Crown Place VCT PLC Crown Place Vct Plc : Annual -6-

02 Oktober 2014 - 6:08PM

UK Regulatory

30 June 2014 30 June 2013

Note GBP'000 GBP'000

Fixed assets

Fixed asset investments 9 27,689 24,567

Investment in subsidiary undertakings 11 15,095 16,580

42,784 41,147

Current assets

Trade and other debtors 12 74 17

Current asset investments 12 42 21

Cash at bank and in hand 16 1,410 2,723

1,526 2,761

Creditors: amounts falling due within one

year 13 (15,260) (16,742)

Net current assets (13,734) (13,981)

Net assets 29,050 27,166

Capital and reserves

Ordinary share capital 14 10,006 9,300

Share premium 5,527 3,756

Capital redemption reserve 1,415 1,283

Unrealised capital reserve 695 (167)

Realised capital reserve (64) 832

Other distributable reserve 11,471 12,162

Total equity shareholders' funds 29,050 27,166

Basic and diluted net asset value per share

(pence)* 15 32.04 32.26

* excluding treasury shares

The Company balance sheet has been prepared in accordance with UK GAAP.

The accompanying notes form an integral part of these Financial

Statements.

These Financial Statements were approved by the Board of Directors, and

authorised for issue on 2 October 2014 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Company number: 03495287

Consolidated statement of changes in equity

Capital Unrealised Realised Other

Ordinary share Share redemption capital capital distributable

capital premium reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2013 9,300 3,756 1,283 (1,690) 1,041 13,476 27,166

Profit and total comprehensive income - - - 1,823 (372) 525 1,976

Transfer of previously unrealised losses on sale or

write off of investments - - - 524 (524) - -

Dividends paid - - - - - (2,132) (2,132)

Purchase of shares for treasury (including costs) - - - - - (174) (174)

Purchase of own shares for cancellation (including

costs) (132) - 132 - - (395) (395)

Issue of equity (net of costs) 838 1,771 - - - - 2,609

As at 30 June 2014 10,006 5,527 1,415 657 145 11,300 29,050

As at 1 July 2012 8,844 2,335 1,065 (3,755) 1,970 15,491 25,950

Profit and total comprehensive income - - - 1,105 31 590 1,726

Transfer of previously unrealised losses on sale or

write off of investments - - - 960 (960) - -

Dividends paid - - - - - (1,983) (1,983)

Cancellation of treasury shares (77) - 77 - - - -

Purchase of shares for treasury (including costs) - - - - - (206) (206)

Purchase of own shares for cancellation (including

costs) (141) - 141 - - (416) (416)

Issue of equity (net of costs) 674 1,421 - - - - 2,095

As at 30 June 2013 9,300 3,756 1,283 (1,690) 1,041 13,476 27,166

The nature of each reserve is described in note 1 below.

Company reconciliation of movements in shareholders' funds

Capital Unrealised Realised Other

Ordinary share Share redemption capital capital distributable

capital premium reserve reserve reserve* reserve* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2013 9,300 3,756 1,283 (167) 832 12,162 27,166

Return for the year - - - 1,823 (372) 2,010 3,461

Revaluation of investment in subsidiaries - - - (1,485) - - (1,485)

Transfer of previously unrealised losses on sale or

write off of investments - - - 524 (524) - -

Dividends paid in year - - - - - (2,132) (2,132)

Purchase of shares for treasury (including costs) - - - - - (174) (174)

Purchase of own shares for cancellation (including

costs) (132) - 132 - - (395) (395)

Issue of equity (net of costs) 838 1,771 - - - - 2,609

As at 30 June 2014 10,006 5,527 1,415 695 (64) 11,471 29,050

As at 1 July 2012 8,844 2,335 1,065 (3,252) 1,761 15,197 25,950

Return for the year - - - 1,105 31 (430) 706

Revaluation of investment in subsidiaries - - - 1,020 - - 1,020

Transfer of previously unrealised losses on sale or

write off of investments - - - 960 (960) - -

Dividends paid in year - - - - - (1,983) (1,983)

Cancellation of treasury shares (77) - 77 - - - -

Purchase of shares for treasury (including costs) - - - - - (206) (206)

Purchase of own shares for cancellation (including

costs) (141) - 141 - - (416) (416)

Issue of equity (net of costs) 674 1,421 - - - - 2,095

As at 30 June 2013 9,300 3,756 1,283 (167) 832 12,162 27,166

* Included within these reserves is an amount of GBP11,407,000 (2013:

GBP12,827,000) which is considered distributable.

The nature of each reserve is described in note 1 below.

Consolidated cashflow statement

Year ended Year ended

30 June 2014 30 June 2013

Note GBP'000 GBP'000

Operating activities

Investment income received 880 917

Deposit interest received 18 22

Dividend income received 29 34

Investment management fees paid (473) (453)

Other cash payments (267) (269)

Net cash flows from operating activities 17 187 251

Cash flows from investing activities

Purchase of non-current asset investments (2,539) (1,062)

Disposal of non-current asset investments 1,129 2,399

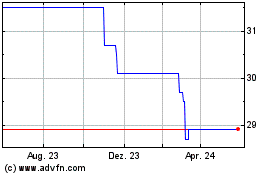

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024