- INBRIJA® (levodopa inhalation powder) Q2 2023 U.S. net revenue

of $8.3 million, a 12% increase from Q2 2022; ex-U.S. net revenue

of $0.8 million

- New INBRIJA prescription request forms increased 42% in 1H 2023

over 2022

- AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg Q2 2023

net revenue of $16.9 million, a 7% decrease from Q2 2022; FAMPYRA

royalty revenue of $2.9 million

- 2023 INBRIJA U.S. net revenue, adjusted operating expenses, and

year-end cash guidance revised

- Company does not expect to be cash flow neutral in 2023

- Nasdaq compliance regained after 1-for-20 reverse split

Acorda Therapeutics, Inc. (Nasdaq: ACOR) today provided a

business update and reported its financial results for the second

quarter ended June 30, 2023.

“INBRIJA’s growth in the first half of 2023 improved

significantly versus the first half of 2022, including a 42%

increase in new prescription request forms, or PRFs. New PRFs are a

leading indicator of future revenue growth, which we expect will

accelerate going forward. We are seeing the impact of the new sales

and marketing programs we launched this year; our streaming TV

commercial has had approximately 8 million views in its first 4

months, and 165 physicians have prescribed INBRIJA for the first

time in 2023 since they or their patients viewed the commercial,”

said Ron Cohen, M.D., Acorda’s President and Chief Executive

Officer. “U.S. net revenue in the first half of the year increased

less quickly than we projected, and we are therefore revising our

guidance for 2023 INBRIJA U.S. net revenue to $34 million-$38

million, from $38 million-$42 million, and as a result we do not

expect to be cash flow neutral this year. The new range continues

to represent significant growth over 2022 and, in addition, we have

continued to control costs, enabling us to revise our guidance for

operating expenses to $93 million-$98 million from $93 million-$103

million.”

Dr. Cohen added, “We were also pleased that Ampyra continued to

perform well, with flattening of its attrition curve. And we have

continued to communicate with our bondholders to enable

constructive approaches to servicing the Company’s convertible

debt.”

Second Quarter 2023 Financial Results

For the quarter ended June 30, 2023, the Company reported

INBRIJA worldwide net revenue of $9.1 million, a 2% decrease, of

which $8.3 million was from sales in the U.S., a 12% increase,

compared to the same quarter in 2022. The first quarter of 2022

included initial channel loading shipments for the launch in

Germany, whereas initial shipments for the launch in Spain occurred

largely in the first quarter of 2023. The Company also reported

ex-U.S. INBRIJA net revenue of $0.8 million in the second quarter

related to the launch in Spain.

For the quarter ended June 30, 2023, the Company reported AMPYRA

net revenue of $16.9 million, a 7% decrease compared to $18.2

million for the same quarter in 2022. Additionally, for the quarter

ended June 30, 2023, the Company reported FAMPYRA royalty revenues

of $2.9 million, a 6% decrease compared to the same quarter in

2022. As previously disclosed, AMPYRA lost its exclusivity when

generics entered the market in 2018, and the Company expects AMPYRA

revenue to continue to decline, although at a slower rate.

Research and development (R&D) expenses for the quarter

ended June 30, 2023 was $1.6 million, compared to $1.5 million for

the quarter ended June 30, 2022. Sales, general and administrative

(SG&A) expenses for the quarter ended June 30, 2023 were $21.8

million, compared to $30.1 million for the same quarter in

2022.

Total operating expenses for the quarter ended June 30, 2023 was

$33.3 million, compared to $45 million for the same quarter in

2022.

Non-GAAP adjusted operating expenses (adjusted OPEX) for the

quarter ended June 30, 2023 was $23.4 million, compared to $31.6

million for the same quarter in 2022. This quarterly non-GAAP

measure, more fully described below under “Non-GAAP Financial

Measures,” excludes costs of goods sold, amortization of intangible

assets, change in fair value of derivative liability, and change in

fair value of acquired contingent liability. A reconciliation of

the GAAP operating expenses to non-GAAP operating expenses is

included with the attached financial statements.

Benefit from income taxes for the quarter ended June 30, 2023

was $2 million, compared to a provision for income taxes of $26.6

million for the same quarter in 2022.

The Company reported a net loss of $9.4 million for the quarter

ended June 30, 2023, or a net loss of ($7.55) per share on both a

basic and diluted basis. Net loss in the same quarter of 2022 was

$46.7 million, or a net loss of ($54.01) per share on both a basic

and diluted basis.

At June 30, 2023, the Company had cash, cash equivalents, and

restricted cash of $26.4 million, compared to $44.7 million at year

end 2022.

2023 Financial Guidance

For the full year 2023, the Company revised INBRIJA U.S. net

revenue guidance to be $34-$38 million, from $38-$42 million.

Adjusted OPEX guidance was revised to be $93-$98 million, from

$93-$103 million. Ending cash balance guidance was revised to be

$39-44 million, from $43-$47 million. The Company reaffirms

guidance for AMPYRA net revenue to be $65-$70 million. The Company

does not expect to be cash flow neutral in 2023.

Reverse Split and Nasdaq Minimum Bid Price Compliance

On June 2, 2023, the Company completed a 1-for-20 reverse stock

split of its outstanding and authorized shares of common stock, and

it began trading on a split-adjusted basis at the market open on

June 5, 2023. The Company subsequently received notification from

the Nasdaq Stock Market that as of June 20, 2023 it had regained

compliance with the minimum bid price requirement set forth in

Nasdaq Listing Rule 5450(a)(1), and the common stock continues to

be listed and traded on the Nasdaq Global Select Market.

Board of Directors

At Acorda’s Annual Meeting of Stockholders on June 22, 2023, Tom

Burns, the Senior Vice President of Finance and Chief Financial

Officer of XOMA Corporation, was elected to the Company’s Board of

Directors. Jeff Randall, who had served on Acorda’s Board since

2006, rotated off the Board.

Webcast and Conference Call

The Company will host a webcast/conference call in conjunction

with its second quarter 2023 update and financial results today at

4:30 p.m. ET.

To participate in the Webcast, please use the following

registration link:

- https://events.q4inc.com/attendee/268055678

If you register for the Webcast, you will have the opportunity

to submit a written question for the Q&A portion of the

presentation. After you have registered, you will receive a

confirmation email with the Webcast details. On the day of the

Webcast, you will receive an email 2 hours prior to the start of

the Webcast with the link to join. The presentation will be

available on the Investors section of www.acorda.com.

A replay of the call will be available from 8:30 p.m. ET on

August 8, 2023, until 11:59 p.m. ET on September 7, 2023. To access

the replay, please dial 1 866 813 9403 (domestic) or +1 929 458

6194 (international); access code 649308. The archived webcast will

be available in the Investor Relations section of the Acorda

website at www.acorda.com.

Non-GAAP Financial Measures

This press release includes financial results prepared in

accordance with accounting principles generally accepted in the

United States (GAAP) and also certain historical and

forward-looking non-GAAP financial measures. Non-GAAP financial

measures are not an alternative for financial measures prepared in

accordance with GAAP, and the calculation of the non-GAAP financial

measures included herein may differ from similarly titled measures

used by other companies. The Company believes that the presentation

of these non-GAAP financial measures, when viewed in conjunction

with actual GAAP results, provides investors with a more meaningful

understanding of our ongoing and projected operating performance

because it excludes (i) certain expenses that are not routine to

the operation of our business, (ii) non-cash charges that are

substantially dependent on changes in the market price of our

common stock, and (iii) other items that are not ascertainable at

the present time. We believe these non-GAAP financial measures help

indicate underlying trends in the Company’s business and are

important in comparing current results with prior period results

and understanding expected operating performance. Also, management

uses these non-GAAP financial measures to establish budgets and

operational goals, and to manage the Company’s business and

evaluate its performance. In addition, management believes that

adjusted OPEX is important in evaluating the administrative costs

of operating the Company’s business.

Adjusted OPEX includes research and development expenses and

selling, general, and administrative expenses, and excludes (i)

costs of goods sold, (ii) amortization of intangible assets, (iii)

change in fair value of derivative liability, and (iv) change in

fair value of acquired contingent liability. We are unable to

reconcile our guidance for this non-GAAP measure to GAAP due to the

forward-looking nature of the adjustments that are needed to

determine this information, which includes information regarding

future compensation charges, future changes in the market price of

our common stock, and changes in the fair value of derivative and

contingent liabilities, none of which are available at this

time.

About Acorda Therapeutics

Acorda Therapeutics develops therapies to restore function and

improve the lives of people with neurological disorders. INBRIJA®

is approved for intermittent treatment of OFF episodes in adults

with Parkinson’s disease treated with carbidopa/levodopa. INBRIJA

is not to be used by patients who take or have taken a nonselective

monoamine oxidase inhibitor such as phenelzine or tranylcypromine

within the last two weeks. INBRIJA utilizes Acorda’s innovative

ARCUS® pulmonary delivery system, a technology platform designed to

deliver medication through inhalation. Acorda also markets the

branded AMPYRA® (dalfampridine) Extended Release Tablets, 10

mg.

Forward-Looking Statements

This press release includes forward-looking statements. All

statements, other than statements of historical facts, regarding

management's expectations, beliefs, goals, plans or prospects

should be considered forward-looking. These statements are subject

to risks and uncertainties that could cause actual results to

differ materially, including: we may not be able to successfully

market INBRIJA, AMPYRA, or any other products that we may develop;

our ability to attract and retain key management and other

personnel, or maintain access to expert advisors; our ability to

raise additional funds to finance our operations, repay outstanding

indebtedness or satisfy other obligations, and our ability to

control our costs or reduce planned expenditures and take other

actions which are necessary for us to continue as a going concern;

risks related to the successful implementation of our business

plan, including the accuracy of our key assumptions; risks related

to our corporate restructurings, including our ability to outsource

certain operations, realize expected cost savings and maintain the

workforce needed for continued operations; risks associated with

complex, regulated manufacturing processes for pharmaceuticals,

which could affect whether we have sufficient commercial supply of

INBRIJA or AMPYRA to meet market demand; our reliance on

third-party manufacturers for the production of commercial supplies

of INBRIJA and AMPYRA; third-party payers (including governmental

agencies) may not reimburse for the use of INBRIJA or AMPYRA at

acceptable rates or at all and may impose restrictive prior

authorization requirements that limit or block prescriptions;

reliance on collaborators and distributors to commercialize INBRIJA

and AMPYRA outside the U.S.; our ability to satisfy our obligations

to distributors and collaboration partners outside the U.S.

relating to commercialization and supply of INBRIJA and AMPYRA;

competition for INBRIJA and AMPYRA, including increasing

competition and accompanying loss of revenues in the U.S. from

generic versions of AMPYRA (dalfampridine) following our loss of

patent exclusivity; the ability to realize the benefits anticipated

from acquisitions because, among other reasons, acquired

development programs are generally subject to all the risks

inherent in the drug development process and our knowledge of the

risks specifically relevant to acquired programs generally improves

over time; the risk of unfavorable results from future studies of

INBRIJA (levodopa inhalation powder) or from other research and

development programs, or any other acquired or in-licensed

programs; the occurrence of adverse safety events with our

products; the outcome (by judgment or settlement) and costs of

legal, administrative or regulatory proceedings, investigations or

inspections, including, without limitation, collective,

representative or class-action litigation; failure to protect our

intellectual property, to defend against the intellectual property

claims of others or to obtain third-party intellectual property

licenses needed for the commercialization of our products; and

failure to comply with regulatory requirements could result in

adverse action by regulatory agencies.

These and other risks are described in greater detail in our

filings with the Securities and Exchange Commission. We may not

actually achieve the goals or plans described in our

forward-looking statements, and investors should not place undue

reliance on these statements. Forward-looking statements made in

this press release are made only as of the date hereof, and we

disclaim any intent or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this press release, except as may be required by law.

Financial Statements

Acorda Therapeutics, Inc. Condensed Consolidated Balance

Sheet Data (in thousands)

June 30,

December 31,

2023

2022

(unaudited)

Assets

Cash and cash equivalents

$

25,270

$

37,536

Restricted cash - short term

828

6,884

Trade receivable, net

13,390

13,866

Other current assets

10,629

11,077

Inventories, net

14,797

12,752

Property and equipment, net

2,163

2,603

Intangible assets, net

289,700

305,087

Restricted cash - long term

255

255

Right of use assets, net

4,765

5,287

Other assets

2,899

248

Total assets

$

364,696

$

395,595

Liabilities and stockholders'

equity

Accounts payable, accrued expenses and

other current liabilities

$

25,544

$

33,873

Current portion of lease liability

1,567

1,545

Current portion of contingent

consideration

3,274

2,532

Convertible senior notes

176,164

167,031

Non-current portion of acquired contingent

consideration

35,226

38,668

Non-current portion of lease liability

3,764

4,341

Deferred tax liability

39,556

44,202

Other long-term liabilities

11,733

9,781

Total stockholders' equity

67,868

93,622

Total liabilities and stockholders'

equity

$

364,696

$

395,595

Acorda Therapeutics, Inc.

Consolidated Statements of Operations (in thousands,

except per share amounts) (unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Revenues:

Net product revenues

$

25,965

$

27,484

$

44,684

$

46,059

Royalty revenues

3,687

3,567

7,215

7,526

License revenue

23

-

34

-

Total revenues

29,675

31,051

51,933

53,585

Costs and expenses:

Cost of sales

3,065

8,800

6,299

14,768

Research and development

1,550

1,525

2,936

3,219

Selling, general and administrative

21,825

30,067

44,339

57,005

Amortization of intangible assets

7,691

7,691

15,382

15,382

Change in fair value of derivative

liability

—

(7

)

—

(37

)

Change in fair value of acquired

contingent consideration

(824

)

(3,110

)

(1,915

)

(6,133

)

Other operating expense, net

-

-

-

-

Total operating expenses

33,307

44,966

67,041

84,204

Operating loss

$

(3,632

)

$

(13,915

)

$

(15,108

)

$

(30,619

)

Other income (expense), net:

Interest expense, net

(7,715

)

(7,454

)

(15,193

)

(15,015

)

Other income, net

1

1,250

93

1,250

Total other expense, net

(7,714

)

(6,204

)

(15,100

)

(13,765

)

Loss before income taxes

(11,346

)

(20,119

)

(30,208

)

(44,384

)

Benefit from (provision for) income

taxes

1,965

(26,563

)

4,003

(26,821

)

Net loss

$

(9,381

)

$

(46,682

)

$

(26,205

)

$

(71,205

)

Net loss per common share - basic

$

(7.55

)

$

(54.01

)

$

(21.10

)

$

(97.33

)

Net loss per common share - diluted

$

(7.55

)

$

(54.01

)

$

(21.10

)

$

(97.33

)

Weighted average common shares - basic

1,242

864

1,242

732

Weighted average common shares -

diluted

1,242

864

1,242

732

Acorda Therapeutics, Inc.

Adjusted Operating Expenses Reconciliation (in thousands,

except per share amounts) (unaudited)

Three Months Ended

Three Months Ended

Six Months Ended

Six Months Ended

June 30,

June 30,

June 30,

June 30,

2023

2022

2023

2022

Operating Expenses per Income Statement

(GAAP)

$

33,307

$

44,966

$

67,041

$

84,204

Adjustments:

Cost of goods sold

(3,065

)

(8,800

)

(6,299

)

(14,768

)

Amortization of intangible assets

(7,691

)

(7,691

)

(15,382

)

(15,382

)

Change in fair value of derivative

liability

-

7

-

37

Change in fair value of acquired

contingent consideration

824

3,110

1,915

6,133

Total adjustments

(9,932

)

(13,374

)

(19,766

)

(23,980

)

Adjusted operating expenses (non-GAAP)

$

23,375

$

31,592

$

47,275

$

60,224

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808758177/en/

Tierney Saccavino (914) 326-5104 tsaccavino@acorda.com

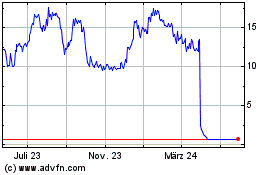

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025