RELATING TO THE FILING OF THE DRAFT

SIMPLIFIED TENDER OFFER

FOR THE SHARES OF THE COMPANY NHOA

S.A.

INITIATED BY TAIWAN CEMENT EUROPE HOLDINGS

B.V., A SUBSIDIARY OF TCC GROUP HOLDINGS CO., LTD

PRESENTED BY CRÉDIT AGRICOLE

CORPORATE AND INVESTMENT BANK

PRESS RELEASE RELATING TO THE FILING OF A

DRAFT OFFER DOCUMENT (PROJET DE NOTE D’INFORMATION) PREPARED BY

TAIWAN CEMENT EUROPE HOLDINGS B.V.

Regulatory News:

NHOA (Paris:NHOA):

This document is an unofficial English-language translation

of the legal press release (communiqué normé) relating to the

filing of the draft simplified tender offer with the French

Autorité des marchés financiers on October 9, 2024, and is provided

for information purposes only. In the event of any discrepancies

between this unofficial English-language translation and the

official French document, the official French document shall

prevail.

Not for publication, dissemination or

distribution, directly or indirectly, in the United States of

America or any other jurisdiction in which the distribution or

dissemination of this Press Release is unlawful. This Press

Release does not constitute an offer to purchase any securities.

The Offer described hereinafter may only be opened after the

clearance of the French Autorité des marchés financiers.

PRICE OF

THE OFFER:

EUR 1.25 per NHOA share

CONDITIONAL PRICE SUPPLEMENT:

Only if certain conditions

materialize, as further detailed in Section 2.2 of the Press

Release, shareholders having tendered their NHOA shares to the

Offer or, if applicable, whose NHOA shares are transferred to the

offeror as part of a squeeze-out, will be entitled to a conditional

price supplement (complément de prix conditionnel) of EUR 0.65 per

NHOA share (the “Conditional Price Supplement”).

DURATION

OF THE OFFER:

10 trading days

The timetable for the simplified

tender offer referred to herein (the “Offer”) will be set

out by the French Autorité des marchés financiers (the

“AMF”) in accordance with provisions of its general

regulation (the “AMF General Regulation”).

This press release relating to the filing

with the AMF on October 9, 2024 of the draft simplified tender

offer for the shares of NHOA was prepared and issued by Taiwan

Cement Europe Holdings B.V. in accordance with the provisions of

Article 231-16, III of the AMF General Regulation (the “Press

Release”).

The

Offer and the draft offer document filed today with the AMF (the

“Draft Offer Document”) remain subject to the review of the

AMF.

IMPORTANT NOTICE

In accordance with the provisions of

Article L. 433-4 II of the French Code monétaire et financier and

Articles 237-1 et seq. of the AMF General Regulation, TCEH intends

to require the AMF, at the latest within three (3) months following

the closing of the Offer, to implement a squeeze-out (retrait

obligatoire) for the NHOA shares not tendered in the Offer (other

than the NHOA free shares subject to a holding period and subject

to a liquidity mechanism and/or assimilated to the shares held,

directly or indirectly, by the offeror) to be transferred to TCEH

in return for (i) compensation per NHOA share equal to the offer

price, being EUR 1.25; and (ii) entitlement to the Conditional

Price Supplement of EUR 0.65 per NHOA share payable only if the

conditions set forth in Section 2.2.1(B) of the Press Release

materialize.

Shareholders’ and potential investors of

NHOA’s attention is drawn to the fact that (a) no Conditional Price

Supplement will be due and/or paid if the Call Option or the Put

Option (as such terms are defined in Section 2.2.1(A) of the Press

Release) is exercised, (b) the Call Option is deeply in the money

and may therefore likely be exercised, and (c) if the Call Option

is not exercised, TCC commits to procure for the exercise of the

Put Option in light of the factors set forth in Section 2.2.1(A) of

the Press Release. Consequently, it is unlikely that a Conditional

Price Supplement will eventually be due and paid to the

shareholders of NHOA. Shareholders and potential investors of NHOA

are encouraged to read the details of the conditions set forth in

Section 2.2.1(B) of the Press Release and exercise caution when

dealing in NHOA securities.

The Draft Offer Document is available on the websites of the AMF

(www.amf-france.org), and of TCC Group Holdings Co., Ltd

(www.tccgroupholdings.com/en/) and the Company (www.nhoagroup.com),

and may be obtained free of charge from Crédit Agricole Corporate

and Investment Bank:

12 place des Etats-Unis CS 70052 92547

Montrouge Cedex

The information relating to, in particular, the legal, financial

and accounting characteristics of Taiwan Cement Europe Holdings

B.V. will be made available to the public, pursuant to Article

231-28 of the AMF General Regulation, no later than the day

preceding the opening of the simplified tender offer. A press

release will be issued to inform the public of the manner in which

this information will be made available.

1. PRESENTATION OF THE OFFER

Pursuant to Title III of Book II, and more specifically Article

233-1, 1° et seq. of the AMF General Regulation, Taiwan Cement

Europe Holdings B.V., a private company with limited liability

(besloten vennootschap met beperkte aansprakelijkheid) organized

under the laws of the Netherlands, having its registered office at

Strawinskylaan 3051, 1077 ZX, Amsterdam, the Netherlands, and

registered with the trade register of the Dutch Chamber of Commerce

under number 82637970 (“TCEH” or the “Offeror”),

irrevocably offers to all the shareholders of NHOA S.A., a société

anonyme à conseil d’administration, with a share capital of EUR

55,080,483.40, having its registered office at 93 boulevard

Haussmann, 75008 Paris, France, registered with the Trade and

Companies Register of Paris under number 808 631 691 (“NHOA”

or the “Company”), to acquire in cash all of their shares in

the Company, whether outstanding or to be issued, which are

admitted to trading on Compartment B of the regulated market of

Euronext Paris (“Euronext Paris”) under ISIN Code

FR0012650166, ticker symbol “NHOA.PA” (the “Shares”), other

than the Shares held, directly or indirectly, by the Offeror, at

the price of EUR 1.25 per Share (the “Offer Price”), which

may be adjusted, if applicable, by a conditional price supplement

(complément de prix conditionnel) as further described below and in

Section 2.2 of the Press Release (the “Conditional Price

Supplement”), as part of a simplified tender offer, the terms

and conditions of which are described hereinafter (the

“Offer”).

The Offeror is an indirect subsidiary of TCC Group Holdings Co.,

Ltd (formerly known as Taiwan Cement Corporation), a company

organized under the laws of the Republic of China (Taiwan), whose

registered office is at No. 113, Section 2, Zhongshan North Road,

Taipei City 104, Taiwan (“TCC”, and, together with its

subsidiaries other than the Company and its subsidiaries, the

“TCC Group”).

TCC’s intention to file a simplified tender offer for the

Shares, indirectly through TCEH, was announced on June 13, 2024.1 A

first draft offer document was filed on July 8, 2024 with the AMF

(the “First Draft Offer Document”) on the basis of an

initial offer price of EUR 1.10 per Share.2 As announced in a press

release of the Company dated August 19, 2024, the ad hoc committee

of the Company’s Board of Directors, in light of the preliminary

work of the independent expert and the financial advisor to the ad

hoc committee, expressed some reservations as to the fairness of

the initial offer price of EUR 1.10 per Share and has therefore

asked TCC to express its intentions regarding the Offer. TCC then

announced on August 21, 2024 that its Board of Directors had

approved an increase of the Offer Price to EUR 1.25 per Share. In

addition, in the event that neither the Call Option nor the Put

Option on the shares held by NHOA Corporate S.r.l. (an Italian

subsidiary of NHOA) in Free2Move eSolutions S.p.A. (“F2MeS”)

is exercised (as such terms are defined in Section 2.2.1(A) of the

Press Release), a Conditional Price Supplement equal to EUR 0.65

per Share will be paid to the shareholders of the Company whose

Shares are tendered in the Offer (including the shareholders of the

Company who sold their Shares to the Offeror as part of the Block

Trades described in Section 1.1.2(B) of the Press Release) or

transferred to the Offeror as part of a squeeze-out , if

applicable, in accordance with Section 2.2 of the Press

Release.

As of the date of the First Draft Offer Document, TCEH held

244,557,486 Shares, representing, on this date, 88.87% of the

Company’s share capital and theoretical voting rights.

The Offer targeted all Shares that were not held, directly or

indirectly, by the Offeror:

- which were already issued – i.e., to the knowledge of the

Offeror as of the date of the First Draft Offer Document, a maximum

number of 30,639,274 Shares;

- which could be issued before the closing of the Offer, as a

result of the vesting of the Free Shares other than the Blocked

Shares (as such terms are defined in Section 2.6 of the Press

Release), subject to the satisfaction of the applicable performance

conditions – i.e., to the knowledge of the Offeror as of the date

of the First Draft Offer Document, a maximum number of 184,414 Free

Shares;

i.e., to the knowledge of the Offeror as of the date of the

First Draft Offer Document, a maximum number of Shares targeted by

the Offer equal to 30,823,688.

In the First Draft Offer Document, the Offeror reserved the

right to purchase, as from the filing of the proposed Offer with

the AMF and until the opening of the Offer, through Kepler

Cheuvreux, Shares on or off-market, in accordance with the

provisions of Articles 231-38 and 231-39 of the AMF General

Regulation, within the limits set out in Article 231-38, IV of the

AMF General Regulation, corresponding to 30% of the existing Shares

targeted by the Offer – i.e., a maximum of 9,191,782 Shares –, at

the initial offer price of EUR 1.10 per Share set forth in the

First Draft Offer Document. In this framework, on July 8 and 9,

2024, after the filing of the First Draft Offer Document and the

publication of the AMF notice setting out the main terms of the

Offer2 and signaling the beginning of the Offer period, the Offeror

acquired 9,191,782 Shares off-market through the Block Trades and

crossed upwards the 90% threshold of the Company’s share capital

and theoretical voting rights (as further described in Sections

1.1.2(B)(c) and 1.1.3(B) of the Press Release).3

Consequently, as of the date of the Draft Offer Document, TCEH

holds 253,749,268 Shares, representing 92.14% of the Company’s

share capital and theoretical voting rights.

Therefore, the Offer targets all Shares that are not held,

directly or indirectly, by the Offeror and which are already issued

– i.e., to the knowledge of the Offeror as of the date of the Draft

Offer Document, a maximum number of 21,628,106 Shares, including

the Free Shares which were issued by the Company on July 28, 2024

but excluding the Blocked Shares (i.e., 180,614 Free Shares after

deduction of 25,043 Blocked Shares, as such terms are defined in

Section 2.6 of the Press Release).

Blocked Shares are not included in the Offer, subject to the

lifting of holding periods provided for by applicable law and

regulations. Holders of Blocked Shares, namely Messrs. Carlalberto

Guglielminotti and Giuseppe Artizzu, will be offered the

possibility to benefit of a liquidity mechanism as set forth in

Section 2.6.2 of the Press Release. The situation of holders of

Free Shares in relation to the Offer is described in Section 2.6 of

the Press Release.

To the knowledge of the Offeror as of the date of the Draft

Offer Document, the Company holds no treasury Shares and there are

no other equity securities or other financial instruments issued by

the Company or rights conferred by the Company that may give

access, immediately or in the future, to the share capital or

voting rights of the Company, other than the Shares (including the

Free Shares).

The Offer, which will be followed, if the required conditions

are met, by a squeeze-out pursuant to Article L. 433-4, II, of the

French Code monétaire et financier and Articles 237-1 et seq. of

the AMF General Regulation, is carried out in accordance with the

simplified procedure governed by Articles 233-1 et seq. of the AMF

General Regulation. The Offer will be open for a period of ten (10)

trading days, it being noted that the Offer will not be reopened

following the publication of the final result of the Offer by the

AMF given that the Offer is carried-out under the simplified

procedure.

The Offer is presented by Crédit Agricole Corporate and

Investment Bank which guarantees, in accordance with the provisions

of Article 231-13 of the AMF General Regulation, the content and

the irrevocable nature of the commitments undertaken by the Offeror

in connection with the Offer, including the Conditional Price

Supplement payable only if the conditions set forth in Section

2.2.1(B) of the Press Release materialize.

1.1 Background and reasons for the

Offer

1.1.1 Reasons for the Offer

The shareholding of TCC in the Company dates back from 2021 when

TCC acquired, through its subsidiary TCEH, approximately 60.48% of

the share capital of NHOA (which was then formerly known as Engie

EPS S.A.) indirectly from ENGIE S.A. A mandatory tender offer was

then launched by TCEH, which closed on September 23, 2021,

following which TCC, indirectly through its subsidiary TCEH, held

65.15% of the share capital of NHOA.

The Offer is motivated by several factors. NHOA’s development

requires significant investments that will be easier to decide on

and implement as a non-listed company: effectively, a private

ownership would enable NHOA to more efficiently implement long-term

strategies without the pressures of the capital markets’

expectations and sensitivity to share price fluctuations.

Furthermore, given the current structure of NHOA’s shareholder

base and the low volume of trading, the listing is not particularly

beneficial for NHOA. A delisting of the Shares from Euronext Paris

would enable the simplification of NHOA’s legal structure, and

eliminate the costs and other burdens associated with running a

publicly listed company.

In this context, TCC announced on June 13, 2024 its intention to

file, indirectly through its subsidiary TCEH, a simplified tender

offer for the Shares at the initial offer price of EUR 1.10 per

Share.

As announced in a press release issued by the Company on June

17, 2024, the Company’s Board of Directors decided, on June 16,

2024, to set up an ad hoc committee, consisting of independent

directors (namely Mr. Romualdo Cirillo (chairman of the ad hoc

committee), Ms. Chen Ming Chang, Mr. Luigi Michi, Ms. Cynthia A.

Utterback et Ms. Veronica Vecchi), which is responsible for

proposing to the Company’s Board of Directors the appointment of an

independent expert, for monitoring the expert’s work and for

preparing a draft reasoned opinion (avis motivé).

On June 16, 2024, the Company’s Board of Directors, on the

advice of its ad hoc committee, appointed Ledouble, represented by

Mr. Olivier Cretté and Ms. Stéphanie Guillaumin, as an independent

expert, in accordance with the provisions of Article 261-1 I and II

of the AMF’s General Regulation, to prepare a report on the

financial conditions of the Offer, followed, if applicable, by a

squeeze-out, which will be provided in full in the Company’s

response document.

The First Draft Offer Document was initially filed by the

Offeror with the AMF on July 8, 2024.4 On July 8 and 9, 2024, TCEH

acquired two blocks of Shares off-market, and crossed upwards the

90% thresholds of NHOA’s share capital and theoretical voting

rights,5 as further described in Sections 1.1.2(B)(c) and 1.1.3(B)

of the Press Release.

As announced in a press release of the Company dated August 19,

2024, the ad hoc committee of the Company’s Board of Directors, in

light of the preliminary work of the independent expert and the

financial advisor to the ad hoc committee, expressed some

reservations as to the fairness of the initial offer price of EUR

1.10 per Share and has therefore asked TCC to express its

intentions regarding the Offer.

On August 21, 2024, TCC announced that its Board of Directors

had approved an increase of the Offer Price to EUR 1.25 per

Share.

In addition, TCC has decided, indirectly through TCEH, to

provide a Conditional Price Supplement in the amount of EUR 0.65

per Share tendered in the Offer (including the shareholders of the

Company who sold their Shares to the Offeror as part of the Block

Trades) or transferred to the Offeror as part of a squeeze-out, if

applicable, only if the conditions set forth in Section 2.2.1(B) of

the Press Release materialize.

1.1.2 Context of the Offer

(A) Presentation of the

Offeror

The Offeror is a private company with limited liability

(besloten vennootschap met beperkte aansprakelijkheid) incorporated

under the laws of the Netherlands. Its sole shareholder is Taiwan

Cement (Dutch) Holdings B.V., a private company with limited

liability (besloten vennootschap met beperkte aansprakelijkheid)

organized under the laws of the Netherlands, having its registered

office at Strawinskylaan 3051, 1077 ZX, Amsterdam, the Netherlands,

and registered with the trade register of the Dutch Chamber of

Commerce under number 73050423.

Taiwan Cement (Dutch) Holdings B.V. (“TCDH”) is

wholly-owned by TCC and its subsidiaries.6

TCC is not controlled within the meaning of Article L. 233-3 of

the French Code de commerce. TCC’s shares are listed on the Taiwan

Stock Exchange.

(B) Acquisition of Shares by the

Offeror over the past twelve months

During the twelve months preceding the filing date of the First

Draft Offer Document and of the Draft Offer Document, the Offeror

acquired Shares as part of the 2023 Rights Issue, the 2024

Acquisition and the Block Trades only. As a result thereof, the

Offeror holds, as of the date of the Draft Offer Document,

253,749,268 Shares, representing 92.14% of the Company’s share

capital and theoretical voting rights.7

(a) 2023 Rights Issue

On August 29, 2023, the Company launched a capital increase with

shareholders’ preferential subscription rights (droits

préférentiels de souscription) through the issuance of 249,663,040

new Shares at a unit subscription price of EUR 1.00 (including EUR

0.20 of nominal value and EUR 0.80 of issue premium), representing

gross proceeds of EUR 249,663,040 (including issue premium) (the

“2023 Rights Issue”). The prospectus of the Company was

approved by the AMF on August 28, 2023, under number 23-370.

The results of the 2023 Rights Issue were announced on September

15, 2023. As part of the 2023 Rights Issue, the Offeror subscribed

in cash to 162,654,272 new Shares on an irreducible basis

corresponding to the exercise of its preferential subscription

rights. The Offeror also subscribed in cash to 62,268,112

additional new Shares, through the mechanism of article L. 225-134,

I, 2° of the French Code de commerce. Consequently, more than 90%

of the Shares issued as part of the 2023 Rights Issue were

subscribed by the Offeror.

As a result of the 2023 Rights Issue, the Offeror held

241,557,486 Shares, representing 87.78% of the Company’s share

capital and theoretical voting rights.

(b) 2024 Acquisition

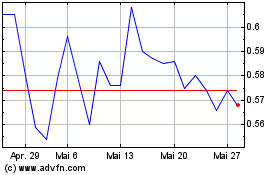

On April 4, 2024, the Offeror acquired 3,000,000 Shares on the

market, from Caisse des Dépôts, at a unit price of EUR 0.5590 per

Share (the “2024 Acquisition”). This 2024 Acquisition was

disclosed to the market under the framework applicable to

transactions of persons discharging managerial responsibilities,

the Offeror being a person closely associated with Mr. Nelson An

Ping Chang, chairman of the Company’s Board of Directors.8

As a result of the 2024 Acquisition, the Offeror held

244,557,486 Shares, representing 88.87% of the Company’s share

capital and theoretical voting rights.

(c) Block Trades completed after the

filing of the First Draft Offer Document

Pursuant to the provisions of Article 231-38 of the AMF General

Regulation, after the filing of the First Draft Offer Document and

the publication of the AMF notice9 setting out the main terms of

the Offer on July 8, 2024 and signaling the beginning of the Offer

period:

- The Offeror acquired a first block of 4,519,000 Shares

off-market, at the price of EUR 1.10 per Share (i.e., the offer

price as set out in the First Draft Offer Document), on July 8,

2024 (the “First Block Trade”);10 and

- The Offeror acquired a second block of 4,672,782 Shares

off-market, at the price of EUR 1.10 per Share, on July 9, 2024

(the “Second Block Trade”, together with the First Block

Trade, the “Block Trades”).11

As a result, the Offeror held 253,749,268 Shares, representing,

upon completion of such Block Trades, 92.21%12 of NHOA’s share

capital and theoretical voting rights.

The Offeror will offer to the relevant shareholders who

transferred Shares as part of the Block Trades an additional

consideration of EUR 0.15 per Share so transferred (i.e., the

difference between the revised Offer Price and the price paid to

the transferors in connection with the Block Trades, which was

equal to the initial offer price of EUR 1.10 per Share), subject to

the Offer being declared compliant (conforme) by the AMF and opened

to the minority shareholders of the Company. Such transferors will

also be eligible to the Conditional Price Supplement, as further

described in Section 2.2 of the Press Release.

After completion of the Block Trades, the Offeror did not

acquire any Shares.

1.1.3 Declarations of thresholds crossing

(A) Declaration of May

2024

In accordance with Articles L. 233-7 et seq. of the French Code

de commerce and Articles 223-11 et seq. of the AMF General

Regulation, pursuant to the declaration of thresholds crossing

dated May 30, 2024, TCC declared, for regularization, that it had

individually crossed upwards, indirectly through TCDH and the

Offeror, the legal threshold of 2/3rd of the Company’s share

capital and voting rights,13 on September 15, 2023, as a result of

the 2023 Rights Issue.14

In accordance with Article 13 of the Company’s articles of

association, pursuant to the declaration of legal and statutory

thresholds crossing dated May 29, 2024, TCC declared, as a

regularization, that it had individually crossed upwards,

indirectly through TCDH and the Offeror, the statutory thresholds

of 66%, 69%, 72%, 75%, 78%, 81%, 84% and 87% of the Company’s share

capital and voting rights,13 on September 15, 2023, as a result of

the 2023 Rights Issue.

As a result of these declarations for regularization purposes,

in accordance with Article L. 233-14 of the French Code de

commerce, the number of voting rights exercisable by TCEH was

limited to 183,464,506 voting rights, i.e., two-thirds of the

number of theoretical voting rights, until the expiration of a

period of two years following the date of regularization of the

declaration.

The 2024 Acquisition did not result in the Offeror crossing any

legal or statutory threshold of the Company’s share capital and

voting rights.

(B) Declaration of July

2024

In accordance with Articles L. 233-7 et seq. of the French Code

de commerce and Articles 223-11 et seq. of the AMF General

Regulation, pursuant to the declaration of thresholds crossing

dated July 10, 2024, TCC declared that it had individually crossed

upwards, indirectly through TCDH and the Offeror, the legal

thresholds of 90% of the Company’s share capital and theoretical

voting rights,15 on July 8, 2024, as a result of the First Block

Trade.16

In accordance with Article 13 of the Company’s articles of

association, pursuant to the declaration of legal and statutory

thresholds crossing dated July 10, 2024, TCC declared, that it had

individually crossed upwards, indirectly through TCDH and the

Offeror, the legal and statutory thresholds of 90% of the Company’s

share capital and theoretical voting rights,15 on July 8, 2024, as

a result of the First Block Trade.

1.1.4 Allocation of the Company’s share capital and voting

rights

On the date of the filing of the First Draft Offer Document on

July 8, 2024, to the knowledge of the Offeror, the Company’s share

capital amounted to EUR 55,039,352 divided into 275,196,760

ordinary Shares of EUR 0.20 par value each, fully paid-up and all

of the same class.

On July 28, 2024, 205,657 Free Shares were definitively vested

and therefore issued in favor of the relevant beneficiaries.

Consequently, to the knowledge of the Offeror as of the date of the

Draft Offer Document, the Company’s share capital amounts to EUR

55,080,483.40, divided into 275,402,417 ordinary Shares of EUR 0.20

par value each, fully paid-up and all of the same class.

To the knowledge of the Offeror as of the date of the Draft

Offer Document, the Company’s share capital and theoretical voting

rights are allocated as follows:

Shareholders

Number of Shares

% of Shares

Number of voting rights

(*)

% of voting rights

TCEH

253,749,268

92.14%

253,749,268

92.14%

Free float

21,653,149

7.86%

21,653,149

7.86%

Total

275,402,417

100.00%

275,402,417

100.00%

(*) Theoretical voting rights calculated pursuant to Article

223-11 of the AMF General Regulation. Please refer to paragraph

1.1.3 above for more information on the voting rights exercisable

by TCEH.

1.1.5 Regulatory clearances

As of the filing date of the First Draft Offer Document, it was

expected that the opening of the Offer would, pursuant to the

provisions of Article 231-32 of the AMF General Regulation, be

subject to the prior authorization of the Italian Government under

the Italian foreign investments regime (“Golden Power”).

The Italian Government, to which a request for authorization was

submitted on June 26, 2024, issued a clearance decision on

September 4, 2024.

1.2 Benefits of the Offer and Offeror’s

intentions for the next twelve months

1.2.1 Industrial, commercial and financial strategy and

policy

Since NHOA is already being part of the TCC Group, the Offeror

does not expect, as a result of the Offer, any material change in

the industrial and financial policy and strategic orientations

currently implemented by NHOA, beyond NHOA’s further cooperation

with the TCC Group and subject to changes resulting, as the case

may be, from the delisting of the Shares of the Company on Euronext

Paris.

In other words, the Offeror intends to continue to support the

strategic development of the Company and its subsidiaries,

leveraging the expertise of TCC, its indirect shareholder.

1.2.2 Employment

Since NHOA is already being part of the TCC Group, the Offeror

does not expect, as a result of the Offer, any particular impact on

the approach pursued by the Company in relation with employment and

employees policies, beyond ordinary course of business and subject

to changes resulting, as the case may be, from the delisting of the

Shares of the Company on Euronext Paris.

1.2.3 Composition of the corporate and management bodies of

the Company

As of the date of the Draft Offer Document, the Company’s Board

of Directors is composed as follows:

- Mr. Nelson An Ping Chang (Chairman);

- Mr. Carlalberto Guglielminotti;

- Ms. Chen-Ming Chang (independent member);

- Mr. Romualdo Cirillo (independent member);

- Mr. Luigi Michi (independent member);

- Ms. Veronica Vecchi (independent member); and

- Ms. Cynthia A. Utterback (independent member).

As of the date of the Draft Offer Document, the Chief Executive

Officer of the Company is Mr. Carlalberto Guglielminotti, who was

renewed as group Chief Executive Officer of NHOA on May 30, 2024 by

the Company’s Board of Directors (for a one-year term). NHOA’s

annual general meeting of June 13, 2024 renewed Mr. Carlalberto

Guglielminotti’s term of office as member of the Board of Directors

for a term of three (3) years expiring at the end of the general

meeting to be held in 2027 to approve the financial statements for

the financial year ended on December 31, 2026.

Upon completion of the Offer, the Offeror does not anticipate,

as of the date of the Draft Offer Document, any change in the

composition of the Board of Directors or in the composition of the

management team of the Company, beyond ordinary course of business

and subject to changes resulting, as the case may be, from the

delisting of the Shares of the Company on Euronext Paris or from an

intragroup reorganization.

1.2.4 Benefits of the Offer for the Offeror, the Company and

the Company’s shareholders

The Offeror intends to continue to support the strategic

development of the Company, leveraging the expertise of TCC, its

indirect shareholder. The Offer will strengthen the Company’s

relationship with a first-class partner to ensure the continuation

of its businesses with extended resources and capacities. In

particular, the Company will continue to benefit from (i) TCC

Group’s wide range of expertise in the sectors of renewable energy,

energy efficient technologies and energy storage and (ii) the

expansion to new addressable markets, notably in Asia, through the

TCC Group.

The Offer enables the Offeror and TCC to pursue their

international energy and energy storage presence as well as to

pursue the diversification of their product offerings. The Offer

will also enable the TCC Group to continue to benefit from the

Company’s highly qualified personnel and recognized expertise.

In addition, the Offeror wishes to proceed with the Offer as

certain shareholders had in the past approached the Offeror seeking

opportunities to liquidate their Shares. In this regard, the Offer

represents:

- An opportunity for shareholders to fully monetize investments

with limited liquidity. The Offeror notes that the trading

liquidity of Shares has been at a low level for a sustained period

of time.

The Offeror is mindful of this prolonged low

trading liquidity, which makes it challenging for shareholders to

execute substantial disposals in the open market without adversely

affecting share price. This is particularly important given the

latest unfavorable developments in both the electric vehicles’ and

the energy storage markets which had led on July 5, 2024 to the

downward revision of the Company’s guidance released with the

Capital Markets Day 2023 and reflected in the Company’s 2023

Universal Registration Document (“2023 Guidance”).

- An opportunity for shareholders to fully monetize investments

for cash amidst uncertain market conditions in the electric

vehicles and energy storage sectors. The Offer provides

shareholders with an opportunity to realize their investment in the

Company for cash amidst an uncertain market climate in the electric

vehicles and energy storage markets. As disclosed in the Company’s

press release on July 5, 2024 revising down the Company’s 2023

Guidance:

- Negative outlook for the electric

vehicles market. In the electric vehicles market, the growth

in sales of electric vehicles has significantly slowed down

compared to what was anticipated during the Capital Markets Day

2023. In Italy, Spain and France for instance, where Atlante has

points of charge, the lower number of electric vehicles in these

countries than as expected by the Company will likely impact the

utilization rates and revenues generation for the Atlante network.

The new Bloomberg’s Electric Vehicle Market Outlook published on

June 12, 2024 also reported an unexpected negative trend in Italy

(-24% electric vehicles sales year-on-year at Q1 2024) and

forecasts 450 thousand electric vehicles in the country by 2025 and

833 thousand in 2027, meaning a three years and a half delay of the

market compared the 2023 Assumptions. Coupled with the growing

uncertainty on the policy support for electric vehicles, as

demonstrated by the reductions in electric vehicles incentives in

some countries and postponement of the phase-out from internal

combustion sales in others, key automakers such as Tesla,

Mercedes-Benz, General Motors and Ford, have cut their near-term

goals for electric vehicles.

- Uncertainties in the energy storage

market. In the energy storage market, over the last 8-11

months abrupt oversupply of batteries (that normally represent

60-70% of project costs) from China has led to a reduction in the

nominal value of contracts, as customers reasonably expect NHOA

Energy and its competitors to pass on the resulting batteries price

reduction to them. Furthermore, counterparty risk has increased on

the supplier side due to the strong margin compression for battery

makers, and NHOA Energy has therefore been more selective in the

commercial opportunities it is pursuing. This is expected to lead

to a delay of approximately two years in the achievement of the

medium-term financial targets released with the Capital Markets Day

2023, driven by a more cautious short-term outlook until market

rebalances.

The Offeror enables minority shareholders of the Company, that

will tender their Shares to the Offer, to obtain full and immediate

liquidity for their Shares at the Offer Price, which represents

(excluding the Conditional Price Supplement) :

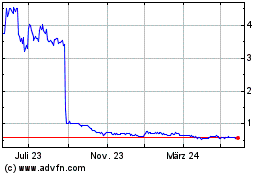

- a premium of 114% over the last closing price per Share of the

Company of June 12, 2024 prior to the announcement of the Offer;

and

- premiums of 114%, 94% and 82% respectively compared to the

volume-weighted average prices over the 60, 120 and 180 trading

days preceding that date.

The information supporting the assessment of the Offer Price and

of the Conditional Price Supplement is presented in Section 3 of

the official, French-language, version of the Draft Offer

Document.

1.2.5 Contemplated synergies and anticipated economic

profits

The Offeror, which is a holding company, does not anticipate any

material cost or revenue synergies with the Company, other than the

savings that may result from a simplification of the NHOA group

legal structure and a delisting of the Shares of the Company on

Euronext Paris, following a squeeze-out, if applicable.

1.2.6 Merger and other reorganizations

Structurally, subject to the assessment of tax aspects and other

potential costs, having multiple layers of holding companies does

not seem efficient. Intragroup reorganizations to simplify the

chain of control may consequently be contemplated. As of the date

of the Draft Offer Document, no decision has been made in this

regard.

The Offeror also reserves the right to implement joint ventures

or alliances with TCC Group’s strategic partners involving the

Company. As of the date of the Draft Offer Document, no decision

has been made in this regard.

1.2.7 Dividend distribution policy

No dividends or reserves have been distributed by the Company

since its incorporation, and, to the knowledge of the Offeror as of

the date of the Draft Offer Document, the Company has no plans to

initiate a policy of dividend payments in the short-term.

No decision has been made with regards to the future

distribution policy of the Company. However, the Offeror reserves

the right to modify the Company’s distribution policy in the

future. Any future distribution policy will be approved by the

Board of Directors of the Company and will be implemented in

accordance with the applicable law and the Company’s articles of

association.

1.2.8 Squeeze-out – Delisting

In accordance with the provisions of Article L. 433-4 II of the

French Code monétaire et financier and Articles 237-1 et seq. of

the AMF General Regulation, the Offeror intends to require the AMF,

at the latest within three (3) months following the closing of the

Offer, to implement a squeeze-out (retrait obligatoire) for the

Shares not tendered in the Offer (other than the Blocked Shares

and/or Shares assimilated to the Shares held, directly or

indirectly, by the Offeror) to be transferred to the Offeror in

return for compensation per Share equal to the Offer Price – i.e.,

EUR 1.25 per Share. If the conditions set forth in Section 2.2.1(B)

of the Press Release materialize, a Conditional Price Supplement of

EUR 0.65 per Share will be paid to the shareholders whose Shares

would be transferred to the Offeror as part of a squeeze-out, as

further detailed in Section 2.2 of the Press Release.

The squeeze-out will result in the delisting of the Shares from

Euronext Paris.

In the event that the Offeror is not in a position, following

the Offer, to implement a squeeze-out under the above-mentioned

conditions, it reserves the right to file a public tender offer

followed, if applicable, by a squeeze-out for the Shares it does

not hold, directly or indirectly, at that date. In this context,

the Offeror does not exclude increasing its interest in the Company

after the end of the Offer and prior to the filing of a new offer

in accordance with the applicable legal and regulatory provisions.

In this case, the squeeze-out will be subject to the review of the

AMF, which will rule on its conformity in light of the independent

expert’s report to be appointed in accordance with the provisions

of Article 261-1 of the AMF’s General Regulation.

1.3 Agreements that may have a material

effect on the assessment of the Offer or its outcome

Other than the Liquidity Agreement contemplated and described in

Section 2.6.2 of the Press Release and the F2MeS Shareholders’

Agreement referred to in Section 2.2 of the Press Release, the

Offeror is not aware of, and is not party to, any agreement that

could have a material effect on the assessment of the Offer or its

outcome.

2. CHARACTERISTICS OF THE OFFER

2.1 Terms of the Offer

In accordance with the provisions of Article 231-13 of the AMF

General Regulation, the draft Offer was filed on July 8, 2024 with

the AMF by Crédit Agricole Corporate and Investment Bank, acting on

behalf of the Offeror. The price offered in the First Draft Offer

Document was EUR 1.10 per Share. On August 21, 2024, TCC announced

that its Board of Directors had approved an increase of the Offer

Price to EUR 1.25 per Share. TCC, indirectly through TCEH, has also

decided to provide a Conditional Price Supplement under the

conditions set forth in Section 2.2. Consequently, on October 9,

2024, the Draft Offer Document was filed with the AMF.

In accordance with Article 233-1 of the AMF General Regulation,

the Offer will be carried out through the simplified procedure.

In accordance with the provisions of Article 231-6 of the AMF

General Regulation, the Offeror irrevocably undertakes to the

Company’s shareholders to acquire, at the Offer Price (i.e., EUR

1.25 per Share), which may be adjusted, if applicable, by the

Conditional Price Supplement of EUR 0.65 per Share (only if the

conditions set forth in Section 2.2.1(B) materialize, as further

detailed in Section 2.2 of the Press Release), all the Shares that

will be tendered to the Offer during a period of ten (10) trading

days. The attention of the Company’s shareholders is drawn on the

fact that the Offer will not be reopened following the publication

of the final result of the Offer by the AMF, given that it is

carried-out under the simplified procedure.

Crédit Agricole Corporate and Investment Bank guarantees the

content and the irrevocable nature of the undertakings made by the

Offeror as part of the Offer, including the Conditional Price

Supplement payable only if the conditions set forth in Section

2.2.1(B) of the Press Release materialize, in accordance with the

provisions of Article 231-13 of the AMF General Regulation.

2.2 Conditional Price

Supplement

TCC has decided, indirectly through TCEH, to provide a

Conditional Price Supplement under the following conditions.

The shareholders’ attention is drawn to the fact that they will

only be eligible to the Conditional Price Supplement in limited

circumstances. For further detail as to the tax treatment of this

Conditional Price Supplement, please refer to Section 2.14 of the

Press Release.

2.2.1 Background, condition of payment and amount of the

Conditional Price Supplement

(A) Background

To the knowledge of the Offeror as of the date of the Draft

Offer Document, Stellantis Europe S.p.A. (“Stellantis”) and

NHOA, through its Italian subsidiary NHOA Corporate S.r.l., hold

respectively 50.10% and 49.90% of the share capital of F2MeS, their

joint venture dedicated to electric mobility. Pursuant to the

Investment and Shareholders Agreement dated January 15, 2021 (as

amended on January 25, 2024) entered into between, inter alia,

Stellantis and the Company (the “F2MeS Shareholders’

Agreement”), before the acquisition of the Company’s control by

TCC in 2021, (i) Stellantis has a call option to acquire the shares

held by NHOA Corporate S.r.l. in F2MeS (the “Call Option”)

and (ii) NHOA Corporate S.r.l. has a put option to sell the same

shares to Stellantis (the “Put Option”). Pursuant to the

F2MeS Shareholders’ Agreement:

- Stellantis will be entitled to exercise the Call Option form

January 1, 2025 until May 31, 2025 on all (and not less than all)

the securities in F2MeS held by NHOA Corporate S.r.l. at a strike

price calculated as follows:

[({average between the 2023 EBITDA and the

2024 EBITDA of F2MeS} multiplied by 7 times) minus the net

financial position of F2MeS as at December 31, 2024] multiplied by

49.9%

- NHOA Corporate S.r.l. will be entitled to exercise the Put

Option from June 1, 2025 to June 30, 2025 on all (and not less than

all) the securities in F2MeS held by NHOA Corporate S.r.l. at a

strike price calculated as follows:

[({average between the 2023 EBITDA and the

2024 EBITDA of F2MeS} multiplied by 5 times) minus the net

financial position of F2MeS as at December 31, 2024] multiplied by

49.9%

The Call Option being deeply in the money, as referred to in

Section 3 of the official, French-language, version of the Draft

Offer Document, it would be in Stellantis’ interest to exercise it,

from a financial standpoint.

If and to the extent the Call Option is not exercised by

Stellantis by May 31, 2025 (inclusive), TCC commits to procure for

the exercise of the Put Option by NHOA Corporate S.r.l. in June

2025 (without NHOA’s Board of Directors having to decide at this

stage on this forthcoming decision). The TCC Group (including the

NHOA group) is taking into account, inter alia, the following

factors in assessing the benefits of the exercise of the Put Option

to the TCC Group (including the NHOA group):

Under the F2MeS Shareholders’ Agreement,

NHOA would be repaid its portion of shareholders’ loan granted to

F2MeS (being an amount in principal equal to c. EUR 25 million as

of June 30, 2024) following the exercise of NHOA Corporate S.r.l.’s

Put Option. In addition, NHOA would not be required to contribute

any further financing to F2MeS so that it could prioritize its

financings to other strategic businesses and projects of the NHOA

group;

F2MeS’s business is the sale of charging

equipment to electric vehicles owners and dealers, which is not the

strategic focus of the NHOA group as a whole and has little

synergies with the rest of NHOA’s businesses. Given the nature of

F2MeS’s business and since it is operated and managed by

Stellantis, its success is highly reliant on Stellantis’ sales

network and related relationships. As such, it could be

commercially sensible for NHOA to dispose of its interest in F2MeS

when the opportunity arises;

As mentioned in Section 1.2.4 of the Press

Release, the outlook of the electric vehicles market is slow or

even negative. Several automakers have revised their near-term

targets downward, and uncertainty around policy support for

electric vehicles is increasing, with some countries reducing

incentives and delaying the phase-out of internal combustion engine

sales. It is reminded that F2MeS’ consolidated revenues stood at

EUR 64 million for the financial year ending December 31, 2023 and

at EUR 32 million for the first semester ending June 30, 2024,

while the objective is to reach EUR 200 million in 2025 and EUR

227.5 million in 2026, as outlined in NHOA’s guidance published on

July 5, 2024;

The F2MeS Shareholders’ Agreement is due to

expire in 2026 and there is no guarantee that a new shareholders

agreement will be entered into, in which case, previously

negotiated minority shareholder rights may not be preserved;

and

The sale of NHOA’s interest in F2MeS to a

third party would be challenging in light of the rights of

Stellantis under the F2MeS Shareholders’ Agreement, the

restrictions imposed on the parties under the F2MeS Shareholders’

Agreement (for example, non-competition and exclusivity), the fact

that NHOA’s indirect interest is a minority interest and the

challenges of a third party agreeing a new shareholders’ agreement

with Stellantis that is satisfactory to all relevant parties.

(B) Condition of payment and amount of

the Conditional Price Supplement

In the event that neither the Call

Option nor the Put Option is exercised

in 2025 by Stellantis or NHOA Corporate S.r.l., respectively, the

minority shareholders of NHOA would receive a Conditional Price

Supplement of EUR 0.65 per Share tendered in the Offer (including

the shareholders of the Company who sold their Shares to the

Offeror as part of the Block Trades) or transferred to the Offeror

as part of a squeeze-out, if applicable. It is specified that the

shareholders of the Company who would transfer their Shares other

than through an order to tender in the Offer or as part of the

squeeze-out, in particular, inter alia, by selling Shares on the

market or off-market, would not benefit from the Conditional Price

Supplement (except for (i) the shareholders of the Company who sold

their Shares to the Offeror as part of the Block Trades and (ii)

Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu pursuant to

the liquidity mechanism referred to in Section 2.6.2 of the Press

Release).

If either the Call Option or the Put Option is exercised in

2025, no Conditional Price Supplement

will be due.

The Conditional Price Supplement of EUR 0.65 per Share was

decided by the Offeror following the preliminary observations of

the ad hoc committee of NHOA’s Board of Directors on the First

Draft Offer Document filed on July 8, 2024. It results from the

difference between the estimated value of NHOA Corporate S.r.l.’s

non-controlling stake in F2MeS, and that of the Call Option, the

exercise of which by Stellantis is deemed likely by TCEH, and will

be analyzed in the independent expert’s report which will be

inserted in NHOA’s draft response document.

Shareholders and potential investors of NHOA should take note

that their entitlement to the Conditional Price Supplement is

subject to conditions that may not materialize. In particular, as

indicated in Section 2.2.1(A) of the Press Release and in light of

the factors set forth therein, TCC commits to procure for the

exercise of the Put Option by NHOA Corporate S.r.l. if the Call

Option is not exercised by Stellantis. Consequently, it is unlikely

that a Conditional Price Supplement will eventually be due and paid

to the shareholders of NHOA.

Accordingly, shareholders and potential investors of NHOA should

exercise caution when dealing in NHOA securities.

2.2.2 Payment of the Conditional Price Supplement

Only if the conditions set forth in Section 2.2.1(B) above

materialize, the Conditional Price Supplement shall be paid, to the

shareholders of the Company having tendered their Shares to the

Offer (including the shareholders of the Company who sold their

Shares to the Offeror as part of the Block Trades), or to the

shareholders of the Company whose Shares will have been transferred

as part of the squeeze-out , if applicable, following receipt by

NHOA Corporate S.r.l. of the funds resulting from the exercise of

the Call Option or of the Put Option (as applicable) (the “Right

to the Conditional Price Supplement”). Each Right to the

Conditional Price Supplement will entitle its holder to the payment

of the Conditional Price Supplement. Each Right to the Conditional

Price Supplement, which will not be admitted to trading and shall

not be transferable, except in limited circumstances (inheritance

or donation), shall be incorporated in a financial security (the

“Financial Security”) admitted to the operations of

Euroclear France.

In light of the results of the Offer, Uptevia (La Défense-Coeur

Défense Tour A, 90-110 Esplanade du Général de Gaulle, 92400

Courbevoie, France ; RCS Nanterre n° 439 430 976), designated as

centralizing agent (the “Centralizing Agent”) shall create

as many Financial Securities as are the Shares tendered to the

Offer (or, if applicable, transferred as part of the squeeze-out),

have them admitted to the operations of Euroclear France, and

deliver them to the relevant financial brokers . The Financial

Securities will be recorded in the securities accounts of their

clients simultaneously to the payment of each tendered Share’s

Offer Price (or, if applicable, transferred as part of the

squeeze-out).

The exercise (or not) of the Call Option or Put Option described

in Section 2.2.1 of the Press Release will be announced by TCC

through a press release and a financial notice. Within 45 calendar

days after the receipt by NHOA Corporate S.r.l. of the funds

resulting from the exercise of the Call Option or the Put Option

(as applicable), the Offeror shall inform the beneficiaries of the

Financial Securities (that is: (i) the shareholders of the Company

having tendered their Shares to the Offer (including the

shareholders of the Company who sold their Shares to the Offeror as

part of the Block Trades) and those whose Shares are transferred as

part of the squeeze-out, or (ii) their legal beneficiaries) of such

transfer of funds by means of a financial notice.

The Centralizing Agent, acting on behalf of the Offeror, shall

pay, on the payment date mentioned in such financial notice, the

Conditional Price Supplement to the custody account keepers of the

beneficiaries of the Financial Securities, in compliance with the

terms that shall be laid out in a circular sent by the Centralizing

Agent to the financial brokers via Euroclear France.

The Centralizing Agent shall keep all unallocated funds and

shall make them available to the beneficiaries of the Financial

Securities and to their legal beneficiaries for a period of 10

years following the payment date mentioned in the financial notice,

after which 10 year period it shall transfer all unallocated funds

to the Caisse des Dépôts et Consignations which will keep them for

a period of 20 years. The funds will not accrue interest.

If either the Call Option or Put Option described in Section

2.2.1 of the Press Release is exercised, the Rights to the

Conditional Price Supplement and the Financial Securities shall

automatically lapse.

2.3 Conditions of the

Offer

A notice of filing of the Offer will be published by the AMF on

its website (www.amf-france.org). In accordance with the provisions

of Article 231-16 of the AMF General Regulation, a press release

containing the main characteristics of the Offer and specifying the

manner in which the Draft Offer Document will be made available to

the public, will be disclosed on the websites of TCC

(www.tccgroupholdings.com/en/) and of the Company

(www.nhoagroup.com). The French version of the Draft Offer Document

is available on the websites of the AMF (www.amf-france.org), TCC

(www.tccgroupholdings.com/en/) and the Company (www.nhoagroup.com),

and may be obtained free of charge from Crédit Agricole Corporate

and Investment Bank.

The Offer and the related Draft Offer Document remain subject to

the review of the AMF.

The AMF will declare the Offer compliant after having verified

its conformity with the legal provisions and regulations applicable

to it and will publish the declaration of conformity on its website

(www.amf-france.org). This declaration of conformity issued by the

AMF will serve as the approval (“visa”) of the offer document.

The offer document having received the AMF’s approval (“visa”)

and the document containing the “Other Information” relating to the

legal, financial, accounting and other characteristics of the

Offeror will, in accordance with the provisions of Articles 231-27

and 231-28 of the AMF General Regulation, be made available to the

public on the websites of the AMF (www.amf-france.org), TCC

(www.tccgroupholdings.com/en/) and the Company (www.nhoagroup.com).

These documents may also be obtained free of charge from Crédit

Agricole Corporate and Investment Bank.

A press release specifying the terms and conditions for making

these documents available will be issued no later than on the day

preceding the opening of the Offer, in accordance with the

provisions of Articles 231-27 and 231-28 of the AMF General

Regulation.

Prior to the opening of the Offer, the AMF will publish a notice

of opening and the timetable of the Offer, and Euronext Paris will

publish a notice setting out the content of the Offer and

specifying the timetable and terms of its completion.

2.4 Adjustment of the terms of the

Offer

In the event that, between the date of the Draft Offer Document

and the date of the settlement-delivery of the Offer (inclusive),

the Company proceeds in any form whatsoever to (i) distribute a

dividend, interim dividend, reserve, premium or any other

distribution (in cash or in kind), or (ii) redeem or reduce its

share capital, and in both cases, in which the detachment date or

the reference date on which it is necessary to be a shareholder in

order to be entitled thereto is set before the date of the

settlement-delivery of the Offer (inclusive), the Offer Price will

be reduced accordingly, on a euro per euro basis, to take into

account this transaction.

Any adjustment of the Offer Price will be subject to the

publication of a press release which will be submitted to the prior

approval of the AMF.

2.5 Number and nature of the Shares

targeted by the Offer

As of the date of the First Draft Offer Document, TCEH held

244,557,486 Shares, representing, on this date, 88.87% of the

Company’s share capital and theoretical voting rights.

The Offer targeted all Shares that were not held, directly or

indirectly, by the Offeror:

- which were already issued – i.e., to the knowledge of the

Offeror as of the date of the First Draft Offer Document, a maximum

number of 30,639,274 Shares;

- which could be issued before the closing of the Offer, as a

result of the vesting of the Free Shares other than the Blocked

Shares (as such terms are defined in Section 2.6 of the Press

Release), subject to the satisfaction of the applicable performance

conditions – i.e., to the knowledge of the Offeror as of the date

of the First Draft Offer Document, a maximum number of 184,414 Free

Shares;

i.e., to the knowledge of the Offeror as of the date of the

First Draft Offer Document, a maximum number of Shares targeted by

the Offer equal to 30,823,688.

On July 8 and 9, 2024, the Offeror acquired 9,191,782 Shares

off-market through the Block Trades (as defined in Section

1.1.2(B)(c) of the Press Release) and crossed upwards the 90%

threshold of the Company’s share capital and theoretical voting

rights (as further described in Sections 1.1.2(B)(c) and 1.1.3(B)

of the Press Release).17

As of the date of the Draft Offer Document, TCEH holds

253,749,268 Shares, representing 92.14% of the Company’s share

capital and theoretical voting rights.18

Therefore, the Offer targets all Shares that are not held,

directly or indirectly, by the Offeror and which are already issued

– i.e., to the knowledge of the Offeror as of the date of the Draft

Offer Document, a maximum number of 21,628,106 Shares, including

the Free Shares which were issued by the Company on July 28, 2024

but excluding the Blocked Shares (i.e., 180,614 Free Shares after

deduction of 25,043 Blocked Shares, as such terms are defined in

Section 2.6 of the Press Release).

Blocked Shares are not included in the Offer, subject to the

lifting of holding periods provided for by applicable law and

regulations. Holders of Blocked Shares, namely Messrs. Carlalberto

Guglielminotti and Giuseppe Artizzu, will be offered the

possibility to benefit of a liquidity mechanism as set forth in

Section 2.6.2 of the Press Release. The situation of holders of

Free Shares in relation to the Offer is described in Section 2.6 of

the Press Release.

To the knowledge of the Offeror as of the date of the Draft

Offer Document, the Company holds no treasury Shares and there are

no other equity securities or other financial instruments issued by

the Company or rights conferred by the Company that may give

access, immediately or in the future, to the share capital or

voting rights of the Company, other than the Shares (including the

Free Shares).

2.6 Situation of the holders of Free

Shares

2.6.1 2022 Free Share Plan

One free share plan has been implemented by the Company in 2022

(the “2022 Free Share Plan”). A total number of 542,200 free

shares have been awarded to 83 employees and officers of the

Company and its subsidiaries, on July 28, 2022 (the “Free

Shares”).

2022 Free Share Plan

Date of the Company shareholders’

general meeting

June 23, 2022

Date of the Company’s Board of

Directors

July 28, 2022

Number of Free Shares granted

542,200

Number of Free Shares cancelled

or lapsed

16,000

Number of Free Shares not vested

due to the success ratio of the performance conditions

320,543

End of the vesting period

July 28, 2024

End of the holding period19

July 28, 2025

Number of Free Shares

definitively vested on July 28, 2024

205,657

Number of Blocked Shares subject

to the holding period

25,043

Retained Free Shares20

6,262

To the knowledge of the Offeror as of the date of the Draft

Offer Document, (i) on July 28, 2024, 205,657 Free Shares were

vested and issued in favor of the relevant beneficiaries, and (ii)

a number of 25,043 Free Shares19 (included in the 205,657 vested

Free Shares) awarded to Messrs. Carlalberto Guglielminotti and

Giuseppe Artizzu are, since their vesting, subject to a holding

period expiring on July 28, 2025 (the “Blocked Shares”).

Such Blocked Shares are not targeted by the Offer, subject to the

lifting of holding periods provided for by applicable law and

regulations. In addition, to the knowledge of the Offeror as of the

date of the Draft Offer Document, Messrs. Carlalberto

Guglielminotti and Giuseppe Artizzu are required to retain 25% of

their Blocked Shares until the termination of their respective

offices (the “Retained Free Shares”). However, the holders

of Blocked Shares (which include the Retained Free Shares), namely

Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu, will be

offered the possibility to enter into a Liquidity Agreement as set

forth in Section 2.6.2 of the Press Release.

Therefore, after excluding the Blocked Shares, 180,614 Free

Shares are targeted by the Offer.

2.6.2 Liquidity mechanism

Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu, as

holders of Blocked Shares, will be offered the possibility to enter

into a liquidity agreement with the Offeror (each, a “Liquidity

Agreement”) to enable them to benefit from a liquidity in cash

for their Blocked Shares which could not be tendered in the

Offer.

The Liquidity Agreements would include (i) a put option

(promesse d’achat) granted by the Offeror to each of Messrs.

Carlalberto Guglielminotti and Giuseppe Artizzu, exercisable during

a period of 20 business days following the Availability Date; (ii)

followed by a call option (promesse de vente) granted by each of

Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu to the

Offeror, exercisable during a period of 20 business days following

the expiration of the put option exercise period, provided that,

and to the extent that, the put option will not have been

exercised.

The put and call options would only be exercisable in the event

of (i) the request by the Offeror of the implementation of a

squeeze-out following the closing of the Offer, (ii) a delisting of

the Company’s Shares from the regulated market of Euronext Paris

for any reason whatsoever, or (iii) a very low liquidity of the

market for Shares following the closing of the Offer.

The “Availability Date” means the first business day

following the expiration of the applicable holding period of the

Blocked Shares (i.e., the first business day after July 28, 2025,

subject to the lifting of holding periods provided for by

applicable law and regulations); provided that, with respect to the

Retained Free Shares, the Availability Date shall mean the first

business day following the latest of (i) the expiration of the

applicable holding period referred to above expiring on July 28,

2025 (subject to the lifting of holding periods provided for by

applicable law and regulations), or (ii) the date of termination of

office of Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu,

respectively.

In the event of exercise of such put and call options, the price

of the relevant Blocked Shares would be the Offer Price less any

distributions of any kind or any proceeds whatsoever effectively

received by Messrs. Carlalberto Guglielminotti and Giuseppe Artizzu

between the Offer closing date and the completion date of the sale

of the Blocked Shares resulting from the exercise of the put or

call options. The Liquidity Agreement would also include a

provision pursuant to which, in the event that the Conditional

Price Supplement of EUR 0.65 per Share would be payable pursuant to

Section 2.2 of the Press Release (i.e., if the conditions set forth

in Section 2.2.1(B) of the Press Release materialize), Messrs.

Carlalberto Guglielminotti and Giuseppe Artizzu would be paid the

Conditional Price Supplement of EUR 0.65 per Blocked Share to the

extent that the liquidity put or call options referred to in this

Section 2.6.2 of the Press Release would be exercised.

In the event of a squeeze-out, the Blocked Shares for which a

Liquidity Agreement is entered into, as part of the liquidity

mechanism described above, will be assimilated to the Shares held

by the Offeror in accordance with article L. 233-9 I, 4° of the

French Code de commerce and, consequently, will not be subject to

the squeeze-out.

2.7 Offeror’s right to purchase Shares

during the Offer period

As described in Section 1.1.2(B)(c) of the Press Release, as

part of the Block Trades, the Offeror purchased 9,191,782 Shares at

the price of EUR 1.10 per Share (i.e., the maximum number of Shares

that it was entitled to acquire up to the 30% cap defined by

Article 231-38 of the AMF General Regulation, computed on the basis

of a total number of Shares targeted by the Offer equal to

30,639,274 (excluding the Free Shares which were only vested and

issued on July 28, 2024, i.e., after the filing of the First Draft

Offer Document)).

Such acquisitions were declared to the AMF and published on the

AMF’s website (www.amf-france.org) in accordance with applicable

regulations.21

2.8 Procedure for tendering Shares to

the Offer

Pursuant to the provisions of Articles 233-1 et seq. of the AMF

General Regulation, the Offer will be open for a period of ten (10)

trading days and will be centralized by Euronext Paris. The Offer

will not be re-opened following the publication of the Offer’s

final results, given that it is carried-out under the simplified

procedure.

The Shares tendered to the Offer must be freely negotiable and

free of all liens, pledges and other sureties and restrictions of

any nature whatsoever restricting the free transfer of their

ownership. The Offeror reserves the right, at its sole discretion,

to reject any Shares tendered to the Offer that do not satisfy

these conditions.

The Company’s shareholders whose Shares are held through a

financial intermediary and who wish to tender their Shares to the

Offer must deliver a tender order to the financial intermediary, in

the form made available to them by such financial intermediary no

later than on the closing date of the Offer. The Company’s

shareholders should contact their financial intermediary to inquire

about any constraints, including deadlines, any deadline for

submitting their orders to tender to the Offer in a timely

manner.

The Company’s shareholders whose Shares are held in “pure”

registered form (“nominatif pur”) shall request that their Shares

be converted into “administrative” registered form (“nominatif

administré”) in order to tender their Shares in the Offer unless

they have already requested a conversion to bearer form (“au

porteur”).

The Offeror will not pay any commission to the financial

intermediaries through which the Company’s shareholders tender

their Shares to the Offer.

Orders tendering Shares to the Offer will be irrevocable.

The Offer and all of related agreements (including the Draft

Offer Document) are governed by French law. Any dispute or conflict

relating to this Offer, whatever its subject-matter or grounds,

will be brought before the competent courts.

2.9 Centralization of orders to tender

in the Offer

Each financial intermediary and the custody account keeper of

the registered accounts (registre nominatif) for the Shares of the

Company shall, on the date indicated in the Euronext Paris notice,

transfer to Euronext Paris the Shares for which they have received

an order to tender in the Offer.

Following receipt by Euronext Paris of all orders to tender in

the Offer in accordance with the above terms, Euronext Paris will

centralize all of such orders, determine the Offer’s result and

report it to the AMF.

2.10 Publication of the results and

settlement-delivery of the Offer

The AMF will announce the final result of the Offer. A notice

published by Euronext Paris will indicate the date and procedure of

the settlement-delivery of the Shares.

On the date of settlement-delivery of the Offer, the Offeror

will credit Euronext Paris with the funds corresponding to the

settlement of the Offer. On that date, the tendered Shares and all

of the rights attached thereto will be transferred to the Offeror.

Euronext Paris will make the cash settlement to the intermediaries

acting on behalf of their clients who have tendered their Shares to

the Offer as from the date of settlement-delivery of the Offer.

Simultaneously, and for the purposes of the Conditional Price

Supplement, the Centralizing Agent will deliver the Financial

Securities referred to in Section 2.2.2 of the Press Release to the

financial intermediaries acting on behalf of their clients who have

tendered their Shares to the Offer.

No interest will be due for the period running from the date on

which the Shares are tendered in the Offer until the date of

settlement-delivery of the Offer.

2.11 Indicative timetable of the

Offer

Prior to the opening of the Offer, the AMF will publish a notice

announcing the opening of the Offer and its timetable, and Euronext

Paris will publish a notice announcing the terms and the timetable

of the Offer.

An indicative timetable of the Offer is set forth below:

Dates

Main steps of the

Offer

July 8, 2024

- Draft Offer and First Draft Offer Document filed with the

AMF

- First Draft Offer Document made available to the public and

posted to the websites of TCC (www.tccgroupholdings.com/en/), the

Company (www.nhoagroup.com) and the AMF (www.amf-france.org)

- Press release published announcing the filing and availability

of the First Draft Offer Document

September 4, 2024

- Clearance by the Italian Government pursuant to the Italian

foreign investments regime (“Golden Power”)

October 9, 2024

- Offer Price increased from EUR 1.10 per Share to EUR 1.25 per

Share and Offeror’s corresponding Draft Offer Document filed with

the AMF, which also includes the payment of a Conditional Price

Supplement of EUR 0.65 per Share, subject to the conditions set

forth in Section 2.2.1(B) of the Press Release materializing, as

further described in Section 2.2 of the Press Release

- Draft Offer Document made available to the public and posted to

the websites of TCC (www.tccgroupholdings.com/en/), the Company

(www.nhoagroup.com) and the AMF (www.amf-france.org)

- Press release published announcing the filing and availability

of the Draft Offer Document

October 18, 2024

- NHOA’s draft response document filed with the AMF

- NHOA’s draft response document made available to the public and

posted to the websites of the Company (www.nhoagroup.com) and the

AMF (www.amf-france.org)

- Press release published announcing the filing and availability

of NHOA’s draft response document

November 5, 2024

- Declaration of conformity of the Offer issued by the AMF, which

serves as the approval (“visa”) of the offer document and NHOA’s

response document

November 6, 2024

- Offer document, approved by the AMF, and the information

relating to the Offeror’s legal, financial and accounting

characteristics made available to the public and posted to the

websites of TCC (www.tccgroupholdings.com/en/), the Company

(www.nhoagroup.com) and the AMF (www.amf-france.org)

- NHOA’s response document, approved by the AMF, and the

information relating to NHOA’s legal, financial and accounting

characteristics made available to the public and posted to the

websites of the Company (www.nhoagroup.com) and the AMF

(www.amf-france.org)

- Press releases published announcing the availability of the

offer document, approved by the AMF, of NHOA’s response document,

approved by the AMF, and of the information relating to NHOA’s and

the Offeror’s legal, financial and accounting characteristics

November 7, 2024

- Opening of the Offer for a period of 10 trading days

November 20, 2024

November 21, 2024

- Results of the Offer published by the AMF

November 26, 2024

- Settlement-delivery of the Offer

Shortly after publication of the

results of the Offer

- Implementation of the squeeze-out and delisting of the

Company’s Shares from the regulated market of Euronext Paris,

provided all conditions are satisfied

2.12 Financing and costs of the

Offer

2.12.1 Costs of the Offer

The overall amount of the fees, costs and external expenses

incurred by the Offeror and its affiliates in connection with the

Offer, including, in particular, fees and other expenses relating

to its various legal, financial and accounting advisors and any

other experts and consultants, as well as publicity costs, is

estimated at approximately EUR 5 million (excluding taxes).

2.12.2 Financing of the Offer

In the event that all Shares targeted by the Offer are tendered

to the Offer, the total amount of compensation in cash to be paid

by the Offeror to the shareholders of the Company that tendered

their Shares to the Offer would amount to EUR 38,524,860.22

Only if the conditions set forth in Section 2.2.1(B) of the

Press Release materialize, and that, consequently, the Conditional

Price Supplement of EUR 0.65 per Share becomes payable, the total

amount of compensation in cash to be paid by the Offeror to the

shareholders of the Company that tendered their Shares to the Offer

would amount to EUR 58,557,787.20.23

The Offer will be financed through the Offeror’s available

cash.

2.12.3 Brokerage fees and compensation of

intermediaries

The Offeror will not bear the cost of any brokerage fees or

compensation for intermediaries (including, in particular,

brokerage and banking commissions and related VAT).

2.13 Offer restrictions outside of

France

The Offer will be made exclusively in France. The Draft Offer

Document will not be distributed in countries other than

France.

The Offer will not be registered or approved outside of France

and no action will be taken to register or approve it abroad. The

Draft Offer Document and the other documents relating to the Offer

do not constitute an offer to sell or purchase transferable

securities or a solicitation of such an offer in any other country

in which such an offer or solicitation is illegal or to any person

to whom such an offer or solicitation could not be duly made.

The holders of the Shares located outside of France can only