Eurocastle Releases First Half 2024 Financial Results

07 August 2024 - 8:00AM

UK Regulatory

Eurocastle Releases First Half 2024 Financial Results

Contact:

Oak Fund Services (Guernsey) Limited

Company Administrator

Attn: Hannah Crocker

Tel: +44 1481

723450

Eurocastle Releases First Half 2024

Financial Results

Guernsey, 7 August 2024 – Eurocastle Investment

Limited (Euronext Amsterdam: ECT) (“Eurocastle” or the “Company”)

today has released its interim management statement for the quarter

ended 30 June 2024.

- IFRS

NAV of €21.59 million, or €21.56 per share (€21.63

million, or €21.66 per share as at Q1 2024).

- ADJUSTED

NET ASSET VALUE (“NAV”)1 of €11.08 million, or

€11.07 per share2 (€11.09 million, or €11.11 per share

as at Q1 2024).

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q1 2024 NAV |

|

Q2 Cash Movement |

|

Q2 FV Movement |

|

Q2 2024 NAV |

|

|

|

€’m |

€ p.s. |

|

€’m |

€ p.s. |

|

€’m |

€ p.s. |

|

€’m |

€ p.s. |

| New Investment

Strategy - Greece |

|

0.10 |

0.10 |

|

0.15 |

0.15 |

|

0.02 |

0.02 |

|

0.27 |

0.27 |

Legacy Italian Real Estate Funds |

|

0.07 |

0.07 |

|

- |

- |

|

(0.01) |

(0.01) |

|

0.06 |

0.06 |

| Net Corporate

Cash3 |

|

17.73 |

17.76 |

|

(0.15) |

(0.15) |

|

(0.05) |

(0.10) |

|

17.53 |

17.51 |

| Legacy

German Tax Asset |

|

3.73 |

3.73 |

|

- |

- |

|

- |

(0.01) |

|

3.73 |

3.72 |

|

IFRS NAV |

|

21.63 |

21.66 |

|

- |

- |

|

(0.04) |

(0.10) |

|

21.59 |

21.56 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Additional

Reserves4 |

|

(10.54) |

(10.55) |

|

- |

- |

|

0.03 |

0.06 |

|

(10.51) |

(10.49) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted NAV

|

|

11.09 |

11.11

|

|

- |

- |

|

(0.01)

|

(0.04)

|

|

11.08

|

11.07

|

|

Ordinary shares outstanding |

|

998,555 |

|

|

|

|

|

|

|

1,001,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at 30 June 2024, the Company’s assets

comprise:

- €17.5 million, or €17.51 per share,

of net corporate cash3 which is primarily available to

fund new investments under the New Investment Strategy.

- Advances of €0.3 million, or €0.27

per share, made in relation to the Company’s first investment under

the New Investment Strategy.

- A tax asset of €3.7 million, or

€3.72 per share, representing amounts paid in relation to

additional tax assessed against a German property subsidiary. The

Company is currently appealing the assessment through the German

fiscal court and expects the matter will eventually be resolved in

the Company’s favour.

- Residual interests in two legacy

Italian Real Estate Fund Investments with a NAV of €0.1 million, or

€0.06 per share, where the underlying apartments are now all sold

with both funds currently in liquidation.

BUSINESS UPDATES

- New Investment

Strategy –

Eurocastle

has now launched a Luxembourg regulated fund, European Properties

Investment Fund S.C.A., SICAV RAIF (the “Fund”), to make

opportunistic real estate investments across Southern Europe. The

Fund completed its first close on August 6, 2024 for €10 million,

with the Company committing €8 million alongside a €2 million

commitment from its JV partner. The Fund is now being marketed to

potential investors with a target fund size of €100 million. In

addition to generating attractive risk adjusted returns on its

share of any investments made by the Fund, Eurocastle also

anticipates receiving a 60% share of fees and promote generated

from external investors with the remaining 40% paid to the JV

Partner. Such amounts include annual management fees representing

1.5% of the Fund’s net asset value and promote of 20% of the Fund’s

total net profit (subject to a return hurdle of 8% per annum). The

Company sees the Fund as an attractive opportunity to earn enhanced

returns on the capital it invests while also building a meaningful

base for future investments5.

In

addition, Eurocastle’s first acquisition under its new strategy,

being part of a boutique retail complex in an affluent part of

Athens, has now met all closing conditions and is intended to be

purchased by the Fund in September. The asset is being acquired

from one of the largest Greek banks out of a distressed situation.

Eurocastle’s strategy is to lease-up the last 20% of the building

which is currently vacant and then seek an exit in the open market.

The total expected investment is approximately €6.3 million. In

parallel with executing this first investment, the Company has been

underwriting a number of additional opportunities.

- Additional

Reserves – During H1 2024, the Company reduced these

reserves from €10.7 million to €10.5 million, or €10.49 per share,

with the reduction of €0.2 million reflecting reserves being

utilised in line with anticipated costs. As at 30 June 2024, of the

total Additional Reserves of €10.5 million, €5.4 million related to

the legacy German tax matter with the balance of approximately €5.1

million in place to allow for future costs and potential

liabilities while the Company establishes in parallel the New

Investment Strategy. The Board anticipates reviewing the

appropriate level of reserves once it has further clarity on the

amount of commitments received by the Fund.

Income Statement for the Quarter ended 30 June 2024 and

First Six Months of 2024 (unaudited)

| |

Income

Statement |

Income

Statement |

| |

Q2 2024 |

H1 2024 |

|

|

€ Thousands |

€ Thousands |

| Portfolio

Returns |

|

|

|

Legacy Real Estate Funds unrealised fair value movement |

(8) |

(18) |

|

Fair value movement on Investments |

(8) |

(18) |

|

Other income |

12 |

17 |

| Interest

income |

176 |

322 |

|

Total income |

180 |

321 |

|

|

|

|

| Operating

Expenses |

|

|

| Manager base and incentive

fees |

20 |

40 |

|

Remaining operating expenses |

203 |

430 |

|

Total expenses |

223 |

470 |

|

|

|

|

|

(Loss) for the period |

(43) |

(149) |

|

€ per share |

(0.04) |

(0.15) |

Balance Sheet and Adjusted NAV Reconciliation as at 30

June 2024 and as at 31 December 2023

|

|

|

New Investment Strategy

- Greece

€ Thousands |

Legacy Italian Investments

€ Thousands |

Corporate

€ Thousands |

30 June 2024

Total

€ Thousands |

31 December 2023

Total

€ Thousands |

|

Assets |

|

|

|

|

|

| |

Other assets |

266 |

- |

20 |

286 |

210 |

| |

Legacy German tax asset |

- |

- |

3,727 |

3,727 |

3,727 |

| |

Investments – Legacy Real

Estate Funds |

- |

63 |

- |

63 |

82 |

| |

Cash, cash equivalents and

treasury investments: |

|

|

|

|

|

| |

Cash and cash equivalents |

- |

- |

17,874 |

17,874 |

13,951 |

| |

Treasury Investments |

- |

- |

- |

- |

4,236 |

|

Total assets |

266 |

63 |

21,621 |

21,950 |

22,206 |

|

Liabilities |

|

|

|

|

|

| |

Trade and other payables |

- |

- |

339 |

339 |

425 |

|

|

Manager

base and incentive fees |

- |

- |

20 |

20 |

41 |

|

Total liabilities |

- |

- |

359 |

359 |

466 |

|

IFRS Net Asset Value |

266 |

63 |

21,262 |

21,591 |

21,740 |

| Liquidation cash

reserve |

- |

- |

(5,081) |

(5,081) |

(5,185) |

| Legacy German tax

cash reserve |

- |

- |

(1,701) |

(1,701) |

(1,728) |

| Legacy German tax

asset reserve |

- |

- |

(3,727) |

(3,727) |

(3,727) |

|

Adjusted NAV |

266 |

63 |

10,753 |

11,082 |

11,100 |

|

Adjusted NAV (€ per Share) |

0.27 |

0.06 |

10.74 |

11.07 |

11.12

|

NOTICE: This announcement contains inside

information for the purposes of the Market Abuse Regulation

596/2014.

ADDITIONAL INFORMATION

For investment portfolio information, please

refer to the Company’s most recent Financial Report, which is

available on the Company’s website (www.eurocastleinv.com).

Terms not otherwise defined in this announcement

shall have the meaning given to them in the Circular.

ABOUT EUROCASTLE

Eurocastle Investment Limited (“Eurocastle” or

the “Company”) is a publicly traded closed-ended investment

company. On 8 July 2022, the Company announced the relaunch of its

investment activity and is currently in the early stages of

pursuing its new strategy by initially focusing on opportunistic

real estate in Greece with a plan to expand across Southern Europe.

For more information regarding Eurocastle Investment Limited and to

be added to our email distribution list, please visit

www.eurocastleinv.com.

FORWARD LOOKING STATEMENTS

This release contains statements that constitute

forward-looking statements. Such forward-looking statements may

relate to, among other things, future commitments to sell real

estate and achievement of disposal targets, availability of

investment and divestment opportunities, timing or certainty of

completion of acquisitions and disposals, the operating performance

of our investments and financing needs. Forward-looking statements

are generally identifiable by use of forward-looking terminology

such as “may”, “will”, “should”, “potential”, “intend”, “expect”,

“endeavour”, “seek”, “anticipate”, “estimate”, “overestimate”,

“underestimate”, “believe”, “could”, “project”, “predict”,

"project", “continue”, “plan”, “forecast” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions, discuss future expectations, describe future plans and

strategies, contain projections of results of operations or of

financial condition or state other forward-looking information. The

Company’s ability to predict results or the actual effect of future

plans or strategies is limited. Although the Company believes that

the expectations reflected in such forward-looking statements are

based on reasonable assumptions, its actual results and performance

may differ materially from those set forth in the forward-looking

statements. These forward-looking statements are subject to risks,

uncertainties and other factors that may cause the Company’s actual

results in future periods to differ materially from forecasted

results or stated expectations including the risks regarding

Eurocastle’s ability to declare dividends or achieve its targets

regarding asset disposals or asset performance.

1 In light of the Realisation Plan announced in 2019,

the Adjusted NAV as at 30 June 2024 reflects additional reserves

for future costs and potential liabilities, which have not been

accounted for under the IFRS NAV. No commitments for these future

costs and potential liabilities existed as at 30 June 2024.

2 Per share calculations for Eurocastle throughout this

document are based on 1,001,555 shares, unless otherwise

stated.

3 Reflects corporate cash net of accrued liabilities and

other assets.

4 Reserves that were put in place when the Company

realised the majority of its investment assets in 2019 in order for

the Company to continue in operation and fund its future costs and

potential liabilities. These reserves are not accounted for under

IFRS.

5 References to the Fund in this document do not

constitute an offer to sell or a solicitation of an offer to buy

any security and may not be relied upon in connection with the

purchase or sale of any security. Any such offer would only be made

by means of formal offering documents, which would govern in all

respects.

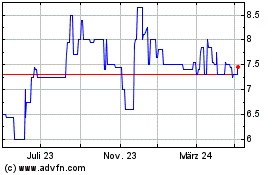

Eurocastle Investment (EU:ECT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

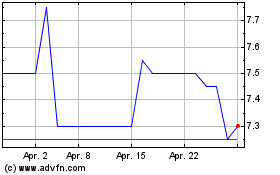

Eurocastle Investment (EU:ECT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024