TIDMIGP

RNS Number : 7212D

Intercede Group PLC

08 December 2009

?

8 DECEMBER 2009

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the 6 Months Ended 30 September 2009

Intercede (AIM: IGP.L) is a leading producer of Identity and Credential

Management software, called MyID, which manages the secure registration,

issuance and life cycle of digital identities for a wide range of uses.

SUMMARY

- 42% increase in sales to GBP2,811,000 (2008: GBP1,981,000).

- Operating profit before exceptional items of GBP674,000 (2008:

GBP268,000).

- Profit before tax of GBP85,000 (2008: GBP222,000).

- Cash inflow of GBP202,000 (2008: GBP686,000).

- Cash balances of GBP3,913,000 at 30 September 2009 (30 September 2008:

GBP1,839,000).

- All external borrowings eliminated following the decision of the

convertible loan note holders to

convert their loan notes into

ordinary shares.

- Release of MyID 8 SR1, a major upgrade to the MyID platform.

- Successful deployment of MyID into two National ID schemes that have

entered 'live' production.

- Continued expansion of Intercede's customer base in the US in partnership

with VeriSign.

- Winning new contracts to supply MyID to government ministries, banks and

business

corporations around the world.

- Intercede overtakes competitors to be No1 in class as measured by the

number of contract

wins announced during the period.

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"Our performance continues to grow in line with our expectations. Intercede has

now delivered three consecutive half year periods of profitability as a result

of substantial revenue growth. This growth is driven by a combination of

recurring sales to existing installations, demand from new customers and an

expansion of both our product scope and geographical reach. We remain very

excited about the size and scope of contracts we are working on and the

potential of our strongest ever sales pipeline."

ENQUIRIES

+-----------------------------------------+-------------------------------------+

| Intercede Group plc | Tel.+44 (0)1455 558111 |

+-----------------------------------------+-------------------------------------+

| Richard Parris, Chairman & Chief | |

| Executive | |

+-----------------------------------------+-------------------------------------+

| Andrew Walker, Finance Director | |

+-----------------------------------------+-------------------------------------+

| | |

+-----------------------------------------+-------------------------------------+

| FinnCap | |

+-----------------------------------------+-------------------------------------+

| Charles Cunningham | Tel. +44 (0)20 7600 1658 |

+-----------------------------------------+-------------------------------------+

| | |

+-----------------------------------------+-------------------------------------+

| Pelham Public Relations | |

+-----------------------------------------+-------------------------------------+

| Archie Berens | Tel.+44 (0)20 7337 1509 |

+-----------------------------------------+-------------------------------------+

| Francesca Tuckett | Tel.+44 (0)20 7337 1537 |

+-----------------------------------------+-------------------------------------+

About Intercede

Intercede is the producer of the MyID Identity and Credential Management System

(IDCMS). Intercede's MyID is the only IDCMS software product that enables

organizations to easily and securely manage the identities of people and their

associated identity credentials within a single, integrated, workflow driven

platform. This includes enabling and managing: secure registration, biometric

capture, application vetting and approval through to smart card personalization,

issuance and management.

Intercede's MyID is being used around the world by large corporations,

governments and banks to manage millions of identities for employees, citizens

and customers. Notable deployments in the US include 10 Federal Agencies, a

programme with Lockheed Martin and two major US financial institutions. In

Europe and the Middle East, Intercede's MyID is being deployed in support of

government identity, health and corporate employee ID security projects.

Intercede and MyID are registered trademarks or trademarks in the UK, US and/or

other countries.

For more information visit http://www.intercede.com.

INTERCEDE GROUP plc

Interim Results for the Six Months Ended 30 September 2009

Chairman's Statement

Introduction

I am pleased to be able to report that excellent commercial and technical

progress has been made during the first half of the year. Revenues have

increased by 42% to GBP2,811,000 (2008: GBP1,981,000), resulting in an operating

profit before exceptional items of GBP674,000 compared to GBP268,000 in the same

period last year.

As a result of this improved performance and careful cash management, cash

balances at 30 September 2009 totaled GBP3,913,000, which compares to

GBP3,711,000 at 31 March 2009 and GBP1,839,000 at 30 September 2008. All

external borrowings have also been eliminated during the period following the

decision of the convertible loan note holders to convert their loan notes into

ordinary shares.

This represents a turning point in the evolution of Intercede's business and is

indicative of the strong commercial progress we continue to make.

Commercial Progress

Significant advances during the year to date include:

* Successful commissioning of two National ID schemes powered by MyID; one in

Kuwait and the other for an undisclosed government customer.

* Winning new US Federal and State government customers in partnership with

VeriSign.

* Securing MyID sales with a Middle Eastern oil company, manufacturing companies

in Austria and Switzerland, government ministries in Romania and Slovakia, and

banks in Australia, the Czech Republic, Scandinavia and the Ukraine.

* Winning a contract with a major security printing and smart card manufacturer

for issuing identity cards to their employees at facilities around the world.

* Selling an additional 100,000 MyID licenses to BT for the NHS Data Spine project

which takes the total sold to date up to 700,000.

* Securing additional orders totaling in excess of $1.0m for MyID software

licenses and professional services in support of the internal identity badge of

the world's largest defence contractor, Lockheed Martin.

* Supporting Lockheed Martin on the US Transportation Worker Identity Credential

(TWIC) program which has to date resulted in the issuance of 1.3 million cards

to US dock workers using MyID.

* Worked with a US partner to win a multi-year contract to supply MyID to a large

US based, global management consultancy group for internal security and

regulatory compliance.

* The addition of the US Social Security Administration (SSA) to Intercede's

HSPD-12 customer list.

* The deployment of MyID 8 SR1 to two existing US Air Force base customers.

Following the successful launch of MyID 8 in June 2008, which repositioned MyID

from being a smart card management system to a fully featured Identity and

Credential Management System, MyID 8 SR1 was released on 26 October 2009. This

updated version includes support for a wide range of third party systems and

devices and enables partners and systems integrators to add value faster using

Intercede's revolutionary Project Designer suite of Application Programming

Interfaces (APIs) and customisation tools.

Financial Results

The financial results reflect the continued momentum from the Group's

involvement in an increasing number of projects around the world.

Sales increased by 42% to GBP2,811,000 (2008: GBP1,981,000) which resulted in a

substantial increase in operating profit before exceptional items from

GBP268,000 to GBP674,000. Exceptional costs incurred during the period as a

result of the ActivIdentity patent infringement lawsuit outlined below totaled

GBP579,000 (2008: GBPnil).

Staff costs continue to represent the main area of expense representing

approximately 80% of the total operating costs excluding exceptional items. The

average number of employees increased from 44 to 54 year on year.

A profit for the period of GBP85,000 (2008: GBP283,000) resulted in a basic

earnings per share of 0.2p (2008: 0.8p) and a fully diluted earnings per share

of 0.2p (2008: 0.6p). Adjusting for the exceptional costs results in a fully

diluted pre exceptional earnings per share of 1.4p (2008: 0.6p).

Cash balances at 30 September 2009 totaled GBP3,913,000 (2008: GBP1,839,000) and

were therefore more than double that of a year ago, notwithstanding the

exceptional legal costs incurred to date as a result of the ActivIdentity patent

infringement lawsuit. During the period, the Group's financial position has also

been substantially strengthened following the decision of all of the convertible

loan note holders to convert their loan notes into ordinary shares.

Intellectual Property

The reported period includes exceptional costs for defending a previously

reported patent infringement case which was filed in the US by ActivIdentity

Corporation on 1 October 2008. Intercede's answer and counterclaims deny that

its products infringe ActivIdentity's patent and allege further that this patent

is invalid and unenforceable. In addition, Intercede has filed counterclaims

against ActivIdentity alleging violations of US antitrust law. Intercede intends

to pursue its defence and its counterclaims vigorously.

Outlook

The first half of the year has been profitable and cash generative. As in

previous years, the full year outcome will be dependent upon the timing of

receipt of orders and our subsequent ability to deliver and recognise revenues

in accordance with the Group's accounting policy. Nevertheless, the level and

pace of customer and partner activity is greater than in previous periods and

the sales pipeline is stronger than ever. I therefore remain confident that our

operating performance will continue to meet expectations.

Richard Parris

Chairman & Chief Executive

8 December 2009

Intercede Group plc

Consolidated Statement of Comprehensive Income

+-----------------------------+------------------+-----------------+--------------+

| | 6 months ended | 6 months ended | Year ended |

+-----------------------------+------------------+-----------------+--------------+

| | 30 September | 30 September | 31 March |

+-----------------------------+------------------+-----------------+--------------+

| | 2009 | 2008 | 2009 |

+-----------------------------+------------------+-----------------+--------------+

| | GBP'000 | GBP'000 | GBP'000 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Continuing operations | | | |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Revenue | 2,811 | 1,981 | 5,701 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Cost of sales | (73) | (25) | (41) |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Gross profit | 2,738 | 1,956 | 5,660 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Administrative expenses | (2,643) | (1,688) | (4,173) |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Operating profit | 95 | 268 | 1,487 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Operating profit before | 674 | 268 | 1,858 |

| exceptional item | | | |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Exceptional item | (579) | - | (371) |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Operating profit | 95 | 268 | 1,487 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Finance income | 16 | 28 | 68 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Finance costs | (26) | (74) | (147) |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Profit before tax | 85 | 222 | 1,408 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Tax | - | 61 | 341 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Profit for the period | 85 | 283 | 1,749 |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Total comprehensive income | 85 | 283 | 1,749 |

| attributable to owners of | | | |

| the company | | | |

+-----------------------------+------------------+-----------------+--------------+

| | | | |

+-----------------------------+------------------+-----------------+--------------+

| Earnings per share (pence) | | | |

+-----------------------------+------------------+-----------------+--------------+

| - basic | 0.2p | 0.8p | 4.7p |

+-----------------------------+------------------+-----------------+--------------+

| - diluted | 0.2p | 0.6p | 3.6p |

+-----------------------------+------------------+-----------------+--------------+

Intercede Group plc

Consolidated Balance Sheet

+-----------------------------+---------------+---------------+---------------+

| | As at | As at | As at |

+-----------------------------+---------------+---------------+---------------+

| | 30 September | 30 September | 31 March |

+-----------------------------+---------------+---------------+---------------+

| | 2009 | 2008 | 2009 |

+-----------------------------+---------------+---------------+---------------+

| | GBP'000 | GBP'000 | GBP'000 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Non-current assets | | | |

+-----------------------------+---------------+---------------+---------------+

| Property, plant and | 70 | 57 | 67 |

| equipment | | | |

+-----------------------------+---------------+---------------+---------------+

| Deferred tax | 280 | - | 280 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| | 350 | 57 | 347 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Current assets | | | |

+-----------------------------+---------------+---------------+---------------+

| Trade and other receivables | 687 | 866 | 902 |

+-----------------------------+---------------+---------------+---------------+

| Cash and cash equivalents | 3,913 | 1,839 | 3,711 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| | 4,600 | 2,705 | 4,613 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Total assets | 4,950 | 2,762 | 4,960 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Equity | | | |

+-----------------------------+---------------+---------------+---------------+

| Called up share capital | 4,413 | 4,302 | 4,305 |

+-----------------------------+---------------+---------------+---------------+

| Share premium account | 4,718 | 2,834 | 2,875 |

+-----------------------------+---------------+---------------+---------------+

| Other reserves | 1,508 | 1,508 | 1,508 |

+-----------------------------+---------------+---------------+---------------+

| Equity reserve | - | 109 | 109 |

+-----------------------------+---------------+---------------+---------------+

| Retained earnings | (7,908) | (9,568) | (8,102) |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Total equity | 2,731 | (815) | 695 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Current liabilities | | | |

+-----------------------------+---------------+---------------+---------------+

| Trade and other payables | 1,025 | 493 | 1,156 |

+-----------------------------+---------------+---------------+---------------+

| Deferred revenue | 1,194 | 1,177 | 1,173 |

+-----------------------------+---------------+---------------+---------------+

| Convertible loan notes | - | 1,907 | 1,936 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| | 2,219 | 3,577 | 4,265 |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| | | | |

+-----------------------------+---------------+---------------+---------------+

| Total equity and | 4,950 | 2,762 | 4,960 |

| liabilities | | | |

+-----------------------------+---------------+---------------+---------------+

Intercede Group plc

Consolidated Statement of Changes in Equity

+----------------------+----------+------------+------------+---------+------------+---------+

| | Share | Share | Other | Equity | Retained | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | Capital | Premium | reserves | reserve | earnings | Total |

+----------------------+----------+------------+------------+---------+------------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 31 March 2009 | 4,305 | 2,875 | 1,508 | 109 | (8,102) | 695 |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Issue of shares, net | 108 | 1,843 | - | - | - | 1,951 |

| of costs | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Loan note conversion | - | - | - | (109) | 109 | - |

| - reversal of FRS25 | | | | | | |

| equity component | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Total comprehensive | - | - | - | - | 85 | 85 |

| income | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 30 September 2009 | 4,413 | 4,718 | 1,508 | - | (7,908) | 2,731 |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 31 March 2008 | 4,292 | 2,764 | 1,508 | 109 | (9,851) | (1,178) |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Issue of shares, net | 10 | 70 | - | - | - | 80 |

| of costs | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Total comprehensive | - | - | - | - | 283 | 283 |

| income | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 30 September 2008 | 4,302 | 2,834 | 1,508 | 109 | (9,568) | (815) |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 31 March 2008 | 4,292 | 2,764 | 1,508 | 109 | (9,851) | (1,178) |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Issue of shares, net | 13 | 111 | - | - | - | 124 |

| of costs | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| Total comprehensive | - | - | - | - | 1,749 | 1,749 |

| income | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| | | | | | | |

+----------------------+----------+------------+------------+---------+------------+---------+

| At 31 March 2009 | 4,305 | 2,875 | 1,508 | 109 | (8,102) | 695 |

+----------------------+----------+------------+------------+---------+------------+---------+

Intercede Group plc

Consolidated Cash Flow Statement

+---------------------------------+------------------+----------------+--------------+

| | 6 months ended | 6 months ended | Year ended |

+---------------------------------+------------------+----------------+--------------+

| | 30 September | 30 September | 31 March |

+---------------------------------+------------------+----------------+--------------+

| | 2009 | 2008 | 2008 |

+---------------------------------+------------------+----------------+--------------+

| | GBP'000 | GBP'000 | GBP'000 |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Cash flows from operating | | | |

| activities | | | |

+---------------------------------+------------------+----------------+--------------+

| Operating profit | 95 | 268 | 1,487 |

+---------------------------------+------------------+----------------+--------------+

| Depreciation | 15 | 12 | 25 |

+---------------------------------+------------------+----------------+--------------+

| Decrease/(increase) in trade | 214 | (441) | (483) |

| and other receivables | | | |

+---------------------------------+------------------+----------------+--------------+

| (Decrease)/increasein trade and | (111) | 701 | (1360) |

| other payables | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Cash generated from operations | 213 | 540 | 2,389 |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Taxation received | - | 61 | 61 |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Net cash from operating | 213 | 601 | 2,450 |

| activities | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Investing activities | | | |

+---------------------------------+------------------+----------------+--------------+

| Interest received | 18 | 22 | 68 |

+---------------------------------+------------------+----------------+--------------+

| Purchases of property, plant | (19) | (17) | (40) |

| and equipment | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Net cash from investing | (1) | 5 | 28 |

| activities | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Financing activities | | | |

+---------------------------------+------------------+----------------+--------------+

| (Cost)/proceeds on issue of | (10) | 80 | 80 |

| shares | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Net increase in cash and cash | 202 | 686 | 2,558 |

| equivalents | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Cash and cash equivalents at | 3,711 | 1,153 | 1,153 |

| the start of the period | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

| Cash and cash equivalents at | 3,913 | 1,839 | 3,711 |

| the end of the period | | | |

+---------------------------------+------------------+----------------+--------------+

| | | | |

+---------------------------------+------------------+----------------+--------------+

+------------------------------------------------------------------------------+-----------------+-----------------+-----------------+

| Intercede Group plc | | | |

+------------------------------------------------------------------------------+-----------------+-----------------+-----------------+

| Notes to the Accounts | | | |

+------------------------------------------------------------------------------+-----------------+-----------------+-----------------+

| | | | |

+------------------------------------------------------------------------------+-----------------+-----------------+-----------------+

| | | | |

+------------------------------------------------------------------------------+-----------------+-----------------+-----------------+

1. Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS as adopted by

the European Union and on the basis of the accounting policies set out in the

Group's Annual Report for the year ended 31 March 2009.

The Group is not required to apply IAS 34 Interim Financial Reporting at this

time.

These interim financial statements have not been audited and do not constitute

statutory accounts as defined in Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 March 2009 have been delivered to the

Registrar of Companies. The Auditors' Report on those accounts was unqualified

and did not contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders prior to the end of December

2009 and copies will be available on the website (www.intercede.com) and at the

registered office: Intercede Group plc, Lutterworth Hall, St Mary's Road,

Lutterworth, Leicestershire, LE17 4PS.

2. Segmental Reporting

All of the Group's revenue, operating profits and net assets originate from

operations in the United Kingdom. The Directors consider that the activities of

the Group constitute a single business segment.

+----------------------------+---------------+---------------+----------+

| The split of revenue by | | | |

| geographical destination | | | |

| of the end customer can be | | | |

| analysed as follows: | | | |

+----------------------------+---------------+---------------+----------+

| | 6 months | 6 months | Year |

| | ended | ended | ended |

+----------------------------+---------------+---------------+----------+

| | 30 September | 30 September | 31 March |

+----------------------------+---------------+---------------+----------+

| | 2009 | 2008 | 2009 |

+----------------------------+---------------+---------------+----------+

| | GBP'000 | GBP'000 | GBP'000 |

+----------------------------+---------------+---------------+----------+

| | | | |

+----------------------------+---------------+---------------+----------+

| United Kingdom | 795 | 882 | 2,488 |

+----------------------------+---------------+---------------+----------+

| Rest of Europe | 806 | 380 | 846 |

+----------------------------+---------------+---------------+----------+

| USA | 1,085 | 704 | 2,104 |

+----------------------------+---------------+---------------+----------+

| Rest of World | 125 | 15 | 263 |

+----------------------------+---------------+---------------+----------+

| | | | |

+----------------------------+---------------+---------------+----------+

| | 2,811 | 1,981 | 5,701 |

+----------------------------+---------------+---------------+----------+

3. Exceptional item

The exceptional item, which is included within administrative expenses,

represents the costs associated with defending a patent infringement lawsuit

which was filed by ActivIdentity in the United States District Court for the

Northern District of California on 1 October 2008.

No provision has been made as at 30 September 2009 in respect of the original

ActivIdentity lawsuit or contingent asset disclosed in respect of Intercede's

counterclaims.

4. Tax

There is no charge for corporation tax due to the availability of losses brought

forward from prior years.

5. Earnings per share

The calculation of earnings per ordinary share is based on the profit and the

weighted average number of ordinary shares in issue during each period i.e.

September 2009: 44,704,340; September 2008: 36,871,850 and March 2009:

37,011,460. The diluted earnings per share is based on a weighted average of

48,735,005 ordinary shares (September 2008 and March 2009: 48,785,009) which

reflects the potential exercise of all existing share options.

6. Dividend

The Directors do not recommend the payment of a dividend.

7. Analysis and reconciliation of net debt

+-----------------------------------+------------+-------------+-------------+

| | 6 months | 6 months | Year |

| | ended | ended | ended |

+-----------------------------------+------------+-------------+-------------+

| | 30 | 30 | 31 |

| | September | September | March |

+-----------------------------------+------------+-------------+-------------+

| | 2009 | 2008 | 2009 |

+-----------------------------------+------------+-------------+-------------+

| | GBP'000 | GBP'000 | GBP'000 |

+-----------------------------------+------------+-------------+-------------+

| | | | |

+-----------------------------------+------------+-------------+-------------+

| Cash and cash equivalents | 3,913 | 1,839 | 3,711 |

+-----------------------------------+------------+-------------+-------------+

| | | | |

+-----------------------------------+------------+-------------+-------------+

| Convertible loan notes | - | (1,907) | (1,936) |

+-----------------------------------+------------+-------------+-------------+

| | | | |

+-----------------------------------+------------+-------------+-------------+

| Net cash/(debt) | 3,913 | (68) | 1,775 |

+-----------------------------------+------------+-------------+-------------+

On 29 May 2009, notification was received from the remaining holders of the

convertible loan notes issued by the Company on 31 March 2000 and 6 December

2001 that they had elected to convert their loan notes together with associated

interest for the period to 31 May 2009 into ordinary shares of 1p each in the

Company. This resulted in the issue of 3,877,166 ordinary shares at a price of

15p per share and 6,897,083 ordinary shares at a price of 20p per share.

Following the conversion, the total issued share capital of the Company is

48,178,005 ordinary shares of 1p each.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFSRFLLDIIA

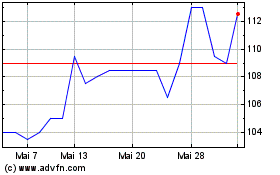

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024