Yen Falls After BoJ Ueda Signals No Rush To Hike

24 September 2024 - 7:23AM

RTTF2

The Japanese yen weakened against other major currencies in the

European session on Tuesday, after the Bank of Japan's Governor

Kazuo Ueda signaled that the central bank is not in a rush to raise

interest rates.

In a speech in Osaka, western Japan, the BoJ Ueda said that the

bank will raise its key interest rate "in a timely and appropriate

manner while taking account of various uncertainties,".

He also added that the BOJ has "enough time" to assess

developments in financial markets.

In economic news, data from S&P Global showed that Japan's

private sector growth softened in September as manufacturing output

fell back into the contraction territory. The au Jibun Bank flash

composite output index fell to 52.5 in September from 52.9 in the

prior month.

The services activity growth strengthened to a five-month high

in September, while manufacturing output contracted for the second

time in three months. The flash services Purchasing Managers' Index

rose to 53.9 from 53.7 in the prior month. Meanwhile, the factory

PMI slid to 49.6 from 49.8 a month ago.

European stocks traded higher, with resource stocks likely to

surge after China's central bank announced a slew of measures to

spur sluggish economic growth.

The People's Bank of China said it would cut the reserve

requirement ratio by 0.5 percentage points in the near future.

The central bank also announced plans to reduce interest rates

on existing mortgages and standardize down payment ratios to

bolster demand in the property sector and stimulate growth.

In the European trading today, the yen fell to a 3-week low of

193.29 against the pound, from an early high of 193.29. The yen is

likely to find support around the 202.00 region.

Against the U.S. dollar and the Swiss franc, the yen slipped to

near 3-week lows of 144.68 and 170.55 from early highs of 143.38

and 169.36, respectively. If the yen extends its downtrend, it is

likely to find support around 149.00 against the greenback and

173.00 against the franc.

The yen edged down to 161.11 against the euro, from an early

high of 159.24. On the downside, 164.00 is seen as the next support

level for the yen.

Against the New Zealand and the Canadian dollars, the yen

dropped to a 3-week low of 90.74 and nearly a 3-week low of 107.06

from early highs of 89.80 and 106.00, respectively. The next

possible downside target level for the yen is seen around 92.00

against the kiwi and 109.00 against the loonie.

The yen edged up to 98.86 against the Australian dollar, from an

early low of 98.29. The yen had fell earlier to a 3-week low of

98.95 against the aussie after the Australia's central bank left

its interest rate unchanged at a 12-year high as widely

expected.

The policy board of the Reserve Bank of Australia governed by

Michele Bullock decided to maintain the cash rate target at 4.35

percent.

Looking ahead, Canada manufacturing sales data for August, U.S.

Redbook report, U.S. S&P Case-Shiller home price index for

July, U.S. Consumer Board's consumer confidence for September, U.S.

Richmond Fed manufacturing index for September are slated for

release in the New York session.

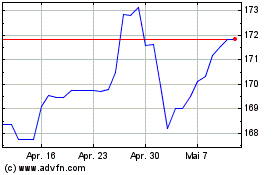

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Okt 2024 bis Nov 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Nov 2023 bis Nov 2024