2022 Annual Results

Thursday, March 9,

2023

-

PRESS RELEASE: 2022 annual

financials

- Sales increase by 16.8%

- Net income Group share down to € 68 million

- Controlled indebtedness

|

|

Key figures in

€M |

12/31/22 |

%Sales |

12/31/21 |

%Sales |

Changes in % |

|

Total |

Structure |

Exchange rates |

Growth |

|

Sales |

6,551 |

|

5,610 |

|

16.8 |

0.3 |

-0.2 |

16.7 |

|

- Cheese Products |

3,821 |

58.3 |

3,450 |

61.5 |

10.7 |

0.6 |

2.8 |

7.3 |

|

- Other Dairy Products |

2,928 |

44.7 |

2,324 |

41.4 |

26.0 |

0.1 |

-5.0 |

30.9 |

|

- Unallocated (Intra-Group transactions) |

-198 |

-3.0 |

-164 |

-2.9 |

20.7 |

0.7 |

-2.2 |

22.2 |

|

Current operating result |

234.3 |

3.6 |

246.1 |

4.4 |

The audit procedures have been carried out

and the audit report relating to certification is currently being

issued.Definitions and methods for aggregates such as structure,

exchange rates, organic growth, and net debt have not changed.They

are defined in the Group financial

report. |

|

Other operating costs and income |

-71.4 |

-1.1 |

-73.1 |

-1.3 |

|

Operating result |

162.9 |

2.5 |

173.0 |

3.1 |

|

Financial result |

-24.4 |

-0.4 |

-20.9 |

-0.4 |

|

Result on monetary position |

2.7 |

-- |

2.7 |

-- |

|

Corporate taxes |

-57.3 |

-0.9 |

-63.6 |

-1.1 |

|

Net income, Group share |

68.0 |

1.0 |

82.9 |

1.5 |

|

Net debt (excluding IFRS 16) |

411 |

|

428 |

|

|

Equity |

1,827 |

|

1,703 |

|

2022 annual

financials

At € 6,551 million as of 31 December 2022, the

Savencia Fromage & Dairy Group’s Sales increased by € 941

million or 16.8% over the previous year, thanks mainly to a 16.7%

organic growth driven by the dynamic growth of Other Dairy

Products.

After a record performance in 2021, current

operating profit, at € 234.3 million, decreased slightly by € 11.4

million. This is mainly due to the time lag between the increase in

costs (including raw materials and energy) and its repercussion on

sales prices. It reflects continued growth in foodservice across

all geographies, a steady consumption in France and a decline in

consumption in Europe in the face of inflation.

The Group's current operating margin, at 3.6%,

is down 80 basis points compared to 2021. It benefited from a

strengthening of Other Dairy Products, where the margin rose from

5.0% to 6.1%, driven by the worldwide quotations for industrial

products. The margin for Cheese Products decreased from 4.5% to

2.1% due to inflation and a drop in volumes in certain

countries.

The operating profit, at € 162.9 million, or

2.5% of sales, decreased by € 10.1 million. It was impacted by

asset impairments, resulting in particular from the increase in

discount rates, and by the consequences of the July 2021 floods in

Belgium.

The financial result deteriorated by € 3.5

million, due to the high exchange rates volatility throughout

2022.

At € 68 million, the Group share of net income

represents 1.0% of sales. Financial balances remain well under

control, with debt (excluding IFRS 16) to equity, down at 22.5%

compared to 25.1% in 2021.

Dividend

At the Shareholders Meeting on 27 April, the

Board of Directors shall propose the distribution of a dividend of

€ 1.30 per share.

The Group’s CSR commitments: Oxygen

Plan

Team commitment to the Group's CSR approach and

its Oxygen Plan has led to several improvements:

- Roll-out of the Charter of Good

Breeding Practices to more than 87% of milk producers,

- Training of more than 62% of the

world’s dairy resource facilitators in the Animal Welfare audit

approach published during the first half of 2022,

- Definition of a roadmap to reduce

water consumption at the Group’s own industrial sites.

Outlook for 2023

Visibility for 2023 remains affected by:

- The evolution of inflation with

residual risks of shortages and adjustments in consumption

patterns,

- The continuation of the armed

conflict in Eastern Europe and its consequences on the slowing

growth of world economies,

- The pace of recovery of the Chinese

economy, the world's largest importer of dairy products

In this highly unpredictable context, Savencia

is continuing its efforts to adapt and invest while developing the

complementary between its different businesses and building on its

relationship of trust with its partners: milk producers,

distributors and consumers. The Group intends to compensate for the

uncertainty of the environment by relying on the quality of its

products and the commitment of all its teams, in line with its

mission: "Leading the way to better food".

Further information can

be found on the website savencia-fromagedairy.com

- Savencia SA - 2022 Annual results

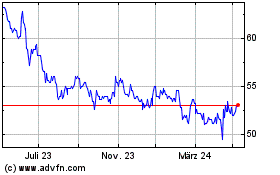

Savencia (EU:SAVE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

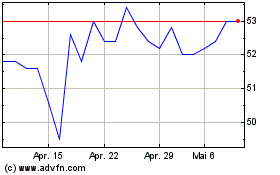

Savencia (EU:SAVE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025