TI Narrows 2Q Guidance Range - Analyst Blog

12 Juni 2012 - 6:32PM

Zacks

Recently, Texas Instruments (TXN), or "TI,"

narrowed its revenue and earnings expectations for the second

quarter of 2012. The chipmaker now expects sales of $3.28–$3.42

billion versus its previous guidance of $3.22–$3.48 billion. The

earnings outlook has also been narrowed to 32–36 cents per share

from the previous guidance of 30–38 cents.

Though the chipmaker has narrowed its guidance range, the

midpoint remains unchanged. According to Thomson Reuters, the

analysts also expect sales of $3.35 billion (in line with the

midpoint of the management guidance).

Specifically, management stated that the wireless segment will

decline sequentially. Even in the last quarter, revenue from the

wireless segment was impacted by lower demand in the baseband

business, which the company expects to phase out completely by the

end of the year.

However, TI’s Analog and Embedded Processing segments are

expected to post solid sequential growth. Orders and backlog are

also expected to grow sequentially based on strong demand.

TI expects the industrial market to recover faster than expected

and the addition of a solid product line-up from National

Semiconductor, acquired last year, to drive strong overall results

this year. On the whole, management commented that the business is

doing well and results are expected to be as expected.

In the past few quarters, TI had been lowering its guidance due

to soft market conditions and weakness in the handset and

industrial end markets. This is the first time in the past year

that the company has not lowered the midpoint of the guidance. TI

remains confident about the end-market recovery and expects

National Semiconductor to boost its results in the analog-chip

market.

Though the first quarter earnings were down 18.4% sequentially

and 28.6% year over year, management stated that the first quarter

should be regarded as the bottom, with growth expected to return in

the second. The fact that orders of $3.24 billion were up both

sequentially as well as from the year-ago quarter, also point to

growth at TI.

We believe the addition of National Semiconductor strengthens

its product line-up and brings additional capacity onboard.

Additionally, the company’s compelling product line-up, the

increased differentiation in its business, restructuring activities

and lower-cost 300mm capacity should drive earnings in the longer

term.

Increasing competition from Maxim Integrated

Products (MXIM), Analog Devices (ADI),

Broadcom (BRCM), and Intel (INTC)

remains a concern.

Currently, TI has a Zacks #3 Rank, which translates into a

short-term Hold rating.

ANALOG DEVICES (ADI): Free Stock Analysis Report

BROADCOM CORP-A (BRCM): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

MAXIM INTG PDTS (MXIM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

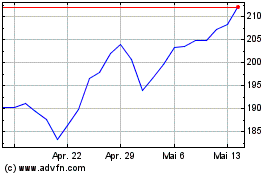

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024