Operating income doubles Very strong growth in

net income: +144% Confirmation of guidance: €110m of cumulative

revenues1 over 2022-2023 Record launch of at least 10 new

productions expected in 2022

Regulatory News:

Xilam Animation (ISIN Code: FR0004034072, Symbol: XIL)

(Paris:XIL), the independent animation production and program

distribution company, announces its results for the fiscal year

ending 31 December 2021, reviewed by the Board of Directors on

March 30, 2022 under the chairmanship of Marc du Pontavice.

(in thousands of euros)

31.12.2021 (1)

31.12.2020

% change

Sales of new production

20,501

10,553

+94%

Other income and grants (2)

8,670

2,751

+215%

Total revenues from new productions and

development

29,171

13,304

+119%

Total revenues and subsidies

6,422

8,633

-26%

Total revenues and subsidies

35,594

21,936

+62%

Other grants and current operating

income(3)

4,646

2,715

+71%

Total operating revenues

40,239

24,651

+63%

Operating expenses

(31,468)

(20,226)

+56%

Current operating income

8,671

4,425

+96%

% of revenues

24.4%

20.2%

Operating income

8,697

4,244

+105%

% of revenues

24.4%

19.3%

Net income of the consolidated

group

6,839

2,806

+144%

% of revenues

19.2%

12.8%

(1) Unaudited data (2) Excluding the Audiovisual Tax credit

(ATC) (3) Including the Audiovisual Tax credit (ATC)

Marc du Pontavice, Chairman and CEO of Xilam,

says: “The strong growth in our income in 2021 demonstrates the

solidity of our model and its growth potential. We are entering

2022 with a record level of 21 projects in the pipeline and we plan

to launch at least 10 new productions during the year, reflecting

the extraordinary appetite of broadcasters for our premium content.

With a strengthened and very experienced management team, top-tier

talents and an effective organization, we are ideally positioned to

benefit from the strong growth in the animation sector.”

Very strong uptick in revenues: +63%

For the first time, the Xilam Group’s total operating revenues

exceeded €40m, to reach €40.2m as of 31 December 2021, growing by

+63% compared to the 2020 fiscal year.

- Sales from new productions almost doubled to reach €20.5m.

- New productions subsidies tripled due to the group’s investment

momentum in proprietary productions.

- As expected, catalogue revenues are experiencing a slight

slowdown compared to 2020. This is mainly a cyclical effect since

as there were no renewal scheduled in 2021 for the two main

properties of the catalogue: Oggy and Zig and Sharko.

It should be remembered that business was negatively affected by

the Trico series delivery being postponed to 2022.

The 2021 fiscal year was also marked by the Group’s rapid

expansion abroad (78% of sales) especially on digital platforms

which now account for 75% of sales (43% in 2019).

Record level of investments during the period

In 2021, investments in proprietary productions reached €31.2m,

an increase of 25%. This strong business activity represents a

total of 14 projects in production, including 3 for the Pre-school

segment, 9 for the Kids’ segment and 2 for the Non-Kids’ segment. 7

of these productions are aimed at SVOD platforms.

Operating income doubles

Current operating income stood at €8.7m, i.e. double that of the

2020 fiscal year. This growth is both a result of a significant

increase in revenues and a good control of fixed costs.

In view of the mainly proprietary component of productions

delivered in 2021, series’ amortization reached €25m, reflecting a

cautious approach to valuing the Group’s catalogue.

Overheads not attributed to new productions stood at €5.0m. This

reflects the Group’s significant €1.6m investments in developing

new projects, and in particular Adult series, a new and very

promising market for the Group.

In a year marked by a strong investment dynamic, the current

operating margin amounted to 24.4% compared to 20.2% in 2020. It

should be noted that Cube’s business, integrated in 2020, achieved

a profit margin approaching that of the Group.

Solid financial position

As of 31 December 2021, net financial debt (excluding rental

debts) stood at €18.6m (vs. €8.4m at the end of December 2020), in

other words, an increase of €10.2m which can be explained by an

increase of €10.1m in self-liquidating debt (such as factoring) on

current productions, which stood at €12.8m as of 31 December

2021.

As a reminder, in March 2021, Xilam signed a €20m production

credit line with Natixis-Coficiné to support this strong

growth.

Non-self-liquidating financial debt remains stable at €15.8m and

cashflow and cash equivalents are also stable at €9.9m, resulting

in a stable net structural (non-self-liquidating) financial debt of

€5.9m.

As of 31 December 2021, shareholders’ equity amounted to €67.6m

(compared to €60.7m at the end of 2020).

Corporate Social Responsibility

Xilam has always placed corporate social and environmental

responsibility at the heart of its concerns and is among the

sector’s key players in this area. Keen to continue to develop its

CSR strategy, the Group will strengthen its team with the

appointment of a Director in charge of CSR.

Given its strong presence in the Pre-school and Kids series

productions, the Group has drawn up a content charter in order to

promote the educational values of openness, tolerance, kindness and

respect for the environment.

In 2021, Xilam was given a rating of 3.5 stars (out of 5) by

Humpact, which placed it in second place in the sector. The Group

also achieved a rating of 63/100 from Gaïa, who ranked it in 22nd

place out of 148 companies with revenues of less than €150m.

Xilam is continuing its efforts to support young talent through

a strong presence in animation training schools, and notably

welcomed 15 apprentices in 2021

Strong objectives and outlook: 2022-2023 guidance

confirmed

Xilam envisages investing between €33m and €36m in 2022 on new

productions.

Xilam began 2022 with a record level of 21 projects in

development, comprising 2 feature films and 19 series, including 4

for Pre-school, 8 for Kids and 9 for Non-Kids, a segment

experiencing very high growth due to demand from platforms. Xilam's

worldwide recognition, particularly in the field of 2D animation

and slapstick comedy, makes it a key partner for the major

streaming platforms.

The Group plans to launch at least 10 new productions during the

year including several Adult series for the first time. This

dynamic reinforces the Group's position as European leader.

2022 will also be the year that merchandising for the Oggy Oggy

pre-school series will be launched (first range of toys planned for

Christmas 2022).

It should be noted that the tragic events in Ukraine have no

impact on the Group's business.

In an environment of very strong growth, driven by record

investments from digital platforms, Xilam is now able to confirm

its cumulative operating revenues guidance for the 2022-2023 cycle

at €110m.

This objective is on track to meet the Ambition 2026 plan,

presented on February 17, which aims to double revenues by 2026 to

€80m

In conclusion, Xilam is entering the period 2022-2026 in a very

strong position which should enable it to capture the record

momentum in the animation sector and thus deliver sustained growth

to create value.

Agenda

2021 Annual Report Notice: 29 April 2022 (after market

closing)

Publication of H1-2022 revenues: 21 July 2022 (after market

closing)

Publication of H1-2022 results: 29 September 2022 (after market

closing)

About Xilam

As a major player in the animation industry, Xilam is an

integrated studio founded in 1999 that creates, produces and

distributes original programmes in more than 190 countries for

children and adults, broadcast on television and on SVoD (Netflix,

Disney+, Amazon, NBC Universal, etc.) and AVoD (YouTube, Facebook,

etc.) platforms. With a global reputation for creativity and its

capacity for innovation, an editorial and commercial expertise at

the forefront of its industry, Xilam is positioned as a key player

in a fast-growing market. Each year, Xilam, builds on its real

successes and capitalises on powerful historical brands (Oggy and

the Cockroaches, Zig & Sharko, Chicky, etc.) and new brands

(Oggy Oggy in the pre-school sector, Mr. Magoo, Trico, etc.) which

are consolidating and expanding a significant catalogue of more the

2,700 episodes and 3 feature films including the Oscar-nominated I

Lost My Body. Xilam has unique GCI skills. Xilam employs more than

500 people, including 400 artists, across its studios in Paris,

Lyon, Angoulême and Hô-Chi-Minh in Vietnam. Xilam is listed on

Euronext Paris Compartment B - PEA - SRD long Eligibility

1 Total operating revenues

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220331005582/en/

Contacts Marc du Pontavice - Chief Executive Officer

Arnaud Duault - CFO Tel +33(0)1 40 18 72 00

Image Sept agency xilam@image7.fr Karine Allouis (Media

Relations) - Tel: +33 (0)1 53 70 74 81 Laurent Poinsot (Investor

Relations) - Tel +33 (0)1 53 70 74 77

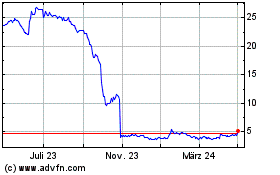

Xilam Animation (EU:XIL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Xilam Animation (EU:XIL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024