Regulatory News:

Gecina (Paris:GFC):

- Gross rental income up +8.7% year-on-year, and +7.3%

like-for-like (vs. +4.4% for FY 2022)

- Occupancy rate up +280bp in 12 months, to nearly 95%

- First-quarter releasing spread of over +30% for offices in

Paris (+7% overall) and +11% for residential

- Increase in indexation’s contribution to like-for-like rental

income growth (to +4.2% vs. +2.1% in 2022)

- Pipeline’s positive net contribution to rental income

- €147m of sales completed or secured, +6% higher than the latest

appraisals

- Group's solid financial position confirmed with several

financing facilities raised or renewed during the first quarter,

confirming good access to bank and bond liquidity

- 2023 recurrent net income per share target confirmed at €5.80

to €5.90

Increase in the occupancy

rate

- Average financial occupancy rate progressing (+280bp

year-on-year and +340bp for offices), reflecting active demand for

Gecina’s assets in central sectors, as well as the improvement in

residential letting processes

Significant rental reversion captured,

particularly at the heart of Paris

- Office rental reversion of over +30% for Paris City and +7%

overall since the start of the year

- Positive rental reversion progressing since the start of 2022

for residential, with +11% on average for the first quarter

Growing contribution by rent

indexation

- Rent indexation reflected in like-for-like growth as leases

pass their anniversary dates

- Contribution of around +4.2% for the first quarter (vs +2.1%

for 2022)

€147m of sales completed or

secured (under preliminary

agreements) since the start of the

year

- With a premium of +6.4% versus the latest appraisal values for

Gecina’s two asset classes

- More than 70% of the disposals outside of Paris

Pipeline’s positive net contribution to

rental income

- Net rental contribution of +€4m, reflecting the impact of the

deliveries of the l1ve building in Paris’ Central Business District

and 157-CdG in Neuilly in 2022 (both fully let), offsetting the

Icône-Marbeuf (Paris-CBD) and Flandre (Paris) assets vacated to be

redeveloped

Liability structure adapted and robust,

ensuring good visibility in an uncertain environment

- €175m of responsible credit lines set up or renewed during the

quarter, with an average term of seven years and a margin that is

consistent with the previous lines

- Cost of debt 90% hedged through to 2025 and nearly 80% on

average through to 2028

- Surplus liquidity currently covering all of the maturities for

drawn debt through to 2027

2023 guidance confirmed

- Recurrent net income (Group share) is expected to reach

€5.80 to €5.90 per share in 2023, up +4.3% to

+6.1%.

Gross rental income of €167m, up +7% like-for-like (vs.

+4.4% at end-2022)

Gross rental income

Mar 31, 2022

Mar 31, 2023

Change (%)

In million euros

Current basis

Like-for-like

Offices

121.2

133.2

+9.8%

+7.9%

Traditional residential

26.7

27.7

+3.9%

+4.7%

Student residences

5.4

5.8

+6.6%

+6.6%

Total gross rental income

153.3

166.7

+8.7%

+7.3%

Like-for-like, the acceleration in performance exceeded

the levels reported at end-2022, with rental income growth of +7.3%

overall (vs. +4.4% at end-2022) and +7.9% for offices (vs. +4.6% at

end-2022).

All of the components contributing to like-for-like rental

income growth during this first quarter are trending up, across all

Gecina’s business lines.

- The impact of the increase in the occupancy rate across all

asset classes contributed +1.7% to like-for-like growth,

benefiting from the strong upturn in transactions in 2022. With the

occupancy rate gradually improving in 2022, and particularly during

the second half of the year, the base effect is expected to

mechanically ease slightly over the second half of 2023.

- The gradual impacts of the acceleration in indexation

contributed +4.2%. As expected, this impact gradually contributed

to like-for-like rental trends as leases were indexed after

reaching their anniversary dates.

- Rental reversion captured for both offices and

residential. The capturing of this reversion and certain

compensation for departures contributed +1.4% to organic rental

income growth.

On a current basis, rental income is up by nearly +9%,

benefiting from not only the robust like-for-like rental

performance, as explained above, but also the pipeline’s strong net

rental contribution, particularly following two major deliveries of

office buildings in 2022 in Paris and Neuilly.

- Offices: positive trends

confirmed for central sectors

Gross rental income - Offices

Mar 31, 2022

Mar 31, 2023

Change (%)

In million euros

Current basis

Like-for-like

Offices

121.2

133.2

+9.8%

+7.9%

Central areas (Paris, Neuilly,

Southern Loop)

88.9

97.1

+9.2%

+6.1%

Paris City

71.2

77.6

+8.9%

+6.6%

- Paris CBD & 5-6-7

43.7

49.7

+13.5%

+5.7%

- Paris - Other

27.5

27.9

+1.7%

+7.9%

Core Western Crescent

17.7

19.5

+10.3%

+4.0%

La Défense

15.1

17.5

+15.9%

+15.9%

Other locations (Peri-Défense,

Inner / Outer Rims, Other regions)

17.2

18.5

+7.8%

+9.1%

Rental reversion captured,

continuing to reach over +30% in Paris for the first quarter

Since the start of the year, Gecina has let, relet or

renegotiated more than 32,000 sq.m, representing nearly €17m of

headline rent. This robust trend follows on from 2022, with a clear

outperformance by the most central sectors.

- Nearly two thirds of these transactions concern relettings

or renewals of leases, with around half (in terms of rental

value) located at the heart of Paris City, where +31% reversion

was captured on average, building on the progress from 2022.

However, the remaining transactions (particularly in Peri-Défense)

recorded negative reversion, taking the average rental reversion

captured on these operations to +7%.

- The remaining third concern new leases signed for buildings

that were vacant, under development or delivered recently.

Further progress with the occupancy

rate

The average financial occupancy rate for offices is up

+340bp to 94.5% (vs. 91.1% at end-March 2022),

reflecting the continued improvement in the occupancy of our

buildings throughout 2022.

This improvement concerns all of the region’s commercial

sectors, and particularly La Défense, where it reached 98%,

benefiting from the expected arrival of the final tenants in the

Carré Michelet building midway through the second half of 2022.

Acceleration in like-for-like

growth, confirming a positive trend for 2023

Like-for-like office rental income

growth came to +7.9% year-on-year (vs. +4.6% at

end-2022), benefiting from an improvement in the occupancy rate

across our buildings for +1.9%, as well as a positive indexation

effect which is continuing to ramp up (+4.8%), passing on the

return of an inflationary context, as well as the impact of the

positive reversion captured in the last few years.)

- In the most central sectors

(85% of Gecina’s office portfolio) in Paris City,

Neuilly-Levallois and Boulogne-Issy, like-for-like rental income

growth came to +6.1%, benefiting from:

- an improvement in the occupancy

rate (+0.3%)

- a positive level of indexation

(+4.4%), which will become stronger over the coming quarters

- and other effects mainly including positive rental reversion (+1.4%)

- On the La Défense market (8%

of the Group’s office portfolio), Gecina’s rental income is up

+15.9% like-for-like:

- Two thirds of this performance factor in a significant increase

in the occupancy rate for the Group’s

buildings, resulting from the major transactions secured recently

on buildings that were previously vacant (Carré Michelet,

Adamas)

- The remaining third is linked to indexation

- Reversion did not have any impact

on this sector

Rental income growth on a current

basis came to nearly +10% for offices, reflecting the

impact of the pipeline’s positive net contribution (+€4m net of

tenant departures from buildings to be redeveloped), notably taking

into account the delivery of the l1ve building in Paris’ Central

Business District during the second half of 2022 and 157-CDG in

Neuilly, which are both fully let, largely offsetting the buildings

vacated and currently being redeveloped (Icône-Marbeuf and Flandre

in Paris).

- Residential: reversion

potential confirmed and excellent level of operational

activity

Gross rental income

Mar 31, 2022

Mar 31, 2023

Change (%)

In million euros

Current basis

Like-for-like

Residential

32.1

33.5

+4.4%

+5.1%

Traditional residential

26.7

27.7

+3.9%

+4.7%

Student residences

5.4

5.8

+6.6%

+6.6%

YouFirst Residence (traditional

residential): acceleration in operational performance

levels

Like-for-like, rental income for traditional residential

properties is up +4.7%, marking an acceleration compared

with the end of 2022 (+2.0%), under the impact of indexation

that is gradually taking shape (+2.4%), as well as a moderate

increase in occupancy levels and rental reversion

that is ramping up (+1.7%). Rents for new arrivals are around

+11% higher than levels for the previous tenants on average

since the start of the year. This performance has been achieved

thanks to Gecina’s ability to continuously adapt its rental

offering to the needs of its clients and especially young

professionals.

On a current basis, rental income is up +3.9%, slightly

lower than the like-for-like performance, reflecting the impact of

the few disposals completed since the start of 2022.

YouFirst Campus (student

residences): strong upturn in activity

Rental income from student residences shows a significant

like-for-like increase of +6.6%, linked primarily to the high level

of positive reversion rapidly captured thanks to the quick rotation

of tenants with this type of product.

Occupancy rate: continued progress since the start of

2022

Average financial occupancy rate -

Offices

Mar 31, 2022

Jun 30, 2022

Sep 30, 2022

Dec 31, 2022

Mar 31, 2023

Offices

91.1%

91.8%

92.3%

92.8%

94.5%

Central areas

93.2%

93.3%

93.3%

93.6%

94.5%

La Défense

82.8%

86.0%

88.7%

91.2%

97.9%

Other locations

89.0%

89.9%

90.3%

90.5%

91.4%

Traditional residential

96.9%

96.8%

96.5%

96.7%

97.1%

Student residences

92.6%

86.3%

82.7%

86.0%

93.4%

Group total

92.0%

92.3%

92.5%

93.1%

94.9%

The Group’s average financial occupancy rate has

progressed each quarter for over a year and is now close to 95%, up

+280bp from end-March 2022, and +180bp higher than the end-2022

average occupancy rate.

For offices, the average occupancy rate reached

94.5%, moving closer to a normalized level. This rate is up

+340bp year-on-year, reflecting the robust rental trends

observed on Gecina’s markets since 2021.

Sales: €147m completed or under preliminary agreements,

achieving premiums versus the latest appraisals

Since the start of the year, Gecina has completed or secured

€147m of sales, with an average premium of +6.4%

versus the latest appraisal values.

- €28m were already completed during the first quarter,

primarily through a fully occupied commercial building in Paris’

Central Business District, as well as vacant unit-based residential

sales.

- €118m of sales are currently subject to preliminary

agreements, and primarily concern block residential sales, with

part including vacant unit-based residential sales, as well as a

commercial asset.

60% of these sales concern residential assets and nearly 75% are

located outside of Paris.

Solid balance sheet: liquidity further strengthened

during the first quarter

Ratios

Covenant

Dec 31, 2022

Loan to value (block, excl. duties)

< 60%

35.7%

Loan to value (block, incl. duties)

33.7%

EBITDA / net financial expenses

> 2.0x

5.6x

Outstanding secured debt / net asset value

of portfolio (block, excl. duties)

< 25%

-

Net asset value of portfolio (block, excl.

duties) in billion euros

> 6.0

20.1

Liquidity further strengthened over the

long term, covering maturities through to 2027

During the first quarter, the Group further strengthened its

liquidity position with:

- Nearly €175m of credit lines set up, including part with a new

European bank, with a maturity of seven years...

- … renewing ahead of schedule €130m due to mature in 2024 based

on equivalent financial conditions (margin)

Since the start of 2022, Gecina has therefore set up nearly

€2.0bn of new credit lines, which are undrawn, with an average

maturity of seven years.

At end-March, Gecina had €4.9bn of liquidity (primarily undrawn

credit lines). Available liquidity net of short-term financing

represents €3.1bn, higher than the Group’s financial policy, which

requires a minimum of €2.0bn, making it possible to date to cover

the bond maturities through to 2027.

Cost of debt 90% hedged on average

through to 2025, with 80% through to end-20281

In terms of the sensitivity of the Group’s average cost of debt,

Gecina’s rate hedging policy stands out through the long maturity

of its hedging instruments (7 years), making it possible to

sustainably protect the average cost of debt.

From 2023 to 2025, around 90% of debt is hedged on

average against changes in the Euribor. The Group’s hedging

policy is also aligned with a longer timeframe, with nearly 80%

of debt hedged on average through to the end of 20281.

Outlook and guidance: 2023 recurrent net income growth of

+4% to +6% expected (between €5.80 and €5.90)

The results published at end-2022 and the trends still observed

during the first quarter reflect the very good level of the rental

markets in Gecina's preferred sectors. This robust operational

performance is being further strengthened by the gradual upturn in

indexation.

The pipeline’s positive contribution to recurrent net income

growth is expected to ramp up, with the major building deliveries

in 2022 and 2023, further strengthening Gecina’s confidence.

Lastly, Gecina’s long debt maturity and active rate hedging

policy will enable it to limit the impact of interest rate rises on

the Group’s financial expenses in 2023.

In a context that therefore requires a cautious approach, Gecina

expects recurrent net income (Group share) to reach €5.80 to

€5.90 per share in 2023, with growth of between +4.3% and

+6.1%.

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. The Group owns, manages

and develops Europe’s leading office portfolio, with over 97%

located in the Paris Region, and a portfolio of residential assets

and student residences, with over 9,000 apartments. These

portfolios are valued at 20.1 billion euros at end-2022.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at

the heart of our sustainable spaces”. For our 100,000 clients,

this ambition is supported by our client-centric brand YouFirst. It

is also positioned at the heart of UtilesEnsemble, our program

setting out our solidarity-based commitments to the environment, to

people and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and Euronext 100 indices. Gecina is also recognized as one of

the top-performing companies in its industry by leading

sustainability benchmarks and rankings (GRESB, Sustainalytics,

MSCI, ISS ESG and CDP).

www.gecina.fr

----------------

1 Based on the volume of debt at end-December 2022

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230420005814/en/

GECINA CONTACTS Financial communications Samuel

Henry-Diesbach Tel: +33 (0)1 40 40 52 22

samuelhenry-diesbach@gecina.fr

Sofiane El Amri Tel: +33 (0)1 40 40 52 74

sofianeelamri@gecina.fr

Press relations Glenn Domingues Tel: +33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle Miclo Tel: +33 (0)1 40 40 51 98

armellemiclo@gecina.fr

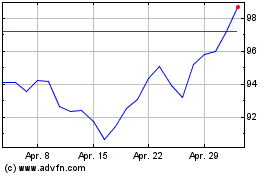

Gecina Nom (EU:GFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Gecina Nom (EU:GFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024