Trending: ASML Shares Fall After Predicting Flat Sales Next Year

18 Oktober 2023 - 4:13PM

Dow Jones News

1340 GMT - ASML Holding is among the most mentioned companies

across news items over the past eight hours, according to Factiva

data, after the Dutch company said it expects revenue next year to

be similar to 2023, sending shares lower. The Dutch

semiconductor-equipment maker made the disclosure as it reported a

drop in third-quarter sales as orders fell 71% compared with the

same period a year earlier. ASML's conservative near-term view

might in part be due to new China restrictions, Jefferies says in a

note. "The new China restrictions announced by the U.S. government

may also be partly responsible for the flat outlook, which ASML

interprets as being applicable to a limited number of fabs in

China," analysts write referring to the fabrication plants in the

country which accounted for 46% of its third-quarter revenue.

Shares are down 3.65% at EUR552.0 having fallen to a low of

EUR544.30 earlier in the session. However, shares are up 11% over

the year to date and 38.5% higher on the year. Dow Jones & Co.

owns Factiva. (ian.walker@wsj.com.)

(END) Dow Jones Newswires

October 18, 2023 09:58 ET (13:58 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

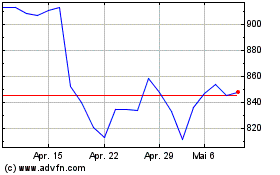

ASML Holding NV (EU:ASML)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ASML Holding NV (EU:ASML)

Historical Stock Chart

Von Apr 2023 bis Apr 2024