Paris, 19 July

2017 (6.00 p.m.)

BUSINESS GROWTH IN

Q2 2017: GROSS PROFIT UP 0.7% LFL

Slowdown in

business activity in the second quarter

-

Q2 20171 gross profit

of €21.9 M, up 0.7% on a reported basis and 0.7%

LFL2.

-

H1 20171 gross profit

of €42.28 M, up 2.5% on a reported basis and 2.3%

LFL2.

-

Growth in digital businesses: Q2 LFL up 3%; H1

LFL up 6.2%.

-

Growth in France: Q2 LFL up 2.5%; H1 LFL up

7%.

-

Decline in Belgium: Q2 LFL down 3.6%; H1 LFL

down 7.9%.

Expected increase

in half-year earnings (adjusted headline PBIT3 and

adjusted operating margin3)

Rise in operating

margin maintained despite weaker business growth outlook in

2017

-

Growth in gross profit revised from more than 4%

to more than 1% LFL.

-

Growth in adjusted headline PBIT3

revised from equal to or greater than 6% to between 4% and

6%.

-

Increase in adjusted operating margin (adjusted

headline PBIT/gross profit)3 maintained at

equal to or greater than 50 bp.

| Gross Profit (in € M)1 |

2017 |

2016 Reported |

2016 LFL2 |

2017/2016

Reported change |

2017/2016

LFL2

change |

| Q1 |

20.38 |

19.51 |

19.56 |

+4.5% |

+4.2% |

| Q2 |

21.90 |

21.76 |

21.76 |

+0.7% |

+0.7% |

| Total H1 |

42.28 |

41.27 |

41.32 |

+2.5% |

+2.3% |

1 Limited audit

by the Statutory Auditors currently in progress.

2 Like for

like: Based on a comparable scope (i.e. including CapitalData over

six months in 2016 and 2017) and at constant exchange rates (i.e.

applying the average exchange rate over the period to data from the

compared period).

3 Adjusted

headline profit before interest & tax: recurring operating

income before restructuring costs and excluding the cost of

performance share plans. Adjusted operating margin: Adjusted

headline PBIT/Gross profit.

Didier Chabassieu, Chairman of the

Management Board, stated, "After an exceptional

year in 2016, the first half of 2017 has been a period of more

contrast for HighCo. Organic growth in Q2 was not as strong as

expected due to the drop in volumes in the Group's offline

businesses, especially in Belgium, and to slower growth in Digital

operations. Despite this, we expect growth in our annual earnings

thanks to sound cost control, and are moving forward with our

investment strategy in digital businesses, especially those

specialised in data and mobile technologies."

SLOWDOWN IN

GROWTH OF DIGITAL BUSINESSES

With

like-for-like growth of 3% in Q2 2017, Digital has enabled

the Group to continue to grow organically, but at a slower pace.

The share of digital activity in total Group business continues to

rise, up from 47.6% in Q2 2016 (excluding the United Kingdom)

to 48.7% in Q2 2017. Down 1.4% like for like over the same

period, offline businesses continue to decline, particularly in

Belgium. As a result, along with the very high comparison base over

this period in 2016 (up 16.5% like for like, excluding the United

Kingdom), the Group posts slight business growth

for Q2 2017, up 0.7% on a reported basis

and 0.7% like for like to €21.9 M.

Digital

businesses grew 6.2% on a like-for-like basis in H1 2017, and

their share in Group gross profit rose accordingly from 45.5% at

end-June 2016 (excluding the United Kingdom) to 47.3% at end-June

2017. HighCo still aims to generate more than 50% of the Group's

total business in digital activity by the end of the year. Offline

businesses fell 0.9% like for like over the first half of 2017.

The Group's gross profit came to €42.28 M

over the period, up 2.5% on a reported basis and 2.3% like for

like.

H1 2017 revenue amounted to

€75.3 M.

FRANCE MAINTAINS ITS GROWTH

TREND

Up 2.5% like for

like, France turned in gross profit of €15.56 M in

Q2 2017, representing 71.1% of the Group's gross profit.

This rise was mainly driven by the development of in-store digital

businesses, which offset the decline in paper coupon clearing.

Digital was up 4.2% like for like in the second quarter, in part

due to the price repositioning initiated at the beginning of the

year for certain Drive-to-Store mobile activities (Internet+ mobile).

H1 2017

gross profit totalled €29.98 M in France, rising 7% like for

like. Digital businesses grew 5.6% like for like over the first

half of the year, and their share in gross profit reached

53.6%.

LESS SUBSTANTIAL DECLINE IN

INTERNATIONAL BUSINESS IN Q2

International

gross profit fell 3.6% like for like to €6.34 M in

Q2 2017, i.e. 28.9% of the Group's gross profit. Despite a

slight improvement, Belgium continues to experience a decline in

the volume of paper coupons cleared and in offline in-store media.

With gross profit of €6.07 M, Benelux was

down 3.6% like for like in Q2 2017, as against a 12.2%

drop in the previous quarter.

International

gross profit stood at €12.3 M in H1 2017, down 7.5% like

for like. Benelux declined 7.9% like for like and represented

27.7% of the Group's gross profit. Business in Southern Europe

(Spain and Italy) held up, with like-for-like growth of 1.4% over

the period. The region accounts for 1.4% of the Group's gross

profit.

2017 HALF-YEAR EARNINGS

Based on the consolidation in

progress, the Group forecasts strong half-year

earnings, with:

-

Growth in adjusted headline PBIT3

and adjusted operating margin3 for H1 2017

(restated H1 2016 headline PBIT: €10.2 M, restated

H1 2016 operating margin: 24.7%);

-

A financial position holding up at a healthy

level, with a net cash surplus (including the working capital

resources of Data businesses) expected to increase significantly

compared with 31 December 2016.

2017 GUIDANCE

REVISED

Given the performance reported for

the second quarter and the outlook expected for the second half of

the year, the Group has revised its guidance for 2017:

-

Growth in 2017 gross profit revised from more

than 4% to more than 1% like for like (2016 gross profit: up 11.8%

like for like);

-

Growth in adjusted headline PBIT3

revised from equal to or greater than 6% to between 4% and 6%

(adjusted 2016 headline PBIT: €14.1 M);

-

Rise in adjusted operating margin3

maintained at equal to or greater than 50 bp (adjusted 2016

operating margin: 17.4%).

About HighCo

Since its creation, HighCo has placed innovation at the

heart of its values, offering its clients - brands and retailers -

Intelligent Marketing Solutions to influence shopper behaviour with

the right deal, in the right place, at the right time and on the

right channel.

Listed in compartment C of

Euronext Paris, and eligible for the "long only" DSS, HighCo has

more than 700 employees and since 2010 has been included in

the Gaia Index, a selection of 70 responsible Small and Mid

Caps.

Your contacts

Cécile

Collina-Hue

Cynthia Lerat

Managing

Director

Press Relations

+33 1 77 75 65

06

+33 1 77 75 65 16

comfi@highco.com

c.lerat@highco.com

Upcoming events

Publications take place after market close.

2017 Half-year Earnings:

Wednesday, 30 August 2017

Conference call on 2017 half-year earnings: Thursday, 31 August

2017 (11.00 a.m. CET)

Q3 and 9-month YTD 2017 Gross Profit: Wednesday, 18 October

2017

Q4 and FY 2017 Gross Profit: Wednesday, 24 January 2018

HighCo is a

component stock of the indices CAC® Small (CACS), CAC®

Mid&Small (CACMS) and CAC® All-Tradable (CACT).

ISIN: FR0000054231

Reuters: HIGH.PA

Bloomberg: HCO FP

For further financial information and press

releases, go to www.highco.com

This

English translation is for the convenience of English-speaking

readers. Consequently, the translation may not be relied upon to

sustain any legal claim, nor should it be used as the basis of any

legal opinion. HighCo expressly disclaims all liability for any

inaccuracy herein.

Download the press

release

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: HIGHCO via Globenewswire

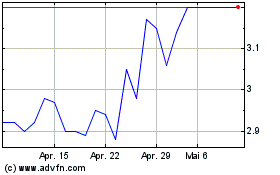

High (EU:HCO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

High (EU:HCO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024