Euro Slides As Eurozone Inflation Dips Below 2% Target, Signaling ECB Rate Cut

01 Oktober 2024 - 9:36AM

RTTF2

The euro weakened against other major currencies in the European

session on Tuesday, after Eurozone inflation fell below the 2

percent target for the first time in more than three years in

September, signaling faster interest rate cuts from the European

Central Bank.

The harmonized index of consumer prices posted an annual

increase of 1.8 percent compared to a 2.2 percent rise in August,

flash data from Eurostat showed Tuesday.

Inflation fell below 2 percent for the first time since June

2021. Economists had forecast inflation to moderate to 1.9

percent.

On a monthly basis, the HICP was down 0.1 percent.

Accordingly, the economist expects the ECB to cut its deposit

rate by 25 basis points in October to 3.25 percent.

In June, the ECB had cut its rates for the first time since

2019. After opting for a pause in July, the bank again reduced its

key rates by 25 basis points in September.

According to the CME Group's FedWatch Tool that tracks the

expectations of interest rate traders, the likelihood of a

half-point cut in the next Fed review in November has fallen to 40

percent from 58 percent a week earlier.

A speech by European Central Bank's Vice President Luis de

Guindos along with the U.S. ISM manufacturing PMI and JOLTS job

openings data may garner investor attention as the day

progresses.

In the European trading today, the euro fell to an 8-day low of

1.1084 against the U.S. dollar, from an early high of 1.1145. The

next possible downside target for the euro is seen around the 1.09

region.

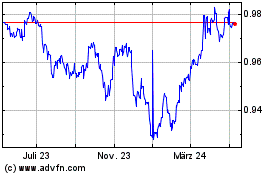

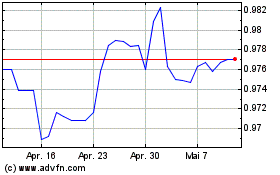

Against the pound, the NZ dollar and the Swiss franc, the euro

edged down to 0.8320, 1.7542 and 0.9386 from early highs of 0.8337,

1.7623 and 0.9435, respectively. If the euro extends its downtrend,

it is likely to find support around 0.81 against the pound, 1.74

against the kiwi and 0.92 against the franc.

Moving away from an early 4-day high of 160.91 against the yen,

the euro edged down to 159.30. On the downside, 154.00 is seen as

the next support level for the euro.

Against the Australia and the Canadian dollars, the euro edged

slipped to nearly a 3-month low of 1.6051 and a 5-day low of 1.4994

from early highs of 1.6115 and 1.5072, respectively. The euro may

test support around 1.59 against the aussie and 1.48 against the

loonie.

Looking ahead, manufacturing PMI reports from U.S. and Canada

for September and U.S. construction spending data for August are

slated for release in the New York session.

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Nov 2024 bis Dez 2024

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Dez 2023 bis Dez 2024