TIDMSTK

RNS Number : 1276V

StreaksAI PLC

30 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014, as retained as part of

the law of England and Wales. Upon the publication of this

announcement via the Regulatory Information Service, this inside

information is now considered to be in the public domain.

Press Release

30 November 2023

StreaksAI PLC

("Streaks" or "the Company")

Interim results

StreaksAI PLC (LSE: STK), a UK-based generative Artificial

Intelligence (AI) platform, announces its unaudited financial

results for the six months ended 31 August 2023.

Operating and financial summary

-- Launched second flagship product, 'Streaks Social', to create realistic chatbots based on

high-profile influencers, allowing the influencers to scale and engage with their audience

using AI and large language models (LLMs), as part of wider expansion into the lucrative artificial

intelligence sector.

-- Changed name to StreaksAI, reflecting the Company's expanded focus on AI technologies across

both Streaks Gaming and Streaks Social.

-- Partnered with community e-commerce platform WeShop to redefine customer service and engagement,

enabling brands to build stronger connections with their audiences.

-- Strengthened Board of Directors with appointment of Philip Blows as Chief Executive Officer.

-- Signed advertising partnership with William Hill US to generate referral revenues, taking

signed commercial partnerships for Streaks Gaming to 14.

-- Loss before tax amounted to GBP0.93m reflecting investments in product development. (GBP3.35m

at the start of the year; H1).

-- Net cash amounted to GBP1.03m as at 31 August 2023 and GBP0.71m as at 27 November 2023.

Post-period highlights

-- Launched 'Streaks Idols', a mass-market product enabling the public to generate their own

AI characters with innate monetisation.

-- Recorded promising early sign-ups to Streaks Idols, with 9,135 users and over 60,000 messages

sent as at 2 November.

-- User numbers rose to 15,736 and over 127,000 messages sent as at 23 November.

-- Expanded AI offering with launch of 'Streaks Companion', a highly personalised AI chatbot

service allowing for sophisticated humanlike companionship.

-- Generated first revenues through sales of AI products.

Outlook

-- Current trading remains in line with management expectations as Streaks expands into the AI

sector. Positive momentum in sign-ups for Streaks Idols and Streaks Companion.

-- The AI industry, especially conversational AI, is at its growth stage and will continue to

develop over the next 12 months and Streaks is well positioned to take advantage of this.

-- Costs expected to fall as one-off development expenses of AI products now completed.

-- Streaks to explore how it can leverage Streaks Gaming's proprietary technology to generate

further revenue.

-- Streaks is focused on expanding its business model through building on current products and

enhancing the current platform, strengthening the pipeline of partnerships and building consumer

trust.

Commenting on the results, Philip Blows, Chief Executive of

Streaks said: "The AI sector has grown rapidly in 2023 and Streaks

has moved quickly to meet consumer demand. With significant

appetite for chatbot products from corporate customers looking to

improve their customer service, as well as consumers looking for

entertainment or companionship, there is a great opportunity for

Streaks to take advantage of AI's upward growth trajectory. I'm

thrilled with the progress we've made in developing our AI products

and we're already seeing consumer interest grow as we have now

entered our revenue-generating phase.

"Streaks Gaming remains an important part of our business, and

we were pleased to partner with William Hill to bring our total

number of partners to 14. We're evaluating where best we can

leverage our proprietary conversational gaming technologies to grow

the Company and complement the burgeoning conversational AI side of

our business."

For further information please contact:

StreaksAI PLC

Philip Blows via Tancredi

Chief Executive +44 207 887 7633

-------------------

Tennyson Securities

-------------------

Corporate Broker

Peter Krens +44 207 186 9030

-------------------

First Sentinel

-------------------

Corporate Broker

Brian Stockbridge +44 203 989 2200

-------------------

Tancredi Intelligent Communication

-------------------

Media Relations

Helen Humphrey

Charlie Hobbs +44 744 922 6720

Neha Dhakal +44 7897 557112

stai@tancredigroup.com +44 7915 035294

-------------------

About Streaks:

StreaksAI PLC is a provider of AI based conversational

technologies. The Company offers two core products in the gaming

and conversational AI space.

For more information on the Conversational Gaming AI product, please visit www.playstreaks.com .

For more information on the Conversational AI product, please visit www.streaks.ai .

Forward-looking statements

This document contains forward-looking statements which are

subject to known and unknown risks and uncertainties because they

relate to future events, many of which are beyond the Company's

control. These forward-looking statements include, without

limitation, statements in relation to the Company's financial

outlook and future performance. No assurance can be given that

future results will be achieved; actual events or results may

differ materially as a result of risks and uncertainties facing the

Company.

You are cautioned not to rely on these forward-looking

statements, which speak only as of the date of this announcement.

The Company undertakes no obligation to update or revise any

forward-looking statement to reflect any change in its expectations

or any change in events, conditions or circumstances. Nothing in

this document is or should be relied upon as a warranty, promise or

representation, express or implied, as to the future performance of

the Company or the Group or their businesses.

INTERIM MANAGEMENT REPORT

Overview

The Company is in its first year, having listed in January 2023,

and has quickly gained momentum, driven by the Company's entry into

the growing conversational AI sector. Consumer interest in

artificial intelligence grew rapidly in early 2023, with OpenAI's

ChatGPT becoming the fastest-growing consumer application in

history (source: Reuters, 2023). The Board identified an

opportunity to leverage the Company's AI expertise from its work in

conversational gaming to gain market share in the still nascent

conversational AI space. Moreover, the Company has been able to

capitalise on its intellectual property realised through its

existing Streaks Gaming business to develop sophisticated new

products in a short development timeframe. This additional pillar

and revenue stream for the business is reflected in the Company's

decision to change its name to StreaksAI, which took place on 10

July.

The loss before tax was GBP925,000 for the period ended 31

August 2023, attributable to several one-off investments into

product development to greatly expand the Company's AI offering,

with the intent of positioning Streaks plc as a leading company in

the conversational AI industry.

Operating Review

Streaks expanded its AI offering first through the launch of

Streaks Social, an influencer-focused product that utilises Natural

Language Processing (NLP) text generators like GPT-4 to create a

realistic AI facsimile of a real-world influencer. Influencer

marketing is a $21.1 billion industry (source: Statista, 2023)

which is reliant on influencers' connection with their fans.

Streaks Social allows fans to have personalised conversations with

influencers, which the Company has monetised through sale of

Streaks credits.

Streaks further expanded its conversational AI offering with the

launch of Streaks Idols, a social product and AI character

generator which offers a range of customisable AI-powered chatbots

capable of sophisticated humanlike interaction. Streaks Idols has

innate monetisation, allowing users to generate revenue through

interactions with their chatbots. Alongside Streaks Idols, Streaks

launched Streaks Companion, providing private chatbots designed for

long-term conversations, offering companionship, mentorship and

digital assistance services. Streaks Companion launched with a

dedicated portal on the Company's state-of-the-art website.

Streaks' conversational AI services have generated positive

momentum, having seen it sign up over 15,700 registered users in

its first few months of operation. Moreover, it surpassed 127,000

in aggregate messages sent across the platform userbase.

The Streaks platform is still developing further despite

competitive market conditions. With Streaks' development of digital

tie-ins including calendar integration, which are expected to

release in Q1 2024, Streaks is well positioned to take advantage of

the new opportunities ahead and create value for shareholders.

Alongside consumer-facing conversational AI, the Company is

continuing to identify growth and partnership opportunities with

commercial partners. In August 2023, Streaks partnered with WeShop,

a community owned social commerce platform that combines shopping

with social media, to deliver a human-like intuitive conversational

interface for shoppers seeking in-platform assistance including

addressing queries, resolving issues, or receiving product

information.

Despite the Company's move into the conversational AI sector,

conversational gaming remains an important part of Streaks'

offering. In March, the Company signed an advertising partnership

with William Hill US to generate referral revenues, taking the

total number of signed commercial partnerships for Streaks Gaming

to 14.

Beyond Streaks' successful partnerships with WeShop and William

Hill in the e-commerce and betting sectors, the Company is

exploring expanding into new areas such as HR and education where

it can leverage its AI technologies and plans to add value by

integrating the product for automation and assistance in these

sectors. Streaks' management has seen positive momentum in user

growth and messages sent on its conversational AI products, and the

Company plans to roll out the Idols service on further platforms

including WhatsApp and SMS text messaging.

Outlook

The Company considers that due to the growing size of the AI

market, there is demand for conversational AI platforms which are

tailored to the individual and useful in personal assistance. The

Board is pleased with the positive momentum of the Company's social

AI products, which have seen positive audience growth following

launch and have generated Streaks' first revenues. The Board

believes the AI sector will continue to grow and mature, evidenced

by the increased presence of large institutional investors in the

space. Streaks is in an excellent position to take advantage of the

sector's growth.

The Directors are of the opinion that the Company has adequate

working capital to meet its obligations over the next 12 months.

The Company is focused on reducing administrative costs in relation

to Streaks and anticipate and forecast that the Streaks Idols and

Streaks Companion will be strongly cash generative, and the costs

related to this revenue will be minimal.

STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTH PERIODING 31 AUGUST 2023

Unaudited Audited

Period ending Year ending

31 August 28 February

2023 2023

Note GBP'000 GBP'000

------------------------------------------ ----- ------------- ------------

Continuing Operations

Administrative expenses (925) (3,351)

Operating loss (925) (3,351)

Finance Income - -

Loss before taxation (925) (3,351)

------------------------------------------------- ------------- ------------

Taxation on loss of ordinary - -

activities

------------------------------------------ ----- ------------- ------------

Loss for the year from continuing

operations (925) (3,351)

Other comprehensive income - -

------------------------------------------ ----- ------------- ------------

Total comprehensive loss for

the year attributable to shareholders

from continuing operations (925) (3,351)

------------------------------------------------- ------------- ------------

Basic & dilutive earnings per

share - pence (0.24) (1.24)

------------------------------------------------- ------------- ------------

STATEMENT OF FINANCIAL POSITION AS AT 31 AUGUST 2023

Unaudited Audited

As At 31 AUG As At 28 FEB

2023 2022

Note GBP'000 GBP'000

------------------------------- -------- ---------------------------- -----------------------------

NON-CURRENT ASSETS

Intangible assets 6 63 63

------------------------------- -------- ---------------------------- -----------------------------

TOTAL NON-CURRENT ASSETS 63 63

------------------------------- -------- ---------------------------- -----------------------------

CURRENT ASSETS

Cash and cash equivalents 1,032 2,070

Trade and other receivables 79 196

------------------------------- -------- ---------------------------- -----------------------------

TOTAL CURRENT ASSETS 1,112 2,266

------------------------------- -------- ---------------------------- -----------------------------

TOTAL ASSETS 1,175 2,329

------------------------------- -------- ---------------------------- -----------------------------

EQUITY

Share capital 4 379 378

Share Premium 4 4,880 4,880

Share Based Payment Reserve 5 704 704

Retained Earnings (4,876) (3,951)

------------------------------- -------- ---------------------------- -----------------------------

TOTAL EQUITY 1,086 2,011

------------------------------- -------- ---------------------------- -----------------------------

CURRENT LIABILITIES

Trade and other payables 89 318

------------------------------- -------- ---------------------------- -----------------------------

TOTAL CURRENT LIABILITIES 89 318

------------------------------- -------- ---------------------------- -----------------------------

TOTAL LIABILITIES 89 318

------------------------------- -------- ---------------------------- -----------------------------

TOTAL EQUITY AND LIABILITIES 1,175 2,329

=============================== ======== ============================ =============================

The condensed interim financial statements were approved and

authorised by the Board of Directors on 24 November 2023 and were

signed on its behalf by:

Nicholas Lyth

Director

STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTH PERIODING 31 AUGUST 2023

Share Capital Share Premium Share Retained Total

GBP'000 GBP'000 based payment Earnings Equity

reserve GBP'000 GBP'000

GBP'000

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Loss for period - - - (3,351) (3,351)

Other comprehensive income - - - - -

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Total comprehensive income

for year - - - (3,351) (3,351)

-

Transactions with owners -

in own capacity

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Ordinary shares issued 224 4,432 - - 4,656

Advisor warrants issued - - - - -

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Transactions with owners

in own capacity - - 679 - 679

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Balance at 28 February

2023 378 4,880 704 (3,951) 2,011

============================= ================== ================= ================= ============= =============

Loss for period - - - (925) (925)

Other comprehensive income 0 (0) - - -

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Total comprehensive income

for year - - - (925) (925)

Transactions with owners

in own capacity

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Ordinary shares issued - - - - -

Advisor warrants issued - - - - -

Share issue costs - - - - -

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Transactions with owners - - - - -

in own capacity

----------------------------- ------------------ ----------------- ----------------- ------------- -------------

Balance at 31 August

2023 379 4,880 704 (4,876) 1,086

============================= ================== ================= ================= ============= =============

STATEMENT OF CASHFLOWS

FOR THE 6 MONTH PERIODING 31 AUGUST 2023

Unaudited Audited

6 month 12 month

period period ended

ended 31 28 Feb

Aug 2023

2023

Note GBP '000 GBP '000

------------------------------------------------------------------------------------ ------------------------ ----------------

Cash flow from operating activities

Cash used by operations (1,037) (2,631)

Net cash outflow from operating activities (1,037) (2,631)

------------------------------------------------------------------------------------ ------------------------ ----------------

Cash flows from investing activities

Purchase of property, plant and equipment - -

Purchase of intangible assets - -

------------------------------------------------------------------------------------ ------------------------ ----------------

Net cash flow from investing activities - -

------------------------------------------------------------------------------------ ------------------------ ----------------

Cash flows from financing activities

Share issue, net of issue costs - 4,656

Net cash flow from financing activities - 4,656

------------------------------------------------------------------------------------ ------------------------ ----------------

Net (decrease) in cash and cash equivalents (1,037) 2,025

Cash and cash equivalents at beginning

of the period 2,070 45

Foreign exchange impact on cash - -

Cash and cash equivalents at end of

the period 1,032 2,070

------------------------------------------------------------------------------------ ------------------------ ----------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE 6 MONTH PERIODING 31 AUGUST 2023

1 General information

StreaksAI Plc is a public limited company incorporated in

England and Wales and domiciled in the United Kingdom. The

registered office and principal place of business is 16 Great Queen

Street, London WC2B 5DG.

The Company was incorporated on 19 March 2021 and started

trading on the LSE on the 5th January 2023.

The Company's principal activities and nature of its operations

are disclosed in the Directors' Report.

2 Accounting policies

IAS 8 requires that management shall use its judgement in

developing and applying accounting policies that result in

information which is relevant to the economic decision-making needs

of users, that are reliable, free from bias, prudent, complete and

represent faithfully the financial position, financial performance

and cash flows of the entity.

2.1 Basis of preparation

The condensed interim financial statements ("interim financial

statements") have been prepared in accordance with International

Accounting Standard 34 "Interim Financial Reporting" (IAS 34) as

adopted by the European Union (EU). The interim financial

statements have been prepared on the historical cost basis, except

for assets and liabilities measured at fair value through profit

and loss, and are presented in pounds sterling (GBP). All amounts

have been rounded to the nearest pound, unless otherwise

stated.

The interim financial statements have not been audited. The

interim financial statements do not constitute statutory accounts

within the meaning of section 434 of the Companies Act 2006. The

figures have been prepared using applicable accounting policies and

practices consistent with those adopted in the audited annual

financial statements ("annual financial statements") for the year

ended 30 November 2021.

The interim financial statements are for the six months to 31

August 2023, being six months from the financial year end for the

Company being 28 February 2023. The interim financial statements do

not include all the information and disclosures required in the

annual financial statements and should be read in conjunction with

the Company's annual financial statements for the period ended 28

February 2023. The Company has not disclosed comparative data for

the period from 28(th) February to 31 Aug 2022 as required for

disclosure by accounting standards due to the company having

started trading on the LSE on the 5th January 2023 and no such data

exists. The company has disclosed the audited figures from the

annual financial statements.

The functional currency for the Company is determined as the

currency of the primary economic environment in which it operates.

Both the function and presentational currency of the Company Pounds

Sterling (GBP).

The business is not considered to be seasonal in nature.

New standards, amendments and interpretations adopted by the

Company

During the current period the Company adopted all the new and

revised standards, amendments and interpretations that are relevant

to its operations and are effective for accounting periods

beginning on 1 December 2021. This adoption did not have a material

effect on the accounting policies of the Company.

New standards, amendments and interpretations not yet adopted by

the Company

The standards and interpretations that are relevant to the

Company, issued, but not yet effective, up to the date of these

interim financial statements have been evaluated by the directors

and they do not consider that there will be a material impact of

transition on the financial statements.

2.2 Going concern

The Company has not yet commenced trade from which it will

generate revenue. However, having successfully had its shares

listed on the London Stock Exchange on 5 January 2023, the

Directors are of the opinion that the Company has adequate working

capital to meet its obligations over the next 12 months. The

Directors have focused on reducing administrative costs in relation

to StreaksAI and anticipate and forecast that the Streaks Social

business will be strongly cash generative, and the costs related to

this revenue will be minimal. As a result, the Directors have

adopted the going concern basis of accounting in the preparation of

the interim financial statements.

2.3 Risks and uncertainties

The principal risks and uncertainties relevant to the Company

have not changed materially since the release of the annual

financial statements for the period ending 28 February 2023. These

risks can be referenced in the strategic report contained within

the annual financial statements.

3 Critical accounting estimates and judgements

In the application of the Company's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods. The areas involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are

significant to the financial statements, are disclosed below:

Share Based Payments

The Company measures the cost of equity-settled transactions by

reference to the fair value of the equity instruments at the date

at which they are granted. The fair value is determined by using

the Black-Scholes model taking into account the terms and

conditions upon which the instruments were granted. The accounting

estimates and assumptions relating to equity-settled share-based

payments would have no impact on the carrying amounts of assets and

liabilities within the next annual reporting period but may impact

profit or loss and equity. There have been no dilutive instruments

issued in the period and the value remains equal to that in the

annual financial statements as at the last reporting period.

4 Share capital and share premium

Ordinary Share Share

Shares Capital Premium Total

# GBP GBP GBP

---------------------- ----------- -------- --------- ---------

At 28 February 2023 378,312,535 378,313 4,880,411 5,258,724

---------------------- ----------- -------- --------- ---------

At 31 August 2023 378,732,535 378,733 4,879,991 5,258,724

---------------------- ----------- -------- --------- ---------

5 Share based payments and Other reserves

As at 31 As at 28

Aug 2023 Feb 2023

GBP GBP

Share based payments Reserve 703,816 24,800

Warrants issued in the period - 679,016

Warrants cancelled in the period - -

--------------------------------- -------------------------------------------------------- ---------

Total 703,816 703,816

6 Intangible assets

Development costs Total

GBP'000 GBP'000

Cost as at 28 Feb 23 63 63

Additions - -

Cost as at 31 Aug 23 63 63

-------------------------------- ------------------ ---------

Amortisation and impairment as - -

at 28 Feb 23

Charge for the period - -

Amortisation and impairment as - -

at 31 Aug 23

-------------------------------- ------------------ ---------

Carrying amount as at Feb 23 63 63

Carrying amount as at Aug 23 63 63

-------------------------------- ------------------ ---------

Intangible assets includes GBP52,000 in relation to the

acquisition of the business and

intangible assets on 15 November 2021 of StreaksAI from Flatiron

Labs Inc

The following warrants over ordinary shares have been granted by

the Company and are outstanding at 31 August 2023:

Number of Warrants Exercise Expiry date

Price

--------------------------- ------------------ -------- -----------

On incorporation - - -

Issued on 18 October 2021 26,700,000 GBP0.01 17 Oct 2024

Issued on 5 January 2023 45,499,000 GBP0.06 4 Jan 2026

Issued on 5 January 2023 4,501,000 GBP0.06 4 Jan 2026

Issued on 5 January 2023 6,000,000 GBP0.03 4 Jan 2026

At 31 Aug 2023 82,700,000

------------------ --------

There were no dilutive instruments issued in the 6 month period

ending 31 Aug 2023.

The fair value of the share warrant rights granted are valued

using the Black-Scholes option pricing model. The option pricing

model assumptions can be referenced in the annual financial

statements.

7 Financial commitments & contingent liabilities

There were no capital commitments or contingent liabilities

pertaining to the Company at 31 Aug 2023.

8 Related party transactions

The company made payments to the following companies in relation

to directors' fees:

Period 1 Mar to Year ended

31 Aug 2023 28 Feb 2023

GBP GBP

Carraway Capital Corp - Mr Mark Rutledge 30,000 32,500

Dark Peak Services Ltd - Mr Nicholas

Lyth 18,000 60,000

Marallo Holdings Inc - Mr Michael

Edwards 48,000 16,000

Infinity Growth Digital Inc. - Mr

David Raphael 45,000 15,000

Gordon Silvera 30,000 7,500

171,000 131,000

9 Events subsequent to period end

There were no material events subsequent to period end that

require disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGQAGUPWGMB

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

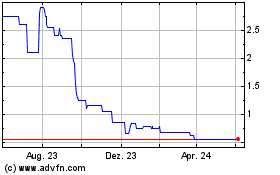

Streaksai (LSE:STK)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

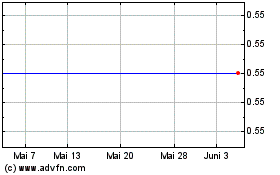

Streaksai (LSE:STK)

Historical Stock Chart

Von Mai 2023 bis Mai 2024