Maroc Telecom_PR-Q3 2023 Results

CONSOLIDATED

RESULTS AT SEPTEMBER 30, 2023

Performances above targets:

- Growth of 3.2% in

consolidated revenues, driven mainly by Moov Africa

subsidiaries (+7.5%);

- Group EBITDA up

3.2%, with high EBITDA margin of

52.5%;

- Adjusted Group net income

increasing by 2.4%;

- Sustained level of Group

investments (excluding frequencies and licenses), reaching

20.7% of revenues.

Against a difficult global macroeconomic

environment, Maroc Telecom Group resumed revenue growth, driven by

Data, particularly in Moov Africa subsidiaries. Thanks to

optimization cost efforts, the Group has maintained a high level of

profitability, and pursued investments to support the development

of usages and the quality of services. This performance comforts

that the Group is on track to achieve its annual targets and

confirms the success and resilience of its business model.

The Group's commitment to sustainable

development and the well-being of citizens remains a priority, and

is reflected in a variety of initiatives in the countries where it

operates. In line with this commitment, Maroc Telecom has mobilized

its teams to support the populations impacted by the earthquake in

the Kingdom of Morocco, and has also made a donation to the

dedicated Special Fund.

Group adjusted consolidated results*:

| (IFRS

in MAD millions) |

Q3 2022 |

Q3 2023 |

Change |

Change at constant exchange

rates(1) |

|

9M 2022 |

9M 2023 |

Change |

Change at constant exchange

rates(1) |

|

Revenues |

9,240 |

9,279 |

0.4% |

-0.8% |

|

26,808 |

27,679 |

3.2% |

1.2% |

|

Adjusted EBITDA |

4,901 |

4,948 |

1.0% |

0.0% |

|

14,072 |

14,527 |

3.2% |

1.5% |

|

Margin (%) |

53.0% |

53.3% |

0.3 pt |

0.4 pt |

|

52.5% |

52.5% |

-0.0 pt |

0.2 pt |

|

Adjusted EBITA |

3,131 |

3,178 |

1.5% |

0.8% |

|

8,872 |

9,230 |

4.0% |

2.5% |

|

Margin (%) |

33.9% |

34.3% |

0.4 pt |

0.6 pt |

|

33.1% |

33.3% |

0.3 pt |

0.4 pt |

|

Adjusted net income Group share |

1,651 |

1,694 |

2.6% |

1.9% |

|

4,520 |

4,629 |

2.4% |

1.5% |

|

Margin (%) |

17.9% |

18.3% |

0.4 pt |

0.5 pt |

|

16.9% |

16.7% |

-0.1 pt |

0.1 pt |

|

CAPEX(2) |

1,777 |

2,777 |

56.3% |

53.0% |

|

5,497 |

5,722 |

4.1% |

1.6% |

| Of which

frequencies and licenses |

0 |

0 |

|

|

|

0 |

0 |

|

|

|

CAPEX/Revenues (excluding frequencies and licenses) |

19.2% |

29.9% |

10.7 pt |

10.4 pt |

|

20.5% |

20.7% |

0.2 pt |

0.1 pt |

|

Adjusted CFFO |

2,833 |

2,139 |

-24.5% |

-24.4% |

|

8,159 |

7,176 |

-12.1% |

-13.4% |

| Net

debt |

17,166 |

17,410 |

1.4% |

-0.6% |

|

17,166 |

17,410 |

1.4% |

-0.6% |

|

Net debt/EBITDA(3) |

0.8x |

0.8x |

|

|

|

0.9x |

0.8x |

|

|

* The adjustments to the financial indicators are detailed in

Appendix 1.

At September 30, 2023, the Group's customer base

was 75.1 million, a slight 0.7%

decrease year-on-year.

For the nine months to September 30, 2023, the

Maroc Telecom Group posted consolidated revenues(4) of MAD

27,679 million, up 3.2%

year-on-year (+1.2% at constant exchange

rates(1)), driven mainly by a 7.5% increase in

international business (+3.1% at constant exchange

rates(1)).

- Earnings from

operations before depreciation and amortization

At September 30, 2023, Maroc Telecom Group’s

consolidated adjusted earnings from operations before depreciation

and amortization (EBITDA) amounted to MAD 14,527

million, up 3.2% (+1.5% at

constant exchange rates(1)), thanks to the increase in consolidated

revenues and an efficient controlling operating costs.

The adjusted EBITDA margin remained high at

52.5% (+0.2 pt at constant

exchange rates(1) year-on-year).

Consolidated adjusted earnings from operations

(EBITA)(5) for the first nine months of 2023 reached MAD

9,230 million, up 4.0%

(+2.5% at constant exchange rates(1)). Adjusted

EBITA margin stood at 33.3% (+0.4

pt at constant exchange rates(1) year-on-year).

Adjusted net income Group share for the nine

months to September 30, 2023 amounted to MAD 4,629

million, up 2.4% (+1.5% at

constant exchange rates(1)).

CAPEX(2) excluding frequencies and licenses

amounted to MAD 5,722 million, representing

20.7% of Group revenues, in line with the

full-year outlook.

Over the first nine months of 2023, adjusted

cash flows from operations (CFFO)(6) amounted to

MAD 7,176 million, down

12.1% compared to the same period in 2022

(-13.4% at constant exchange rates(1)), in line

with the rise in the investments.

In response to the Royal appeal, Maroc Telecom

supported the Special Fund set up to palliate the disastrous

consequences of the recent earthquake in the Kingdom of Morocco.

The Group contributed MAD 700 million to the fund in addition to

individual employee contributions in order to support

reconstruction and restoration work in the affected regions.

Group business review:

The adjustments to the “Morocco” and “International” financial

indicators are explained in Appendix 1.

Morocco

| (IFRS

in MAD millions) |

Q3 2022 |

Q3 2023 |

Change |

|

9M 2022 |

9M 2023 |

Change |

|

Revenues |

5,247 |

5,069 |

-3.4% |

|

14,808 |

14,749 |

-0.4% |

|

Mobile |

3,245 |

3,132 |

-3.5% |

|

8,930 |

8,870 |

-0.7% |

| Services |

3,021 |

2,990 |

-1.0% |

|

8,518 |

8,359 |

-1.9% |

|

Equipments and other revenues |

224 |

142 |

-36.6% |

|

411 |

511 |

24.1% |

|

Fixed |

2,461 |

2,382 |

-3.2% |

|

7,239 |

7,207 |

-0.4% |

| Of which Fixed

Data* |

1,027 |

1,031 |

0.3% |

|

3,000 |

3,167 |

5.5% |

|

Elimination and other income |

-459 |

-446 |

|

|

-1,360 |

-1,329 |

|

|

Adjusted EBITDA |

3,031 |

3,018 |

-0.4% |

|

8,395 |

8,435 |

0.5% |

|

Margin (%) |

57.8% |

59.5% |

1.8 pt |

|

56.7% |

57.2% |

0.5 pt |

|

Adjusted EBITA |

2,138 |

2,165 |

1,3% |

|

5,763 |

5,849 |

1.5% |

|

Margin (%) |

40.7% |

42.7% |

2.0 pt |

|

38.9% |

39.7% |

0.7 pt |

|

CAPEX(2) |

623 |

958 |

53.7% |

|

2,381 |

2,385 |

0.2% |

| Of which

frequencies and licenses |

0 |

0 |

|

|

0 |

0 |

|

|

CAPEX/Revenues (excluding frequencies and licenses) |

11.9% |

18.9% |

7.0 pt |

|

16.1% |

16.2% |

0.1 pt |

|

Adjusted CFFO |

2,266 |

1,717 |

-24.2% |

|

5,456 |

4,527 |

-17.0% |

| Net

debt |

10,667 |

8,609 |

-19.3% |

|

10,667 |

8,609 |

-19.3% |

|

Net debt/EBITDA(3) |

0.8x |

0.7x |

|

|

0.9x |

0.7x |

|

* Fixed Data includes Internet, ADSL TV and Data services to

companies.

Over the first nine months of 2023, business

operations in Morocco generated revenues of

MAD 14,749 million, almost stable

year-on-year, driven mainly by Fixed-line Data

(+5.5%).

Over the same period, adjusted earnings from

operations before depreciation and amortization (EBITDA) amounted

to MAD 8,435 million, a year-on-year increase of

0.5%. Adjusted EBITDA margin remains at the high

level of 57.2%, an improvement of 0.5

pt.

Adjusted earnings from operations (EBITA)(5)

amounted to MAD 5,849 million, up

1,5% year-on-year. Adjusted EBITA margin improved

by 0.7 pt to 39.7%.

During the first nine months of 2023, adjusted

cash flows from operations (CFFO)(6) totaled

MAD 4,527 million, down

17,0%.

Mobile

|

|

Unit |

9/30/2022 |

9/30/2023 |

Change |

|

|

|

|

|

|

|

Customer base(8) |

(000) |

19,925 |

19,978 |

0.3% |

|

Prepaid |

(000) |

17,521 |

17,492 |

-0.2% |

|

Postpaid |

(000) |

2,404 |

2,486 |

3.4% |

| Of which

Internet 3G/4G+(9) |

(000) |

11,041 |

11,807 |

6.9% |

|

ARPU(10) |

(MAD/month) |

46.9 |

46.8 |

-0.3% |

At September 30, 2023, the Mobile customer

base(8) totaled nearly 20.0 million customers,

continuing to benefit from the strong momentum of the postpaid

segment, which expanded by 3.4%.

Mobile revenues slightly decreased

(-0.7%) versus the same period in 2022 to MAD

8,870 million.

ARPU(10) for the first nine months of 2023

amounted to MAD 46.8, almost stable compared with

the same period in 2022.

Fixed-line and Internet

|

|

Unit |

9/30/2022 |

9/30/2023 |

Change |

|

|

|

|

|

|

|

Fixed-line |

(000) |

1,937 |

1,819 |

-6.1% |

|

Broadband access(11) |

(000) |

1,710 |

1,598 |

-6.5% |

The Fixed-line customer base stood at

1.8 million lines at end-September 2023. Growth in

the FTTH customer base (+44%) largely offset the

decline in the ADSL customer base.

Fixed-line and Internet activities generated

revenues of MAD 7.2 billion, down slightly by

0.4% compared to 2022. Growth in Fixed-line Data

(+5.5%) partially offset the decline in Voice.

International

Financial indicators

|

(IFRS in MAD millions) |

Q3 2022 |

Q3 2023 |

Change |

Change at constant exchange

rates(1) |

|

9M 2022 |

9M 2023 |

Change |

Change at constant exchange

rates(1) |

|

Revenues |

4,248 |

4,485 |

5.6% |

2.9% |

|

12,801 |

13,765 |

7.5% |

3.1% |

| Of which

Mobile services |

3,930 |

4,129 |

5.1% |

2.3% |

|

11,844 |

12,703 |

7.2% |

2.9% |

|

Adjusted EBITDA |

1,870 |

1,930 |

3.2% |

0.8% |

|

5,678 |

6,093 |

7.3% |

3.0% |

|

Margin (%) |

44.0% |

43.0% |

-1.0 pt |

-0.9 pt |

|

44.4% |

44.3% |

-0.1 pt |

-0.1 pt |

|

Adjusted EBITA |

994 |

1,014 |

2.0% |

-0.1% |

|

3,108 |

3,381 |

8.8% |

4.4% |

| Margin

(%) |

23.4% |

22.6% |

-0.8 pt |

-0.7 pt |

|

24.3% |

24.6% |

0.3 pt |

0.3 pt |

|

CAPEX(2) |

1,154 |

1,819 |

57.7% |

52.6% |

|

3,116 |

3,336 |

7.1% |

2.8% |

| Of which

frequencies and licenses |

0 |

0 |

|

|

|

0 |

0 |

|

|

|

CAPEX/Revenues (excluding frequencies and licenses) |

27.2% |

40.6% |

13.4 pt |

13.1 pt |

|

24.3% |

24.2% |

-0.1 pt |

-0.1 pt |

|

Adjusted CFFO |

567 |

422 |

-25.6% |

-25.2% |

|

2,704 |

2,649 |

-2.0% |

-6.0% |

|

Net debt |

6,892 |

8,865 |

28.6% |

23.6% |

|

6,892 |

8,865 |

28.6% |

23.6% |

|

Net debt/EBITDA(3) |

0.9x |

1.1x |

|

|

|

0.9x |

1.0x |

|

|

The Group’s international revenues for the first

nine months of 2023 were up 7.5%

(+3.1% at constant exchange rates(1)) at

MAD 13,765 million, thanks to a good momentum

in Mobile Data up 27,4% (+22.3%

at constant exchange rates(1)) and the performance of Mobile Money

up 11,6% (+7.3% at constant

exchange rates(1)). Excluding the reduction in call termination

rates, subsidiaries’ revenues were up 3.5% at

constant exchange rates(1).

Adjusted earnings from operations before

depreciation and amortization (EBITDA) rose 7.3%

(+3.0% at constant exchange rates(1)) to

MAD 6,093 million, representing an adjusted

EBITDA margin of 44.3%.

Adjusted earnings from operations (EBITA)(5)

amounted to MAD 3,381 million, up

8.8% (+4.4% at constant exchange

rates(1)), mainly due to the increase in adjusted EBITDA. This

performance led to a slight 0.3 pt increase in

adjusted EBITA margin to 24.6%.

Adjusted cash flows from operations (CFFO)(6)

fell 2.0% (-6.0% at constant

exchange rates(1)) to MAD 2,649 million,

mainly due to the increase in investment.

Operating indicators

|

|

Unit |

9/30/2022 |

9/30/2023 |

Change |

|

Mobile |

|

|

|

|

|

Customer base(8) |

(000) |

51,548 |

51,145 |

|

|

Mauritania |

|

2,642 |

2,642 |

0.0% |

| Burkina

Faso |

|

11,021 |

11,339 |

2.9% |

| Gabon |

|

1,536 |

1,486 |

-3.2% |

| Mali |

|

9,163 |

8,358 |

-8.8% |

| Côte

d’Ivoire |

|

10,534 |

9,704 |

-7.9% |

| Benin |

|

5,371 |

5,489 |

2.2% |

| Togo |

|

2,771 |

2,882 |

4.0% |

| Niger |

|

2,849 |

3,008 |

5.6% |

| Central

African Republic |

|

216 |

230 |

6.3% |

| Chad |

|

5,444 |

6,007 |

10.3% |

|

Fixed |

|

|

|

|

|

Customer base |

(000) |

362 |

383 |

|

|

Mauritania |

|

56 |

38 |

-32.8% |

| Burkina

Faso |

|

76 |

75 |

-1.0% |

| Gabon |

|

39 |

52 |

33.6% |

| Mali |

|

191 |

218 |

14.2% |

| Fixed

Broadband |

|

|

|

|

|

Base(11) |

(000) |

153 |

189 |

|

|

Mauritania |

|

19 |

22 |

14.8% |

| Burkina

Faso |

|

16 |

21 |

32.9% |

| Gabon |

|

35 |

49 |

38.3% |

|

Mali |

|

83 |

97 |

16.6% |

Notes:

(1) Constant MAD/ouguiya/CFA franc exchange

rate. (2) Capital expenditure corresponds to acquisitions of

property, plant and equipment and intangible assets recognized

during the period.(3) The net debt/EBITDA ratio excludes the impact

of IFRS 16, and takes into account the annualization of EBITDA.(4)

Maroc Telecom consolidates in its financial statements Casanet and

the Moov Africa subsidiaries in Mauritania, Burkina Faso, Gabon,

Mali, Côte d’Ivoire, Benin, Togo, Niger, Central African Republic

and Chad. (5) EBITA corresponds to operating profit before

amortization of intangible assets related to business combinations,

impairment of goodwill and other intangible assets related to

business combinations and other income and expenses related to

financial investment transactions and transactions with

shareholders (except when they are recognized directly in

equity).(6) CFFO comprises the net cash flows from operating

activities before taxes as presented in the cash flow statement, as

well as dividends received from associates and non-consolidated

equity interests. It also includes net capital expenditure, which

corresponds to net cash outflows on acquisitions and disposals of

property, plant and equipment and intangible assets.(7) Borrowings

and other current and non-current liabilities less cash (and cash

equivalents) including cash blocked for bank loans.(8) The active

customer base consists of prepaid customers who have made or

received a voice call (excluding calls from the public

telecommunication network operator concerned or its Customer

Relations Centers) or sent an SMS/MMS or who have used the Data

services (excluding exchanges of technical data with the public

telecommunication network operator concerned) in the past three

months, and non-terminated postpaid customers.(9) The active

customer base of the 3G and 4G+ Mobile Internet includes holders of

a postpaid subscription contract (whether or not coupled with a

voice offer) and holders of a prepaid subscription to the Internet

service who have carried out at least one recharge during the past

three months or whose credit is valid and who have used the service

during this period.(10) ARPU (average revenues per user) is defined

as revenues generated by incoming and outgoing calls and data

services net of promotions, excluding roaming and equipment sales,

divided by the average number of users in the period. This is the

blended ARPU of the prepaid and postpaid segments.(11) The

broadband customer base includes ADSL, FTTH and leased connections

and also includes CDMA in Mali.

Important Warning:Forward-looking

statements. This press release contains forward-looking

statements and items of a forward-looking nature relating to the

financial position, results of operations, strategy and outlook of

Maroc Telecom and the impacts of certain operations. Although Maroc

Telecom believes that these forward-looking statements are based on

reasonable assumptions, they do not constitute guarantees as to the

future performance of the company. Actual results may be very

different from forward-looking statements due to a number of known

or unknown risks and uncertainties, most of which are beyond our

control, including the risks described in public documents filed by

Maroc Telecom with the Moroccan Capital Market Authority

(www.ammc.ma) and the French Financial Markets Authority

(www.amf-france.org), also available in French on our website

(www.iam.ma). This press release contains forward-looking

information that can only be assessed on the day it is distributed.

Maroc Telecom makes no commitment to supplement, update or modify

these forward-looking statements due to new information, a future

event or any other reason, subject to applicable regulations, in

particular Articles 2.19 et seq. of the circular of the Moroccan

Capital Market Authority and 223-1 et seq. of the General

Regulation of the French Financial Markets Authority.

Maroc Telecom is a global

telecommunications operator in Morocco, a leader in all its

business segments, Fixed-line, Mobile and Internet. It has grown

internationally and is now present in eleven countries in Africa.

Maroc Telecom is listed simultaneously in Casablanca and Paris and

its reference shareholders are the Société de Participation dans

les Télécommunications (SPT)* (53%) and the Kingdom of Morocco

(22%).

* SPT is a Moroccan company controlled

by Etisalat.

|

Contacts |

|

Investor

relationsrelations.investisseurs@iam.ma |

Press relationsrelations.presse@iam.ma |

Appendix 1: Relationship between adjusted

financial indicators and published financial indicators

Adjusted EBITDA, adjusted EBITA, Group share of adjusted net

income and adjusted CFFO are not strictly accounting measures and

should be considered as additional information. They better

illustrate the Group’s performance by excluding exceptional

items.

|

|

9M 2022 |

9M 2023 |

|

(in MAD millions) |

Morocco |

International |

Group |

Morocco |

International |

Group |

|

Adjusted EBITDA |

8,395 |

5,678 |

14,072 |

8,435 |

6,093 |

14,527 |

|

Published EBITDA |

8,395 |

5,678 |

14,072 |

8,435 |

6,093 |

14,527 |

|

Adjusted EBITA |

5,763 |

3,108 |

8,872 |

5,849 |

3,381 |

9,230 |

|

ANRT decision |

-2,451 |

|

-2,451 |

|

|

|

|

Restructuring costs |

|

-2 |

-2 |

|

|

|

|

Published EBITA |

3,313 |

3,106 |

6,419 |

5,849 |

3,381 |

9,230 |

|

Adjusted net income Group share |

|

|

4,520 |

|

|

4,629 |

|

ANRT decision |

|

|

-2,451 |

|

|

|

|

Restructuring costs |

|

|

-1 |

|

|

|

|

Income tax revision |

|

|

|

|

|

-67 |

|

Earthquake fund donation |

|

|

|

|

|

-481 |

|

Published net income Group share |

|

|

2,068 |

|

|

4,081 |

|

Adjusted CFFO |

5,456 |

2,704 |

8,159 |

4,527 |

2,649 |

7,176 |

|

Payment of license |

|

-26 |

-26 |

|

|

|

|

Restructuring costs |

|

-2 |

-2 |

|

|

|

|

ANRT decision |

-2,451 |

|

-2,451 |

|

|

|

|

Published CFFO |

3,005 |

2,675 |

5,680 |

4,527 |

2,649 |

7,176 |

Appendix 2: Impact of the IFRS 16 norm

At the end of September 2023, the impacts of the

IFRS 16 norm on the main indicators of the Maroc Telecom Group

were as follows:

|

|

9M 2022 |

9M 2023 |

|

(in MAD millions) |

Morocco |

International |

Group |

Morocco |

International |

Group |

|

Adjusted EBITDA |

193 |

202 |

395 |

203 |

235 |

438 |

|

Adjusted EBITA |

10 |

32 |

42 |

10 |

37 |

47 |

|

Adjusted net income Group share |

|

|

-6 |

|

|

-5 |

|

Adjusted CFFO |

193 |

202 |

395 |

203 |

235 |

438 |

|

Net Debt |

733 |

643 |

1,375 |

781 |

845 |

1,627 |

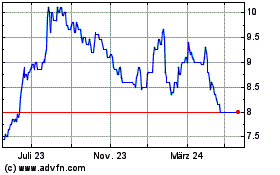

- Maroc Telecom_PR-Q3 2023 Results

Maroc Telecom (EU:IAM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

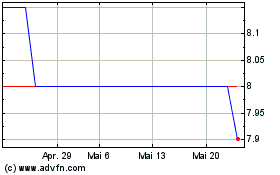

Maroc Telecom (EU:IAM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025