

% |

| Joint Preservation and

Restoration |

15,296 |

|

14,347 |

|

949 |

|

|

7 |

% |

|

54,879 |

|

50,402 |

|

4,477 |

|

|

9 |

% |

| Non-Orthopedic |

2,603 |

|

2,824 |

|

(221 |

) |

|

-8 |

% |

|

9,856 |

|

13,850 |

|

(3,994 |

) |

|

-29 |

% |

| Revenue |

$ |

42,971 |

|

$ |

39,622 |

|

$ |

3,349 |

|

|

8 |

% |

|

$ |

166,662 |

|

$ |

156,236 |

|

$ |

10,426 |

|

|

7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

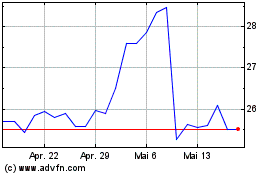

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024