Yen Rises After BoJ Junko Nagakawa Comments

11 September 2024 - 7:09AM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Wednesday, after the Bank of Japan policymaker

Junko Nagakawa signaled about on potential interest rate hikes.

The BoJ board member Nagakawa stated that the central bank may

adjust the extent of its monetary easing if the economy and prices

align with its projections.

"When considering adjusting the degree of monetary easing

further, we must look back upon market developments after our

policy shift in July, and carefully assess how the market's changes

affect our economy and price outlook," she said.

Asian stocks traded lower, with Chinese, Hong Kong and Japanese

markets leading regional declines as worries persisted about the

health of the Chinese economy.

The focus now shifts to the U.S. consumer price inflation

reading later in the day that could offer fresh insights into the

central bank's interest rate plans.

There is fair amount of uncertainty around the size of the cut

at next week's Federal Reserve meeting. Markets are pricing in one

out of three chances of a 50-basis point cut and anticipate 114 bps

of easing this year.

In the Asian trading today, the yen rose to nearly a 9-month

high of 140.72 against the U.S. dollar and nearly a 5-week high of

184.48 against the pound, from yesterday's closing quotes of 142.23

and 186.28, respectively. The yen may test resistance around 138.00

against the greenback and 179.00 against the pound.

Against the euro and the Swiss franc, the yen advanced to more

than 5-week highs of 155.50 and 167.04 from Tuesday's closing

quotes of 156.94 and 168.16, respectively. If the yen extends its

uptrend, it is likely to find resistance around 153.00 against the

euro and 165.00 against the franc.

The yen climbed to a 5-week high of 86.47 against the NZ dollar,

from Tuesday's closing value of 87.57. On the upside, 83.00 is seen

as the next resistance level for the yen.

Against the Australia and the Canadian dollars, the yen jumped

to more than 5-week highs of 93.65 and 103.50 from Tuesday's

closing quotes of 94.77 and 104.64, respectively. The next possible

upside target for the yen is seen around 90.00 against the aussie

and 101.00 against the loonie.

Looking ahead, U.S. CPI data for August and U.S. EIA crude oil

data are slated for release in the New York session.

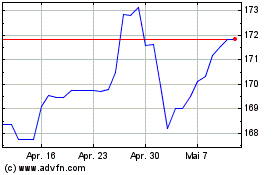

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Aug 2024 bis Sep 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

Von Sep 2023 bis Sep 2024