TIDMRQIH

RNS Number : 8686Q

R&Q Insurance Holdings Ltd

20 October 2023

This announcement contains inside information

R&Q Insurance Holdings Ltd

Proposed Sale of R&Q's Program Management business,

Accredited, to Onex

for $465 million

20 October 2023

On 4th April 2023, R&Q Insurance Holdings Ltd ("R&Q",

the "Company" or the "Group") announced that it was undertaking a

strategic initiative to separate its legacy insurance business

("R&Q Legacy") and its program management business

("Accredited"). Today R&Q announces that it has entered into a

conditional agreement with funds advised by Onex Corporation (the

"Purchaser" or "Onex" (1) ) to sell 100% of the equity interest in

Randall & Quilter America Holding Inc., the holding company of

Accredited (the "Sale"). Closing of the Sale is conditional on

R&Q shareholder approval, regulatory approval and customary

consents from certain R&Q debt providers.

Key sale highlights

-- Proposed Sale of Accredited for an enterprise value of $465m,

representing an expected equity value of approximately $438

million.

-- Net cash proceeds from the Sale are expected to be

approximately $300 million ( "Expected Net Cash Proceeds").

-- Net cash proceeds available for utilisation immediately on

closing are expected to be between approximately $170 million and

$210 million ( "Available Net Cash Proceeds").

-- The Available Net Cash Proceeds will be entirely used to

facilitate a material de-leveraging of R&Q.

-- The Sale is conditional on the transfer of R&Q's Chief

Executive Officer, William Spiegel, and Chief Financial Officer,

Thomas Solomon to Accredited upon closing.

-- Upon closing of the Sale, Group Non-Executive Chairman Jeff

Hayman will act as Chairman and Interim Chief Executive Officer of

R&Q. The Board will initiate a search to appoint a new Chief

Executive Officer of R&Q at the appropriate time.

-- Upon closing of the Sale, Paul Bradbrook, currently Chief

Accounting Officer of R&Q, will become Chief Financial Officer

of R&Q and a member of the Board of Directors.

Background and Board recommendation

On 4(th) April 2023, the Board announced that it had decided to

explore a full separation and deconsolidation of Accredited and

subsequently ran a sale process to find a suitable partner for its

clients and colleagues and to realise full value for R&Q and

its shareholders. The sale process commenced in April 2023 with an

extensive global outreach to potentially interested parties,

representing a broad range of financial and strategic partners. The

Sale is the outcome of this process.

The Non-Executive Directors unanimously support the Sale and

strongly encourage shareholders to vote in favour of the resolution

to approve the Sale at the Special General Meeting.

The Non-Executive Directors believe the terms of the Sale are in

the best interests of R&Q, its shareholders and its other

stakeholders. The Non-Executive Directors believe that the Sale

represents R&Q's best opportunity to achieve a full separation

and deconsolidation of Accredited from the Group, in order to

enable Accredited to retain a fully independent rating.

In the event that Accredited does not retain a fully independent

rating, the Board is clear in its view that there is a significant

risk that AM Best will downgrade Accredited. Such a downgrade would

have a detrimental impact on Accredited's ability to successfully

operate its business, particularly in the United States where an

'A-' financial strength rating is a minimum requirement from

Accredited's counterparties. The Board therefore believes that a

downgrade would have material implications on R&Q's ability to

continue as a going concern.

Additionally, the Board is of the view that the current

financial leverage of R&Q is unsustainable and if the Sale were

not to proceed and the Available Net Cash Proceeds were not

available to facilitate a material de-leveraging of R&Q,

R&Q may not be able to continue to satisfy or obtain waivers on

the covenant requirements for its existing debt facilities or repay

certain of its debt facilities as they become due. A potential

default or cross-default by R&Q on its existing debt facilities

may lead its lenders to take action to protect their interests by

requiring collateral or enforcing their security over certain

R&Q assets, resulting in a materially worse outcome for R&Q

and its shareholders.

The Sale constitutes a fundamental change of business and under

the AIM Rules for Companies, Rule 15 will apply. The closing of the

Sale is therefore conditional on the approval by a majority of

shareholders at a Special General Meeting. The Special General

Meeting of R&Q's shareholders is expected to take place by the

end of the year.

As Accredited and certain of its subsidiaries are authorised and

regulated entities, the Sale is also conditional on obtaining

customary regulatory approvals. The Sale is also conditional on

customary consents from certain R&Q debt providers. Closing of

the Sale is expected to occur in late Q1 2024 or early Q2 2024.

Future strategy of R&Q

The Sale refocuses R&Q as a legacy insurance business in

Bermuda, Europe, the US and the UK. After the Sale, R&Q will

have a legacy platform with over 150 people across M&A, claims

management, servicing, actuarial and finance functions. In

addition, it will have Reserves Under Management of over $1.1

billion and a strong transaction pipeline. R&Q Legacy will

continue to be an important player in the legacy market.

The Sale will enable the Board to undertake a material

de-leveraging of R&Q which will enhance the business' ability

to execute the Board's existing strategy of transitioning to a

capital efficient and stable recurring fee-based business model.

The Board will also continue to focus on minimising future reserve

volatility as well as driving improved underlying performance of

R&Q through better automation and expense management.

In parallel to executing its organic plan, the Board will also

continue to explore potential transactions to de-risk and reduce

volatility in R&Q Legacy's balance sheet or otherwise maximise

value to stakeholders.

Board and management

The Sale is conditional on the transfer of R&Q's Chief

Executive Officer, William Spiegel, and Chief Financial Officer,

Thomas Solomon, to Accredited upon closing. William's and Thomas'

employment and appointments as Chief Executive Officer, Chief

Financial Officer and as Executive Directors of R&Q and its

subsidiaries will therefore cease on closing of the Sale. William

and Thomas will retain their current positions until closing of the

Sale and are working with the Board to ensure the successful

closing of the Sale and will assist with an orderly transition post

closing.

Upon closing of the Sale, Group Non-Executive Chairman Jeff

Hayman will act as Chairman and Interim Chief Executive Officer of

R&Q. The Board will initiate a search to appoint a new Chief

Executive Officer of R&Q at the appropriate time. In addition,

Paul Bradbrook, currently Chief Accounting Officer of R&Q, will

become Chief Financial Officer of R&Q and a member of the Board

upon closing of the Sale, subject to customary approvals.

All of R&Q's other Non-Executive Directors, Philip Barnes,

Eamonn Flanagan, Jo Fox, Jerome Lande and Robert Legget will

continue in their current roles.

Commenting on the Sale, Jeff Hayman, Chairman of R&Q ,

said:

"The Non-Executive Directors unanimously recommend the sale of

Accredited to Onex. We believe this transaction represents the best

possible outcome for R&Q's stakeholders, enabling R&Q to

realise value for a business we have grown from a standing start in

2017 while allowing Accredited to maintain its essential

independent financial strength rating of 'A-' under new ownership.

Onex has an extensive track record of successfully investing in

businesses across the insurance value chain, making them the ideal

partner for Accredited to continue its growth trajectory as a

leading transatlantic program manager.

The Sale will generate meaningful net cash proceeds which will

facilitate a material de-leveraging of the Group while also

strengthening its liquidity and working capital position, which

will support R&Q's ongoing commitments and requirements.

Furthermore, the Sale will create a simpler and better capitalised

R&Q which will be positioned to continue to execute the

existing strategy of transitioning to a capital efficient and

stable recurring fee-based business model.

R&Q is a longstanding leader in the legacy market, with an

established platform, more than $1.1 billion of Reserves Under

Management and an over 30-year history of executing innovative

transactions. The landmark deal earlier this year to acquire and

professionally manage the non-insurance legacy liabilities of MSA

Safety now means R&Q Legacy earns fees from two distinct but

complementary pools of liabilities: traditional insurance reserves

and corporate non-insurance liabilities. The Sale will allow us to

refocus fully on this business, while our materially de-leveraged

balance sheet, alongside our ability to deploy third-party capital

via Gibson Re, will enable us to pursue our pipeline opportunities

with renewed confidence. While we have more work to do, including

implementing further operational improvements, we now have a clear

pathway towards a sustainably profitable legacy business."

Commenting on the Sale, Adam Cobourn, Managing Director of Onex

Partners, said:

"We are pleased to have the opportunity to establish Accredited

as an independent, market-leading program management platform.

Accredited has all the ingredients for success as a hybrid carrier,

including a talented management team, a well-diversified and

high-quality book of business, strong reinsurer relationships and

robust underwriting and risk management protocols. It will be well

positioned for responsible growth with a strong balance sheet and

backing from Onex Partners. Investing in the insurance industry has

been a core strength for Onex for many years. We look forward to

supporting Accredited's management team in this next phase of

growth."

Enquiries to: R&Q Insurance Holdings Ltd Tel: +44 (0)20 7780 5850

Jeff Hayman

William Spiegel

Tom Solomon

Fenchurch Advisory Partners LLP (Financial Adviser) Tel: +44 (0)20 7382

2222

Kunal Gandhi

Brendan Perkins

John Sipp

Richard Locke

Tihomir Kerkenezov

Barclays Bank PLC (Financial Adviser and Joint Broker) Tel: +44 (0)20

7632 2322

Gary Antenberg

Andrew Tusa

Grant Bickwit

Howden Tiger (Financial Adviser) Tel : +44 (0)20 7398 4888

Rob Bredahl

Leo Beckham

Deutsche Numis (Nominated Adviser and Joint Broker) Tel : +44 (0)20 7260

1000

Charles Farquhar

Giles Rolls

FTI Consulting Tel: +44 (0)20 3727 1051

Tom Blackwell

Proposed Sale of R&Q's Program Management business,

Accredited, to Onex

Introduction

On 4(th) April 2023, R&Q Insurance Holdings Ltd ("R&Q",

the "Company" or the "Group") announced that it was undertaking a

strategic initiative to separate its legacy insurance business

("R&Q Legacy") and its program management business

("Accredited"). Today R&Q announces that it has entered into a

conditional agreement with funds advised by Onex Corporation (the

"Purchaser" or "Onex" [i] ) to sell 100% of the equity interest in

Randall & Quilter America Holding Inc., the holding company of

Accredited (the "Sale") for an enterprise value of $465 million

(the "Purchase Price") which represents an expected equity value of

approximately $438 million, when adjusted for Accredited's existing

debt commitments.

Net cash proceeds from the Sale are expected to be approximately

$300 million after adjusting for a number of Purchaser conditions

of the Sale, including i) the repayment of an existing $46 million

intercompany loan by R&Q to Accredited, ii) an estimated $76

million [ii] equity capital contribution by R&Q into Accredited

so Accredited can satisfy a minimum AM Best capital adequacy ratio

of 44% at closing, and iii) $15 million in transaction costs (the

"Expected Net Cash Proceeds").

Net cash proceeds available for utilisation immediately on

closing are expected to be between approximately $170 million and

$210 million (the "Available Net Cash Proceeds") after allowing for

i) an estimated approximately $40 million to $80 million [iii] of

additional collateral R&Q will be required to hold against

existing legacy insurance exposures retained by Accredited as a

further Purchaser condition of the Sale and ii) an estimated

approximately $50 million [iv] of cash to be retained by R&Q

for its ongoing liquidity and working capital requirements. It is

expected that, over the course of the next few years, the estimated

$40 million to $80 million of collateral in i) above will be

released and available to R&Q as the underlying exposures are

reduced and eliminated.

Following closing of the Sale, the Board intends to use all of

the Available Net Cash Proceeds to facilitate a material

de-leveraging of R&Q while retaining liquidity and working

capital for R&Q's ongoing commitments and requirements. R&Q

will be refocused as a legacy insurance business and will continue

to execute on its transition to a capital efficient and stable

recurring fee-based business model. The Board will also continue to

focus on minimising future reserve volatility as well as driving

improved underlying performance of R&Q through better

automation and expense management.

In parallel to executing its organic plan, the Board will also

continue to explore potential transactions to de-risk and reduce

volatility in R&Q Legacy's balance sheet or otherwise maximise

value to stakeholders.

The Sale is conditional on the transfer of R&Q's Chief

Executive Officer, William Spiegel, and Chief Financial Officer,

Thomas Solomon, to Accredited upon closing. William's and Thomas'

employment and appointments as Chief Executive Officer, Chief

Financial Officer and as Executive Directors of R&Q and its

subsidiaries will therefore cease on closing of the Sale. William

and Thomas will retain their current positions until closing of the

Sale and are working with the Board to ensure the successful

closing of the Sale and will assist with an orderly transition post

closing.

Upon closing of the Sale, Group Non-Executive Chairman Jeff

Hayman will act as Chairman and Interim Chief Executive Officer of

R&Q. Jeff's extensive industry experience makes him well placed

to lead R&Q as Interim Chief Executive Officer. The Board will

initiate a search to appoint a new Chief Executive Officer of

R&Q at the appropriate time.

In addition, Paul Bradbrook, currently Chief Accounting Officer

of R&Q, will become Chief Financial Officer of R&Q and will

be appointed to the Board upon closing of the Sale, subject to

customary approvals . Paul has over 20 years' experience of

financial management within the insurance industry and a deep

understanding of R&Q through his experience as Chief Accounting

Officer which makes him well positioned to act as Chief Financial

Officer.

All of R&Q's other Non-Executive Directors, Philip Barnes,

Eamonn Flanagan, Jo Fox, Jerome Lande and Robert Legget will

continue in their current roles.

1. Background to and strategic rationale for the Sale

R&Q is a global non-life speciality insurance company

currently organised around two principal businesses: a legacy

insurance business (R&Q Legacy) and a program management

business (Accredited).

R&Q Legacy manages small and medium sized non-life legacy

insurance portfolios, providing creative financial solutions to

owners of discontinued insurance and reinsurance business. The

non-life legacy market opportunity is significant and growing, with

total global reserves estimated to be $960 [v] billion in 2022, an

increase of $100 billion (5) from 2021. In 2021, R&Q launched

Gibson Re, a Bermuda-domiciled collateralised reinsurer with

approximately $300 million of long-term, third-party capital that

underpins R&Q Legacy's ability to deploy capital and offer

innovative legacy solutions. The dedicated reinsurance sidecar

reinsures 80% of R&Q Legacy's transactions with R&Q Legacy

retaining 20% of the risk exposure. Following R&Q's landmark

deal earlier this year to acquire and professionally manage the

non-insurance legacy liabilities of MSA Safety, R&Q Legacy now

earns fees from two distinct but complementary pools of

liabilities: traditional insurance reserves and corporate

non-insurance liabilities.

Accredited is a leading program manager, providing A- rated

insurance capacity in the US, UK and Europe. Accredited's US, UK

and EU-regulated insurance companies act as an intermediary between

Managing General Agents ("MGAs") and reinsurers. Accredited has

grown significantly over the last three years achieving Gross

Written Premium and Fee Income of $1.8 billion and $80 million [vi]

, respectively, in the twelve months to 31(st) December 2022, and

$1.1 billion and $46 million, respectively, in the six months to

30(th) June 2023.

As at 30(th) June 2023, the unaudited gross assets and

shareholders' equity of the business subject to the Sale were $4.3

billion [vii] and $243 million (7) , respectively. As at 31(st)

December 2022, the unaudited gross assets and shareholders' equity

of the business subject to the Sale were $3.9 billion (7) and $225

million (7) , respectively. For the financial year ended 31(st)

December 2022, the unaudited statutory loss before tax for the

business subject to the Sale was $(16) million (7) . For the six

months ended 30th June 2023, the unaudited statutory profit before

tax for the business subject to the Sale was $13 million (7) .

R&Q has supported the growth and strategic development of

Accredited since its launch in 2017. Accredited relies on an 'A-'

financial strength rating from AM Best to conduct business and

historically relied on the financial strength of the broader

R&Q group to obtain its financial strength rating. However,

following a review in Q1 2023 the Board concluded that given

Accredited's size and scale it was in the best interests of

R&Q's stakeholders for Accredited to obtain a standalone rating

without influence from the broader R&Q group. An important

factor in obtaining a standalone rating for Accredited was AM

Best's guidance that a full separation and transaction with a third

party which resulted in the deconsolidation of Accredited from the

Group was essential to enable Accredited to obtain a fully

independent rating.

In response to the guidance from AM Best, the Board announced on

4(th) April 2023 a legal reorganisation to separate R&Q Legacy

and Accredited. In addition, the Board announced that it had

decided to explore a full deconsolidation of Accredited and

subsequently ran a sale process to find a suitable partner for its

clients and colleagues and to realise full value for R&Q and

its shareholders. The sale process commenced in April 2023 with an

extensive global outreach to potentially interested parties,

representing a broad range of financial and strategic partners. The

Sale is the outcome of this process.

Alongside this process, the legal reorganisation was completed

in June 2023. As of that date, AM Best recognised Accredited as an

independent rating unit with a financial strength rating of 'A-'.

The rating however, remained under review with negative

implications subject to the sale and deconsolidation of

Accredited.

A strategic transaction committee was formed to provide

governance oversight of the Sale, comprised of the Non-Executive

Directors (comprising all of the directors other than William

Spiegel, Thomas Solomon and Alan Quilter) (the "Non-Executive

Directors"). The Non-Executive Directors consider the Sale to be in

the best interests of R&Q shareholders and that it enables

R&Q to realise value for Accredited. The Sale will facilitate a

material de-leveraging of R&Q and will create a simpler and

better capitalised R&Q Legacy business. R&Q will be

positioned to deliver value to shareholders by continuing to

execute its existing strategy of transitioning to a capital

efficient and stable recurring fee-based business model.

2. Recommendation

The Non-Executive Directors unanimously support the Sale and

believe the terms of the Sale are in the best interests of R&Q,

its shareholders and its other stakeholders. The Non-Executive

Directors believe the Sale provides the most certainty for

Accredited to maintain an independent financial strength rating of

'A-', which is essential to protect its value.

Shareholders should note that if the resolution to approve the

Sale is not approved by shareholders at the Special General

Meeting, the Sale will not proceed. The Non-Executive Directors

believe that the Sale represents R&Q's best opportunity to

achieve a full separation and deconsolidation of Accredited from

the Group and, as noted above, such full separation is necessary to

enable Accredited to retain a fully independent rating. In the

event that Accredited does not retain a fully independent rating,

the Board believes there is a significant risk that AM Best will

downgrade Accredited which would have a detrimental impact on

Accredited's ability to successfully operate its business,

particularly in the United States where an 'A-' financial strength

rating is a minimum requirement from Accredited's counterparties.

Such a downgrade would therefore have material implications on

R&Q's ability to continue as a going concern.

Additionally, the Board believes that the current financial

leverage of R&Q is unsustainable and if the Sale were not to

proceed and the Available Net Cash Proceeds were not available to

facilitate a material de-leveraging of R&Q, R&Q may not be

able to continue to satisfy or obtain waivers on the covenant

requirements for its existing debt facilities or repay certain of

its debt facilities as they become due. A potential default or

cross-default by R&Q on its existing debt facilities may lead

its lenders to take action to protect their interests by requiring

collateral or enforcing their security over certain R&Q assets,

resulting in a materially worse outcome for R&Q and its

shareholders.

R&Q remains in close dialogue with its lending banks,

providers of credit and other financing providers. R&Q will

require support from these parties in relation to renewals or

redemptions due in November and December of this year, ongoing

requests for waivers for potential covenant breaches and for the

necessary approvals and consents required to enable the Sale to

take place.

Accordingly, the Non-Executive Directors strongly encourage

shareholders to vote in favour of the resolution to approve the

Sale at the Special General Meeting.

3. Irrevocable undertakings

The Non-Executive Directors have irrevocably undertaken to vote

or procure votes in favour of the resolution to approve the Sale in

respect of their holdings of R&Q shares, in aggregate,

representing 240,476 outstanding R&Q shares and constituting

approximately 0.1 per cent. of R&Q's issued voting share

capital as at 19 October 2023 (being the latest practicable date

prior to the date of this announcement).

In addition to the irrevocable undertakings from the

Non-Executive Directors, William Spiegel, Thomas Solomon, Alan

Quilter and certain other members of R&Q's management team have

given irrevocable undertakings to vote, or procure votes, in favour

of the resolution to approve the Sale. In aggregate, these

irrevocable undertakings represent, as at 19 October 2023 (being

the latest practicable date prior to the date of this

announcement), 8,059,692 outstanding R&Q shares and constitute

approximately 2.2 per cent. of R&Q's issued voting share

capital.

In addition Scopia Capital Management ("Scopia") has given an

irrevocable undertaking to vote, or procure votes, in favour of the

resolution to approve the Sale. This irrevocable undertaking,

represents, as at 19 October 2023 (being the latest practicable

date prior to the date of this announcement), 30,000,000

outstanding R&Q shares and constitutes approximately 8.0 per

cent. of R&Q's issued voting share capital.

In aggregate, irrevocable undertakings have been given to vote,

or procure votes, in favour of the resolution to approve the Sale

representing, as at 19 October 2023 (being the latest practicable

date prior to the date of this announcement), 38,059,692

outstanding R&Q shares and constituting approximately 10.2 per

cent. of R&Q's issued voting share capital .

Further details of these irrevocable undertakings, including the

circumstances in which they cease to apply, are set out in the

Appendix.

4. Financing of the Purchase Price

In support of Onex's obligation to pay the Purchase Price, Onex

has provided an equity commitment letter up to the full amount of

the purchase price.

In the event that Onex fails to pay the purchase price under the

Sale agreement following the satisfaction of all of the conditions

to closing, R&Q would have the right to enforce the equity

commitment letter for the payment of the Purchase Price.

5. Conditions to closing

The Sale is structured as the sale of the entire issued share

capital of Randall & Quilter America Holding Inc, which is the

holding company of the Accredited business. R&Q Insurance

Holdings Ltd (the "Seller"), will effect the Sale. The Sale

agreement contains certain obligations of R&Q, including the

requirement to hold the Special General Meeting to approve the Sale

as well as other customary conditions.

The Sale constitutes a fundamental change of business and under

the AIM Rules for Companies, Rule 15 will apply. The closing of the

Sale is therefore conditional on the approval by a majority of

shareholders at a Special General Meeting.

As Randall & Quilter America Holding Inc and certain of its

subsidiaries are authorised and regulated entities, the Sale is

also conditional on obtaining regulatory approvals from the Arizona

Department of Insurance, the Florida Office of Insurance

Regulation, the Prudential Regulation Authority, the Malta

Financial Services Authority and US Antitrust authorities.

The Sale is also conditional on customary consents from certain

R&Q debt providers.

As is usual in transactions of this nature, the Sale agreement

sets out the obligations on the parties to obtain the required

approvals, as well as customary representations, warranties,

covenants and indemnities. The transaction documentation also

includes certain transitional services (set out below) to be

provided by R&Q and Accredited for a limited period following

closing. R&Q is exploring customary representation and warranty

insurance to limit any liabilities, but there is no guarantee such

insurance will be placed.

6. Transitional services

Under a transitional services agreement between R&Q and

Accredited to be entered into upon the closing of the Sale (the

"TSA"), each party will provide transitional services to the other

party for limited periods of up to 12 months following closing of

the Sale, with a commitment to provide those services generally at

the same level of service with which they were provided before

closing. The services performed by R&Q for Accredited will

cover the following functions: finance and accounting (including

assistance with Accredited's year-end closings for 2023); legal,

risk, and compliance; human resources; information technology

("IT") and facilities and equipment management. Accredited will

perform for R&Q a more limited set of services covering the

following functions: finance and accounting (including assistance

with R&Q's year-end closings for 2023); finance change

management; legal, risk, and compliance (including UK senior

manager functions); and IT support. In connection with the

continued provision of these services under the TSA, each party

will also assist the other with data and knowledge transfer and

similar migration services. The charges for the services will

reflect the providing party's internal and external costs of

providing the services, without markup. Each party's liability as

provider of a service will be limited to the fees it has received

for such service.

7. Use of proceeds and impact on the pro-forma financial position of remaining R&Q

Given the expected timing of the Sale, R&Q will own

Accredited for the rest of the 2023 financial year and most likely

for a period of 2024. Following closing of the Sale, R&Q will

be refocused as a legacy insurance business, positioned to continue

to execute on its transition to a capital efficient and stable

recurring fee-based business model.

Available Net Cash Proceeds on closing are expected to be

between approximately $170 million and $210 million. Following

closing of the Sale, the Board intends to use the Available Net

Cash Proceeds to facilitate a material de-leveraging of R&Q

while retaining liquidity and working capital for R&Q's ongoing

commitments.

Adjusted for closing of the Sale and subsequent de-leveraging of

R&Q assuming Available Net Cash Proceeds of $170 million (at

the lower end of the expected range), R&Q's current estimated

pro-forma financial position as at 30 June 2023 would be as

follows:

Assets $2.0 billion

Debt $203 million

-------------

Shareholders' Equity $356 million

-------------

Debt to Capital Ratio 36%

-------------

Group Solvency Ratio >200%

-------------

Net Asset Value Per Common Share 80 cents

-------------

Net Asset Value Per Common Share (Diluted) 79 cents

[viii]

-------------

8. Future strategy of R&Q

The Sale refocuses R&Q as a legacy insurance business in

Bermuda, Europe, the US and the UK. After the Sale, R&Q will

have a legacy platform with over 150 people across

M&A/reinsurance solutions, claims management, servicing,

actuarial and finance functions. In addition, it will have Reserves

Under Management of over $1.1 billion and a strong transaction

pipeline. R&Q Legacy will continue to be an important player in

the legacy market.

The Sale will enable the Board to undertake a material

de-leveraging of R&Q which will enhance the business' ability

to execute the Board's existing strategy of transitioning to a

capital efficient and stable recurring fee-based business model.

Gibson Re, R&Q's dedicated sidecar will continue to be a core

component of this transition. R&Q retains 20% of a typical

legacy transaction with the remaining 80% ceded to Gibson Re.

Gibson Re will underpin R&Q's ability to deploy capital and

offer innovative legacy solutions to its clients.

The non-life legacy market is significant and growing, with

total global reserves estimated at $960 billion in 2022, an

increase of $100 billion from the previous year. R&Q has a

strong pipeline, with identified transactions comprising over $0.9

billion of reserves, including three deals in advanced stages with

over $100 million of reserves. Going forward, R&Q will continue

to focus on transactions in the small to medium size range, where

R&Q maintains a competitive advantage, and offering compelling

finality solutions for corporates in the US, UK and Europe. This

follows R&Q's landmark deal earlier this year to invest

alongside Obra Capital to acquire and professionally manage the

non-insurance legacy liabilities of MSA Safety. This strategy,

alongside Gibson Re, will generate fees from two distinct but

complementary pools of liabilities: traditional insurance reserves

and corporate non-insurance liabilities.

From a financial perspective, immediately following the Sale,

R&Q expects to experience run-rate operating losses as it

continues to execute on its transition to a capital efficient and

stable recurring fee-based business model. As part of this

strategy, the Board is focused on making R&Q a more efficient

and scalable business. R&Q has already identified and taken

action on a number of opportunities to reduce expenses, including

simplifying its legal entity structure and rationalising its real

estate footprint. Work is also underway to automate the input of

data received from third party administrators ("TPAs") and move

internal systems to the Cloud. Better use of data is enabling

R&Q to make smarter decisions, more quickly, while more

automated processing is reducing duplication and costs. The

decrease in R&Q Legacy Fixed Operating Expenses to $36 million

for the six months to June 2023 compared to $ 39 million for the

six months to June 2022 is evidence of the results and success this

strategy is already delivering. The Board expects this will create

further operational leverage benefits as R&Q grows Reserves

Under Management. The Board is confident that R&Q has a team

with the right experience to deliver this strategy, and that it

represents the best way to deliver value to shareholders.

In parallel to executing its organic plan, the Board will

continue to explore potential transactions to de-risk and reduce

volatility in R&Q Legacy's balance sheet or otherwise maximise

value to stakeholders.

Board and management

Upon closing of the Sale, Group Non-Executive Chairman Jeff

Hayman will act as Chairman and Interim Chief Executive Officer of

R&Q. Jeff's extensive industry experience makes him well placed

to lead R&Q as interim Chief Executive Officer. He has spent

over 40 years in the insurance industry with long tenures at The

Travelers and AIG, including divisional and global CEO roles. In

addition, Jeff was recently a Board member and committee chair of

Zurich Insurance Group.

The Board will also initiate a search to identify and appoint a

new Chief Executive Officer of R&Q at the appropriate time.

In addition, as outlined above, Paul Bradbrook, currently Chief

Accounting Officer of R&Q, will become Chief Financial Officer

of R&Q.

Andrew Pinkes, Global Legacy Chief Executive Officer, has

informed the Board that he has decided to retire from R&Q by

the end of the year. Andrew came out of retirement and joined

R&Q in 2021 to help drive R&Q's strategic ambitions and to

transition R&Q Legacy to a capital efficient, data-driven and

stable recurring fee-based model. The Board would like to take this

opportunity to thank Andrew for his significant contribution to and

thoughtful leadership of R&Q Legacy. The Board and Andrew have

agreed that upon retirement Andrew will enter into a consultancy

arrangement with R&Q and will become an adviser to R&Q and

the leadership team until closing of the Sale.

As announced on 31(st) March 2023, Alan Quilter, Group Head of

Program Management, will retire from R&Q and the Board of

Directors at the end of the year. The Board and Alan have agreed

that upon retirement Alan will also enter into a consultancy

arrangement with R&Q and will become an adviser to R&Q and

the leadership team following closing of the Sale.

All of R&Q's other Non-Executive Directors, including Philip

Barnes, Eamonn Flanagan, Jo Fox, Jerome Lande and Robert Legget

will be continuing in their current roles.

9. Expected timetable of principal events

A Circular containing further details of the Sale, the

Non-Executive Directors ' recommendation, and the notice of the

Special General Meeting (which will set out the resolution required

to approve the Sale) will be sent to R&Q's shareholders in the

coming weeks. The Special General Meeting of R&Q's shareholders

is expected to take place by the end of the year. Closing of the

Sale is expected to occur in late Q1 2024 or early Q2 2024.

10. Information relating to Onex

Onex is an investor and asset manager that invests capital on

behalf of Onex shareholders and clients across the globe. Formed in

1984, Onex has a long track record of creating value for clients

and shareholders. Onex' two primary businesses are Private Equity

and Credit. In Private Equity, Onex raises funds from third-party

investors, or limited partners, and invest them, along with Onex's

own investing capital, through the funds of their private equity

platforms, Onex Partners and ONCAP. Similarly, in Credit, Onex

raises and invests capital across several private credit, public

credit and public equity strategies. Onex's investors include a

broad range of global clients, including public and private pension

plans, sovereign wealth funds, insurance companies and family

offices. In total, Onex has approximately $50 billion in assets

under management, of which approximately $8 billion is Onex's own

investing capital. With offices in Toronto, New York, New Jersey,

Boston and London, Onex and its experienced management teams are

collectively the largest investors across Onex's platforms.

Important Notices

Barclays Bank PLC, acting through its Investment Bank

("Barclays"), which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the FCA and the

Prudential Regulation Authority, is acting exclusively for R&Q

and no one else in connection with the Sale and will not be

responsible to anyone other than R&Q for providing the

protections afforded to clients of Barclays nor for providing

advice in relation to the Sale or any other matter referred to in

this Announcement.

Fenchurch Advisory Partners LLP ("Fenchurch"), which is

authorised and regulated in the United Kingdom by the FCA, is acted

as joint financial adviser for R&Q and no one else in

connection with the Sale and will not be responsible to anyone

other than R&Q for providing the protections afforded to

clients of Fenchurch nor for providing advice in relation to the

Sale or any other matter referred to in this Announcement.

TigerRisk Capital Markets & Advisory (UK) Limited ("Howden

Tiger Capital Markets & Advisory"), which is authorised and

regulated in the United Kingdom by the FCA, is acting as joint

financial adviser for R&Q and no one else in connection with

the Sale and will not be responsible to anyone other than R&Q

for providing the protections afforded to clients of Howden Tiger

Capital Markets & Advisory nor for providing advice in relation

to the Sale or any other matter referred to in this

Announcement.

Numis Securities Limited ("Numis"), which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for R&Q and no one else in connection with the matters set out

in this announcement and will not regard any other person as its

client in relation to the matters in this announcement and will not

be responsible to anyone other than R&Q for providing the

protections afforded to clients of Numis, nor for providing advice

in relation to any matter referred to herein.

Further Information

This announcement is for information purposes only and is not

intended to and does not constitute, or form any part of, an offer

to sell or an invitation to purchase or subscribe for any

securities or the solicitation of any vote or approval in any

jurisdiction pursuant to the Sale or otherwise, nor shall there be

any sale, issuance or transfer of securities of R&Q in any

jurisdiction in contravention of applicable law. The Sale will be

made solely pursuant to the terms of the Circular, which will

contain the full terms and conditions of the Sale, including

details of how to vote in respect of the Sale and accompanied by

forms of proxy and forms of instruction for use at the Special

General Meeting. Any decision in respect of, or in response to, the

Sale should be made only on the basis of the information in the

Circular. R&Q shareholders are advised to read the Circular and

any other formal documentation published in relation to the Sale

carefully, once it has been published or dispatched.

This announcement has been prepared for the purpose of complying

with Bermuda and English law and the information disclosed may not

be the same as that which would have been disclosed if this

announcement had been prepared in accordance with the laws of

jurisdictions outside the United Kingdom and Bermuda.

This announcement does not constitute a prospectus or prospectus

equivalent document.

Financial information relating to R&Q included in this

announcement and the Circular has been or shall have been prepared

in accordance with accounting standards applicable in the United

States and may not be comparable to financial information of UK

companies or companies whose financial statements are prepared in

accordance with generally accepted accounting principles in the

United Kingdom.

Forward-Looking Statements

This announcement contains forward-looking statements with

respect to R&Q and its industries, that reflect its current

views with respect to future events and financial performance.

Statements that are not historical facts, including statements

about R&Q's beliefs, plans or expectations, are forward-looking

statements. These statements are based on current plans, estimates

and expectations, all of which involve risk and uncertainty.

Statements that include the words "expect," "intend," "plan,"

"believe," "project," "anticipate," "may", "could" or "would" or

similar statements of a future or forward-looking nature identify

forward-looking statements. Actual results may differ materially

from those included in such forward-looking statements and

therefore you should not place undue reliance on them.

A non-exclusive list of the important factors that could cause

actual results to differ materially from those in such

forward-looking statements includes: (a) changes in the size of

claims relating to natural or man-made catastrophe losses due to

the preliminary nature of some reports and estimates of loss and

damage to date; (b) trends in rates for property and casualty

insurance and reinsurance; (c) the timely and full recoverability

of reinsurance placed by R&Q with third parties, or other

amounts due to R&Q; (d) changes in the projected amount of

ceded reinsurance recoverables and the ratings and credit

worthiness of reinsurers; (e) actual loss experience from insured

or reinsured events and the timing of claims payments being faster

or the receipt of reinsurance recoverables being slower than

anticipated; (f) increased competition on the basis of pricing,

capacity, coverage terms or other factors such as the increased

inflow of third party capital into reinsurance markets, which could

harm R&Q's ability to maintain or increase its business volumes

or profitability; (g) greater frequency or severity of claims and

loss activity than R&Q's underwriting, reserving or investment

practices anticipated based on historical experience or industry

data; (h) changes in the global financial markets, including the

effects of inflation on R&Q's business, including on pricing

and reserving, increased government involvement or intervention in

the financial services industry and changes in interest rates,

credit spreads, foreign currency exchange rates and future

volatility in the world's credit, financial and capital markets

that adversely affect the performance and valuation of R&Q's

investments, financing plan and access to such markets or general

financial condition; (i) changes in ratings, rating agency policies

or practices; (j) the potential for changes to methodologies,

estimations and assumptions that underlie the valuation of

R&Q's financial instruments that could result in changes to

investment valuations; (k) changes to R&Q's assessment as to

whether it is more likely than not that it will be required to

sell, or has the intent to sell, available-for-sale debt securities

before their anticipated recovery; (l) the ability of R&Q's

subsidiaries to pay dividends; (m) the potential effect of

legislative or regulatory developments in the jurisdictions in

which R&Q operates, such as those that could impact the

financial markets or increase their respective business costs and

required capital levels, including but not limited to changes in

regulatory capital balances that must be maintained by operating

subsidiaries and governmental actions for the purpose of

stabilising the financial markets; (n) the actual amount of new and

renewal business and acceptance of products and services, including

new products and services and the materialisation of risks related

to such products and services; (o) changes in applicable tax laws,

tax treaties or tax regulations or the interpretation or

enforcement thereof; (p) the effects of mergers, acquisitions,

divestitures and retrocession.

No Profit Forecasts or Estimates

No statement in this announcement is intended as a profit

forecast or estimate of the future financial performance of R&Q

following closing of the Sale for any period unless otherwise

stated. Furthermore, no statement in this announcement should be

interpreted to mean that earnings or earnings per R&Q share for

R&Q for the current or future financial years would necessarily

match or exceed the historical published earnings or earnings per

R&Q share.

APPIX

Irrevocable undertakings

1. Directors' irrevocable undertakings

The following Directors and members of management have

irrevocably undertaken to vote or procure votes in favour of the

resolution to approve the Sale. As at 19 October 2023 (being the

latest practicable date prior to the date of this announcement),

their holdings of R&Q shares are:

Name Total number of Percentage of existing

R&Q shares share capital of

R&Q

William Spiegel 2,746,207 0.735

--------------------------- ----------------------------------

Thomas Solomon 1,223,957 0.327

--------------------------- ----------------------------------

Alan Quilter 2,554,281 0.683

--------------------------- ----------------------------------

Joanne Fox 50,000 0.013

--------------------------- ----------------------------------

Eamonn Flanagan 95,238 0.025

--------------------------- ----------------------------------

Philip Barnes 95,238 0.025

--------------------------- ----------------------------------

Patrick Rastiello 339,625 0.091

--------------------------- ----------------------------------

Andrew Pinkes 735,895 0.197

--------------------------- ----------------------------------

Robert Thomas 219,251 0.059

--------------------------- ----------------------------------

Total 8,059,692 2.156

--------------------------- ----------------------------------

The obligations under these irrevocable undertakings shall lapse

and cease to have effect on and from the following occurrences:

-- this announcement is not released by 1 November 2023 or such

later time or date as the Company may determine;

-- the Sale agreement is terminated in accordance with its terms;

-- the Special General Meeting has been held and the resolution

to approve the Sale voted upon at that Special General Meeting;

and

-- if the undertakings have not lapsed earlier, on 1 April 2024.

Given their impending retirements, Alan Quilter and Andrew

Pinkes are permitted to deal in their R&Q shares. The other

Directors and members of management are, however, precluded from

dealing in their R&Q Shares until their obligations under their

undertakings lapse.

2. Scopia irrevocable undertaking

Scopia has given an irrevocable undertaking to vote, or procure

votes, in favour of the resolution to approve the Sale in respect

of the R&Q Shares it holds from time to time. This irrevocable

undertaking, as at 19 October 2023 (being the latest practicable

date prior to the date of this announcement), represents 30,000,000

outstanding R&Q shares and constitutes approximately 8.0 per

cent. of R&Q's issued voting share capital. Scopia is permitted

to deal in its R&Q shares for the duration of the

undertaking.

The obligations under this irrevocable undertaking shall lapse

and cease to have effect on and from the following occurrences:

-- this announcement is not released by 1 November 2023 or such

later time or date as the Company may determine;

-- the Sale agreement is terminated in accordance with its terms;

-- the Special General Meeting has been held and the resolution

to approve the Sale voted upon at that Special General Meeting;

-- an offer for Accredited made in writing to the Board, which

represents an equity value which may be higher than the equity

value which the Sale represents (such determination of whether the

equity value represented by such offer is higher to be made by

Scopia acting reasonably);the Non-Executive Directors do not make,

withdraw, modify or qualify the Board recommendation; and

-- if the undertaking has not lapsed earlier, on 1 April 2024.

The following footnotes are contained throughout this

announcement:

[i] Funds advised are Onex Partners V LP

[ii] Represents management's estimate based on forecast of

retained earnings through closing and AM Best treatment of

available and required capital under BCAR model

[iii] Represents management's estimate based on forecast of loss

reserves and collateral expected to be in place at closing under

various reinsurance agreements

[iv] Represents management's estimate of working capital

required for 18 months subsequent to closing

[v] As per the PwC 'Global Insurance Run-Off Survey 2022'

[vi] Excluding minority stakes in MGAs

[vii] The principal differences between the statutory financial

information of the Accredited entities subject to the Sale, and the

reported financials for Accredited line of business are in respect

of: (i) the inclusion of R&Q Legacy exposure in the Accredited

entities; (ii) the inclusion of certain central costs to the

Accredited entities that support both program management and

legacy; (iii) the inclusion of EUR25 million of debt in the legal

entities and (iv) investment income in the legal entities

supporting both program management and legacy insurance

[viii] Reflects 73.3 million shares upon conversion of $55

million of preferred equity at 75 cents per share

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKEEAAADFFA

(END) Dow Jones Newswires

October 20, 2023 12:23 ET (16:23 GMT)

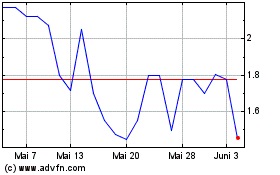

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024