bioMérieux: Description of the New Share Buyback Program Pursuant to Article 241-1 to Article 241-6 of the AMF General Regul...

30 Juni 2020 - 6:00PM

Business Wire

Implementation of the share buyback program

authorized by the Annual General Meeting on June 30, 2020

Regulatory News:

bioMérieux (Paris:BIM):

- Issuer: bioMérieux S.A. / ISIN: FR 0013280286 (compartment

A).

- Relevant securities: ordinary shares;

- Maximum stake proposed to the Annual Shareholders’ Meeting of

June 30, 2020: 10% of the number of shares making up the Company’s

share capital (at any time, as this percentage applies to a share

capital adjusted according to the transactions affecting it); as of

June 30, 2020, these 10% of capital represent 11 836 122 shares

;

- Maximum buyback percentage of shares purchased by the Company

to be held and subsequently delivered as payment or in exchange as

part of a merger, spin-off or contribution: 5%;

- Maximum unit purchase price: the unit purchase price must not

exceed €200 per share (excluding acquisition costs);

- Total cost of program: the maximum theoretical cost of

implementing this program is €2.367.224.400 (maximum theoretical

amount not taking into account the shares owned by the Company).

However, the Board could adjust the aforementioned purchase price

in the event of a change in the share’s par value, of an increase

in capital through the capitalisation of reserves and granting of

free shares, of share splits or consolidation, of capital

redemption or reduction, of the distribution of reserves or other

assets, or of any other transactions affecting equity, in order to

take into account the incidence of such transactions on the share

value.

- Objectives of the share buy back program:

- maintain a liquid secondary market for bioMérieux's shares

through market-making transactions carried out by an independent

investment firm under a liquidity agreement that complies with the

decisions of the French Financial Markets Authority (AMF);

- ensure the hedging of stock option plans and/or free share

plans (or equivalent plans) for the benefit of Group employees

and/or corporate officers, as well as all share allocations or

sales under a Company or Group savings plan (or a similar plan) for

profit sharing and/or any other form of allocation of shares to

Group employees and/or corporate officers;

- reduce the Company's share capital by cancelling shares subject

to the limits laid down by law;

- retain the shares purchased and to swap them again at a later

date for exchange, or as payment as part of any external expansion

acquisitions;

- implement any market practices permitted or that may be

permitted by the market authorities.

The acquisition, sale and transfer of the Company's shares may

be carried out by any means, in part through the use of

derivatives, whether on the stock market or over the counter,

excluding the sale of put options save in the case of exchanges in

accordance with applicable regulations. No restriction applies to

the portion of buybacks carried out through block trades, which may

account for the entire program.

- Term of the program : from the date of the « description of the

program » and until the end of the Annual General Meeting called to

approve the financial statements for the year ending 31 December

2020, subject to the limit of an eighteen-month period from the

Annual Shareholders’ Meeting on June 30, 2020.

Breakdown per objective of shares held by the Company as of

June 30, 2020

At June 26, 2020, morning, the Company’s share capital is made

up of 118,361,220 shares. At this date, the Company held 559 621

shares :

- of which 15 523 shares under the liquidity agreement with ODDO

BHF, which is compliant with market practice as approved by the

AMF, with effective date on July 2, 2018. The shares purchased by

ODDO BHF were acquired exclusively to maintain a liquid market in

the Company’s shares through market-making transactions carried out

by an independent investment service provider under a liquidity

agreement that complies with the AMAFI Code of Ethics approved by

the AMF;

- of which 63 908 shares under an agency agreement entered into

with the Natixis with the sole objectives of delivering shares upon

the exercise of rights in connection with free share grants to

employees of the Company or companies within the Group, as well as

under the MyShare employees shareholding plan.

The purchase, sale and transfer of the aforementioned securities

was carried out to meet two of the program’s objectives approved by

the Annual Shareholders’ Meetings of May 17, 2018 and May 23, 2019,

i.e. maintaining a liquid market in the Company’s shares through

market-making transactions carried out by an independent investment

service provider under a liquidity agreement that complies with the

AMAFI Code of Ethics, approved by the AMF and delivering shares

upon the exercise of rights in connection with free share grants to

employees of the Company or companies within the Group, as well as

under the MyShare employees shareholding plan. The Company has not

cancelled any shares in the last 24 months and acquired no shares

prior to April 16, 2014, date on which the new share buyback

program under the new regulation from the European Market Abuse

Directive entered into force.

The Company has not used derivatives as part of this share

buyback program and there have been no open positions to buy or

sell derivatives at the date this buyback program description was

published.

bioMérieux S.A. Société anonyme au

capital de 12 029 370 euros Siège social : 69280 Marcy l'Etoile 673

620 399 RCS LYON

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200630005735/en/

bioMérieux

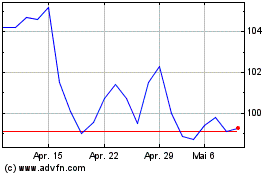

Biomerieux (EU:BIM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Biomerieux (EU:BIM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025