Yen Rises Amid BoJ Rate Hike Uncertainty

15 Oktober 2024 - 9:57AM

RTTF2

The Japanese yen strengthened against other major currencies in

the European session on Tuesday, following Bank of Japan Governor

Kazuo Ueda's dovish remarks and incoming Prime Minister Shigeru

Ishiba's unexpected resistance to additional rate increases.

Optimism about the U.S. economic outlook, rising bets that the

Bank of Japan will forgo raising interest rates again this year,

also bolstered the trader's sentiment.

Prime Minister Shigeru Ishiba reportedly said his government is

aiming to compile a supplementary budget for the current fiscal

year in excess of last year's 13.1 trillion yen ($87.6 billion) to

fund an economic support package.

Fed Governor Christopher Waller on Monday signaled that future

U.S. Fed interest rate cuts will be less aggressive than the big

move in September, following mixed data points in recent days.

In economic news, data from the Ministry of Economy, Trade, and

Industry showed that Japan's industrial production decreased as

initially estimated in August. Industrial production contracted 3.3

percent on a monthly basis, reversing a 3.1 percent rebound in

July. That was in line with the flash data published earlier.

Year-on-year, industrial production declined 4.9 percent in

August versus a 2.9 percent rise in the prior month.

In the European trading today, the yen rose to 4-day highs of

162.37 against the euro and 148.85 against the U.S. dollar, from

early lows of 163.36 and 149.79, respectively. The yen may test

resistance near 157.00 against the euro and 142.00 against the

greenback.

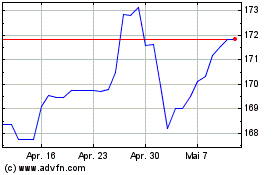

The yen advanced to a 6-day high of 172.80 against the Swiss

franc, from an early low of 173.69. On the upside, 168.00 is seen

as the next resistance level for the yen.

Against Australia, the New Zealand and the Canadian dollars, the

yen climbed to a 5-day high of 99.94, a 4-day high of 90.60 and

nearly a 2-week high of 107.81 from early lows of 100.77, 91.22 and

108.50, respectively. If the yen extends its uptrend, it is likely

to find resistance around 98.00 against the aussie, 88.00 against

the kiwi and 104.00 against loonie.

The yen edged up to 194.65 against the pound, from an early low

of 195.68. The next possible upside target for the yen is seen

around the 190.00 region.

Looking ahead, Canada CPI data for September, U.S. NY Empire

State manufacturing index for October, U.S. Redbook report and U.S.

consumer inflation expectations for September are set to be

released in the New York session.

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Sep 2024 bis Okt 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Okt 2023 bis Okt 2024