TIDMPYC

RNS Number : 0723S

Physiomics PLC

07 March 2023

7 March 2023

Physiomics Plc

("Physiomics") or (the "Company")

Interim Results Statement

for the six-month period ended 31 December 2022

Physiomics plc (AIM: PYC), the oncology consultancy using

mathematical models to support the development of cancer treatment

regimens and personalised medicine solutions, today announces its

unaudited financial results for the six months ended 31 December

2022.

Summary financial results

-- Revenue of GBP338k (six months ended 31 December 2021: GBP366k)

-- Total income of GBP346k* (six months ended 31 December 2021: GBP395k*)

-- Operating loss of GBP287k (six months ended 31 December 2021: GBP170k)

-- Cash and cash equivalents of GBP498k at 31 December 2022 (31 December 2021: GBP794k)

-- Shareholders' funds of GBP762k at 31 December 2022 (31 December 2021: GBP1.08m)

* Total income for the six months ended 31 December 2022

includes other operating income, being grant income, of GBP8k

(grant income for six months ended 31 December 2021: GBP29k).

Total income was GBP49k lower than the comparable prior period,

of which GBP21k was due to a reduction in grant income following

the completion of the NIHR funded PARTNER study. Operating losses

were GBP117k higher than the comparable previous period due to

higher staffing costs and a return to physical conference

attendance after several years of virtual attendance. The Company

finished the half with shareholder funds of GBP762k at 31 December

2022 (compared with GBP1.08m at 31 December 2021) of which GBP498k

were cash and equivalents.

The Company has significantly enhanced its sales and business

development process under its new Business Development lead

resulting in better management and tracking of the pipeline and

higher conversion rates into projects. At least partly as a result

of this, the Company has significantly diversified its client base

over the course of the last year, with approximately 62% of its

total revenue for this half being derived from six small / medium

sized clients (compared with four representing 33% of revenues in

the comparable previous period).

Operational highlights

Key events in the period include:

-- Follow on contracts with existing clients Merck KGaA, Numab

Therapeutics and Ankyra Therapeutics

-- First contract directly with Cancer Research UK (relating to

the clinical development of Aleta Biotherapeutics ALETA-001)

-- Successful completion of the NIHR-sponsored PARTNER study at

Portsmouth Hospitals University NHS Trust

-- Appointment of a second highly experienced independent

Non-Executive Director, Shalabh Kumar

Key event after the period end:

-- Announcement by partner DoseMe on 17 February 2023 of its

acquisition by an affiliate of Fairlong Capital LLC as of 20

January 2023

Chairman and CEO's business strategy update

The Directors are pleased with the Company's continued ability

to attract new clients as well as to secure repeat business from

existing customers. The successful completion of the NIHR-sponsored

PARTNER study appears to offer several avenues to further develop

the Company's personalised dosing technology platform. Lastly, the

Directors note the significant diversification of the Company's

revenues away from a single large client in Merck KGaA (known

locally as EMD Serono) ("Merck"), which they believe significantly

mitigates the risk of relying on a single main source of revenue,

notwithstanding Merck continues to be an important relationship

with the Company.

Consulting business based on modelling & simulation using

Virtual Tumour(TM) and other tools

The Company was pleased to sign its first agreement directly

with Cancer Research UK (CRUK) relating to the development of

Boston-based biotech Aleta Biotherapeutics' ALETA-001. Together

with Bicycle Therapeutics, Ankyra Therapeutics and Merck, this

represents Physiomics' fourth current client relationship in the

Boston area.

The Company also attended the Society for Immunotherapy in

Cancer (SITC) conference in Boston in November 2022 where it

co-presented a poster with client Numab Therapeutics. At the

conference, the Physiomics team visited existing clients and

established contact with four other companies with which

discussions regarding possible projects are currently ongoing. As

noted above, these sorts of business development initiatives have

in large part been responsible for the significant diversification

of the Company's business pipeline away from a single large client.

Other marketing initiatives planned for this calendar year include

attendance at conferences such as BIOEurope in March and the

American Association for Cancer Research Annual Meeting (AACR) in

April.

Personalised oncology

At the beginning of this calendar year, the Company was

delighted to announce the successful completion of its

NIHR-sponsored PARTNER study at Portsmouth Hospitals University NHS

Trust. Building on work completed under two previous grants from

Innovate UK, the data from the study was analysed using the

Company's personalised dosing tool which confirmed the ability of

the tool to predict levels and timing of episodes of low white

blood cell count associated with use of docetaxel in prostate

cancer. Trial data further suggested there is potential for the

tool to be used to predict the effect of GCSF (granulocyte-colony

stimulating factor), a drug commonly used to increase white blood

cell count during chemotherapy. The Company believes that the tool

would be highly synergistic with a device that can measure blood

cells counts in community or out-patient settings and in addition

believes that the results merited further exploration of the use of

the tool in other settings including, for example, haematology and

paediatrics.

Other areas

In addition to the areas noted above, the Company is actively

considering how it could expand its business beyond its current

consulting services areas as follows:

-- Expansion into therapy areas other than cancer

-- Expansion into consulting areas adjacent to those currently serviced

-- Application of the Company's capabilities (e.g. machine

learning and other AI related areas) to pharmaceutical R&D

Board composition

The Company retained a second, highly experienced, Non-Executive

Director, Shalabh Kumar on 1 September 2023. After a successful

career in consulting, Mr Kumar co-founded a life sciences

consultancy and services business which was sold to private equity.

Mr Kumar brings a wealth of experience in the setting up and growth

of life sciences services businesses.

Outlook

We are looking forward to a solid second half (historically

stronger due to absence of summer and Christmas holiday periods),

underpinned by significant contracted revenues from Merck, Bicycle

Therapeutics, CRUK and Ankyra, as well as other potential projects

which are currently in late-stage discussions.

Enquiries:

Physiomics plc

Dr Jim Millen, CEO

+44 (0)1865 784 980

Strand Hanson Ltd (NOMAD)

James Dance & James Bellman

+44 (0)20 7409 3494

Hybridan LLP (Broker)

Claire Louise Noyce

+44 (0)20 3764 2341

Notes to Editor

About Physiomics

Physiomics plc (AIM: PYC) is an oncology consultancy using

mathematical models to support the development of cancer treatment

regimens and personalised medicine solutions. The Company's Virtual

Tumour(TM) technology uses computer modelling to predict the

effects of cancer drugs and treatments to improve the success rate

of drug discovery and development projects while reducing time and

cost. The predictive capability of Physiomics' technologies have

been confirmed by over 100 projects, involving over 40 targets and

70 drugs, and has worked with clients such as Merck KGaA, Astellas,

Merck & Co and Bicycle Therapeutics.

Physiomics Plc

Unaudited Statement of Comprehensive Income for the half year ended 31 December 2022

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-22 31-Dec-21 30-Jun-22

GBP'000 GBP'000 GBP'000

Revenue 338 366 830

Other operating income 8 29 71

Total income 346 395 901

Operating expenses (633) (565) (1,260)

Operating loss and loss before taxation (287) (170) (359)

UK corporation tax 55 50 106

Loss for the period attributable to equity shareholders (232) (120) (253)

--------------- --------------- -----------

Loss per share (pence)

Basic and diluted (0.24) p (0.12) p (0.26) p

Physiomics Plc

Unaudited Statement of financial position as at 31 December 2022

Unaudited Unaudited Audited

As at As at As at

31-Dec-22 31-Dec-21 30-Jun-22

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 3 3 3

Property, plant and equipment 14 17 14

17 20 17

Current assets

Trade and other receivables 446 485 410

Cash and cash equivalents 498 794 688

944 1,279 1,098

Total assets 961 1,299 1,115

------------ ---------- ------------

Current liabilities

Trade and other payables (104) (82) (126)

Deferred revenue (95) (137) (14)

------------ ---------- ------------

Total liabilities (199) (219) (140)

------------ ---------- ------------

Net assets 762 1,080 975

------------ ---------- ------------

Capital and reserves

Share capital 1,283 1,283 1,283

Capital reserves 6,237 6,190 6,218

Profit & loss account (6,758) (6,393) (6,526)

Equity shareholders' funds 762 1,080 975

------------ ---------- ------------

Physiomics Plc

Unaudited Statement of changes in equity for the half year ended 31 December 2022

Share Share-based Total

Share premium compensation Retained shareholders'

capital account reserve earnings funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2021 1,283 5,934 222 (6,273) 1,166

Transfer to other reserves - - 34 - 34

Loss for the period - - - (120) (120)

At 31 December 2021 1,283 5,934 256 (6,393) 1,080

Transfer to other reserves - 2 26 - 28

Loss for the period - - - (133) (133)

At 30 June 2022 1,283 5,936 282 (6,526) 975

Transfer to other reserves - - 19 - 19

Loss for the period - - - (232) (232)

At 31 December 2022 1,283 5,936 301 (6,758) 762

Physiomics Plc

Unaudited Cash Flow Statement for the half year ended 31 December 2022

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-22 31-Dec-21 30-Jun-22

GBP'000 GBP'000 GBP'000

Cash flows from operating activities:

Operating loss (287) (170) (359)

Amortisation and depreciation 4 6 12

Share-based compensation 19 34 59

(Increase) decrease in receivables 19 (174) (163)

Increase / (decrease) in payables ( 22 ) (32) 12

Increase / (decrease) in deferred revenue 81 94 (29)

Net cash generated from / (used in) operations ( 186 ) (242) (468)

UK corporation tax received - - 119

Net cash generated from / (used in) operating activities (186) ( 242 ) (349)

Cash flows from investing activities:

Purchase of non-current assets, net of grants received (4) (7) (9)

Net cash used in investing activities (4) (7) (9)

------------- ------------- -----------

Cash flows from financing activities:

Issue of ordinary share capital (net of costs) - - 3

Net cash generated from financing activities - - 3

------------- ------------- -----------

Net (decrease) / increase in cash and cash equivalents (190) (249) (355)

Cash and cash equivalents at beginning of period 688 1,043 1,043

Cash and cash equivalents at end of period 498 794 688

------------- ------------- -----------

Physiomics Plc

Notes to the Interim Financial Statements

1. General information

Physiomics Plc is a public limited company ("the Company")

incorporated in England & Wales (registration number 4225086).

The Company is domiciled in the United Kingdom and its registered

address is The Magdalen Centre, Robert Robinson Avenue, The Oxford

Science Park, Oxford, OX4 4GA. The Company's ordinary shares are

traded on the AIM Market of the London Stock Exchange ("AIM").

Copies of the interim report are available from the Company's

website, www.physiomics.co.uk. Further copies of the Interim Report

and Annual Report and Accounts may be obtained from the address

above.

The Company's principal activity is the provision of services to

pharmaceutical companies in the area of outsourced systems and

computational biology.

2. Basis of preparation

The interim financial statements of the Company for the six

months ended 31 December 2022, which are unaudited, have been

prepared in accordance with the accounting policies set out in the

annual report and accounts for the year ended 30 June 2022, which

were prepared under International Financial Reporting Standards

("IFRS").

The financial information contained in the interim report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The financial information for the full

preceding year is based on the statutory accounts for the year

ended 30 June 2022. Those accounts, upon which the auditors,

Shipleys LLP, issued a report which was unqualified but contained

an emphasis of matter paragraph, have been delivered to the

Registrar of Companies.

As permitted, this interim report has been prepared in

accordance with the AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" therefore it is not fully

compliant with IFRS.

The interim financial statements are presented in sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except when otherwise indicated.

3. Loss per share

Basic loss per share is 0.24p (H1 2021: loss per share 0.12p).

The basic loss per ordinary share is calculated by dividing the

loss of GBP231,754 (H1 2021: loss GBP120,382) by 97, 424,778 (H1

2021: 97,334,778), the weighted average number of shares in issue

during the period.

The loss attributable to equity holders (holders of ordinary

shares) of the Company for calculating the fully diluted loss per

share is identical to that used for calculating the loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti- dilutive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANDKESDDEFA

(END) Dow Jones Newswires

March 07, 2023 02:00 ET (07:00 GMT)

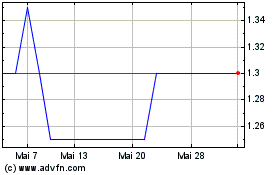

Physiomics (LSE:PYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Physiomics (LSE:PYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024