POSITIVE OPERATING CASH FLOW AT +EUR 1.6 MILLION

GROWTH OF THE AVIONIC BUSINESS RESILIENCE OF THE GROUP

IN THE CONTEXT OF THE COVID-19 PANDEMIC

Consolidated revenue at EUR 11.4 million for FY 2021, up +3%

in euros and +6% in dollars

Positive annual EBITDA at +EUR 1.0 million

Operating loss at -EUR 0.2 million – Net loss at -EUR 0.3

million

Consolidated available cash at EUR 5.3 million as of December

31, 2021, up +1.1 million vs. December31, 2020

Regulatory News:

MEMSCAP (NYSE Euronext: MEMS) (Paris:MEMS), the leading provider

of innovative solutions based on MEMS (micro-electro-mechanical

systems) technology, today announced its earnings for the 2021

financial year ending December 31, 2021.

Analysis of the consolidated income statement

In line with the previous quarterly press releases, MEMSCAP

reported an audited revenue of EUR 11.4 million for FY 2021 (US$

13.5 million) compared to EUR 11.1 million for FY 2020 (US$ 12.7

million).

Consolidated revenue distribution by market segment, over FY

2021, is as follows:

Market segments / Revenue (In

million euros)

FY 2021

%

FY 2020

%

Aerospace

5.4

47%

4.6

41%

Medical / Biomedical

3.3

29%

3.5

32%

Optical communications / Adaptive

optics

2.0

18%

2.4

22%

Others

0.7

6%

0.5

5%

Total

11.4

100%

11.1

100%

(Any apparent discrepancies in totals are due to rounding.)

Revenue for FY 2021 increased by +2.5% in euros and +6.4% in US

dollars compared to FY 2020. It is to be noted that sales made in

US dollars represented approximately 69% of the consolidated

revenue for FY 2021 (2020: 66%).

Sales of the Standard Products division (+EUR 0.5 million /

+6.2% vs. 2020) benefited from the recovery of the avionics segment

(+EUR 0.8 million / +17.2% vs. 2020) despite the context of the

Covid-19 pandemic. Sales of medical segment of the division

decreased by EUR 0.3 million compared to FY 2020, this previous

financial year having been marked by high volumes of activity. The

growth rate of the medical segment was +98.2% vs. FY 2019 and

+59.7% vs. FY 2018. On the other side, the avionics business

remains the Group's leading market segment, representing 47.3% of

the consolidated revenue (2020: 41.3%), with annual sales of EUR

5.4 million (2020: EUR 4.6 million).

The unavailability of industrial equipment at the US site during

the first half of 2021, due to a technical incident at the end of

FY 2020 year, impacted the sales of the Custom Products division

(including the Optical Communications / Adaptive optics segment).

The division's sales were thus down -EUR 0.2 million / -7.3%

compared to FY 2020.

* * *

Analysis of the consolidated income statement

MEMSCAP’s consolidated earnings for FY 2021 are given within the

following table:

In million euros

FY 2021

FY 2020

Revenue

11.4

11.1

- Standard products*

- Custom products

8.5

2.9

8.0

3.1

Cost of revenue

(8.1)

(8.0)

Gross margin

3.3

3.1

% of revenue

29%

28%

Operating expenses**

(3.5)

(3.4)

Operating profit / (loss)

(0.2)

(0.3)

Financial profit / (loss)

(0.0)

(0.2)

Income tax expense

(0.1)

(0.1)

Net profit / (loss)

(0.3)

(0.5)

(Financial data were subject to an audit by the Group’s

statutory auditors who will issue their reports at a later date. On

March 24th, 2022, the MEMSCAP’s board of directors authorized the

release of the FY 2021 consolidated financial statements. Any

apparent discrepancies in totals are due to rounding.) * Including

the royalties from the dermo-cosmetics segment. ** Net of research

& development grants.

The positive volume effect related to the activities of the

Standard Products division, due to the increase of the avionics

business, impacted the Group's gross margin rate which stood at

28.9% compared to 28.2% for the previous year. The consolidated

gross margin thus amounted to EUR 3.3 million compared to EUR 3.1

million for FY 2020.

Operating expenses, net of research and development grants,

amounted to EUR 3.5 million compared to EUR 3.4 million for FY

2020, i.e. an annual increase of 3.5%. It is recalled that selling

and administrative expenses were subject to specific cost reduction

programs during 2020 in the context of the Covid-19 pandemic.

Research and development expenses, net of grants, amounted to EUR

1.2 million for FY 2021 and represented 11.3% of consolidated sales

(FY 2020: EUR 1.3 million / 11.3% of consolidated sales). In

addition, the total number of full-time equivalent employees in the

Group was 58.6 in FY 2021 compared to 63.7 in FY 2020.

For FY 2021, the Group posted an operating loss of EUR 0.2

million compared to an operating loss of EUR 0.3 million for FY

2020. The net financial loss was non-significant in FY 2021

(including a net foreign exchange gain of EUR 0.1 million) compared

with a net financial loss amounted to EUR 0.2 million for FY 2020

(including a net foreign exchange loss of EUR 0.1 million). The tax

expense recognized over FY 2021 and FY 2020 corresponded to the

change in deferred tax assets. This tax expense had no impact on

the Group's cash position.

The Group therefore reported a net loss of EUR 0.3 million for

FY 2021 compared to a net loss of EUR 0.5 million for FY 2020.

* * *

Evolution of the Group’s cash / Consolidated shareholders’

equity

For FY 2021, the Group posted a positive EBITDA at EUR 1.0

million compared to EUR 0.8 million for the previous year.

Including the EUR 0.7 million reduction in the working capital

requirement, the positive cash flow from operating activities

amounted to EUR 1.6 million against a cash generation of EUR 1,5

million for FY 2020.

On December 31, 2021, the Group reported available cash at EUR

5.3 million (December 31, 2020: EUR 4.2 million) including cash

investments (Corporate bonds / investment securities) recorded

under non-current financial assets. In addition to this amount, the

available unused credit lines amounted to EUR 0.4 million on

December 31, 2021.

MEMSCAP shareholders’ equity totalled EUR 15.8 million on

December 31, 2021 (December 31, 2020: EUR 15.6 million).

* * *

Analysis and perspectives / Impact of Covid-19

pandemic

The 2021 financial year was marked by the growth of the avionics

business, the Group's leading market segment, despite the context

of the Covid 19 pandemic. As the previous financial year, the

diversity of its businesses allows MEMSCAP to face the effects of

such a major health and economic crisis.

MEMSCAP pursues its strategy focused on avionics, medical and

optical communications segments, backed by its own intellectual

property, as well as the development of an increased flexibility of

its production capacities.

* * *

Q1 2022 earnings: April 27, 2022

Annual meeting of shareholders: May 31, 2022

About MEMSCAP MEMSCAP is the leading provider of

innovative micro-electro-mechanical systems (MEMS)-based solutions.

MEMSCAP’s products and solutions include components, component

designs (IP), manufacturing and related services

For more information, visit our website at:

www.memscap.com.

MEMSCAP is listed on Euronext Paris ™ - Segment C - ISIN:

FR0010298620 - MEMS.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at 31 December 2021

31 December 2021

31 December 2020

€000

€000

Assets

Non-current assets

Property, plant and

equipment.................................................................................

1 662

1 693

Goodwill and intangible

assets..................................................................................

7 238

7 305

Right-of-use

assets....................................................................................................

5 224

5 486

Other non-current financial

assets.............................................................................

1 385

1 217

Employee benefit net

asset.......................................................................................

35

--

Deferred tax

asset.....................................................................................................

229

284

15 773

15 985

Current assets

Inventories...............................................................................................................

2 493

2 604

Trade and other

receivables......................................................................................

2 824

2 558

Prepayments............................................................................................................

426

306

Other current financial

assets....................................................................................

--

58

Cash and short-term

deposits....................................................................................

3 919

2 952

9 662

8 478

Total assets

25 435

24 463

Equity and liabilities

Equity

Issued

capital............................................................................................................

1 869

1 869

Share

premium.........................................................................................................

17 972

18 783

Treasury

shares.........................................................................................................

(144)

(133)

Retained

earnings.....................................................................................................

(1 130)

(1 752)

Foreign currency

translation......................................................................................

(2 779)

(3 178)

15 788

15 589

Non-current liabilities

Lease

liabilities..........................................................................................................

4 989

5 126

Interest-bearing loans and

borrowings......................................................................

229

348

Employee benefit

liability..........................................................................................

67

35

5 285

5 509

Current liabilities

Trade and other

payables..........................................................................................

3 375

2 317

Lease

liabilities..........................................................................................................

577

582

Interest-bearing loans and

borrowings......................................................................

390

447

Provisions.................................................................................................................

20

19

4 362

3 365

Total liabilities

9 647

8 874

Total equity and liabilities

25 435

24 463

CONSOLIDATED STATEMENT OF INCOME

For the year ended 31 December 2021

2021

2020

€000

€000

Continuing operations

Sales of goods and

services......................................................................................

11 396

11 121

Revenue..................................................................................................................

11 396

11 121

Cost of

sales............................................................................................................

(8 101)

(7 989)

Gross

profit.............................................................................................................

3 295

3 132

Other

income..........................................................................................................

474

326

Research and development

expenses.......................................................................

(1 721)

(1 586)

Selling and distribution

costs....................................................................................

(662)

(658)

Administrative

expenses..........................................................................................

(1 611)

(1 482)

Operating profit /

(loss)...........................................................................................

(225)

(268)

Finance

costs...........................................................................................................

(144)

(212)

Finance

income.......................................................................................................

98

35

Profit / (loss) for the year from

continuing operations before tax...........................

(271)

(445)

Income tax

expense.................................................................................................

(57)

(100)

Profit / (loss) for the year from

continuing

operations............................................

(328)

(545)

Profit / (loss) for the

year........................................................................................

(328)

(545)

Earnings per share:

- Basic, for profit / (loss) for

the year attributable to ordinary equity holders of the parent (in

euros)..........................................................................................

€ (0.044)

€ (0.073)

- Diluted, for profit / (loss)

for the year attributable to ordinary equity holders of the parent

(in

euros)..........................................................................................

€ (0.044)

€ (0.073)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

2021

2020

€000

€000

Profit / (loss) for the

year..........................................................................................

(328)

(545)

Items that will not be reclassified

subsequently to profit or loss

Actuarial gains /

(losses)............................................................................................

8

2

Income

tax on items that will not be reclassified to profit or

loss................................

--

--

Total items that will not be

reclassified to profit or

loss............................................

8

2

Items that may be reclassified

subsequently to profit or loss

Net gain

/ (loss) on available-for-sale financial

assets.................................................

131

(5)

Exchange

differences on translation of foreign

operations..........................................

399

(577)

Income

tax on items that may be reclassified to profit or

loss.....................................

--

--

Total items that may be reclassified to

profit or

loss.................................................

530

(582)

Other comprehensive income for the

year, net of

tax...............................................

538

(580)

Total comprehensive income for the

year, net of

tax................................................

210

(1 125)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021

(In thousands of euros, except for

number of shares)

Number

Issued

Share

Treasury

Retained

Foreign

Total

of shares

capital

premium

shares

earnings

currency translation

shareholders’ equity

€000

€000

€000

€000

€000

€000

At 1 January

2020............................................................................

7 468 340

1 867

18 775

(131)

(1 204)

(2 601)

16 706

Loss for the

year...............................................................................

--

--

--

--

(545)

--

(545)

Other comprehensive income for the year,

net of tax........................

--

--

--

--

(3)

(577)

(580)

Total comprehensive

income............................................................

--

--

--

--

(548)

(577)

(1 125)

Capital

increase................................................................................

8 562

2

8

--

--

--

10

Treasury

shares................................................................................

--

--

--

(2)

--

--

(2)

At 31 December

2020.......................................................................

7 476 902

1 869

18 783

(133)

(1 752)

(3 178)

15 589

At 1 January

2021............................................................................

7 476 902

1 869

18 783

(133)

(1 752)

(3 178)

15 589

Loss for the

year...............................................................................

--

--

--

--

(328)

--

(328)

Other comprehensive income for the year,

net of tax........................

--

--

--

--

139

399

538

Total comprehensive

income............................................................

--

--

--

--

(189)

399

210

Retained earnings offset with share

premium...................................

--

--

(811)

--

811

--

--

Treasury

shares................................................................................

--

--

--

(11)

--

--

(11)

At 31 December

2021.......................................................................

7 476 902

1 869

17 972

(144)

(1 130)

(2 779)

15 788

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2021

2021

2020

€000

€000

Cash flows from operating

activities:

Net

profit / (loss) for the

year.......................................................................................

(328)

(545)

Non-cash

items written back:

Amortization and

depreciation................................................................................

1 191

1 166

Loss / (capital gain) on disposal of fixed

assets.........................................................

40

24

Other

non-financial

activities..................................................................................

31

83

Accounts

receivable......................................................................................................

(135)

149

Inventories...................................................................................................................

252

325

Other

debtors...............................................................................................................

(279)

(30)

Accounts

payable..........................................................................................................

851

259

Other

liabilities.............................................................................................................

(28)

31

Total net cash flows from operating

activities..............................................................

1 595

1 462

Cash flows from investing

activities:

Purchase of fixed

assets................................................................................................

(146)

(497)

Proceeds from sale / (purchase) of

financial

assets........................................................

(46)

(2)

Total net cash flows from investing

activities...............................................................

(192)

(499)

Cash flows from financing

activities:

Proceeds from

borrowings............................................................................................

--

734

Repayment of

borrowings.............................................................................................

(205)

(183)

Payment of lease

liabilities............................................................................................

(580)

(563)

Sale / (purchase) of treasury

shares..............................................................................

(11)

(2)

Change in restricted

cash..............................................................................................

58

--

Proceeds from issue of

shares.......................................................................................

--

10

Total net cash flows from financing

activities...............................................................

(738)

(4)

Net

foreign exchange

difference...................................................................................

55

(21)

Increase / (decrease) in net cash and

cash

equivalents.................................................

720

938

Opening cash and cash equivalents

balance.................................................................

2 928

1 990

Closing cash and cash equivalents

balance...................................................................

3 648

2 928

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220324005855/en/

Yann Cousinet Chief Financial Officer Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com

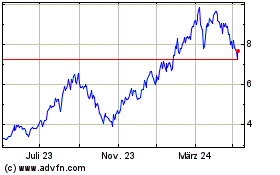

Memscap (EU:MEMS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Memscap (EU:MEMS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024